Minnesota Discovery - Garnishment Interrogatories - Garnishee's Employer

Overview of this form

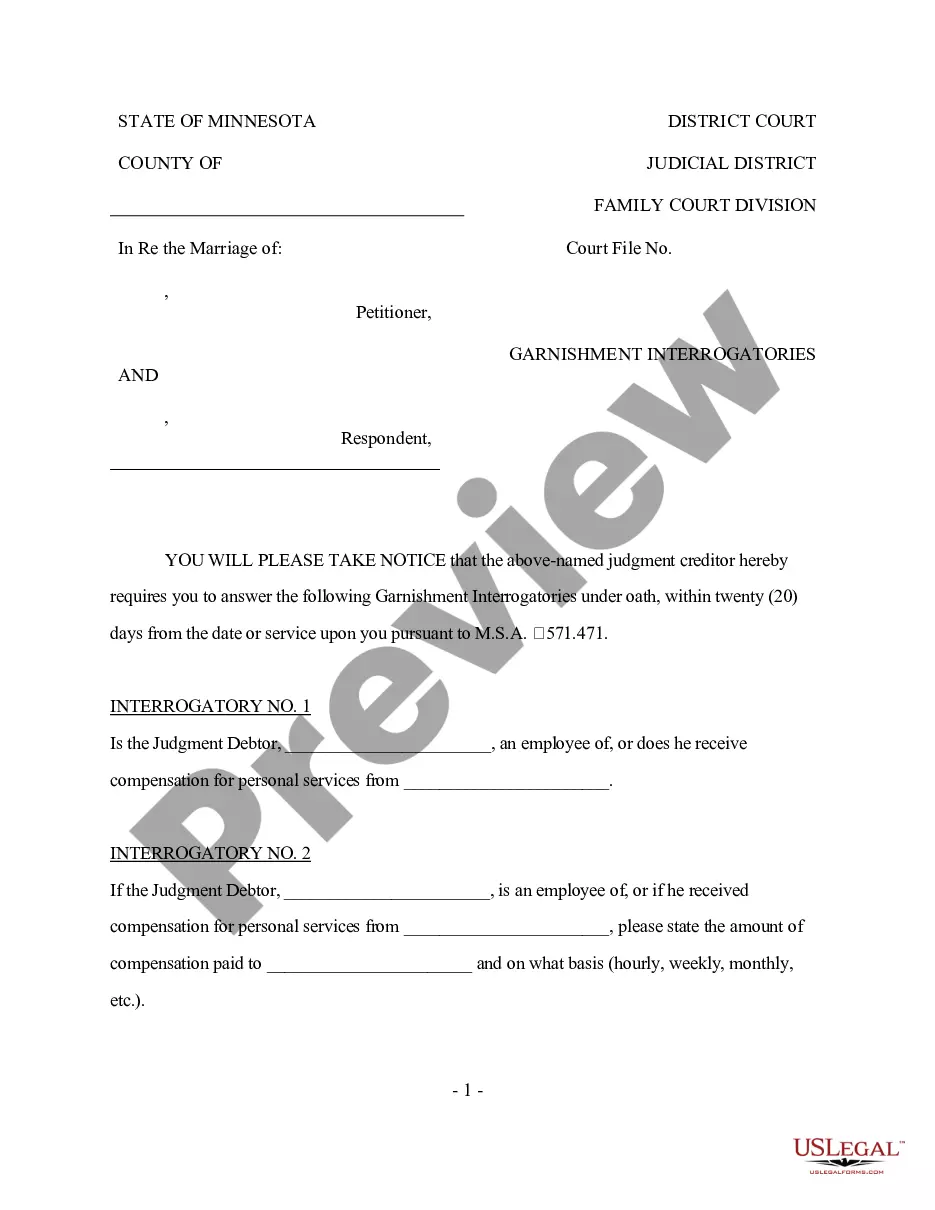

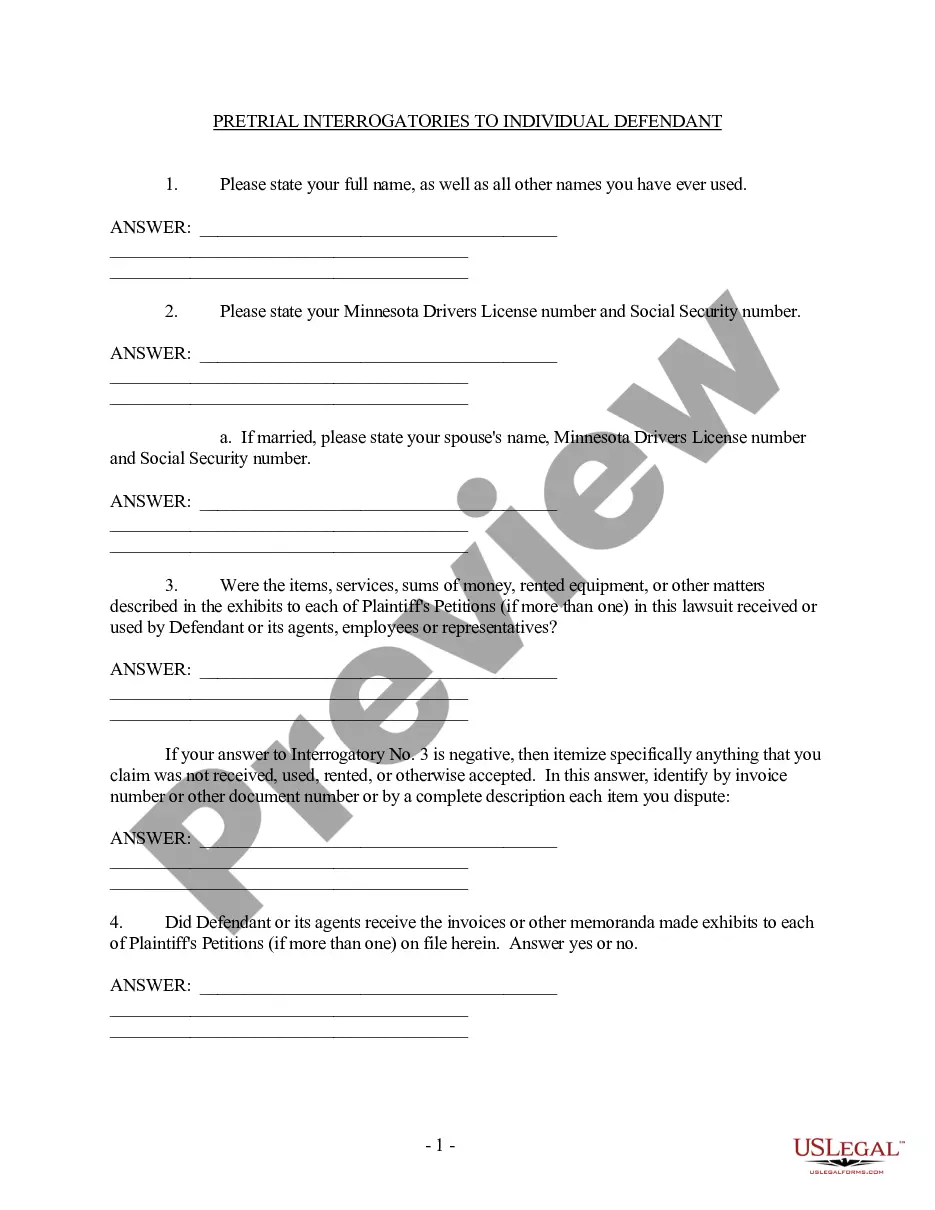

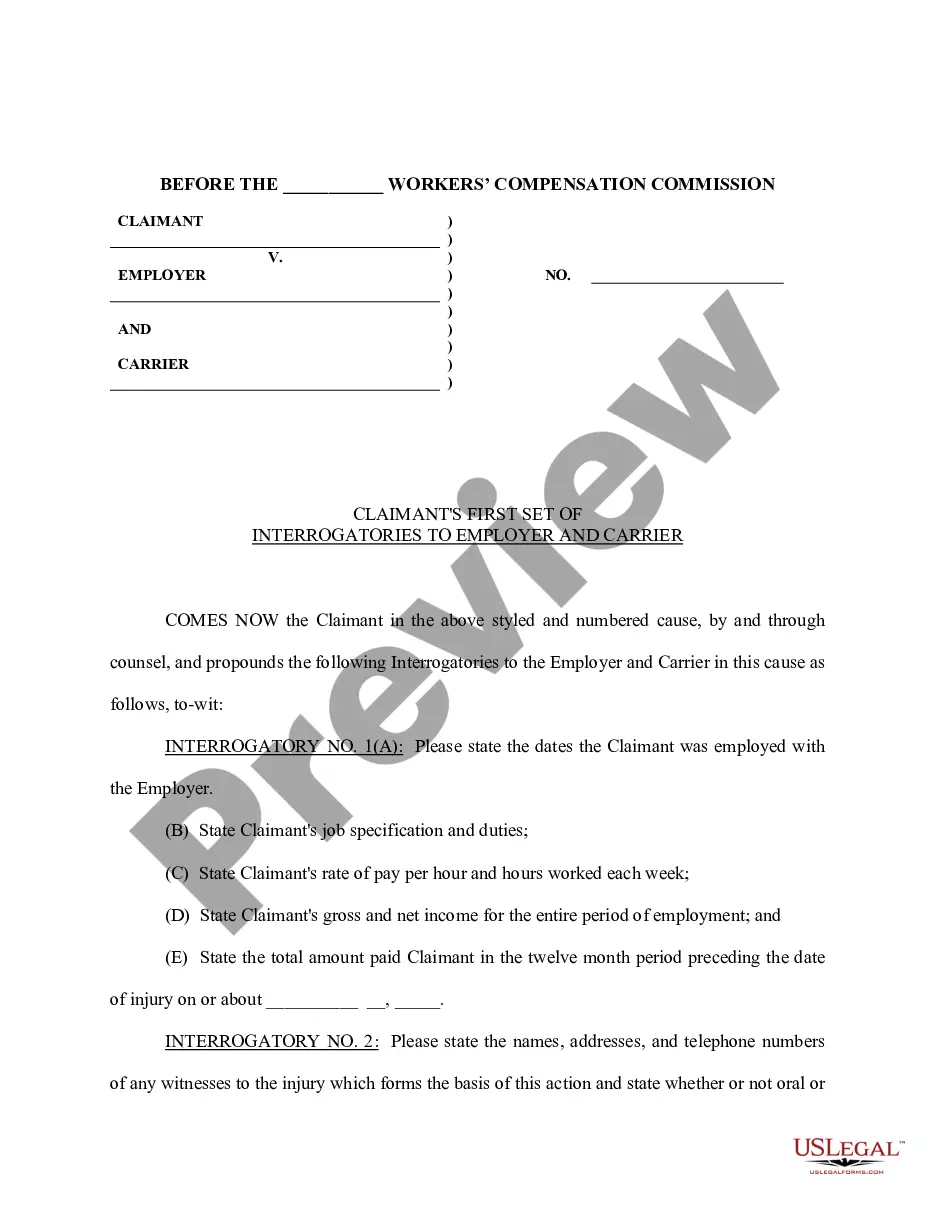

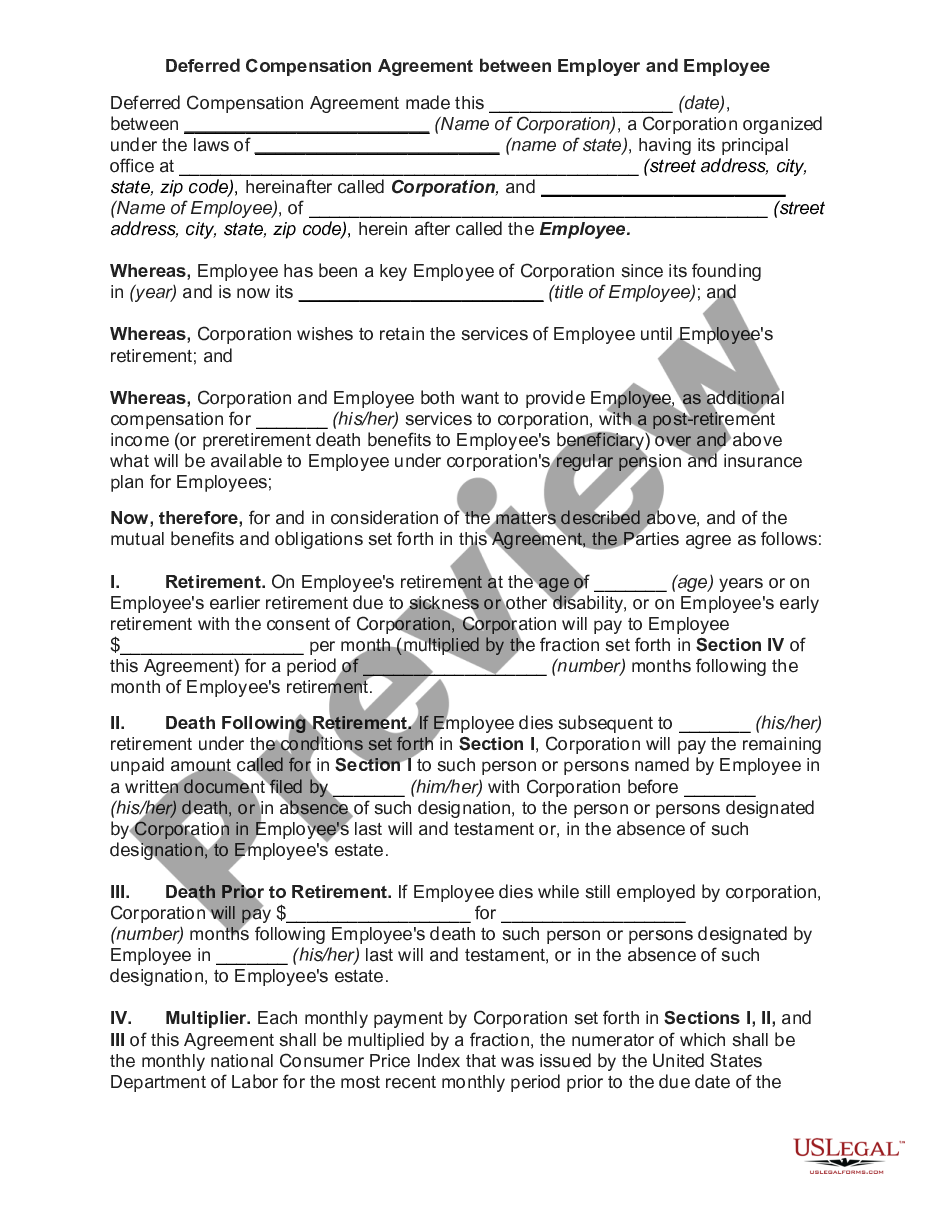

The Discovery - Garnishment Interrogatories - Garnishee's Employer form is a legal document used to gather information about a judgment debtorâs employment and compensation during a garnishment proceeding. This form helps creditors identify the debtorâs income sources and amounts due, which assists in the garnishment process. It is specifically tailored for use in dissolution of marriage cases, ensuring both compliance and clarity in the legal proceedings.

Main sections of this form

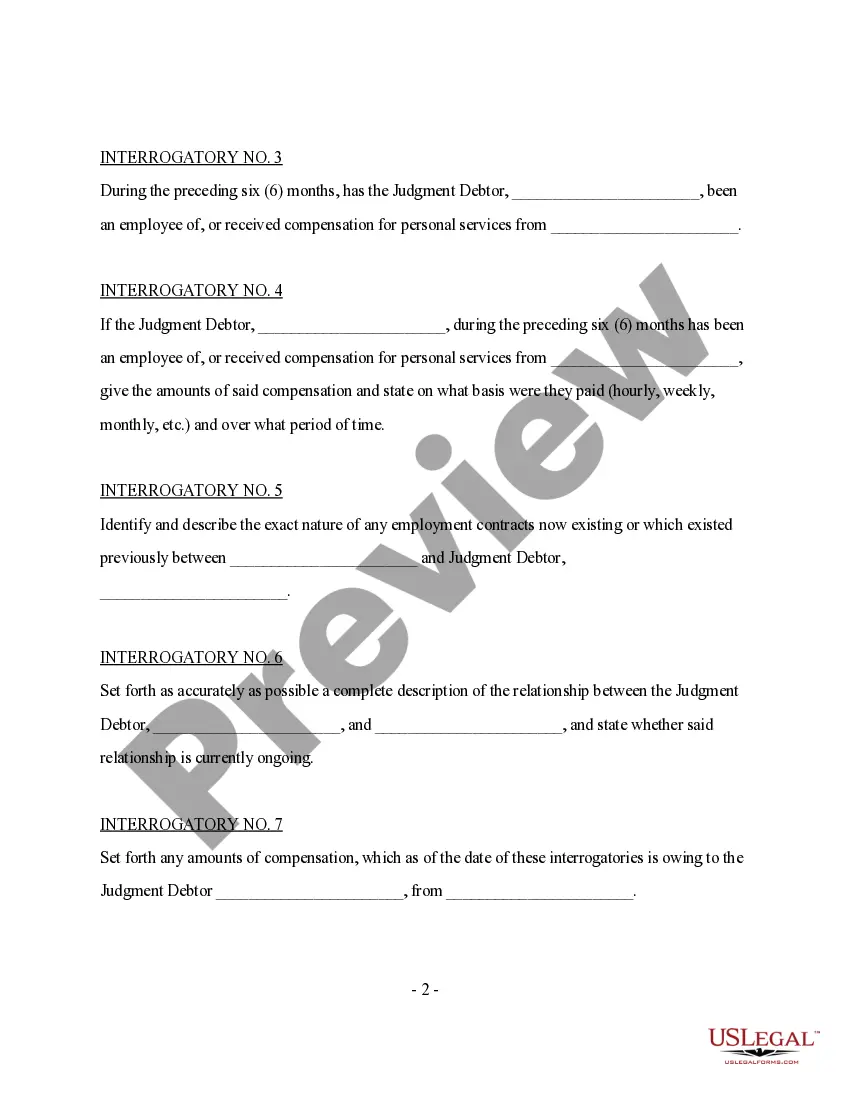

- Interrogatory questions regarding the judgment debtorâs employment status and compensation details.

- Notable time frames for information collection, such as the preceding six months.

- Clarification of any existing employment contracts between the judgment debtor and the garnishee's employer.

- Questions about expected future compensation owed to the judgment debtor.

- Descriptions requested about the relationship between the judgment debtor and the employer.

When this form is needed

This form should be utilized when a creditor seeks to enforce a judgment through garnishment, particularly in cases involving dissolution of marriage. It is applicable when gathering necessary details about the judgment debtor's employer to initiate or proceed with garnishment actions effectively.

Who can use this document

- Creditors seeking to enforce judgments through garnishment.

- Attorneys representing creditors in divorce-related judgments.

- Individuals involved in a divorce proceeding where garnishment is necessary to collect owed amounts.

- Employers who have received garnishment orders concerning their employees.

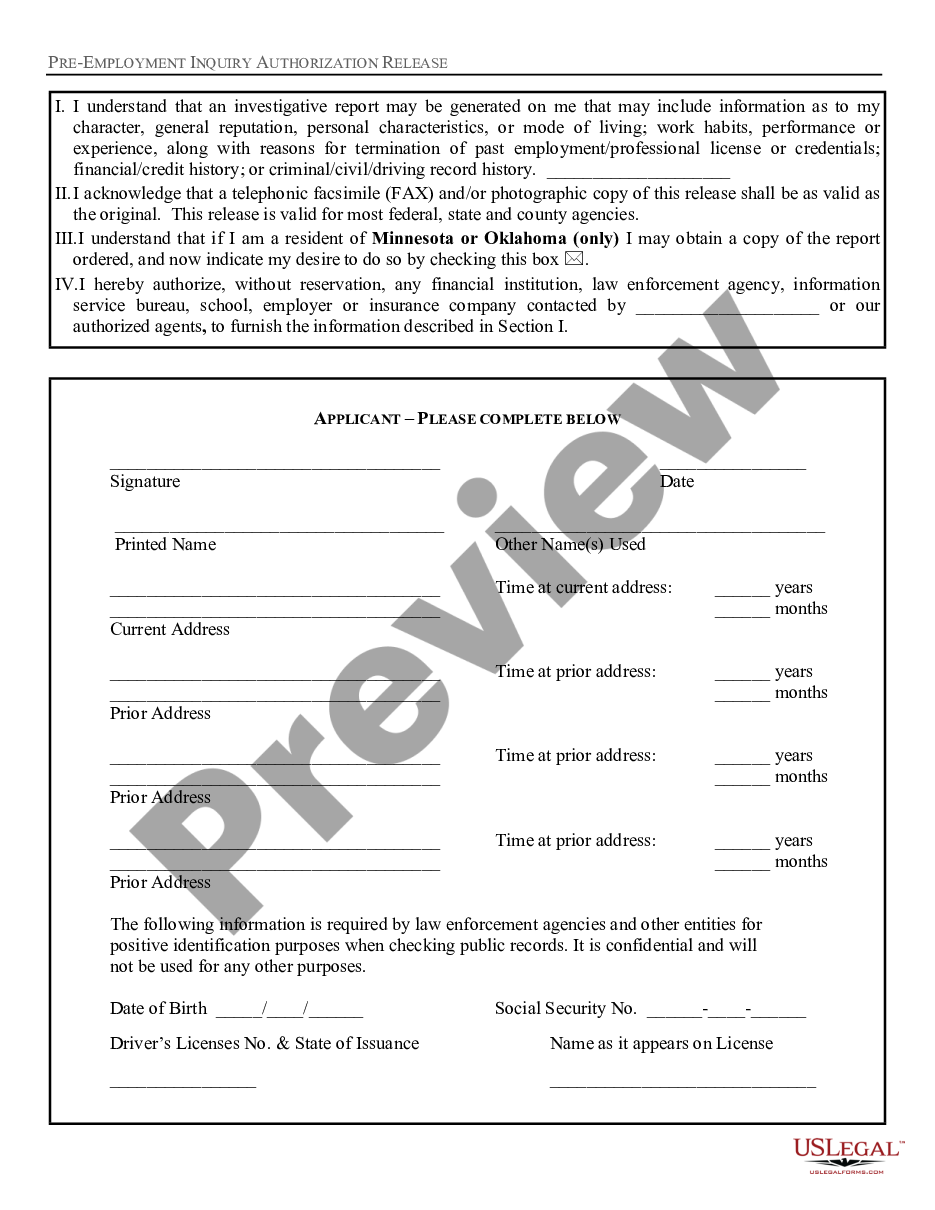

How to prepare this document

- Identify the judgment debtor by entering the debtor's full name in the designated fields.

- Provide accurate information regarding the employment status of the debtor and the employer's name.

- Detail any compensation amounts paid to the debtor and the payment schedule (hourly, weekly, or monthly).

- Clarify the nature of any employment contracts between the debtor and employer, if applicable.

- Indicate ongoing relationships and any expected future compensation owed to the debtor.

Does this form need to be notarized?

Notarization is generally not required for this form. However, certain states or situations might demand it. You can complete notarization online through US Legal Forms, powered by Notarize, using a verified video call available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Failing to accurately identify the judgment debtor, potentially leading to delays.

- Not providing complete or accurate compensation details, which can complicate the garnishment process.

- Neglecting to respond to all interrogatories, which can result in legal repercussions.

Advantages of online completion

- Convenience of downloading and completing the form from home.

- Editability to ensure all required information is accurately captured.

- Access to legally vetted content by licensed attorneys, ensuring reliability.

Looking for another form?

Form popularity

FAQ

Wage garnishment is a legal procedure in which a person's earnings are required by court order to be withheld by an employer for the payment of a debt such as child support.

If it's already started, you can try to challenge the judgment or negotiate with the creditor. But, they're in the driver's seat, and if they don't allow you to stop a garnishment by agreeing to make voluntary payments, you can't really force them to. You can, however, stop the garnishment by filing a bankruptcy case.

If you are served with a garnishment summons, do not ignore these documents because they do not directly involve a debt that you owe. Instead, you should immediately freeze any payments to the debtor, retain the necessary property, and provide the required written disclosure.

Some of the ways to loweror even eliminatethe amount of a wage garnishment include: filing a claim of exemption. filing for bankruptcy, or. vacating the underlying money judgment.

Regular creditors cannot garnish your wages without first suing you in court and obtaining a money judgment. That means that if you owe money to a credit card company, doctor, dentist, furniture company, or the like, you don't have to worry about garnishment unless those creditors sue you in court.

When a creditor obtains a writ of garnishment, the employer is the garnishee and the creditor is the garnishor.In most states, employers answer a writ of garnishment by filling out the paperwork attached to the judgment and returning it to the creditor or the creditor's attorney.

Garnishment is a proceeding by a creditor (a person or entity to whom money is owed) to collect a debt by taking the property or assets of a debtor (a person who owes money). Wage garnishment is a court procedure where a court orders a debtor's employer to hold the debtor's earnings in order to pay a creditor.

Respond to the Creditor's Demand Letter. Seek State-Specific Remedies. Get Debt Counseling. Object to the Garnishment. Attend the Objection Hearing (and Negotiate if Necessary) Challenge the Underlying Judgment. Continue Negotiating.

What Happens When a Garnishment Summons Is Served?In the case of a nonearnings garnishment, the garnishee must provide a written disclosure to the creditor within 20 days after service of the garnishment summons that identifies all indebtedness, money, or property that the garnishee owes to the debtor.