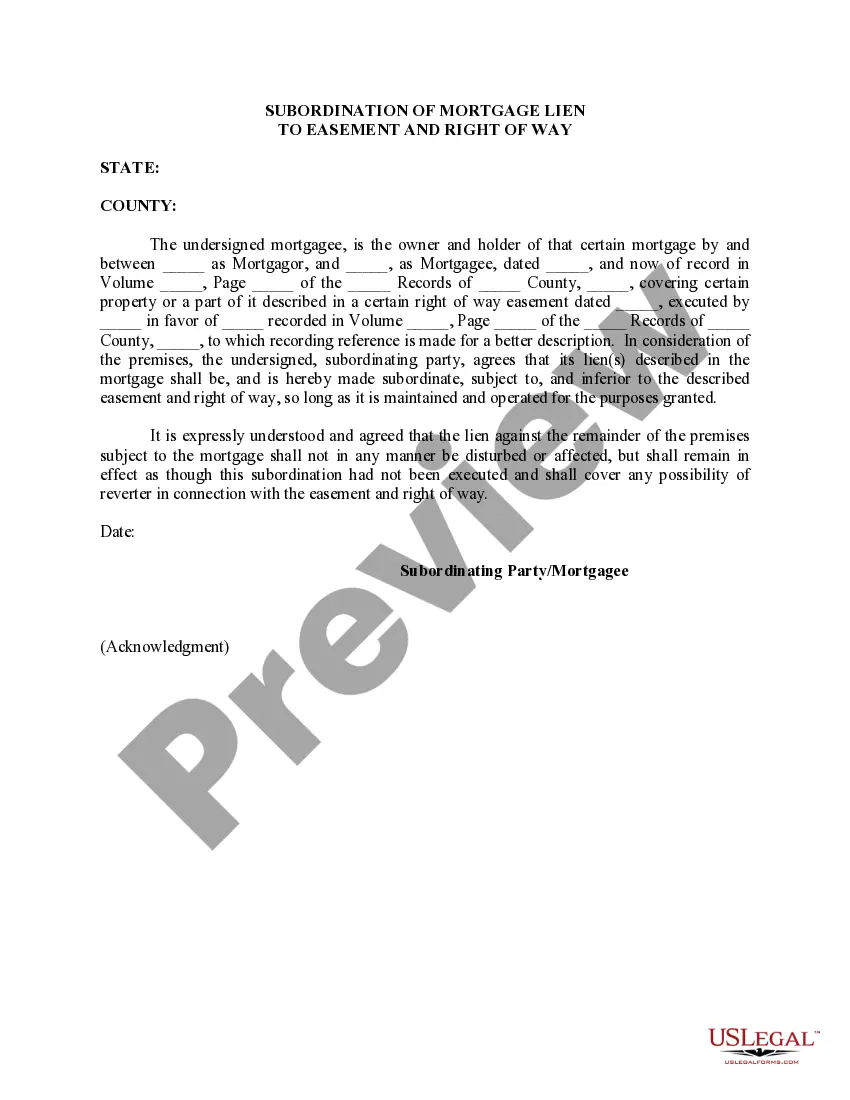

Vermont Subordination of Lien (Deed of Trust/Mortgage to Right of Way)

Description

How to fill out Subordination Of Lien (Deed Of Trust/Mortgage To Right Of Way)?

Choosing the right legitimate file format might be a have difficulties. Needless to say, there are a lot of layouts accessible on the Internet, but how do you get the legitimate form you require? Take advantage of the US Legal Forms website. The service delivers thousands of layouts, such as the Vermont Subordination of Lien (Deed of Trust/Mortgage to Right of Way), that you can use for organization and personal requirements. All the types are checked out by specialists and meet up with federal and state specifications.

Should you be presently signed up, log in in your bank account and click on the Down load option to obtain the Vermont Subordination of Lien (Deed of Trust/Mortgage to Right of Way). Use your bank account to check with the legitimate types you might have acquired formerly. Proceed to the My Forms tab of your own bank account and have yet another copy of your file you require.

Should you be a new user of US Legal Forms, listed here are simple directions that you should follow:

- First, be sure you have chosen the correct form for the metropolis/area. You may examine the shape while using Preview option and read the shape outline to make sure it will be the best for you.

- When the form does not meet up with your requirements, use the Seach industry to discover the appropriate form.

- Once you are certain the shape would work, click the Buy now option to obtain the form.

- Select the costs plan you want and type in the needed info. Build your bank account and purchase the transaction making use of your PayPal bank account or charge card.

- Pick the document formatting and download the legitimate file format in your product.

- Complete, edit and printing and sign the attained Vermont Subordination of Lien (Deed of Trust/Mortgage to Right of Way).

US Legal Forms is definitely the most significant catalogue of legitimate types where you will find numerous file layouts. Take advantage of the service to download expertly-created documents that follow condition specifications.

Form popularity

FAQ

Definition and Example of a Subordination Clause For instance, say you buy a home with a mortgage. Later, you add a home equity line of credit (HELOC). Due to a subordination clause likely located in your original mortgage contract, your first mortgage ranks as the first priority or lien.

Example of a Subordination Agreement A standard subordination agreement covers property owners that take a second mortgage against a property. One loan becomes the subordinated debt, and the other becomes (or remains) the senior debt. Senior debt has higher claim priority than junior debt.

The party that primarily benefits from a subordination clause in real estate is the lender. However, if you decide to pursue a second mortgage, then the subordination clause prioritizes the first lender's repayment and contract rights. The most common application of subordination clauses is when refinancing a property.

A subordination clause is a clause in an agreement that states that the current claim on any debts will take priority over any other claims formed in other agreements made in the future.

Lien subordination refers to the order in which claims on collateral are prioritized. This takes place most often among senior secured lenders and does not imply that one tranche of senior debt has payment preference over another.

Subordination agreements are used to legally establish the order in which debts are to be repaid in the event of a foreclosure or bankruptcy. In return for the agreement, the lender with the subordinated debt will be compensated in some manner for the additional risk.

A subordination clause serves to protect the lender if a homeowner defaults. If this happens, the lender then has the legal standing to repossess the home and cover their loan's outstanding balance first. If other subordinate mortgages are involved, the secondary liens will take a backseat in this process.

A subordinated loan is also known as subordinated debt, subordinated debenture, and junior debt. Subordinated debt holders receive payment after the senior debt has been fully settled in the event of a liquidation. High yield bonds and mezzanine debt are two examples of subordinated loans.