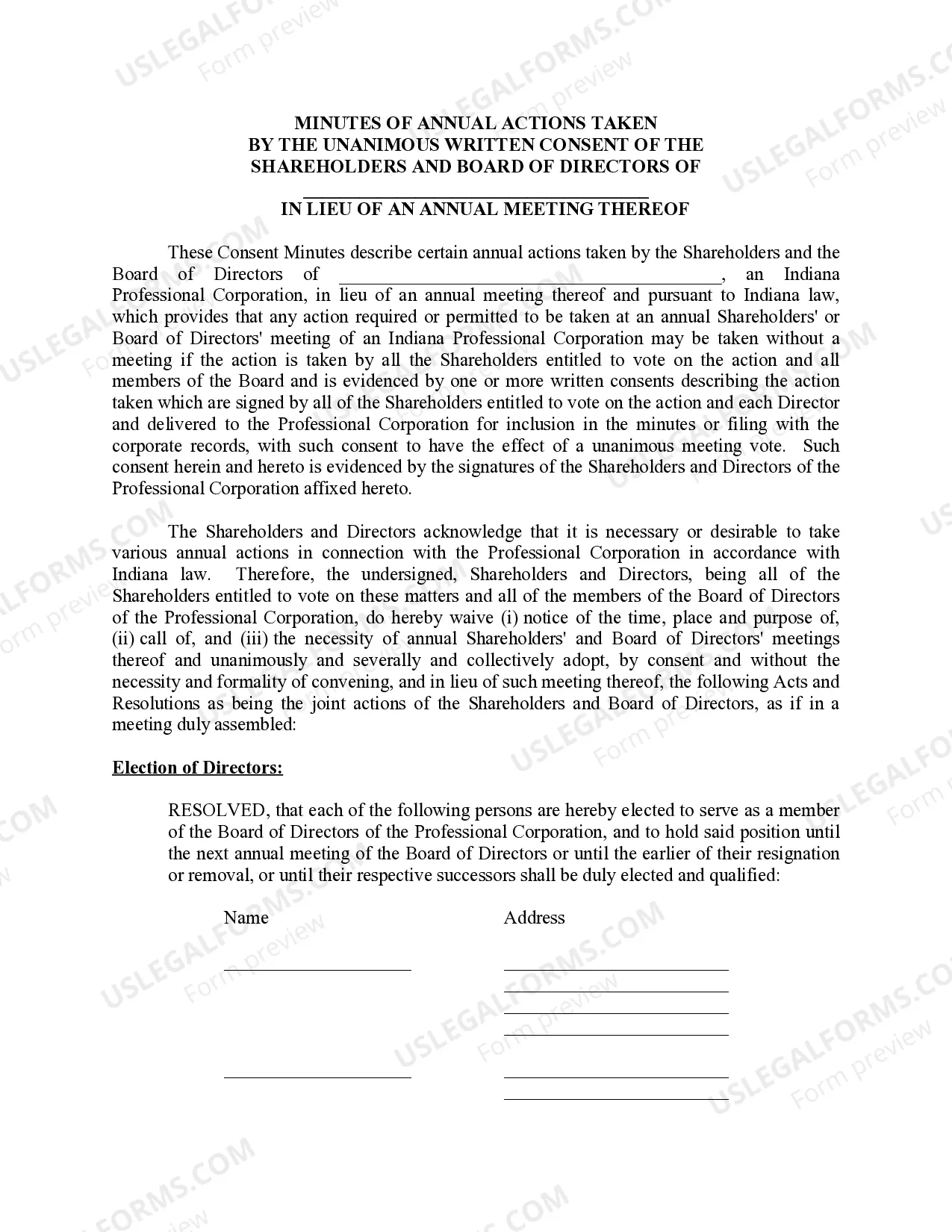

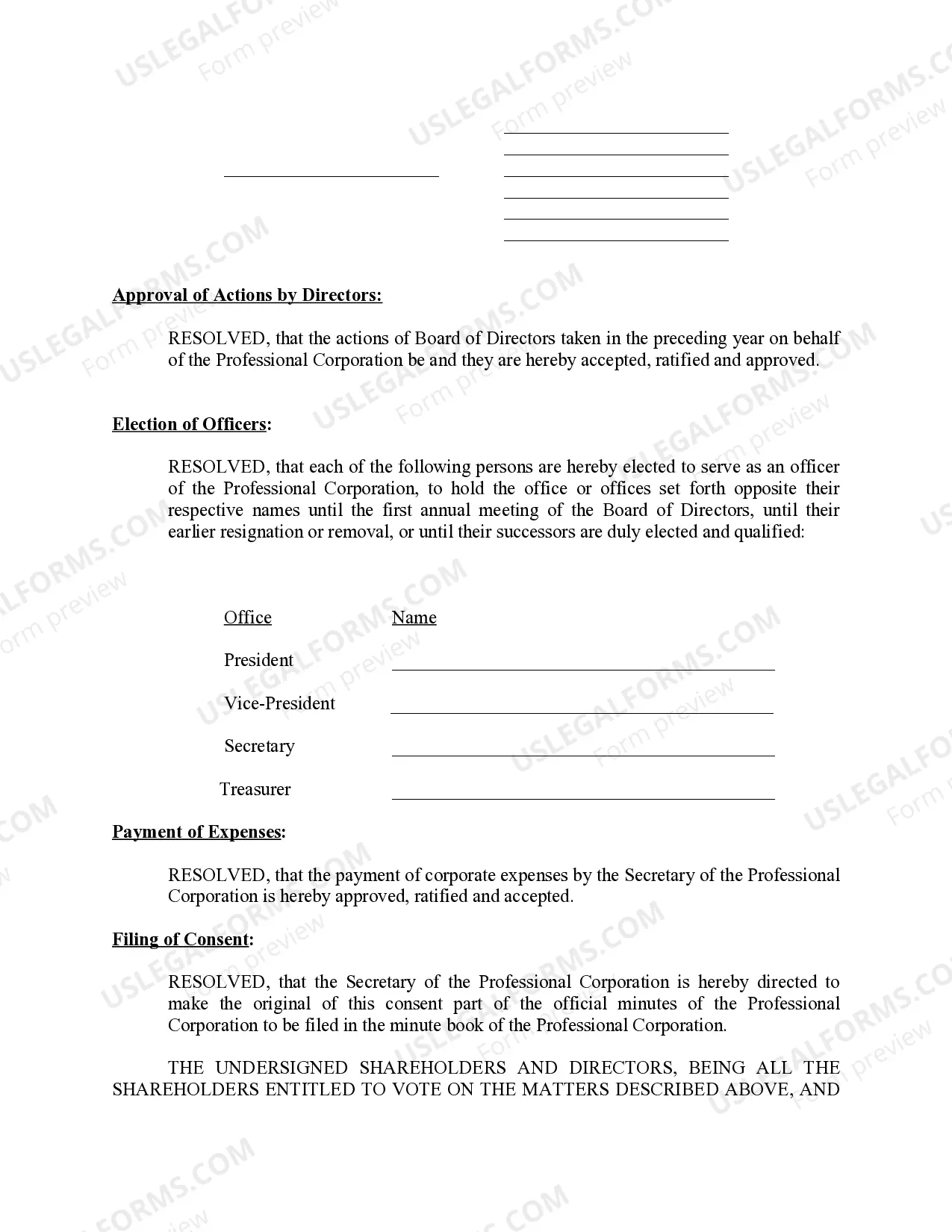

Annual Minutes document any changes or other organizational activities of a Professional Corporation during a given year.

Sample Annual Minutes for an Indiana Professional Corporation

Description

How to fill out Sample Annual Minutes For An Indiana Professional Corporation?

Searching for Sample Annual Minutes for an Indiana Professional Corporation example can be challenging when trying to complete them.

To conserve time, money, and effort, utilize US Legal Forms to select the appropriate template tailored for your state within just a few clicks.

Our attorneys create all documents, so all you need to do is fill them in. It really is that effortless.

Select your plan on the pricing page and create an account. Choose your payment method via credit card or PayPal. Download the document in your preferred format. Now you can print the Sample Annual Minutes for an Indiana Professional Corporation template or complete it using any online editor. Don't worry about making mistakes because your template can be used, sent, and printed as many times as necessary. Visit US Legal Forms to gain access to approximately 85,000 state-specific legal and tax documents.

- Log in to your account and navigate back to the form's webpage to save the document.

- All of your downloaded templates are stored in My documents and can be accessed at any time for future use.

- If you haven't signed up yet, it's advisable to register.

- Follow our detailed guidelines to obtain the Sample Annual Minutes for an Indiana Professional Corporation template within minutes.

- To acquire an eligible form, verify its relevance to your state.

- Examine the form using the Preview feature (if available).

- If there's a description, review it to grasp the essential details.

- Click on the Buy Now button if you've found what you're looking for.

Form popularity

FAQ

Use a template. Check off attendees as they arrive. Do introductions or circulate an attendance list. Record motions, actions, and decisions as they occur. Ask for clarification as necessary. Write clear, brief notes-not full sentences or verbatim wording.

If you run an S corporation, you are not required by law to keep meeting minutes. However, they can be a good way to record the progress your company makes toward meeting corporate objectives. Minutes can also be useful as a legal record of corporate activities in the event of a lawsuit or tax audit.

A corporation's organizational meeting is meant to be the initial meeting of the owners of the corporation and management. Typically, the items on the meeting agenda include: The appointment of corporate officers. The acquisition of a minute book to record meeting minutes and actions. The approval of Corporate Bylaws.

Meeting name and place. Date and time of the meeting. List of meeting participants. Purpose of the meeting. For each agenda items: decisions, action items, and next steps. Next meeting date and place. Documents to be included in the meeting report.

Organizational meetings are held to appoint officers, elect or appoint directors, issue shares in the corporation, approve bylaws, setup minute books, appoint or waive the appointment of auditors, set up bank accounts, etc.

Date, time, and location. Minutes should include this basic information about when and where the meeting was held and how long it lasted. Creator. List of persons present. Topics list. Voting record. Review and approval.

One of the most important formalities required of corporations is to hold annual shareholder meetings and to keep detailed reports of these meetings, known as annual meeting minutes.While there's no statutory requirement for LLCs to hold meetings, it may be required by your LLC's own operating agreement.

Minutes typically include: Meeting date, time, and location. Names of attendees and whether they missed any part of the meeting. List of those absent. Agenda items and brief descriptions. Any voting actions and how each individual voted. Time that meeting was adjourned.

The participants to the meetings have a reminder aid. The minutes say who will do what and when. They are the starting point of the following meeting. They are helpful for those absent to know was discussed and what decisions have been taken. In case of conflicts, they are useful to know what agreements were made.