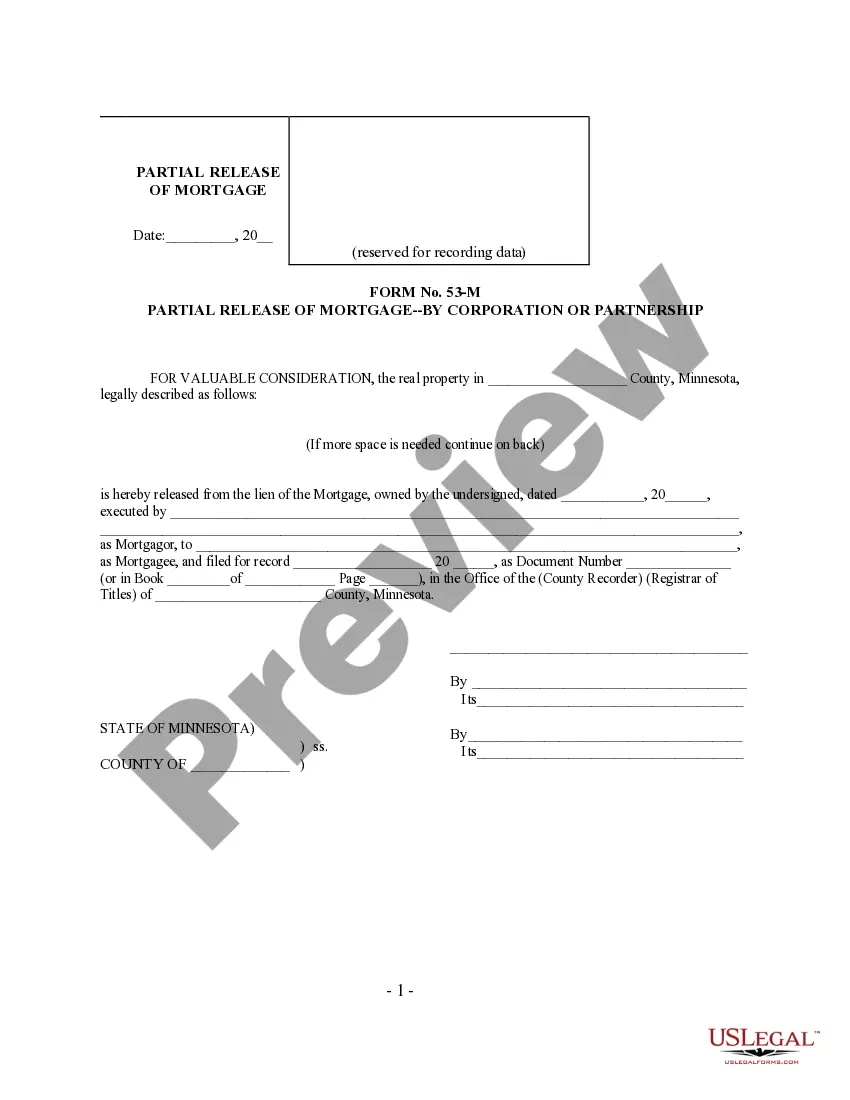

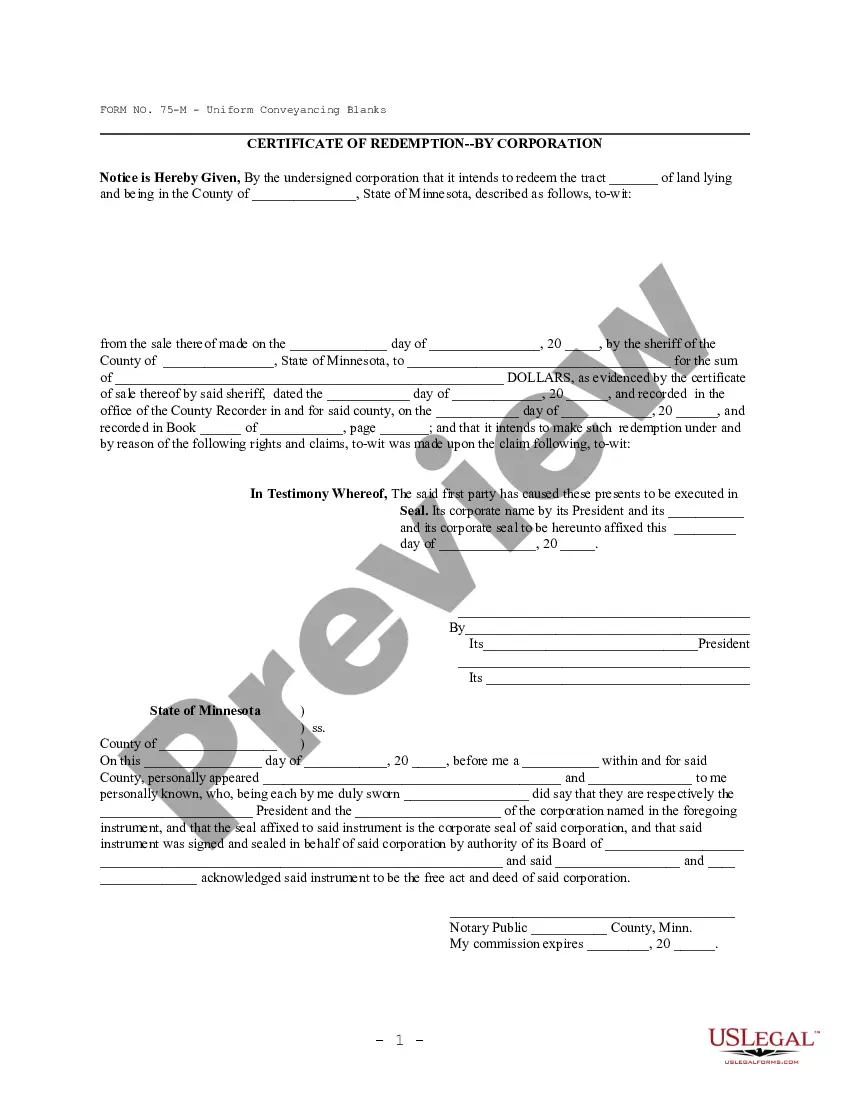

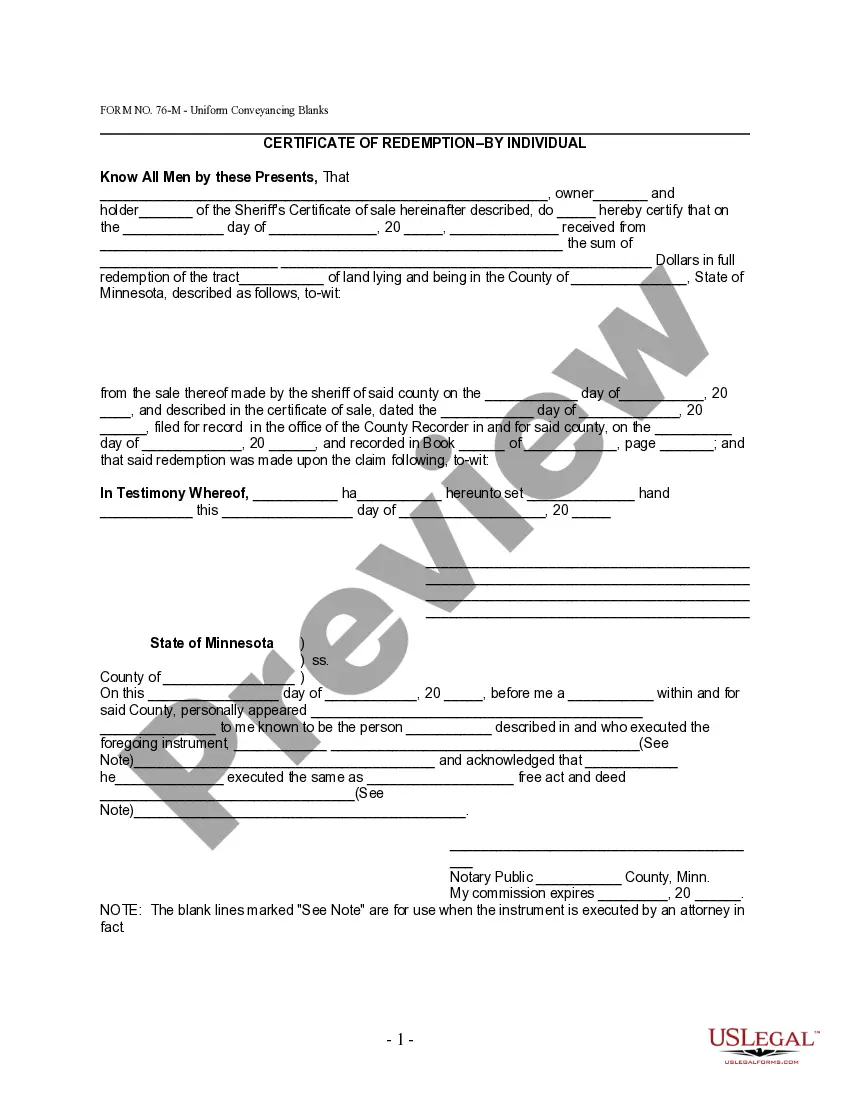

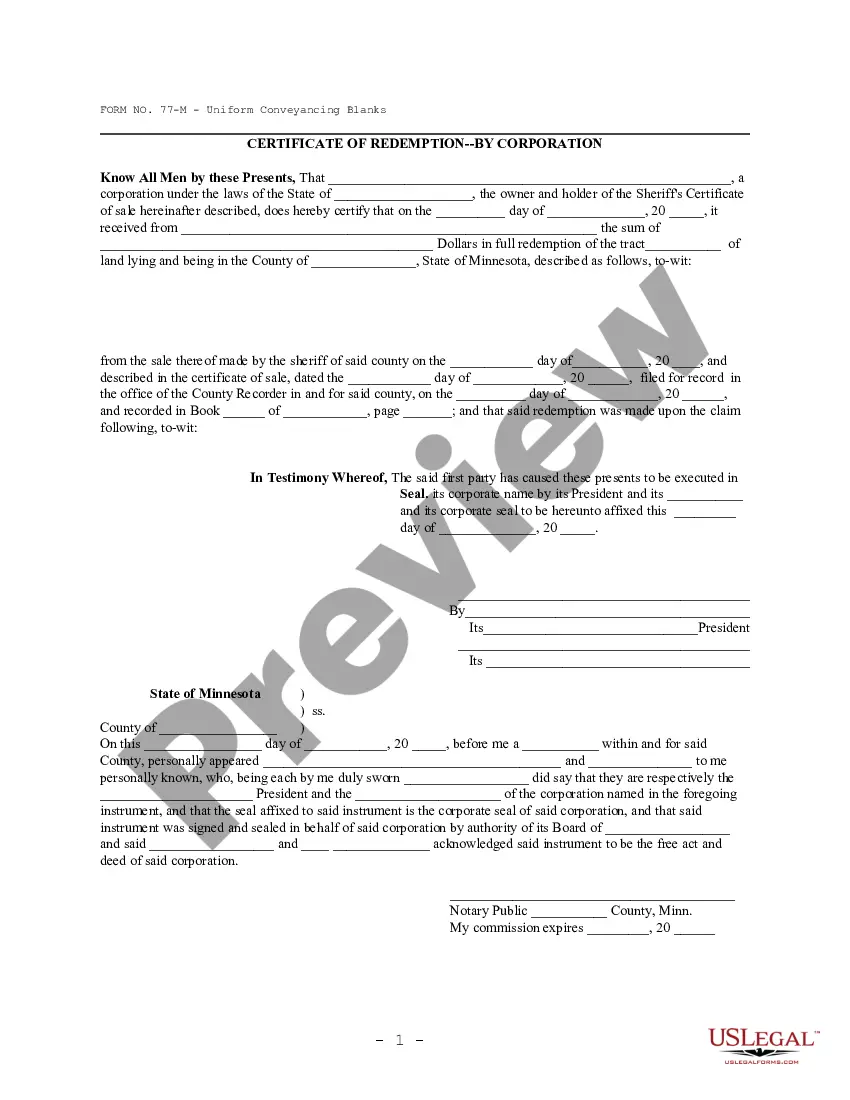

Minnesota Partial Payment Certificate - Mortgage or Contract - By Corporation - UCBC Form 60.4.5

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Minnesota Partial Payment Certificate - Mortgage Or Contract - By Corporation - UCBC Form 60.4.5?

Obtain any version from 85,000 lawful documents such as the Minnesota Partial Payment Certificate - Mortgage or Contract - By Corporation - UCBC Form 60.4.5 online with US Legal Forms. Each template is crafted and refreshed by state-authorized attorneys.

If you already possess a subscription, Log In. Once you are on the form’s page, click on the Download button and navigate to My documents to retrieve it.

If you have yet to subscribe, adhere to the following guidelines.

With US Legal Forms, you will consistently have immediate access to the appropriate downloadable template. The platform offers you access to documents and categorizes them to streamline your search. Utilize US Legal Forms to acquire your Minnesota Partial Payment Certificate - Mortgage or Contract - By Corporation - UCBC Form 60.4.5 swiftly and effortlessly.

- Verify the state-specific criteria for the Minnesota Partial Payment Certificate - Mortgage or Contract - By Corporation - UCBC Form 60.4.5 you intend to utilize.

- Examine the description and review the example.

- Once you're confident the template meets your requirements, click Buy Now.

- Choose a subscription plan that genuinely suits your financial situation.

- Establish a personal account.

- Pay using either of two convenient methods: by card or through PayPal.

- Select a format to download the document in; two options are available (PDF or Word).

- Download the file to the My documents section.

- After your reusable template is prepared, print it out or save it to your device.

Form popularity

FAQ

Completing a quit claim deed in Minnesota involves obtaining the correct form and accurately filling in all required details. You need to provide the names of the parties involved, a complete legal description of the property, and the date of the transfer. After signing the deed in front of a notary, you will need to file it with the county recorder. For assistance, you can access the Minnesota Partial Payment Certificate - Mortgage or Contract - By Corporation - UCBC Form 60.4.5 through uslegalforms for a smooth process.

To properly fill out a quitclaim deed, ensure you have the correct legal form, which you can find on platforms like uslegalforms. Clearly state the property description, the names of both the grantor and grantee, and the effective date. Double-check all information for accuracy and be sure to sign the document in front of a notary. Lastly, file the completed deed with your county's recorder office to finalize the transfer.

In Minnesota, a quitclaim deed transfers ownership of property without guaranteeing that the title is clear. This means the grantor conveys whatever interest they have in the property, but they do not assure the grantee of its value or any liens. It is commonly used among family members or in situations where the parties trust each other. For more detailed guidance, consider using the Minnesota Partial Payment Certificate - Mortgage or Contract - By Corporation - UCBC Form 60.4.5 available on uslegalforms.

To fill out a Minnesota quit claim deed, start by downloading the appropriate form from a reliable source like uslegalforms. Enter the names of the grantor and grantee clearly, along with the legal description of the property. Don’t forget to include the date of the transfer and ensure all necessary signatures are present. Once completed, you should file the deed with your county's recorder office for it to be legally recognized.

Filing a quitclaim deed in Minnesota involves several straightforward steps. First, access the required form, such as the Minnesota Partial Payment Certificate - Mortgage or Contract - By Corporation - UCBC Form 60.4.5, from US Legal Forms. After completing the form, you will need to sign it in the presence of a notary. Lastly, submit the signed quitclaim deed to your local county recorder's office, ensuring that you comply with any associated fees and guidelines.

Transferring ownership of property in Minnesota can be accomplished using a quit claim deed or a warranty deed. You can easily find the necessary forms on websites like US Legal Forms, including the Minnesota Partial Payment Certificate - Mortgage or Contract - By Corporation - UCBC Form 60.4.5. Once you have filled out the appropriate deed, have it notarized, and submit it to the county recorder's office. This process ensures that the transfer is legally recognized.

To cancel a contract for deed in Minnesota, you must follow specific legal procedures, including providing written notice to the buyer. This notice should clearly state your intent to cancel and include reasons for the cancellation. It is also advisable to consult legal resources or professionals to ensure compliance with Minnesota laws. The Minnesota Partial Payment Certificate - Mortgage or Contract - By Corporation - UCBC Form 60.4.5 can assist you in managing this process effectively.

In Minnesota, a buyer has a maximum of four months from the date of signing to record a contract for deed. This is crucial to ensure legal protection and establish the buyer's interest in the property. Failing to record within this timeframe could lead to complications regarding ownership and rights. Utilizing the Minnesota Partial Payment Certificate - Mortgage or Contract - By Corporation - UCBC Form 60.4.5 can help streamline this process and provide clarity.