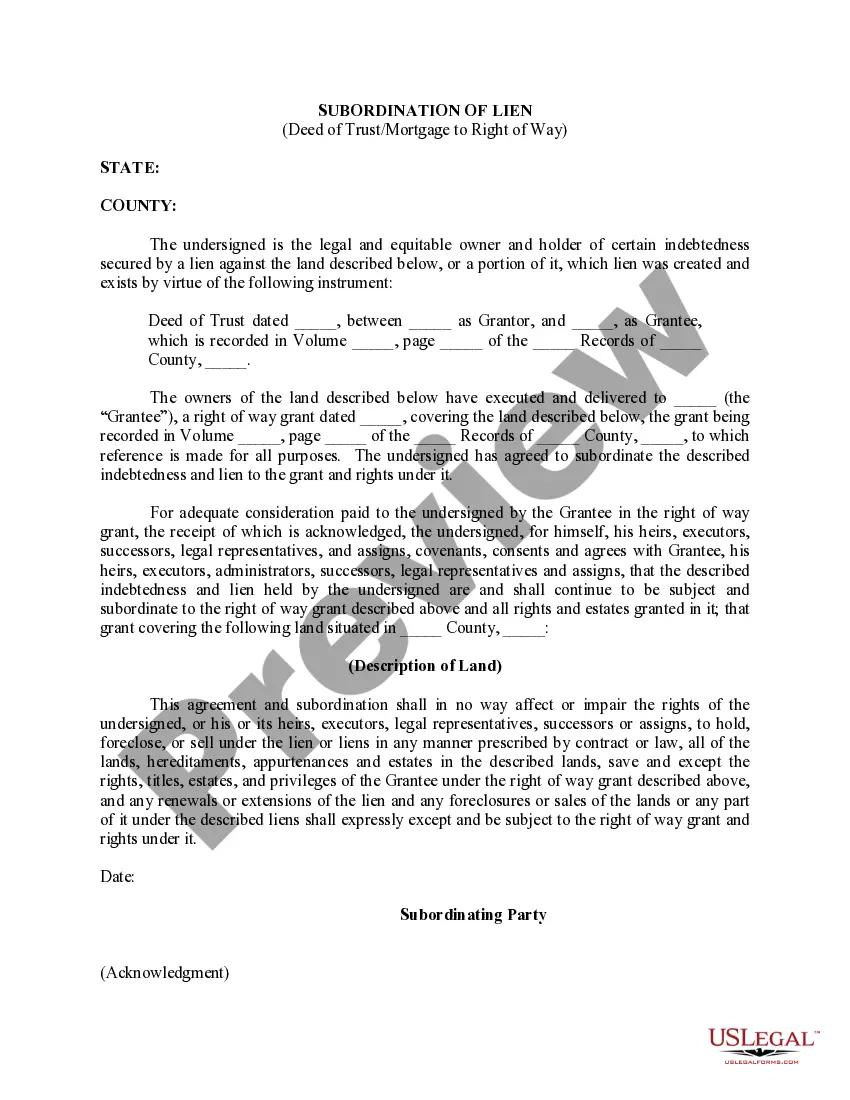

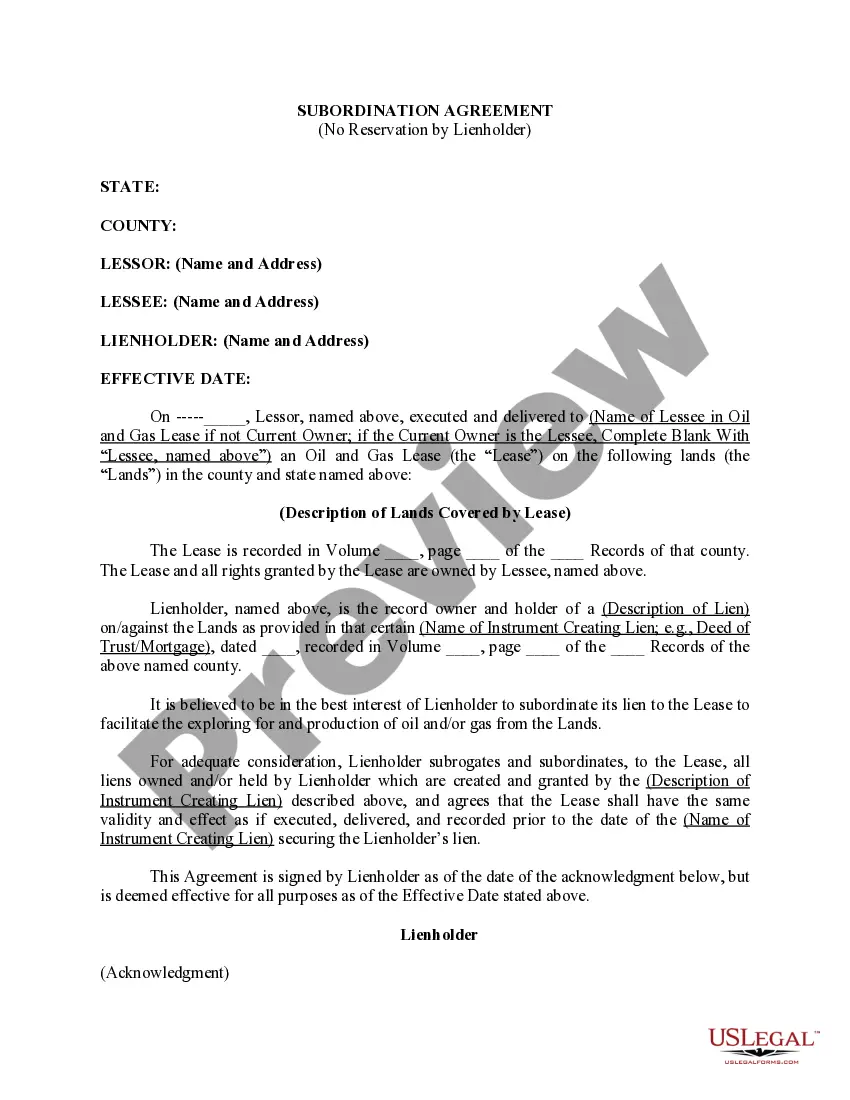

Vermont Subordination of Lien

Description

How to fill out Subordination Of Lien?

If you need to comprehensive, download, or printing authorized record web templates, use US Legal Forms, the greatest variety of authorized kinds, which can be found online. Utilize the site`s easy and convenient search to find the paperwork you will need. Different web templates for company and person uses are categorized by classes and suggests, or key phrases. Use US Legal Forms to find the Vermont Subordination of Lien with a couple of click throughs.

When you are presently a US Legal Forms buyer, log in for your bank account and then click the Obtain switch to get the Vermont Subordination of Lien. You may also gain access to kinds you previously acquired from the My Forms tab of your own bank account.

Should you use US Legal Forms initially, refer to the instructions listed below:

- Step 1. Ensure you have chosen the shape for that proper town/nation.

- Step 2. Make use of the Preview option to check out the form`s content. Never overlook to read through the outline.

- Step 3. When you are unsatisfied with all the type, use the Look for discipline towards the top of the display to get other types of your authorized type design.

- Step 4. Once you have identified the shape you will need, go through the Acquire now switch. Choose the pricing program you choose and add your credentials to register on an bank account.

- Step 5. Method the transaction. You may use your Мisa or Ьastercard or PayPal bank account to complete the transaction.

- Step 6. Choose the format of your authorized type and download it on your own system.

- Step 7. Comprehensive, revise and printing or indication the Vermont Subordination of Lien.

Every single authorized record design you acquire is the one you have eternally. You have acces to every single type you acquired within your acccount. Go through the My Forms segment and pick a type to printing or download once more.

Compete and download, and printing the Vermont Subordination of Lien with US Legal Forms. There are thousands of specialist and express-distinct kinds you may use for your personal company or person requirements.

Form popularity

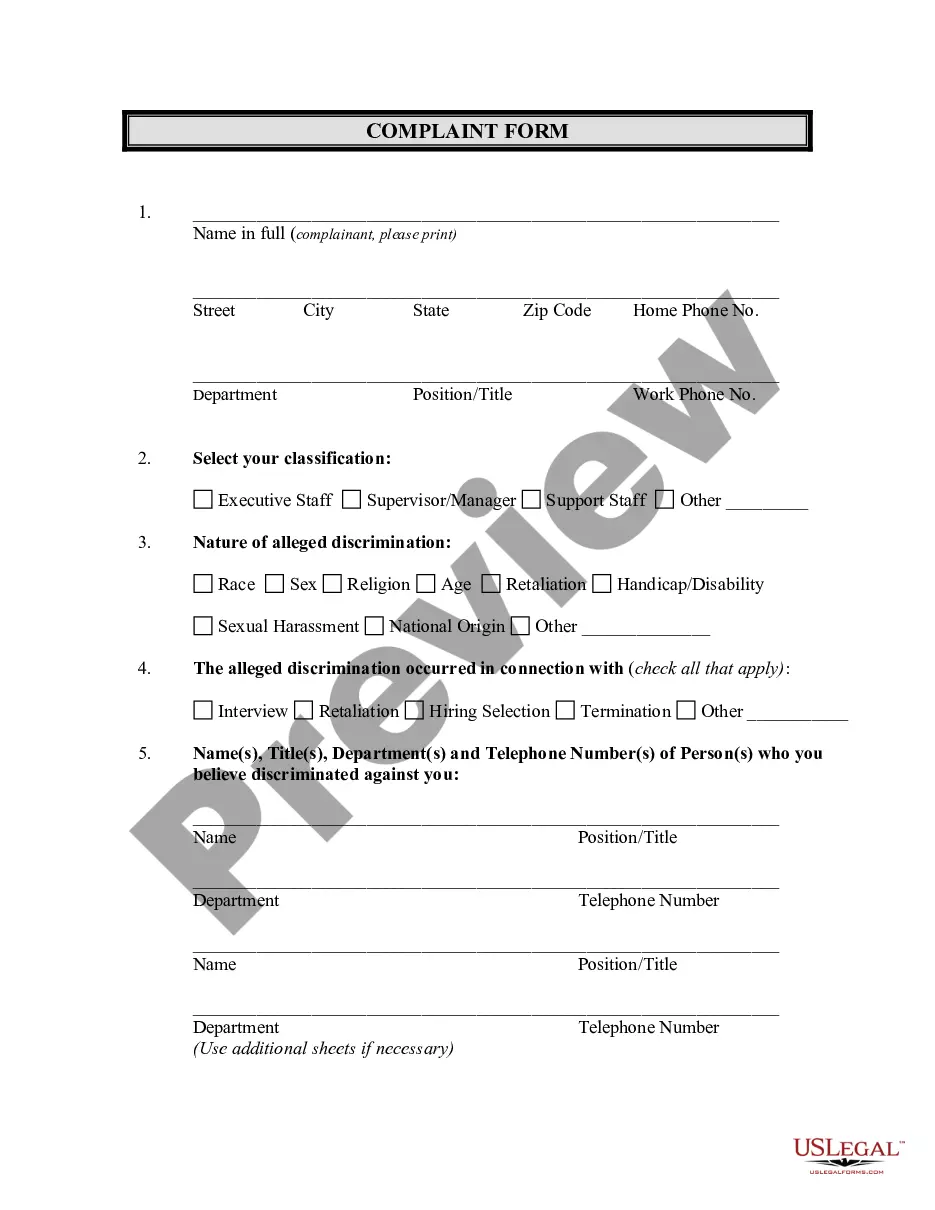

FAQ

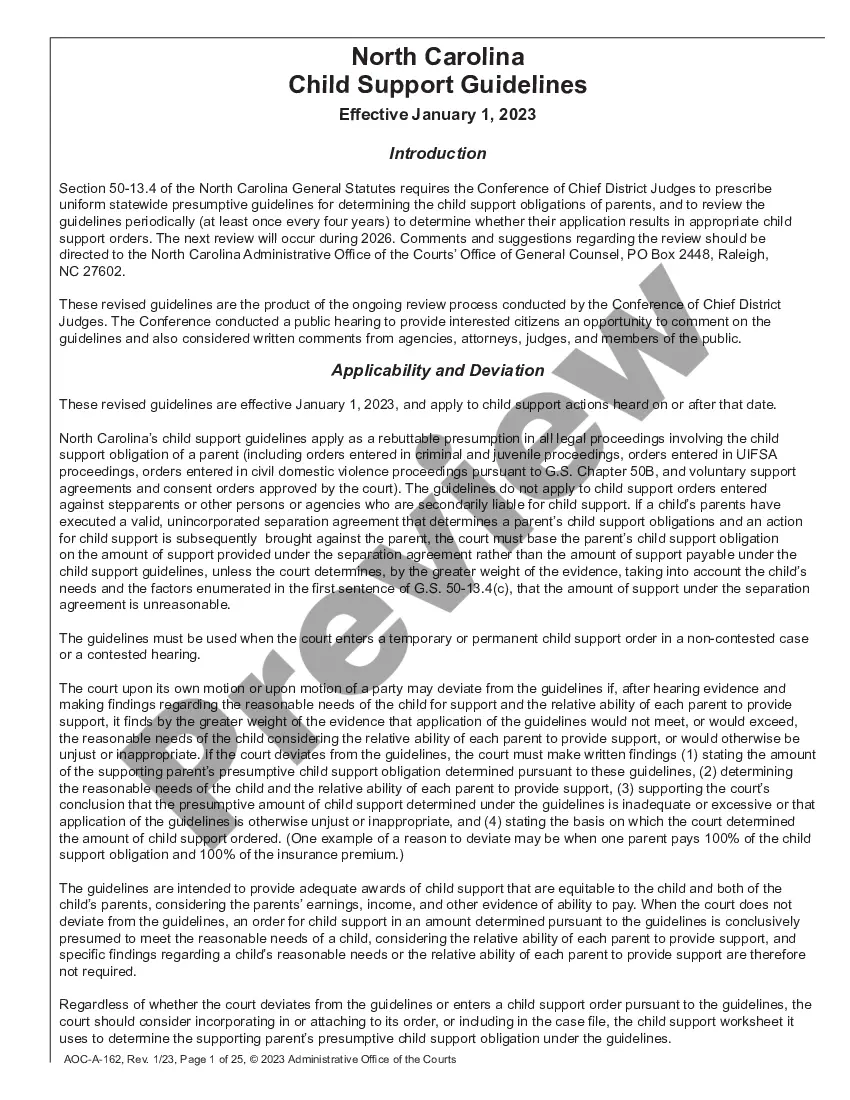

When land enrolled in the Current Use Program is developed or withdrawn from the program, it is subject to a penalty, the Land Use Change Tax (LUCT), under Vermont law at 32 V.S.A. § Section 3757(a). The LUCT is a percentage of the full fair market value of the changed land.

Use Value Appraisal, or ?Current Use? as it is commonly known, is a property tax incentive available to owners of agricultural and forestry land in Vermont. Eligible landowners can enroll in the program to have their land appraised at its Current Use (farming or forestry) value rather than fair market value.

The Land Use Change Tax (LUCT) is imposed at a rate of 10% of the full fair market value of land that is developed. LUCT is also due when land is withdrawn from the Current Use Program and the owner removes the lien.

A primary residence in Vermont pays at a varying rate ? 0.5% on the first $100,000 in value and then 1.45% (really 1.25% transfer tax and 0.2% clean water fee) on the remaining value. Properties other than a primary residence pay the 1.45% on all value.

Use tax has the same rate of 6%, rules, and exemptions as sales tax. Vermont Sales and Use Tax is ?destination-based.? One of the following must happen for the purchased item to be subject to sales and use tax: The buyer takes possession of the item in Vermont.

A person claiming a lien under section 1921 of this title shall file for record in the clerk's office of the town where such real estate is situated a written memorandum, signed by him or her, asserting his or her claim, which shall charge such real estate with such lien as of the visible commencement of work or ...

Owners who wish to withdraw all or a portion of land and/or buildings should file Form LV-314, Request For Withdrawal From The Use Value Appraisal Program by mail or online at myVTax. See the guide on how file Form LV-314 using myVTax.

Eligible landowners can enroll in the program to have their land appraised at its Current Use (farming or forestry) value rather than fair market value. This method of appraisal results in significant property tax savings to the landowner in every year that the land remains enrolled in the program.