Michigan Last Will and Testament with All Property to Trust called a Pour Over Will

Description

How to fill out Michigan Last Will And Testament With All Property To Trust Called A Pour Over Will?

Obtain any template from 85,000 legal documents including the Michigan Legal Last Will and Testament Form with All Property to Trust known as a Pour Over Will online through US Legal Forms. Each template is crafted and refreshed by state-certified legal experts.

If you possess a subscription, sign in. Once on the form’s page, hit the Download button and navigate to My documents to retrieve it.

If you haven’t subscribed yet, adhere to the following guidance: Check the specific state requirements for the Michigan Legal Last Will and Testament Form with All Property to Trust known as a Pour Over Will that you wish to utilize. Review the description and preview the template. Once you’re confident the template meets your needs, click on Buy Now. Choose a subscription plan that suits your financial situation. Establish a personal account. Make payment using one of two suitable methods: by credit card or through PayPal. Choose a format to download the file in; two choices are available (PDF or Word). Save the document to the My documents tab. Once your reusable form is downloaded, print it or save it to your device.

- With US Legal Forms, you will consistently have immediate access to the correct downloadable sample.

- The platform provides access to forms and categorizes them to simplify your search.

- Utilize US Legal Forms to acquire your Michigan Legal Last Will and Testament Form with All Property to Trust known as a Pour Over Will quickly and effortlessly.

Form popularity

FAQ

A Michigan Last Will and Testament with All Property to Trust called a Pour Over Will serves a specific purpose. While a traditional last will distributes assets directly to beneficiaries upon your death, a pour-over will transfers any remaining assets into your trust. This means any property not previously included in the trust will be directed there, ensuring all your assets are managed according to your trust's terms. By using uslegalforms, you can easily create a pour-over will that complements your estate plan and protects your assets.

You might want a pour-over will to ensure that all your assets are managed according to your wishes after your death. This tool helps streamline the transfer of assets into your trust, reducing the chances of leaving behind an unintentional mess. Moreover, it provides peace of mind, knowing that any assets not already in the trust will be included. Utilizing platforms like uslegalforms can help you create a comprehensive Michigan Last Will and Testament with All Property to Trust called a Pour Over Will, tailored to your specific needs.

One drawback of a pour-over will is that it still requires probate for the will itself to be validated in Michigan. This can introduce delays and additional costs during the estate settlement process. Additionally, if your assets are not properly transferred to the trust during your lifetime, they will be subject to probate. It’s essential to ensure that your estate planning is comprehensive to mitigate these challenges.

over will does not entirely avoid probate in Michigan, as the will itself must be probated. However, it simplifies the process by directing assets into a trust, which typically avoids the drawnout probate process once the trust is established. This can lead to a faster and more efficient distribution of your assets. By using a Michigan Last Will and Testament with All Property to Trust called a Pour Over Will, you can minimize the complications associated with probate.

In Michigan, a pour-over will is a specific type of last will and testament that directs your assets into a trust upon your death. This document serves to ensure that all property not already placed in the trust will be transferred seamlessly. Essentially, it acts as a bridge between your estate and your trust, making the estate planning process more straightforward. It is particularly useful for those who want to manage their assets effectively after passing.

over will works by transferring any remaining assets you own at the time of your death into your trust. This means that, if you have not transferred certain assets into the trust during your lifetime, the pourover will ensures they are included. In Michigan, this legal instrument acts as a safety net, capturing assets and directing them to your trust. The process helps maintain your estate plan's coherence and effectiveness.

over trust example typically involves a scenario where an individual creates a trust during their lifetime and designates it to receive remaining assets through a Michigan Last Will and Testament with All Property to Trust called a Pour Over Will. For instance, if someone has a home and investments, they may transfer these assets into the trust after their death. This process simplifies asset distribution and ensures that all properties are managed according to the trust’s terms.

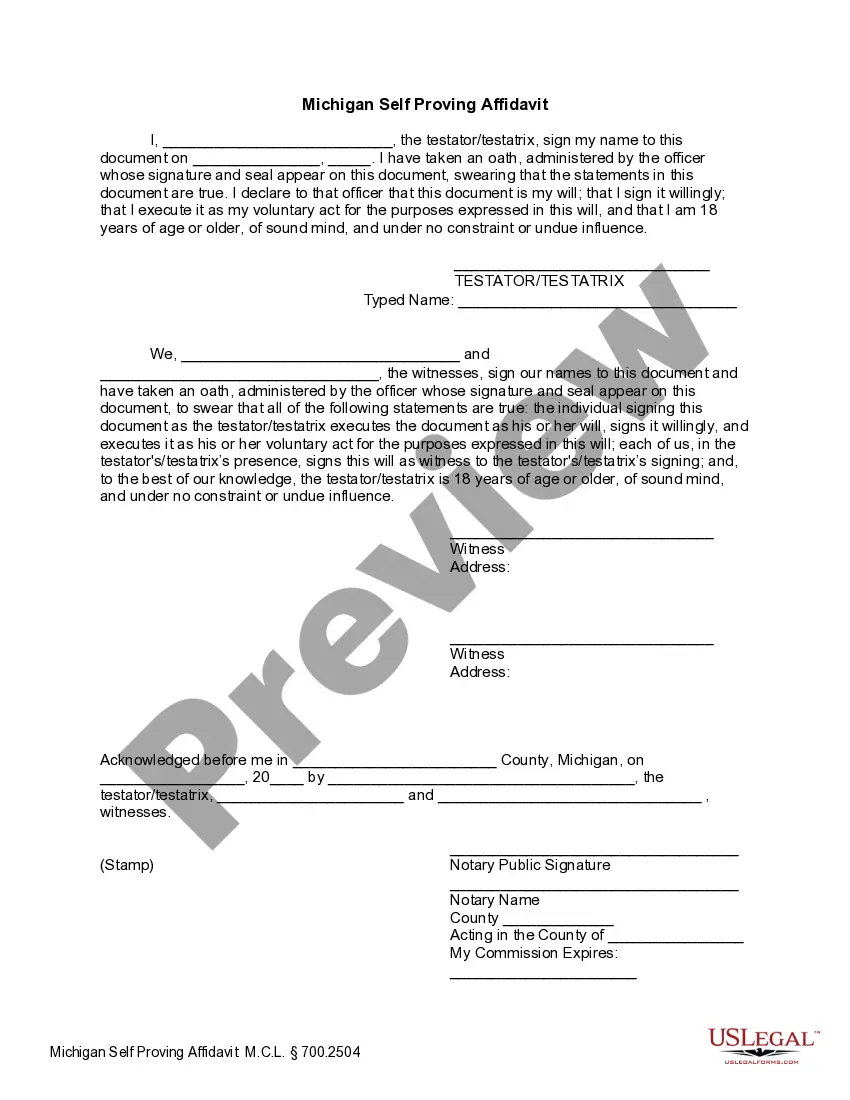

Drafting a Michigan Last Will and Testament with All Property to Trust called a Pour Over Will involves a few key steps. First, you need to identify and list your assets clearly. Next, specify that these assets will transfer to your trust upon your passing. Finally, it’s advisable to consult a legal professional or use a reliable service like USLegalForms to ensure compliance with Michigan laws.