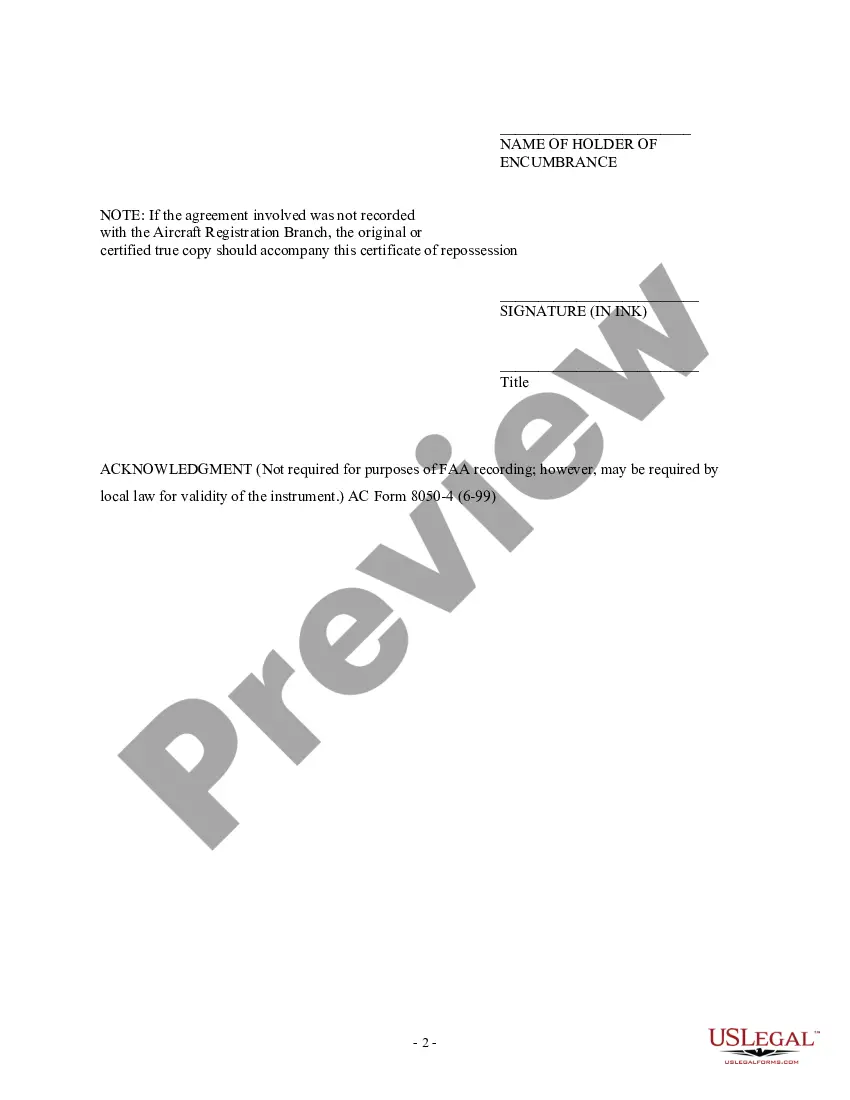

Michigan Certificate of Repossession of Encumbered Aircraft

Description

How to fill out Certificate Of Repossession Of Encumbered Aircraft?

If you want to complete, obtain, or print legal document web templates, use US Legal Forms, the biggest selection of legal varieties, which can be found on the Internet. Utilize the site`s basic and handy look for to discover the papers you require. Numerous web templates for organization and individual uses are categorized by groups and says, or keywords. Use US Legal Forms to discover the Michigan Certificate of Repossession of Encumbered Aircraft in just a number of click throughs.

Should you be previously a US Legal Forms client, log in to your account and click on the Acquire switch to find the Michigan Certificate of Repossession of Encumbered Aircraft. Also you can access varieties you previously delivered electronically from the My Forms tab of your own account.

If you work with US Legal Forms initially, refer to the instructions beneath:

- Step 1. Make sure you have chosen the shape for your right city/nation.

- Step 2. Make use of the Preview solution to examine the form`s information. Do not overlook to read through the information.

- Step 3. Should you be not satisfied using the type, utilize the Lookup industry near the top of the display to discover other versions in the legal type format.

- Step 4. When you have identified the shape you require, click on the Get now switch. Choose the pricing strategy you choose and add your qualifications to sign up for the account.

- Step 5. Procedure the purchase. You may use your Мisa or Ьastercard or PayPal account to finish the purchase.

- Step 6. Select the structure in the legal type and obtain it on the system.

- Step 7. Full, revise and print or sign the Michigan Certificate of Repossession of Encumbered Aircraft.

Every legal document format you purchase is yours permanently. You possess acces to every type you delivered electronically in your acccount. Click on the My Forms portion and choose a type to print or obtain again.

Compete and obtain, and print the Michigan Certificate of Repossession of Encumbered Aircraft with US Legal Forms. There are many expert and status-certain varieties you can use for the organization or individual requirements.

Form popularity

FAQ

For the work, pilots get anywhere from $500 to $1,700 per day?plus expenses. But how do pilots get those repo jobs? Usually through someone like Nick Popovich. Popovich, the president of sage-popovich, is one of the kings of airline repossession.

Airplanes are expensive. They can cost several million dollars. Every plane that is repossessed is delivered back to the bank for a 6% to 10% commission of the resale price. That could mean anywhere from $10,000 to $900,000 per plane.

He chose to follow only one piece of the advice that his father gave him, and got his pilot certificate at the age of 16 ? being a pilot ?might come in handy,? his father said. For Nick Popovich, it all started when a bank loaned a company enough cash to buy a couple of Boeing 747s.

To get started in this job, become a licensed pilot. Learn how to fly as many types of aircrafts as possible. Contact banks about jobs or make contacts with a repossession company. Besides planes, many companies also dabble in boat repossessions.

Airplane Repo is an American documentary-style fiction show following repossession agents hired by financial institutions to recover aircraft and occasionally other high-value assets from owners who have fallen behind on their payments.

Lender's guide to aircraft repossession Sign a tripartite agreement beforehand. ... Establish a good relationship with the operator. ... Carry out as many inspections as possible. ... Know where the records are. ... Assess whether repossession is really worth the cost. ... Think about the resell. ... Hire a repossession specialist.