Michigan Self-Employed Utility Services Contract

Description

How to fill out Self-Employed Utility Services Contract?

Locating the appropriate legal document template can be challenging. Of course, there are numerous templates accessible online, but how can you find the legal form you need? Utilize the US Legal Forms website. This service provides thousands of templates, including the Michigan Self-Employed Utility Services Contract, which you can use for business and personal purposes. All documents are reviewed by experts and comply with federal and state regulations.

If you are already registered, Log In to your account and click the Download button to obtain the Michigan Self-Employed Utility Services Contract. Use your account to browse through the legal documents you have previously purchased. Go to the My documents section of your account and download another copy of the document you require.

If you are a new user of US Legal Forms, here are simple steps you should follow: First, ensure you have selected the correct form for your locality. You can review the form using the Preview feature and examine the form outline to confirm it is suitable for you. If the form does not meet your needs, utilize the Search feature to find the appropriate form. Once you are certain the form is right, click the Buy now button to acquire the form. Choose the pricing plan you desire and enter the necessary details. Create your account and complete the transaction using your PayPal account or credit card. Select the document format and download the legal document template to your device. Complete, modify, print, and sign the obtained Michigan Self-Employed Utility Services Contract.

With US Legal Forms, you can ensure that your legal documentation is accurate and compliant with legal standards.

- US Legal Forms is the largest collection of legal forms that you can explore various document templates.

- Make use of the service to acquire professionally designed documents that comply with state requirements.

- Access thousands of templates for various legal needs.

- Easily navigate through your account to find previously purchased forms.

- Enjoy reliable and expert-reviewed documents for personal and business use.

- Simplify your documentation process with user-friendly features.

Form popularity

FAQ

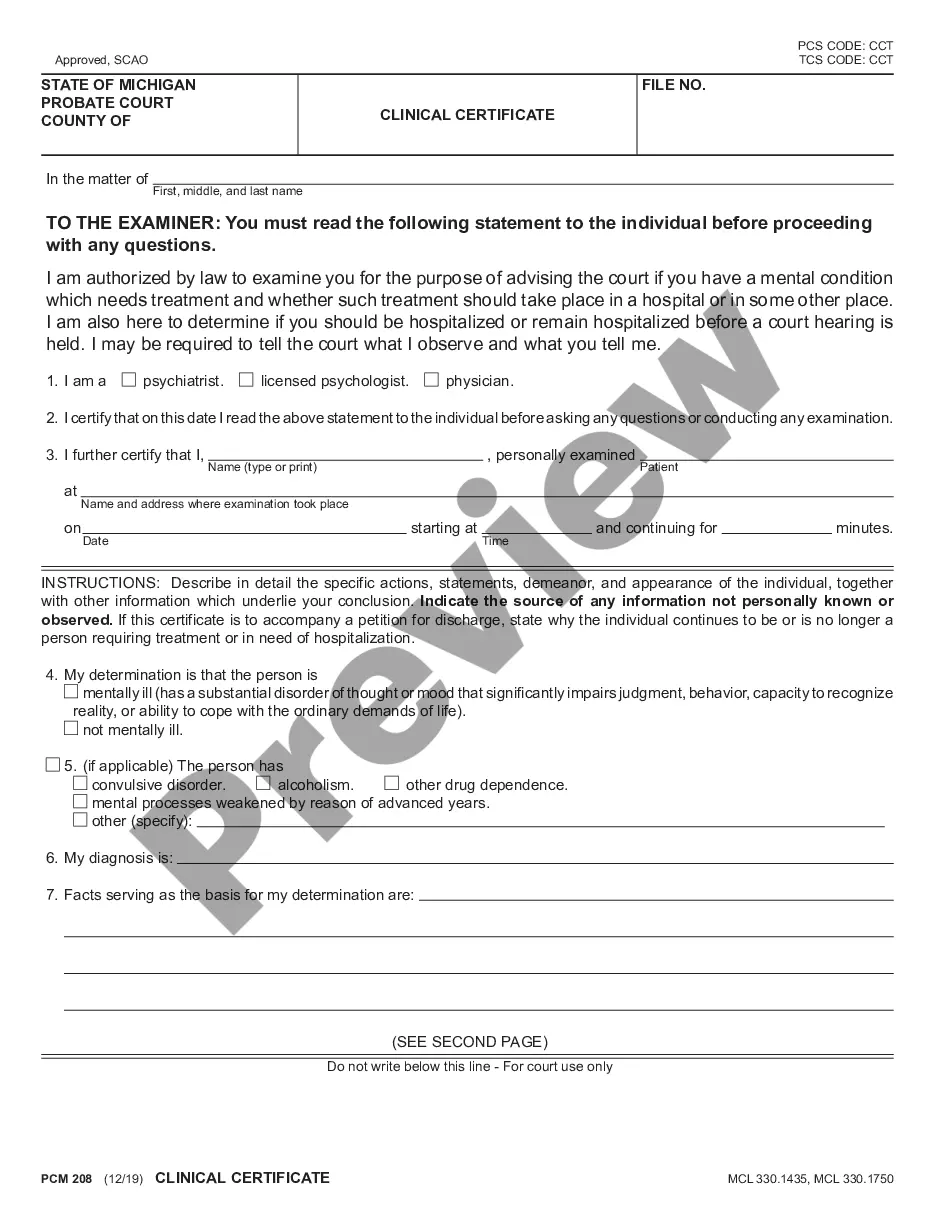

The DHS 431 form in Michigan is a document used for reporting services provided by various types of independent contractors, including utility service providers. This form helps the state track and verify services rendered under government programs. If you are working under a Michigan Self-Employed Utility Services Contract, understanding this form is crucial for compliance. Ensure you complete it accurately to avoid any delays in payment or service validation.

To prove you are an independent contractor, you can present documents such as a Michigan Self-Employed Utility Services Contract, invoices, and payment records. These documents demonstrate your relationship with clients and confirm your status as a self-employed individual. Additionally, maintaining your own business records, including tax filings, can further support your independent contractor status. If you need assistance, platforms like uslegalforms can help you create the necessary documentation.

In the United States, an independent contractor must earn at least $600 in a calendar year from a single client to receive a 1099 form. This form is crucial for reporting your income and ensuring compliance with tax regulations. If you are working under a Michigan Self-Employed Utility Services Contract, keep track of your earnings from each client to ensure you receive the appropriate documentation. It's important to understand your tax obligations as an independent contractor.

Yes, having a contract as an independent contractor is essential. A Michigan Self-Employed Utility Services Contract clearly outlines the terms and conditions of your work, protecting both you and your client. It defines the scope of services, payment terms, and responsibilities, ensuring everyone is on the same page. Using a well-drafted contract helps prevent misunderstandings and potential disputes.

To write a simple employment contract, start by stating the job title, responsibilities, and compensation details. Clearly outline the terms of employment, including start dates and any probationary period. If you are creating a Michigan Self-Employed Utility Services Contract, be specific about the utility services involved. Using US Legal Forms can help you create a straightforward and effective contract.

Writing an independent contractor agreement requires you to define the nature of the work and the terms of payment. Make sure to include a clause on confidentiality and any termination conditions. If you're drafting a Michigan Self-Employed Utility Services Contract, detail the specific utility services provided. Consider using US Legal Forms for structured templates that guide you through the necessary elements.

To write a contract for a 1099 employee, focus on their role, responsibilities, and payment structure. Include clauses that clarify their independent status and outline any project timelines. When preparing a Michigan Self-Employed Utility Services Contract, it’s important to specify the utility-related tasks. You can find useful templates on US Legal Forms to simplify this process.

Writing a self-employed contract involves outlining the specific services you will provide and the terms of your engagement. Be sure to include payment details, duration of the contract, and any legal obligations. For a Michigan Self-Employed Utility Services Contract, tailor your document to reflect the unique needs of utility services. Tools from US Legal Forms make it easy to create a comprehensive agreement.

Yes, you can write your own legally binding contract, provided it meets the essential elements of a contract, such as offer, acceptance, and consideration. In the context of a Michigan Self-Employed Utility Services Contract, ensure you comply with state laws and include all necessary details. However, using templates from US Legal Forms can ensure you don’t miss vital legal components.

To write a self-employment contract, begin by clearly defining the scope of work and the services you will provide. Include payment terms, deadlines, and any other specific conditions. For a Michigan Self-Employed Utility Services Contract, ensure you specify the services related to utility management or maintenance. Utilizing platforms like US Legal Forms can help you structure your contract correctly.