This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Contract for the Sale of Commercial Property - Owner Financed with Provisions for Note and Purchase Money Mortgage and Security Agreement

Description

How to fill out Contract For The Sale Of Commercial Property - Owner Financed With Provisions For Note And Purchase Money Mortgage And Security Agreement?

Aren't you sick and tired of choosing from countless samples each time you require to create a Contract for the Sale of Commercial Property - Owner Financed with Provisions for Note and Purchase Money Mortgage and Security Agreement? US Legal Forms eliminates the wasted time countless American people spend browsing the internet for perfect tax and legal forms. Our expert crew of lawyers is constantly updating the state-specific Samples library, so that it always has the right documents for your scenarion.

If you’re a US Legal Forms subscriber, just log in to your account and then click the Download button. After that, the form are available in the My Forms tab.

Users who don't have an active subscription should complete a few simple actions before being able to get access to their Contract for the Sale of Commercial Property - Owner Financed with Provisions for Note and Purchase Money Mortgage and Security Agreement:

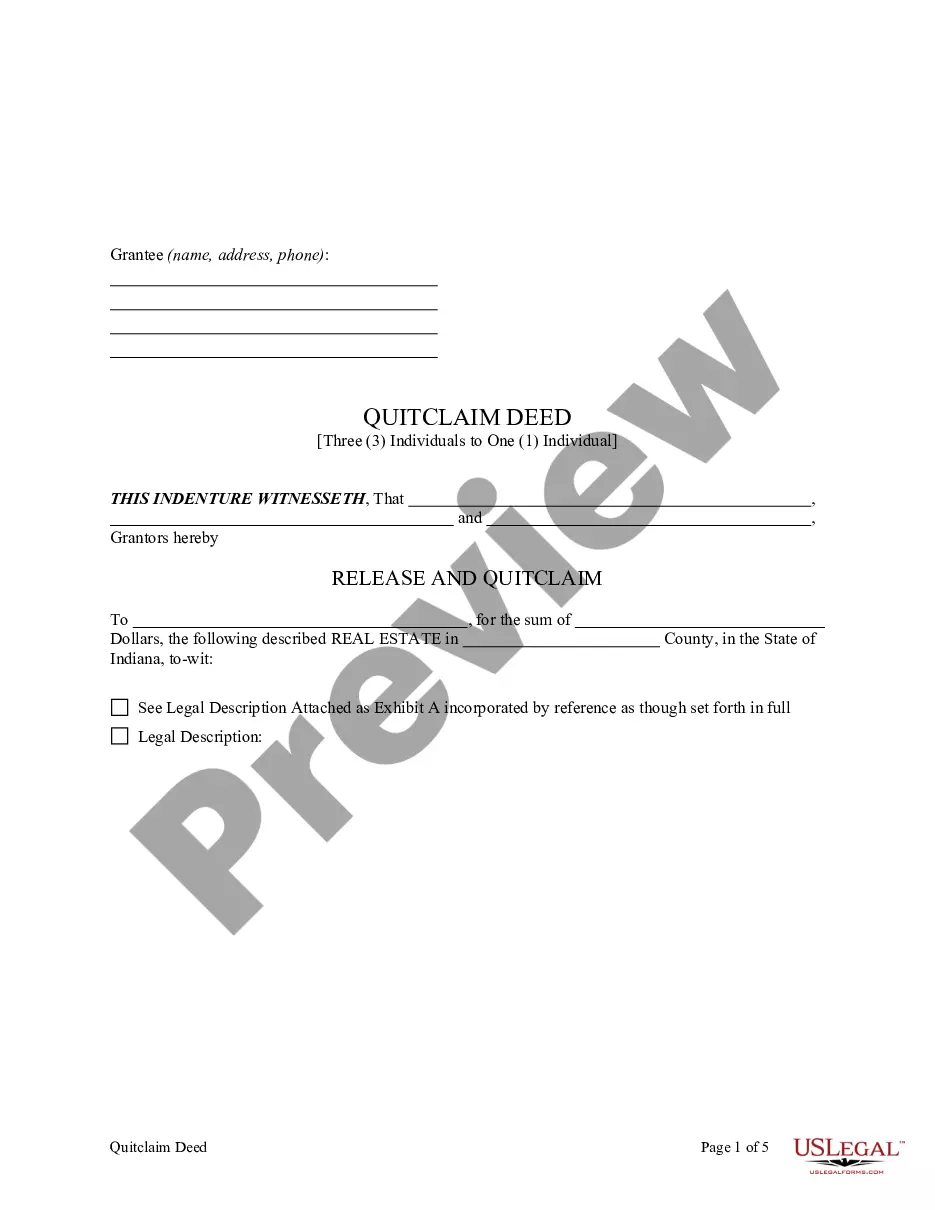

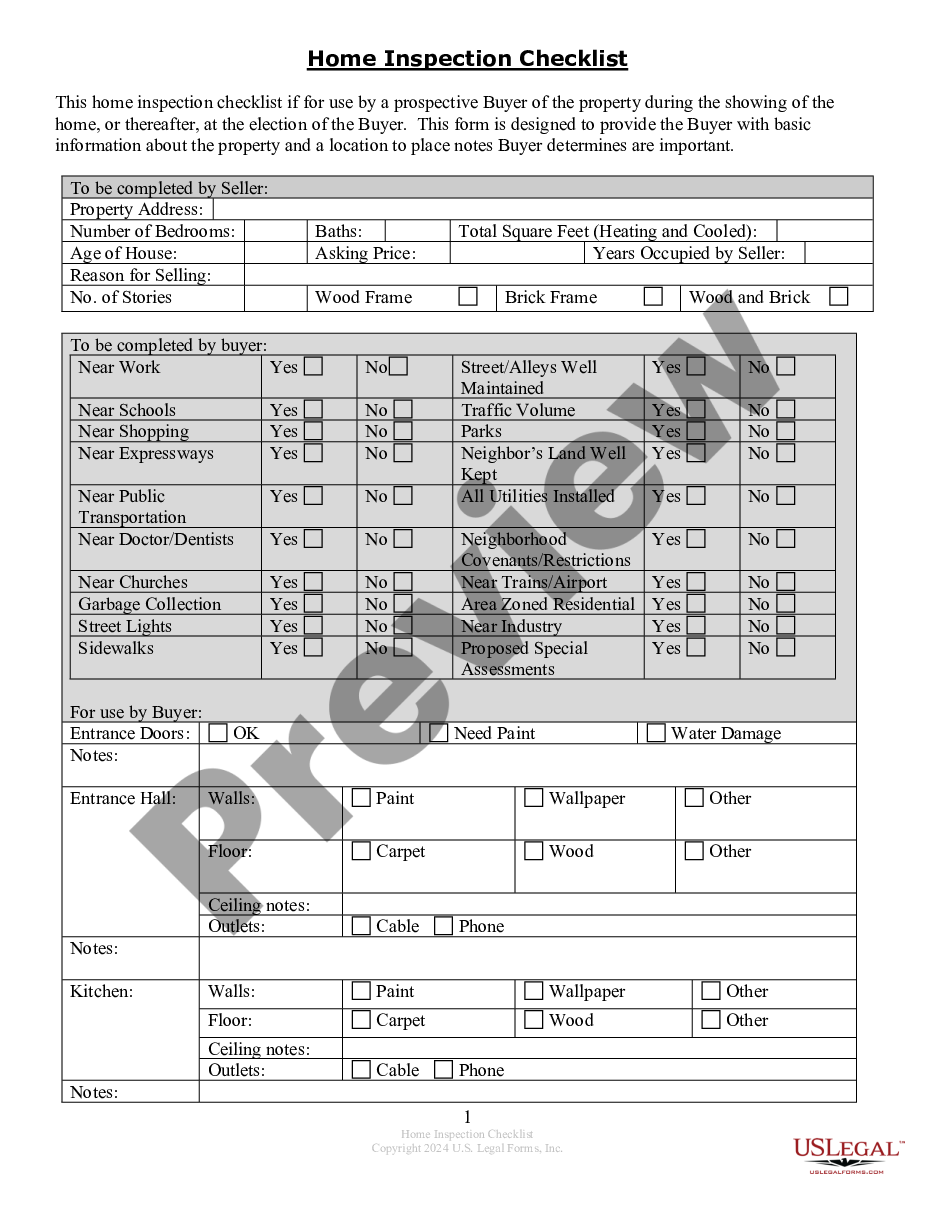

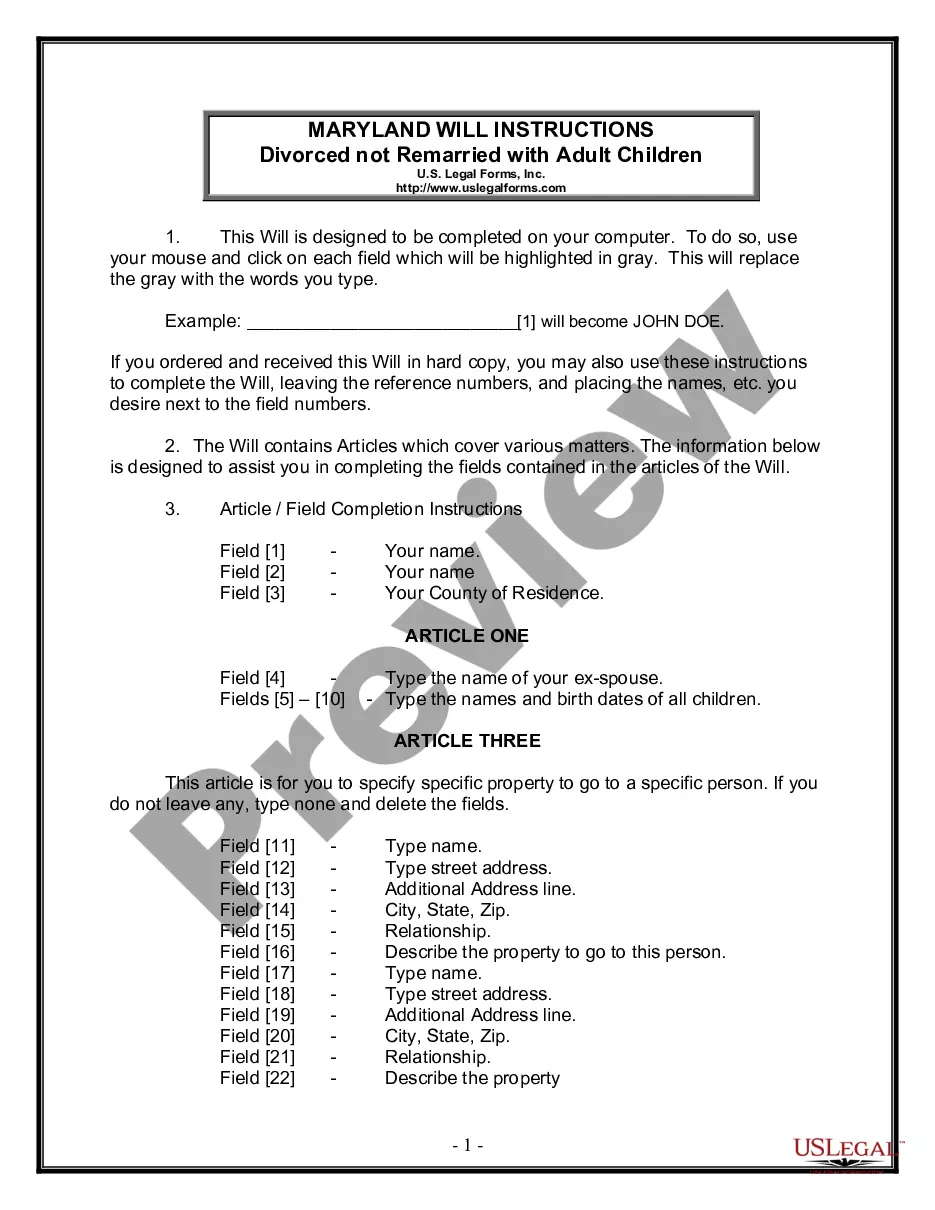

- Utilize the Preview function and read the form description (if available) to be sure that it is the correct document for what you’re trying to find.

- Pay attention to the validity of the sample, meaning make sure it's the right sample to your state and situation.

- Use the Search field on top of the web page if you need to look for another file.

- Click Buy Now and choose a convenient pricing plan.

- Create an account and pay for the service utilizing a credit card or a PayPal.

- Get your sample in a required format to complete, print, and sign the document.

As soon as you’ve followed the step-by-step instructions above, you'll always be capable of sign in and download whatever file you require for whatever state you require it in. With US Legal Forms, finishing Contract for the Sale of Commercial Property - Owner Financed with Provisions for Note and Purchase Money Mortgage and Security Agreement samples or any other legal paperwork is not hard. Get going now, and don't forget to examine your samples with accredited attorneys!

Form popularity

FAQ

With owner financing (aka seller financing), the seller doesn't hand over any money to the buyer as a mortgage lender would. Instead, the seller extends enough credit to the buyer to cover the purchase price of the home, less any down payment. Then, the buyer makes regular payments until the amount is paid in full.

The seller financing addendum outlines the terms at which the seller of the property agrees to loan the money to the buyer in order to purchase their property.Once complete, this addendum should be signed and attached to the purchase agreement made between the parties.

Owner financing allows buyers who wouldn't otherwise be able to enter the market to participate. It also helps buyers spread out the cost of the land over a number of monthly payments, which can then be offset by using creative ways to make money from raw land.

In seller financing, the seller takes on the role of the lender. Instead of giving cash to the buyer, the seller extends enough credit to the buyer for the purchase price of the home, minus any down payment. The buyer and seller sign a promissory note (which contains the terms of the loan).

Purchase price. Down payment. Interest rate. Number of monthly installments. Responsibilities of the buyer and seller. Legal remedies for the seller if the buyer does not make payments.

Step 1: Obtain the current principal balance and interest rate from the land contract or promissory note. Step 2: Times the balance by the interest rate. Step 3: Divide by 12. Step 1: A seller-financed note has a balance of 100,000 at 8% interest. Step 2: $100,000 x 8% (or .08) = $8,000 (interest for the year)

Advantages of buying an owner-financed home In a seller-financed transaction there are no closing costs such as loan origination fees, discount points and mortgage insurance premiums. Because you won't have to wait for bank approvals, closing can happen much quicker than with traditional financing.

Interest rateInterest rates for seller-financed loans are typically higher than what traditional lenders would offer. The seller takes on some risk by holding financing, and he or she may charge a higher interest rate to offset this risk. It's not uncommon to see interest rates from 4% to 10%.

Complete the addendum, including your name, the purchaser's name and a description of the property. Include the type of financing that you are providing, such as first mortgage, second mortgage or deed of trust. List the terms of the loan.