Michigan Fuel Delivery And Storage Services - Self-Employed

Description

How to fill out Fuel Delivery And Storage Services - Self-Employed?

If you need to obtain comprehensive, download, or print sanctioned document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Utilize the site's straightforward and user-friendly search function to find the documents you require.

Various templates for business and personal purposes are categorized by type and state, or keywords.

Step 4. Once you have found the form you need, click the Purchase now option. Select the pricing plan you prefer and enter your information to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.Step 6. Choose the format of the legal form and download it to your device. Step 7. Fill out, edit, and print or sign the Michigan Fuel Delivery And Storage Services - Self-Employed. Every legal document template you purchase is yours permanently. You have access to every form you saved in your account. Click on the My documents section and select a form to print or download again. Complete and download, and print the Michigan Fuel Delivery And Storage Services - Self-Employed with US Legal Forms. There are millions of professional and state-specific forms you can use for your personal business or individual needs.

- Use US Legal Forms to acquire the Michigan Fuel Delivery And Storage Services - Self-Employed in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and select the Download option to obtain the Michigan Fuel Delivery And Storage Services - Self-Employed.

- You can also access forms you previously saved from the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

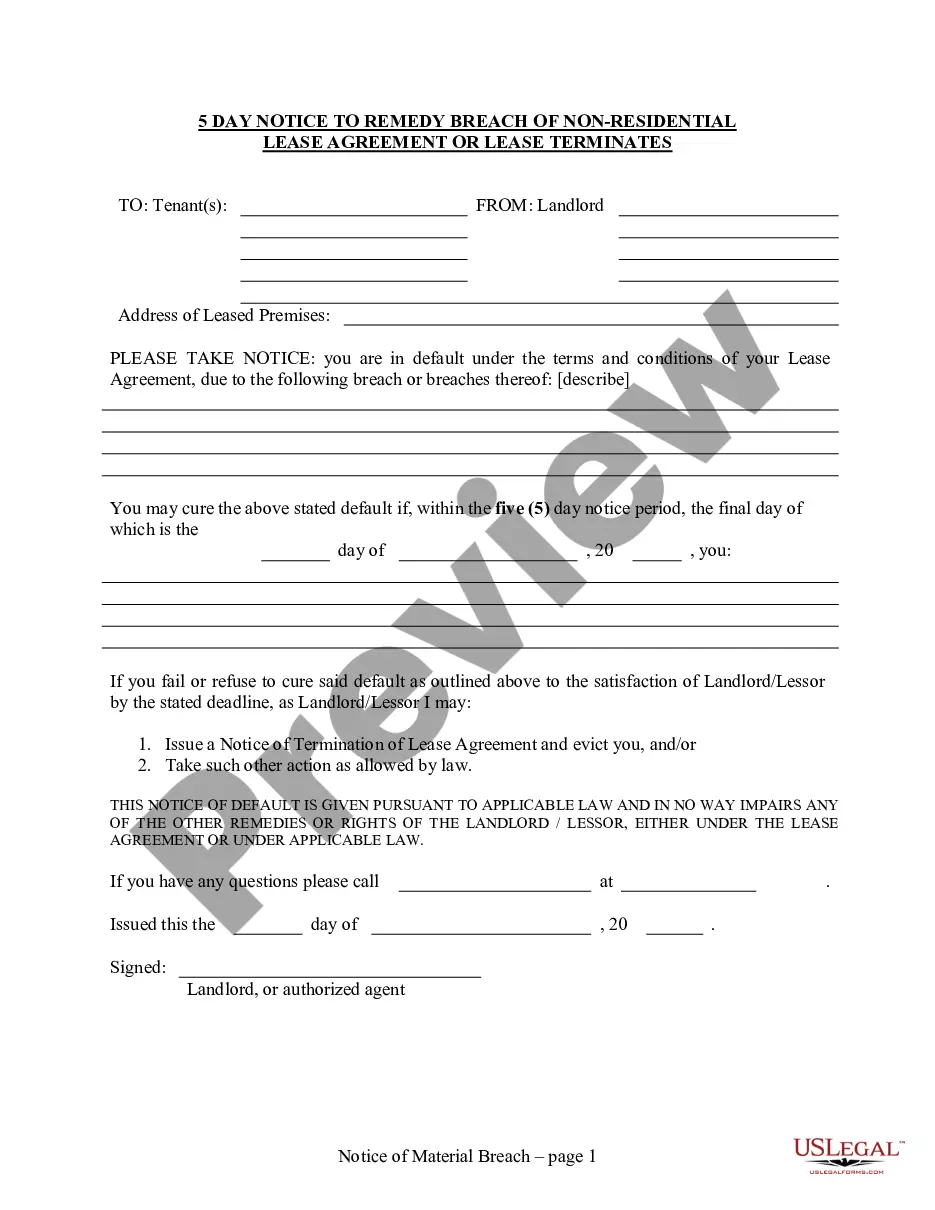

- Step 2. Utilize the Preview option to review the form's content. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other variations of the legal form template.

Form popularity

FAQ

To start a bulk fuel delivery business in Michigan, begin by conducting thorough market research to understand the demand for Michigan fuel delivery and storage services among self-employed individuals. Next, obtain the necessary permits and licenses required for operating a fuel delivery service, which may include local, state, and federal regulations. It’s also essential to invest in reliable transportation and storage equipment, ensuring compliance with safety standards. Lastly, consider using platforms like USLegalForms, which can help you streamline the documentation process and provide insights on business structuring and legal requirements.

Yes, an LLC must file a tax return in Michigan, even if it has no income. As a self-employed person offering Michigan fuel delivery and storage services through an LLC, you will need to file an annual corporate income tax return. Additionally, you'll report any income on your personal tax return to comply with state regulations.

In Michigan, self-employment taxes can be substantial, as they typically include both Social Security and Medicare taxes. For self-employed individuals, the total self-employment tax rate is currently 15.3%. If you're running a business in Michigan focused on fuel delivery and storage services, it's important to factor in these taxes when planning your finances.

To start a fuel delivery business, you will need several key components. First, secure a reliable fuel supply and invest in properly equipped delivery vehicles. Additionally, having a solid understanding of the logistics involved, as well as a marketing plan to promote your Michigan Fuel Delivery And Storage Services - Self-Employed, is essential. For legal and documentation needs, consider utilizing the resources available at uslegalforms to ensure everything is in order.

Owning a mobile fuel delivery business requires specific permits and licenses to operate legally. Generally, you will need a commercial driver’s license, a business license, and possibly environmental permits. The exact requirements can vary by state, so it's crucial to research local regulations for Michigan Fuel Delivery And Storage Services - Self-Employed. Using resources like uslegalforms can simplify the process of obtaining the necessary documentation.

Yes, the fuel delivery business can be quite profitable. With the growing demand for Michigan Fuel Delivery And Storage Services - Self-Employed, you have the opportunity to tap into a steady stream of customers. By efficiently managing your delivery operations and ensuring timely service, you can significantly increase your profit margins. Additionally, diversifying your offerings can attract a wider range of clients.

Are delivery, shipping or handling charges taxable? Delivery charges include, but are not limited to, transportation, shipping, postage, handling, crating, and packing and are generally subject to Michigan tax.

Retail sales of tangible items in California are generally subject to sales tax. Examples include furniture, giftware, toys, antiques and clothing. Some labor service and associated costs are subject to sales tax if they are involved in the creation or manufacturing of new personal property.

In general, delivery-related charges for taxable products are not taxable when you ship directly to the purchaser via common carrier, contract carrier, or USPS; delivery, shipping, freight, or postage charges are separately stated; and the charge isn't greater than the actual cost of delivery.

In the state of Michigan, services are not generally considered to be taxable.