Minnesota Garnishment Earnings Disclosure Instructions

Understanding this form

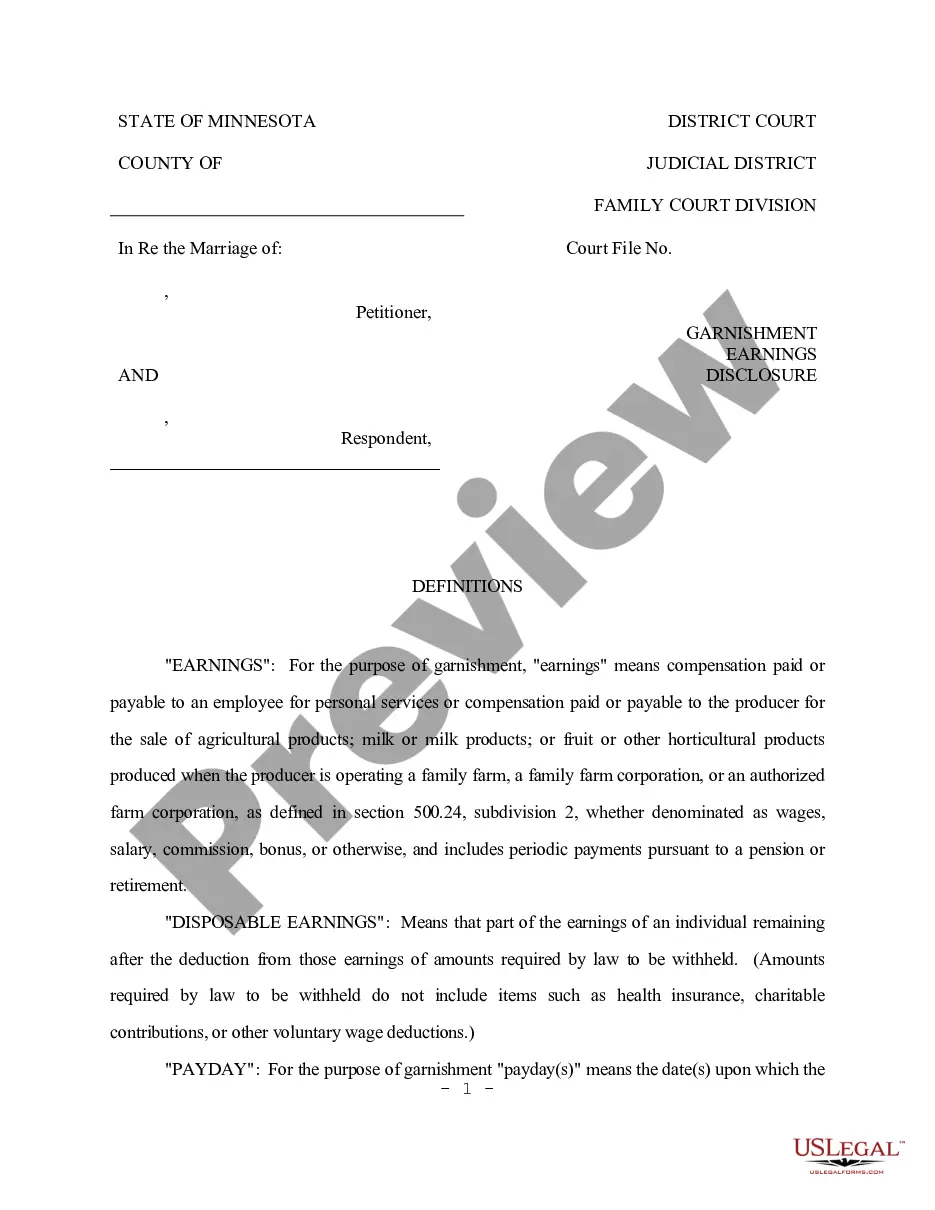

The Garnishment Earnings Disclosure Instructions document is designed to guide employers, referred to as garnishees, in how to disclose a debtor's earnings. This form is essential in complying with garnishment orders, specifying how to calculate disposable earnings, and ensuring legal obligations are met. Unlike other financial disclosures, this form focuses on garnishments related to earnings and provides a step-by-step worksheet for clarity.

Main sections of this form

- Definitions of key terms such as disposable earnings and payday.

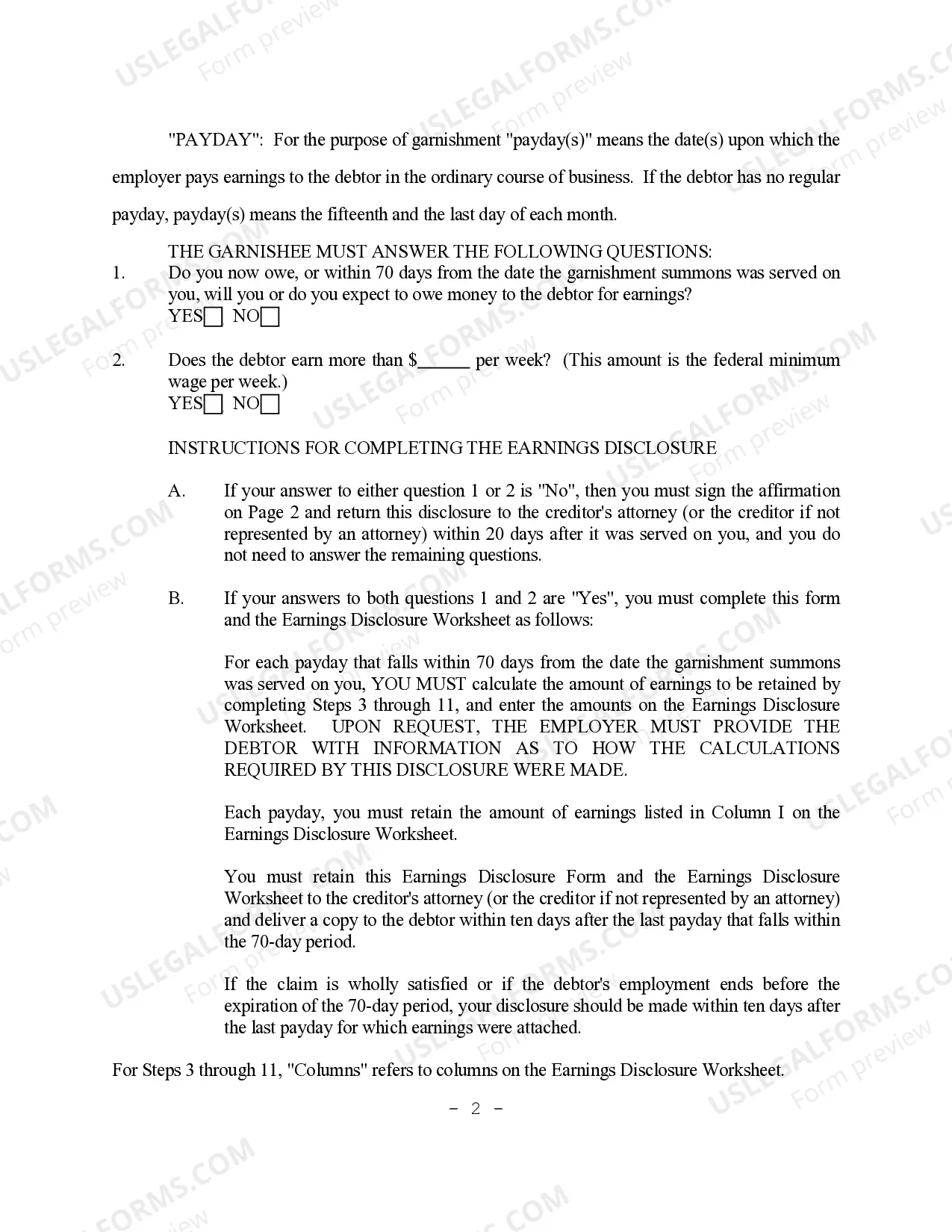

- A clear set of instructions for answering questions regarding the debtor's earnings.

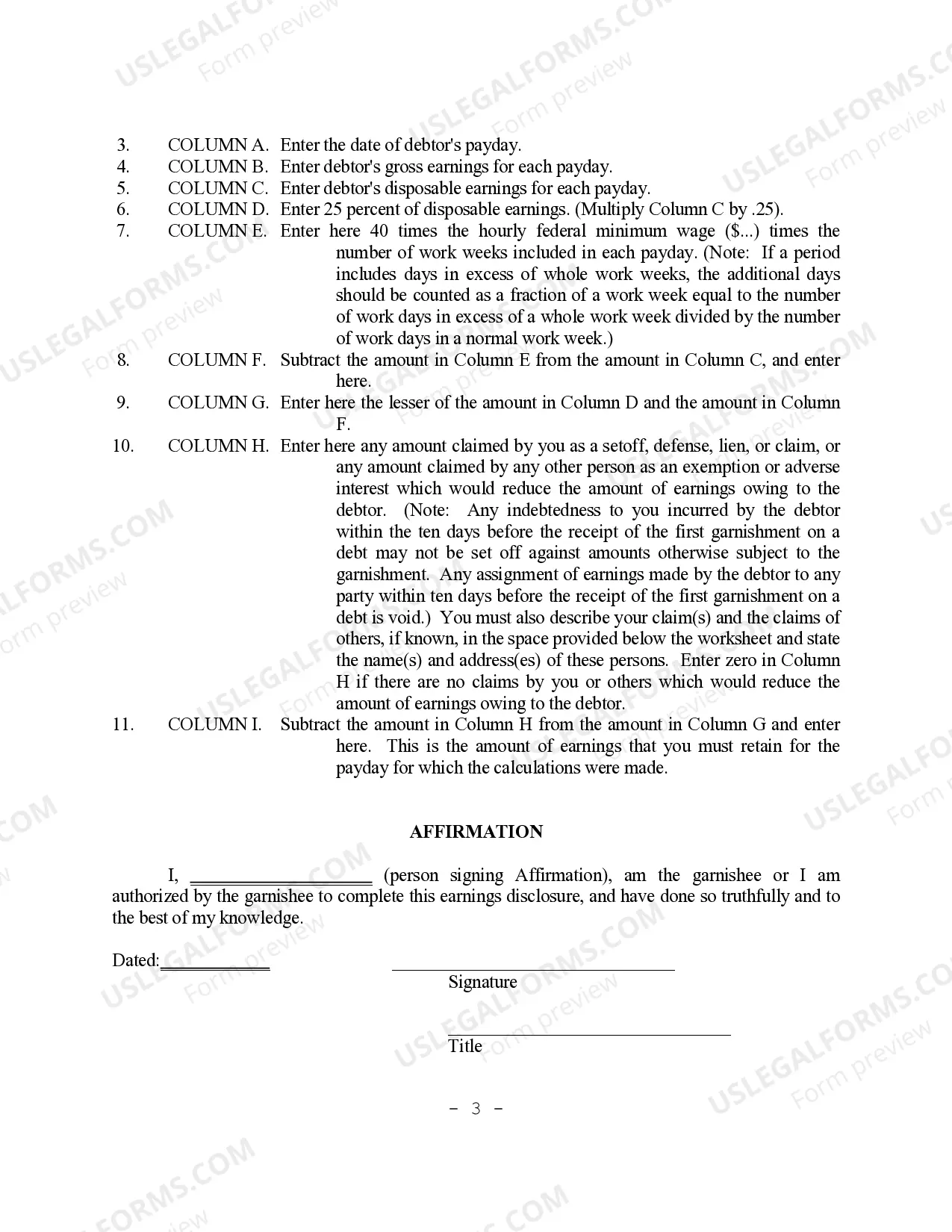

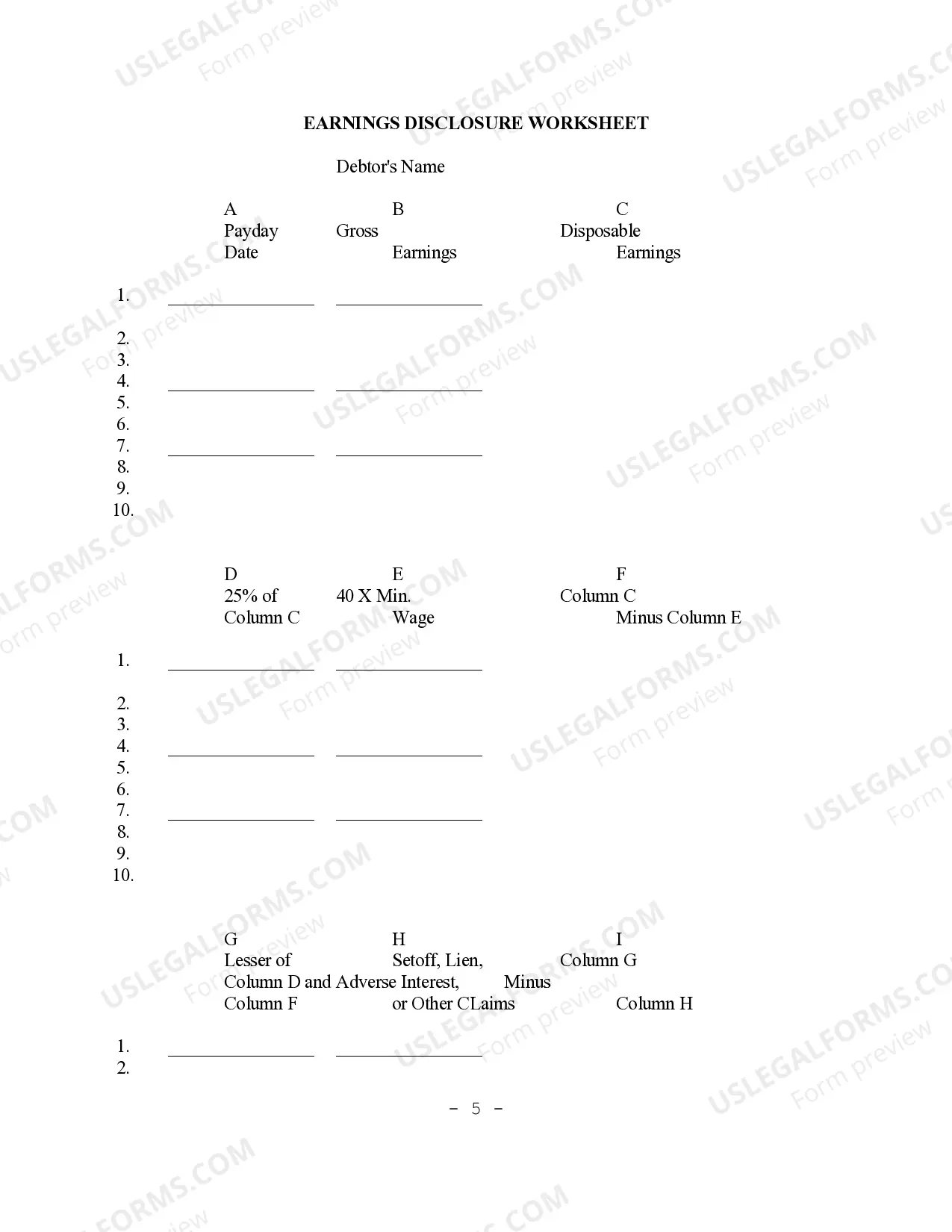

- A step-by-step Earnings Disclosure Worksheet to calculate and report the amount to be withheld.

- An affirmation statement to be signed by the person filling out the form.

Situations where this form applies

This form should be utilized when an employer receives a garnishment summons against an employee (the debtor) to ascertain the disposable earnings that can be withheld. It is vital to complete this form to ensure compliance with legal requirements and provide accurate information regarding earnings changes within a specified 70-day period. Common scenarios include child support enforcement, debt recovery, or other creditor actions requiring wage garnishment.

Who should use this form

- Employers who are garnishees as a result of a court order.

- Human resources personnel responsible for payroll management.

- Payroll administrators handling employee compensation and deductions.

- Legal representatives assisting employers in garnishment processes.

How to complete this form

- Identify the debtor's paydays and enter the corresponding dates on the worksheet.

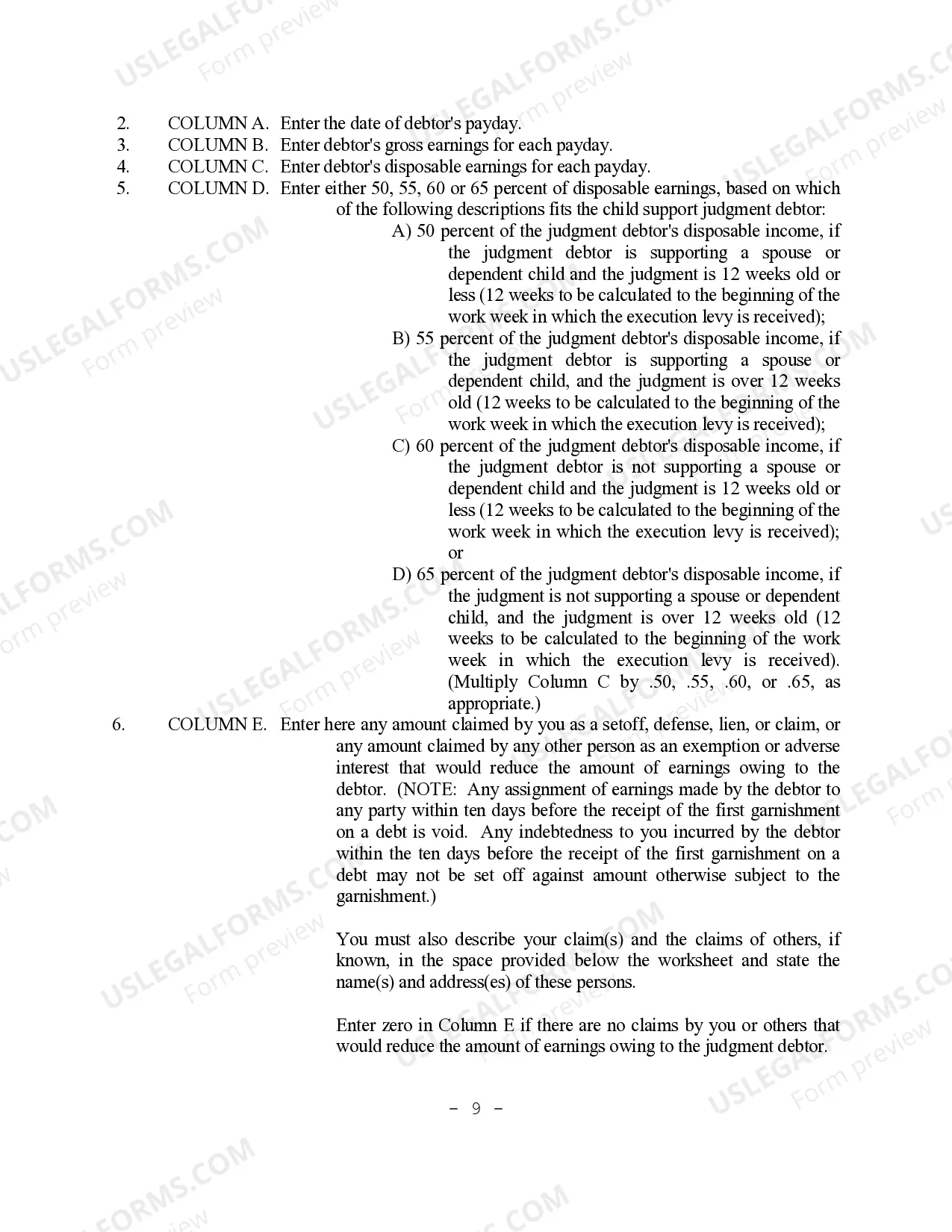

- Calculate the debtor's gross earnings and disposable earnings for each payday.

- Determine the appropriate withholding percentage based on disposable earnings.

- Complete any additional calculations required for setoffs or claims that may reduce the retained earnings.

- Sign the affirmation at the end of the form with the appropriate title and contact information.

Is notarization required?

This form does not typically require notarization to be legally valid. However, some jurisdictions or document types may still require it. US Legal Forms provides secure online notarization powered by Notarize, available 24/7 for added convenience.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to include all pay periods within the 70-day window.

- Incorrectly calculating disposable earnings by misapplying statutory deductions.

- Not delivering a copy of the completed form to the debtor within the required timeline.

- Omitting signatures or necessary information in the affirmation section.

Advantages of online completion

- Convenience of instant download and access at any time.

- Editable and printable formats for easy completion.

- Reliable templates created by experienced attorneys to ensure legal validity.

- Time-saving measures that eliminate the need for in-person consultations.

Looking for another form?

Form popularity

FAQ

To garnish someone's wages in Minnesota, you need a court judgment that confirms the amount owed. After securing the judgment, you must complete the appropriate garnishment forms as outlined in the Minnesota Garnishment Earnings Disclosure Instructions. Additionally, you should provide the employer with the garnishment order, which includes details about the debtor's earnings and the amount to be withheld. US Legal Forms offers resources to help you gather the required documentation efficiently.

To garnish wages in Minnesota, you must follow the procedures set forth in the Minnesota Garnishment Earnings Disclosure Instructions. Start by obtaining a court judgment against the debtor. Once you have the judgment, you can issue a garnishment order to the debtor's employer, who must then withhold a portion of the debtor's wages until the debt is satisfied. Using a platform like US Legal Forms can simplify this process, providing necessary templates and guidance.

In Minnesota, the order for disclosure follows specific steps outlined in the Minnesota Garnishment Earnings Disclosure Instructions. First, the creditor must provide a written request for garnishment to the employer. Next, the employer must disclose the employee's earnings and any exemptions that apply. This process ensures transparency and compliance with state regulations.

To calculate disposable earnings for garnishment, first determine your total earnings. From this amount, subtract mandatory deductions such as federal and state taxes, Social Security, and health insurance. The remaining amount is your disposable earnings, which is subject to garnishment. For comprehensive guidance, refer to the Minnesota Garnishment Earnings Disclosure Instructions provided by US Legal Forms.

The garnishment rules in Minnesota are designed to protect debtors while allowing creditors to collect. Creditors must file a court action and obtain a judgment before garnishment can begin. The Minnesota Garnishment Earnings Disclosure Instructions outline the steps involved, including the notice requirement and exemptions that may apply to your earnings. Utilizing a platform like USLegalForms can simplify the process and ensure you have the right forms and information to proceed correctly.

In Minnesota, the maximum amount that can be garnished from your paycheck is 25% of your disposable earnings or the amount by which your disposable earnings exceed 40 times the federal minimum wage, whichever is less. This ensures that you retain some income for your living expenses. To navigate these rules smoothly, Minnesota Garnishment Earnings Disclosure Instructions can provide clarity on your specific situation. Always check with a legal expert to understand how these rules apply to you.

2)What Happens When the Wage Garnishment is Paid? The wage garnishment continues until the debt is paid in full. Once the debt is paid, the creditor should notify the employer to stop deductions for the debt. It is difficult to stop a wage garnishment after it begins.

In Minnesota, the most that can be garnished from your wages is the lesser of: 25% of your disposable earnings, or. the amount by which your weekly disposable earnings exceed the greater of 40 times the federal or state hourly minimum wage.

Step 1: Serve Notice of Garnishment. You must serve the debtor with a Garnishment Exemption Notice and Notice of Intent to Garnish Earnings Within 10 Days upon the debtor at least 10 days before attempting to garnish wages. Step 2: Garnishment Summons and Disclosure Form. Step 3: More Notice of Garnishment to the Debtor.

Once a garnishment is approved in court, the creditor will notify you before contacting your bank to begin the actual garnishment. However, the bank itself has no legal obligation to inform you when money is withdrawn due to an account garnishment.