Minnesota Partial Exemption from Garnishment

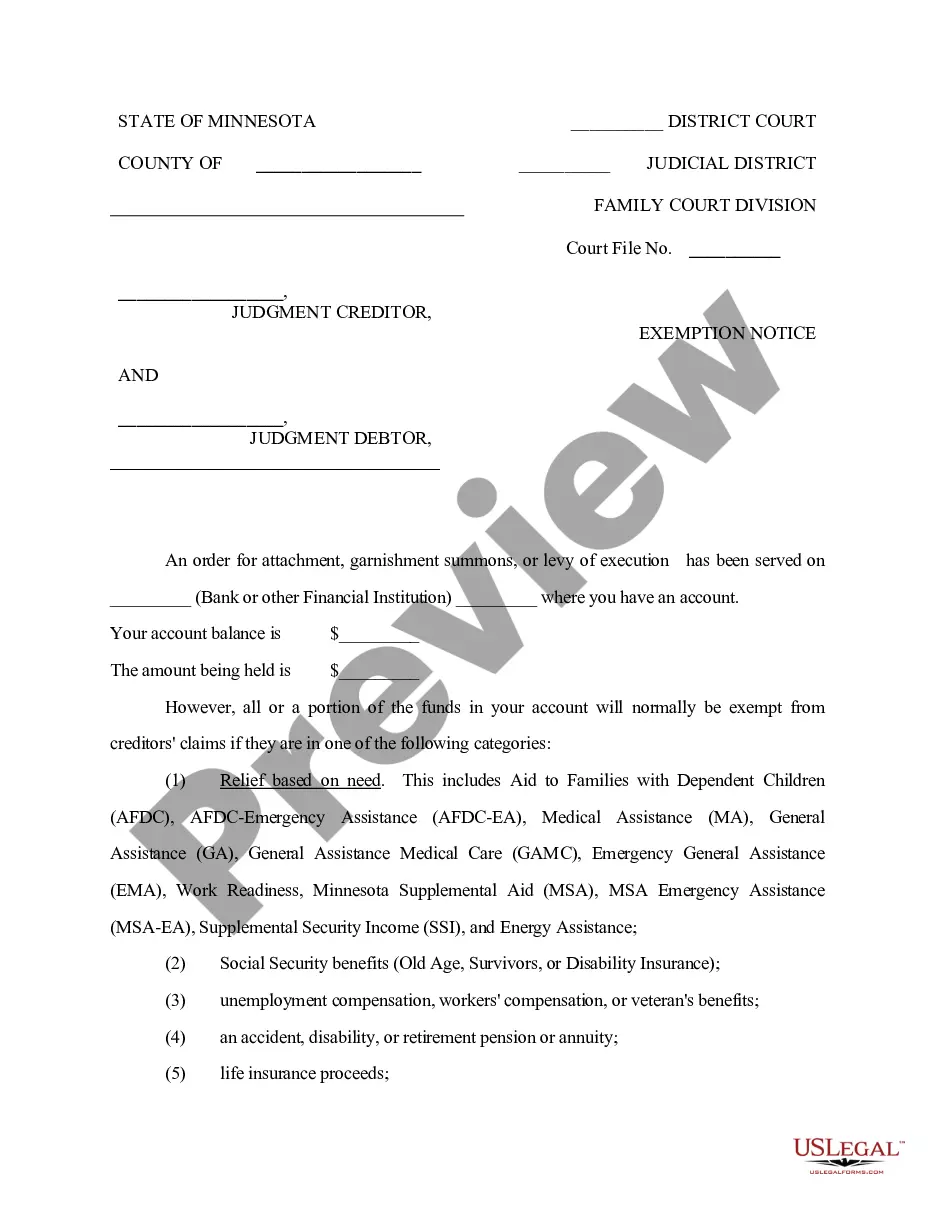

What is this form?

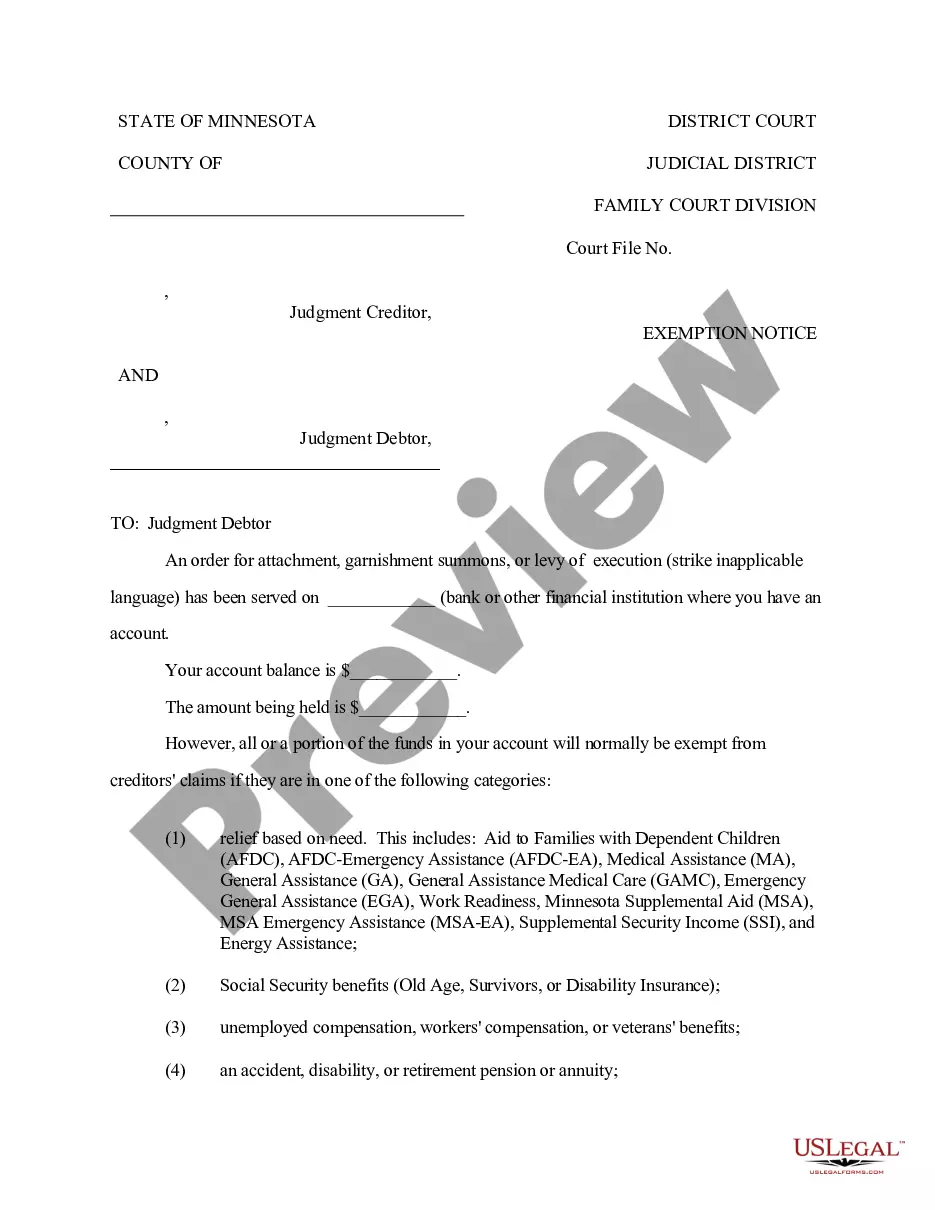

The Partial Exemption from Garnishment form is a legal document that allows a judgment debtor to claim that certain funds in their bank account are exempt from creditor claims. When an order for garnishment has been served on a financial institution, this form notifies the creditor and the financial institution of the debtor's eligibility to protect specified funds from being seized.

What’s included in this form

- Identification of the financial institution holding the debtor's account.

- Details regarding the account balance and the amount being garnished.

- A list of categories under which funds may be exempt.

- Instructions for claiming an exemption, including mailing details for the exemption claim.

- Timeline for claiming exemptions and consequences of not doing so.

Common use cases

This form should be used when a judgment debtor learns that their funds are being garnished due to a court order. It is particularly important when the debtor believes that specific funds in their account fall under legal exemptions that protect them from creditor claims, such as social security benefits, unemployment compensation, or certain types of public assistance.

Who can use this document

Those who may use this form include:

- Individuals facing garnishment of their bank account by creditors.

- Debtors who receive social security, unemployment benefits, or other public assistance.

- People with funds in their accounts that may qualify under the exemptions listed.

How to prepare this document

- Identify and write down the name of the financial institution where the account is held.

- Specify the account balance and the amount being held due to garnishment.

- Indicate your claim regarding which funds you believe are exempt based on the provided categories.

- Fill in your contact information and the necessary details regarding the source of the exempt funds.

- Sign and date the form before mailing it to the creditor and the financial institution as instructed.

Does this document require notarization?

This form usually doesn’t need to be notarized. However, local laws or specific transactions may require it. Our online notarization service, powered by Notarize, lets you complete it remotely through a secure video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to submit the form within the required fourteen (14) days.

- Not providing complete information regarding the source of exempt funds.

- Neglecting to send copies to both the financial institution and the judgment creditor's attorney on the same day.

Why use this form online

- Convenient access to legal forms that can be filled out and downloaded from anywhere.

- Editable templates that allow users to customize their exemption claim based on personal circumstances.

- Reliability of forms developed by licensed attorneys ensuring compliance with legal standards.

Looking for another form?

Form popularity

FAQ

In Minnesota, several exemptions exist that can protect your income from garnishment. Common exemptions include public assistance benefits, certain retirement accounts, and a portion of your wages based on your income level. Understanding the specifics of these exemptions can help you maintain financial stability. For detailed information and assistance, consider using USLegalForms to access the necessary legal resources that outline your rights.

Claiming an exemption from wage garnishment involves submitting a request to the court. You will need to demonstrate that you meet the criteria for a Minnesota Partial Exemption from Garnishment, such as showing that your income falls below a certain threshold. Completing the required forms accurately is crucial to expedite your claim. Using resources like USLegalForms can help you find the right documentation and guidance for your situation.

To reduce your garnishment, you can file a motion with the court that issued the garnishment order. This process allows you to present evidence that supports your claim for a Minnesota Partial Exemption from Garnishment. It is important to gather documentation about your financial situation to strengthen your case. Additionally, consulting with a legal expert can help you understand your rights and navigate this process effectively.

You can also stop most garnishments by filing for bankruptcy. Your state's exemption laws determine the amount of income you'll be able to keep.

Include in your letter what steps you plan to take to address the default, such as making a reasonable effort at a payment plan. Mention any circumstances that have changed recently to make your ability to pay off the debt more likely. This conveys to the creditor your goodwill toward satisfying the debt.

Some of the ways to loweror even eliminatethe amount of a wage garnishment include: filing a claim of exemption. filing for bankruptcy, or. vacating the underlying money judgment.

The federal benefits that are exempt from garnishment include: Social Security Benefits. Supplemental Security Income (SSI) Benefits. Veterans' Benefits.