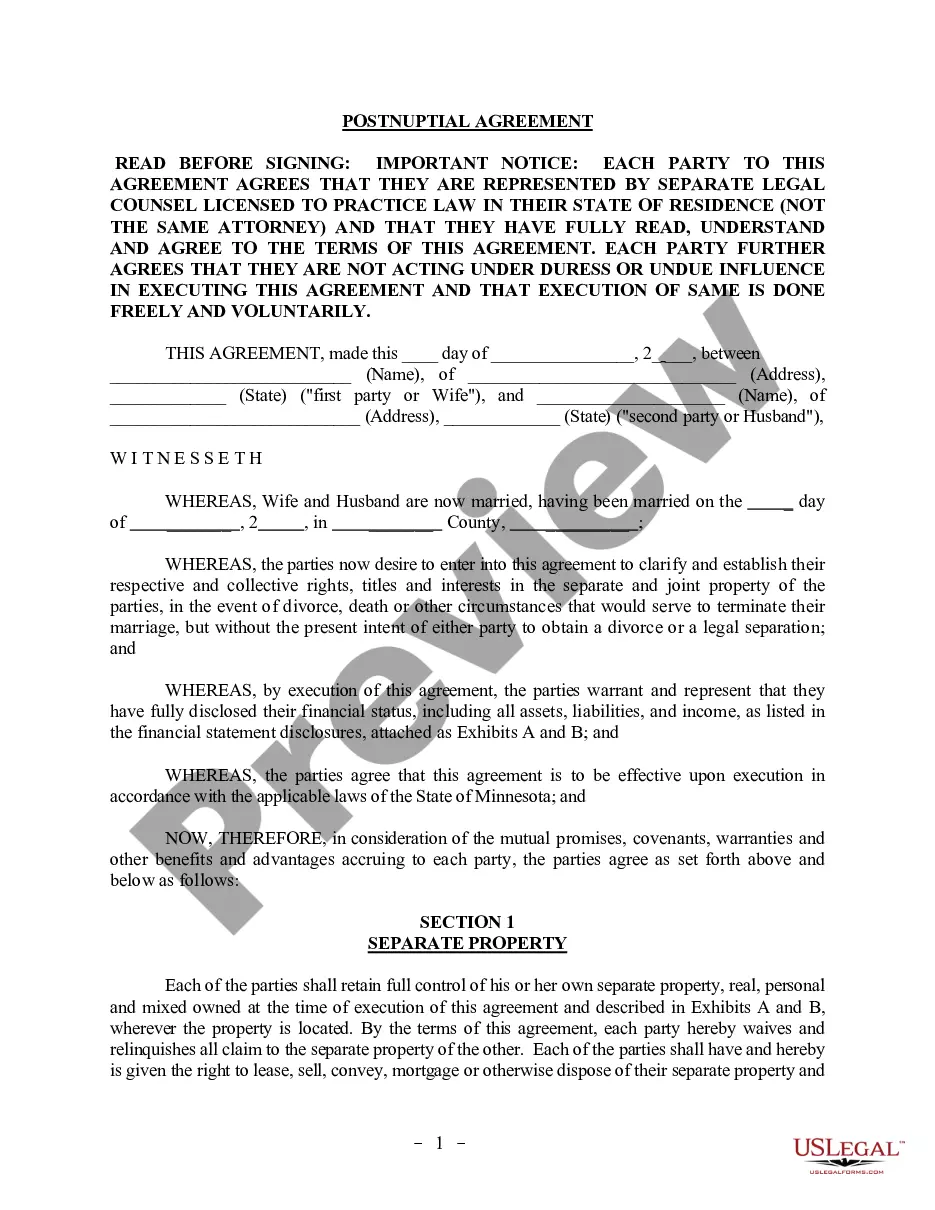

Minnesota Postnuptial Property Agreement

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

Key Concepts & Definitions of Postnuptial Property Agreement

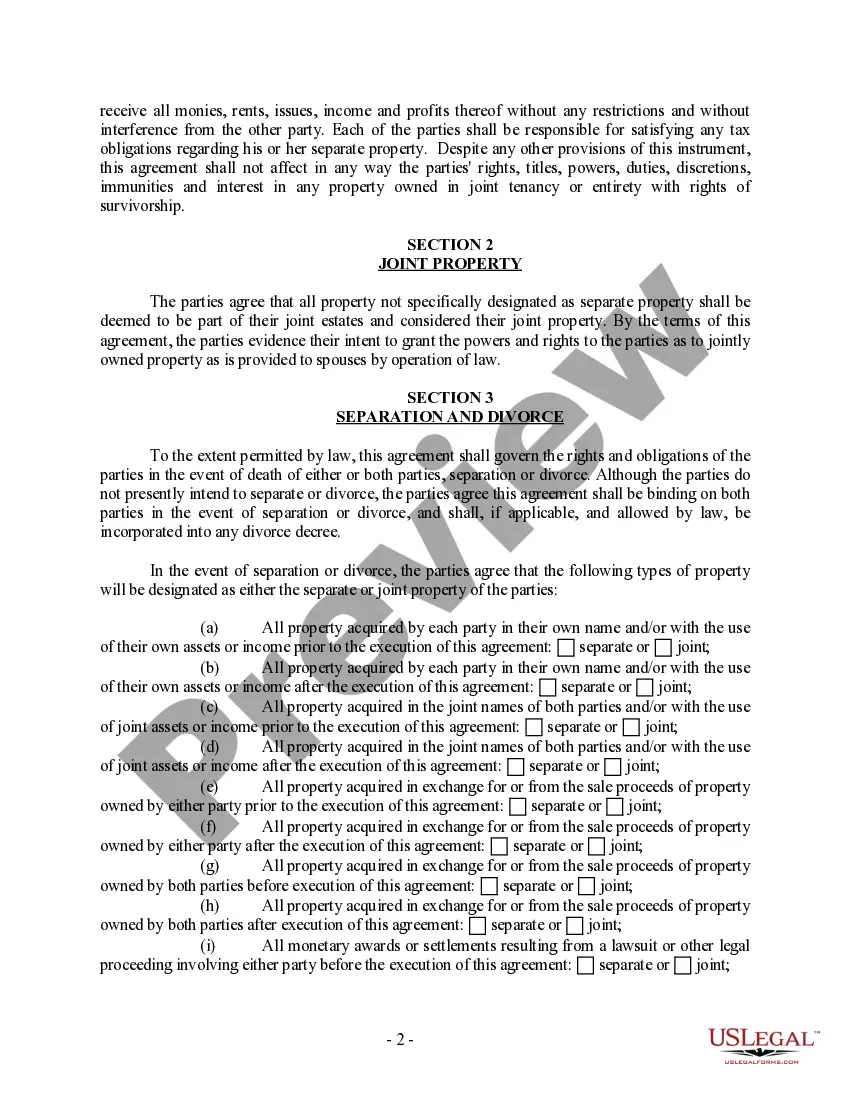

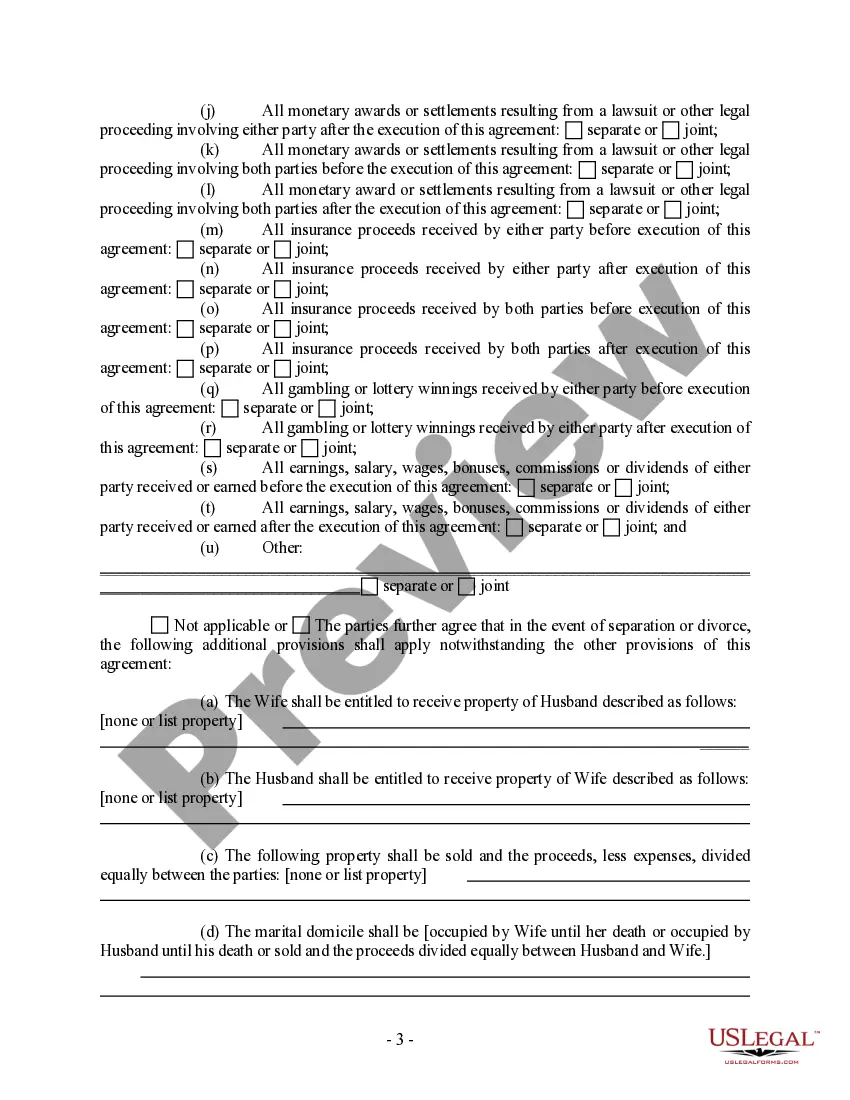

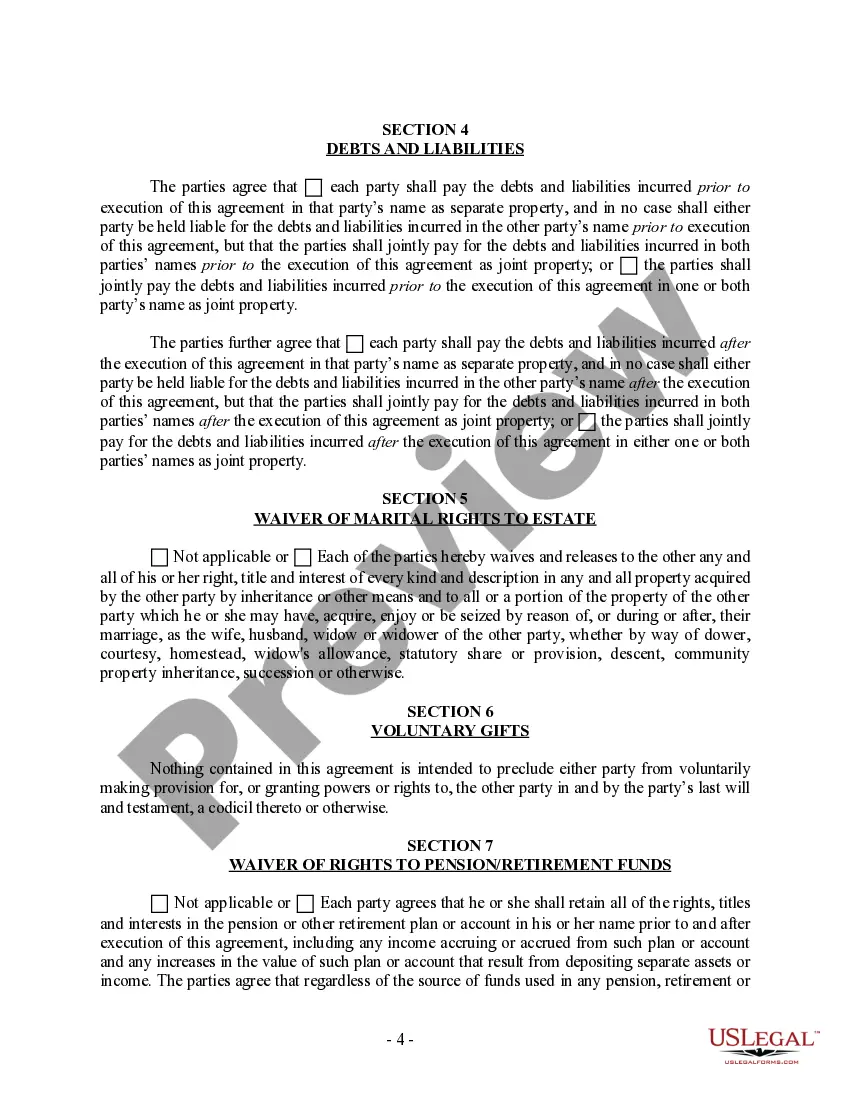

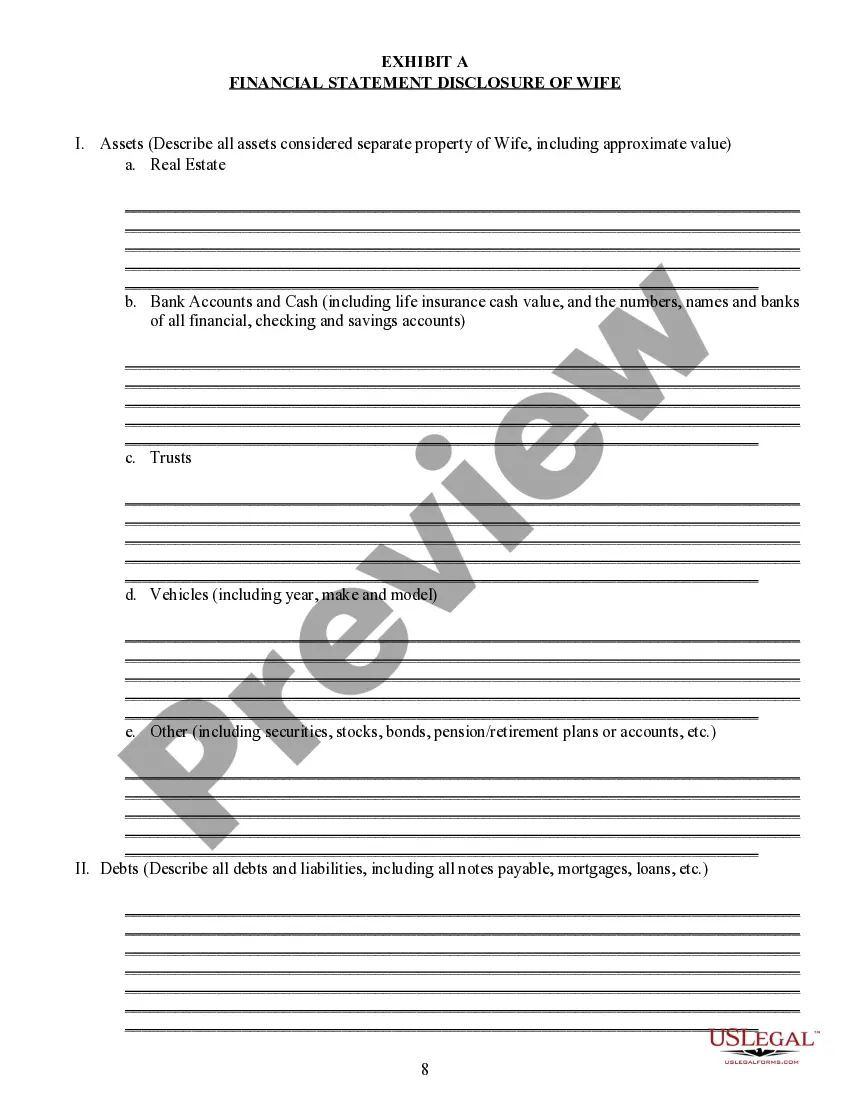

A postnuptial property agreement is a legal document executed by a married couple that outlines how their assets and debts will be handled during the marriage or in the event of a divorce. Unlike a prenuptial agreement, which is created before marriage, a postnuptial agreement is established after a couple is legally wed. This agreement can cover various topics, including one spouse's separate property, allocation of joint assets, and responsibilities for any debts.

Step-by-Step Guide to Creating a Postnuptial Property Agreement

- Consult a marital lawyer specializing in family law to ensure that all legal aspects are properly addressed.

- Discuss and decide the terms with your spouse, focusing on fairness and full disclosure, particularly involving real estate and significant assets.

- Document these decisions in a draft and review them together, possibly with a mediator if necessary.

- Finalize the document by having both parties sign it, ideally with legal witnesses or a notary to solidify its validity.

- Keep the signed document in a safe but accessible place.

Risk Analysis of Postnuptial Agreements

Postnuptial agreements can be instrumental in protecting assets, but they carry risks such as potential conflicts and challenges in court if not properly executed. Risks include the possibility of a spouse feeling coerced into signing, or the agreement favoring one spouse disproportionately. Ensuring both parties have independent legal advice can mitigate such risks.

Pros & Cons of Postnuptial Agreements

- Pros: Clarifies financial rights, reduces conflicts during a divorce, and can strengthen a relationship by removing financial disputes.

- Cons: May create tensions if not approached delicately, risk of invalidation if not properly drafted, and might not be enforceable in all jurisdictions.

Best Practices in Drafting Postnuptial Agreements

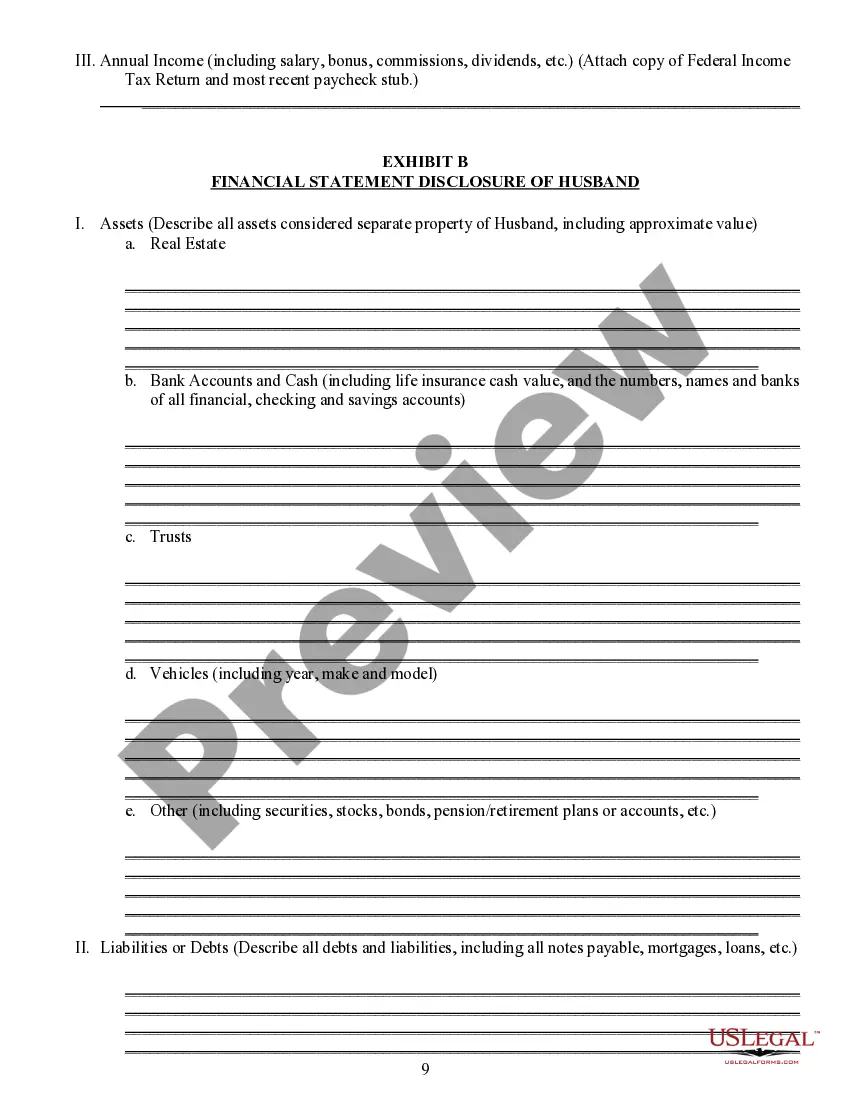

When drafting a postnuptial agreement, it's crucial to ensure transparency and fairness. Both parties should fully disclose their assets and liabilities, and each should have their own marital lawyer. As part of best practices, the agreement should be revisited and possibly updated at significant life events or changes in financial status.

Common Missteps in Postnuptial Agreements & How to Avoid Them

A frequent mistake is excluding a marital lawyer in the drafting process, which can lead to disputes or invalidation of the agreement. To avoid this, always involve legal experts who can ensure all elements are legally sound and in compliance with current family law standards.

How to fill out Minnesota Postnuptial Property Agreement?

Obtain any template from 85,000 legal documents like the Postnuptial Property Agreement - Minnesota online with US Legal Forms. Each template is crafted and refreshed by state-licensed legal experts.

If you possess a subscription, Log In. Once you are on the form’s page, click on the Download button and navigate to My documents to retrieve it.

If you have not subscribed yet, follow the guidelines below.

With US Legal Forms, you will consistently have immediate access to the appropriate downloadable sample. The platform offers you access to documents and categorizes them to streamline your search. Utilize US Legal Forms to acquire your Postnuptial Property Agreement - Minnesota swiftly and effortlessly.

- Review the state-specific criteria for the Postnuptial Property Agreement - Minnesota you wish to utilize.

- Browse the description and preview the example.

- When you’re confident that the template meets your needs, click on Buy Now.

- Select a subscription plan that aligns with your financial plan.

- Establish a personal account.

- Make a payment using one of two convenient methods: by credit card or through PayPal.

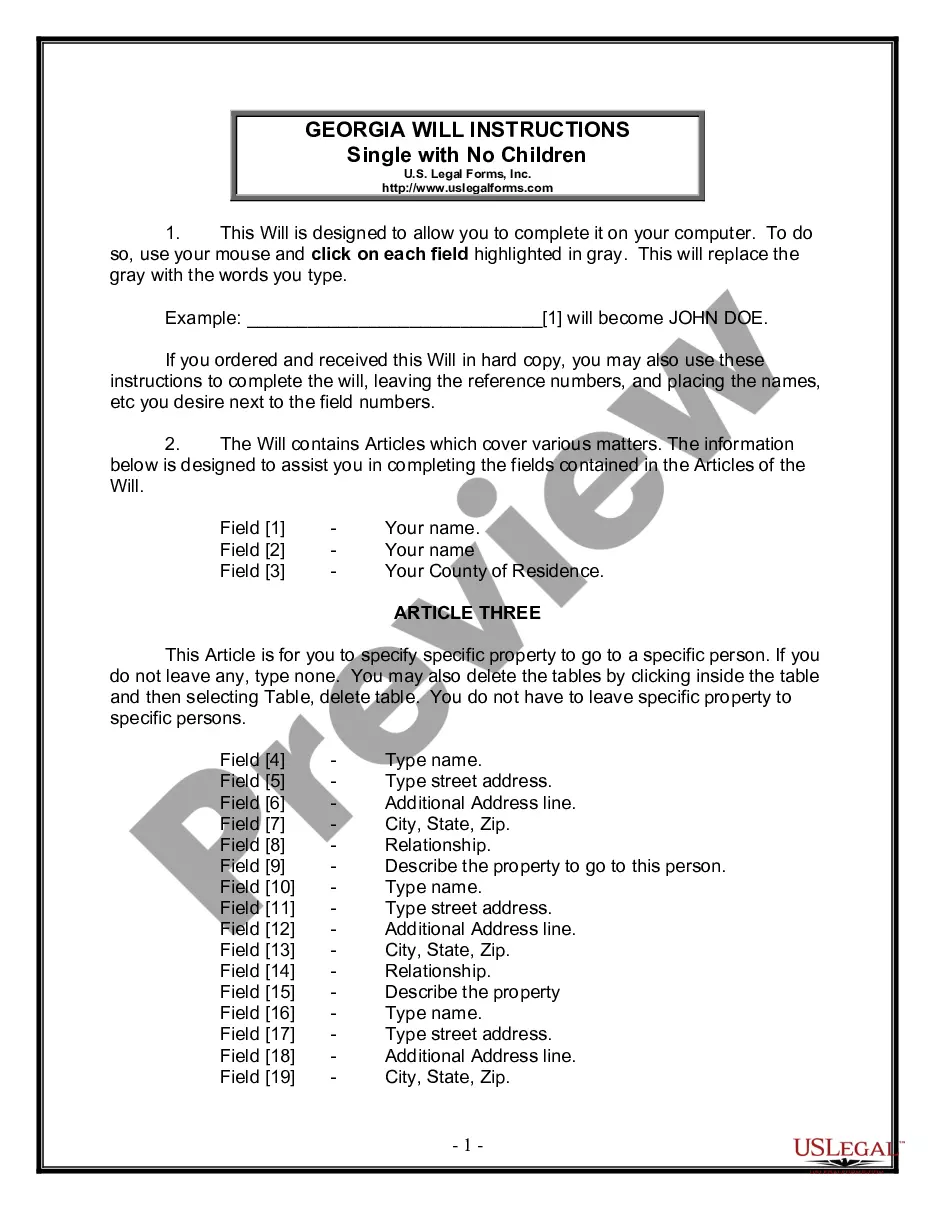

- Choose a format to download the file in; two choices are available (PDF or Word).

- Download the file to the My documents tab.

- After your reusable template is downloaded, print it out or save it to your device.

Form popularity

FAQ

Yes, you can create your own Minnesota Postnuptial Property Agreement, but it is crucial to ensure that it is legally valid. Both you and your spouse must agree on the terms and sign the document in the presence of a notary. While DIY agreements are possible, using a professional service like USLegalForms can help you avoid common pitfalls and ensure your agreement is comprehensive and enforceable.

To obtain a Minnesota Postnuptial Property Agreement, start by discussing your intentions with your spouse. Next, outline the terms you both wish to include in the agreement, such as asset division and financial responsibilities. You can then either consult a lawyer or use a service like USLegalForms, which provides templates and guidance to help you create a valid postnuptial contract that meets Minnesota laws.

Getting a Minnesota Postnuptial Property Agreement is generally straightforward, but it does require careful consideration. You and your spouse must openly discuss your financial situation and future goals. It is essential to draft the agreement clearly and ensure that both parties understand its terms. Utilizing a professional service, like USLegalForms, can simplify the process and help you create a legally binding document.

To write a Minnesota Postnuptial Property Agreement, start by clearly outlining the terms regarding property ownership, debt responsibilities, and other financial matters. It is crucial to be specific and detailed to avoid misunderstandings later. You may find it beneficial to use resources from US Legal Forms, which offers templates and guidance tailored to Minnesota laws. This ensures your agreement is valid and enforceable.

Yes, you can write your own Minnesota Postnuptial Property Agreement. However, it is essential to ensure that the agreement meets state requirements and addresses your unique circumstances. To avoid potential legal issues, consider consulting a legal expert or using a trusted platform like US Legal Forms. This approach helps you create a solid agreement that protects your interests.

Certain matters cannot be included in a Minnesota Postnuptial Property Agreement, such as child custody arrangements or child support obligations. Courts generally do not allow agreements that could jeopardize a child's well-being or that are deemed unfair to one party. Additionally, any illegal provisions are void. It is advisable to work with a legal expert to create a comprehensive agreement that focuses on property rights and financial matters.

A Minnesota Postnuptial Property Agreement is enforceable if it meets specific legal requirements. Both parties must voluntarily sign the agreement, and it must be fair and reasonable at the time of execution. Furthermore, full disclosure of assets is essential to prevent future disputes. To ensure your agreement holds up in court, consult with a legal professional familiar with Minnesota law.

In Minnesota, if you purchased your house before marriage, it generally remains your separate property. However, during a divorce, your spouse could claim a portion of the house's value if marital funds were used for improvements or mortgage payments. To protect your assets, consider a Minnesota Postnuptial Property Agreement that clearly outlines property rights. This agreement can provide peace of mind and clarify ownership matters.

Several factors can void a Minnesota Postnuptial Property Agreement, including lack of voluntary consent, misrepresentation, or fraud. If one party was coerced or misled about the terms, the agreement may be challenged in court. Additionally, if the agreement is found to be unconscionable or unfair, a judge may refuse to enforce it. To avoid these issues, ensure transparency and fairness when drafting your agreement.

In Minnesota, you do not need to be married for a specific duration to claim half of the marital property. The division of property, including what is outlined in a Minnesota Postnuptial Property Agreement, is typically based on equitable distribution principles. The court will consider various factors, including the length of the marriage and contributions by each spouse. It's wise to consult with a legal professional to understand your rights fully.