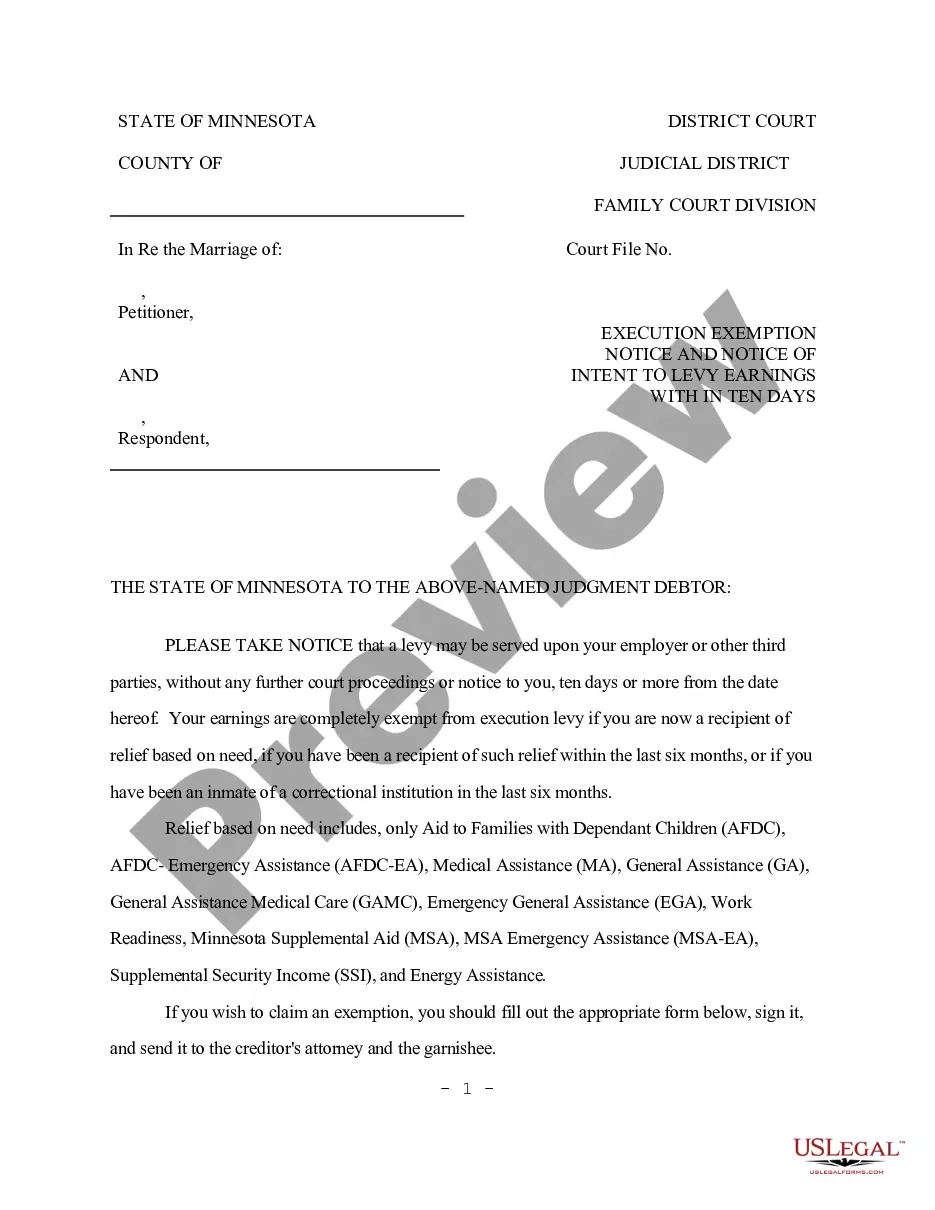

Minnesota Notice to Garnishee of Intent to Levy Earnings

Description

How to fill out Minnesota Notice To Garnishee Of Intent To Levy Earnings?

Obtain any version from 85,000 lawful documents including Minnesota Notice to Garnishee of Intent to Levy Earnings online with US Legal Forms. Each template is composed and refreshed by state-authorized legal experts.

If you already possess a subscription, Log In. Once you’re on the form’s page, click on the Download button and go to My documents to retrieve it.

If you have not subscribed yet, follow the steps below.

With US Legal Forms, you’ll always have instant access to the relevant downloadable template. The platform grants you access to forms and categorizes them to simplify your search. Utilize US Legal Forms to obtain your Minnesota Notice to Garnishee of Intent to Levy Earnings swiftly and effortlessly.

- Verify the state-specific requirements for the Minnesota Notice to Garnishee of Intent to Levy Earnings you need to utilize.

- Examine the description and preview the template.

- When you are confident the template meets your needs, simply click Buy Now.

- Choose a subscription plan that truly suits your budget.

- Create a personal account.

- Pay using one of two suitable methods: by credit card or through PayPal.

- Select a format to download the file in; two options are available (PDF or Word).

- Download the file to the My documents tab.

- Once your reusable form is downloaded, print it out or save it to your device.

Form popularity

FAQ

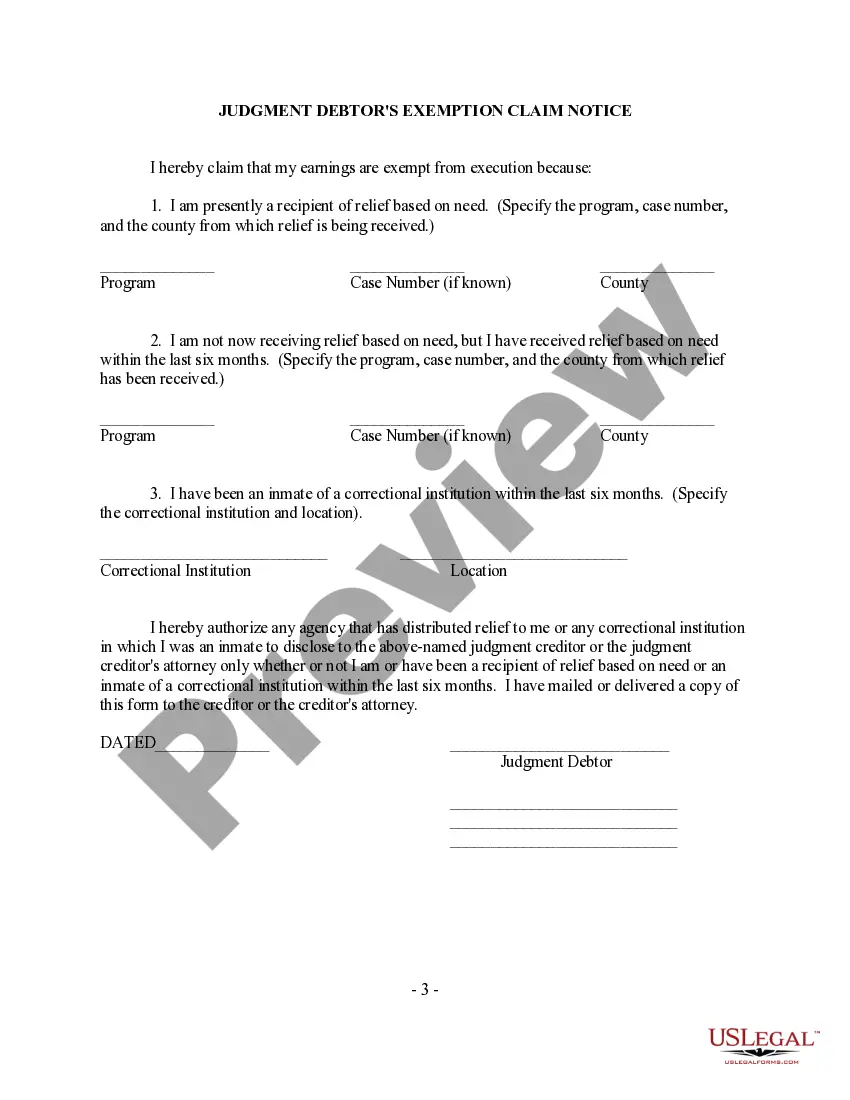

After receiving the notice of garnishment, employers must comply with the requirements set forth in the Minnesota Notice to Garnishee of Intent to Levy Earnings. This includes withholding the specified amount from the employee's wages and submitting it to the court or creditor. Failure to comply can result in legal repercussions for the employer. To ensure compliance and understand the process better, using resources from US Legal Forms can provide clarity and necessary documentation.

Filing a motion for wage garnishment in Minnesota involves several steps. First, you must complete the necessary court forms, which include the Minnesota Notice to Garnishee of Intent to Levy Earnings. Next, you file these forms with the court and serve them to the garnishee and debtor. Utilizing platforms like US Legal Forms can simplify this process by providing the required forms and guidance tailored to your needs.

In Minnesota, garnishment rules aim to protect debtors while allowing creditors to collect owed amounts. The Minnesota Notice to Garnishee of Intent to Levy Earnings is a crucial document that notifies employers of the garnishment process. This notice provides essential details about the debt and the required withholding amount. Understanding these rules can help both debtors and creditors navigate the garnishment procedure effectively.

In Minnesota, wage garnishment follows specific rules that protect both creditors and debtors. First, the Minnesota Notice to Garnishee of Intent to Levy Earnings must be issued, notifying the garnishee of the debt owed. Additionally, the law limits the amount that can be garnished from your wages, ensuring you have enough income to cover your living expenses. For those navigating this complex process, platforms like US Legal Forms can provide valuable resources and guidance.

In Minnesota, wages cannot be garnished without proper notice. The Minnesota Notice to Garnishee of Intent to Levy Earnings serves as the official communication that informs the garnishee of the impending levy. This notice ensures that you, as the employee, have an opportunity to respond and protect your rights. Therefore, understanding this process is essential for anyone facing wage garnishment.

To write a letter to a judge regarding garnishment, start by clearly stating your intention. Include relevant details such as the case number, your name, and the names of the parties involved. It is crucial to mention the Minnesota Notice to Garnishee of Intent to Levy Earnings to ensure that the judge understands the context of your letter. Additionally, you should respectfully request the judge's consideration and provide any necessary documentation to support your request.

Your stimulus check can be garnished, but some states are pushing back.Unlike the second stimulus payment, which was protected against garnishment from private debt collectors after the first round of checks lacked protections, the third round of stimulus checks also don't include garnishment prohibitions.

Generally, state laws don't require employers to notify you in advance before garnishing wages. Nor are they required to give you a period of time to dispute the debt or garnishment. However, your employer should, as a courtesy, provide you with a copy of the notice.

The exempt benefits are typically funds received from the government for a specific reason. For example, Veteran's Assistance benefits, Social Security, Workers' Compensation, Unemployment and Disability are benefits that cannot be seized in order to pay off outstanding debts.

The federal benefits that are exempt from garnishment include: Social Security Benefits. Supplemental Security Income (SSI) Benefits. Veterans' Benefits.