Michigan Nonqualified Defined Benefit Deferred Compensation Agreement

Description

How to fill out Nonqualified Defined Benefit Deferred Compensation Agreement?

In case you need to acquire, access, or generate legitimate document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Utilize the site’s simple and convenient search to locate the documents you require.

A variety of templates for commercial and personal purposes are categorized by types and states, or keywords.

Every legal document template you acquire is yours indefinitely. You have access to every form you have saved in your account. Visit the My documents section and select a form to print or download again.

Stay competitive and obtain, and print the Michigan Nonqualified Defined Benefit Deferred Compensation Agreement with US Legal Forms. There are numerous professional and state-specific forms you can utilize for your business or personal needs.

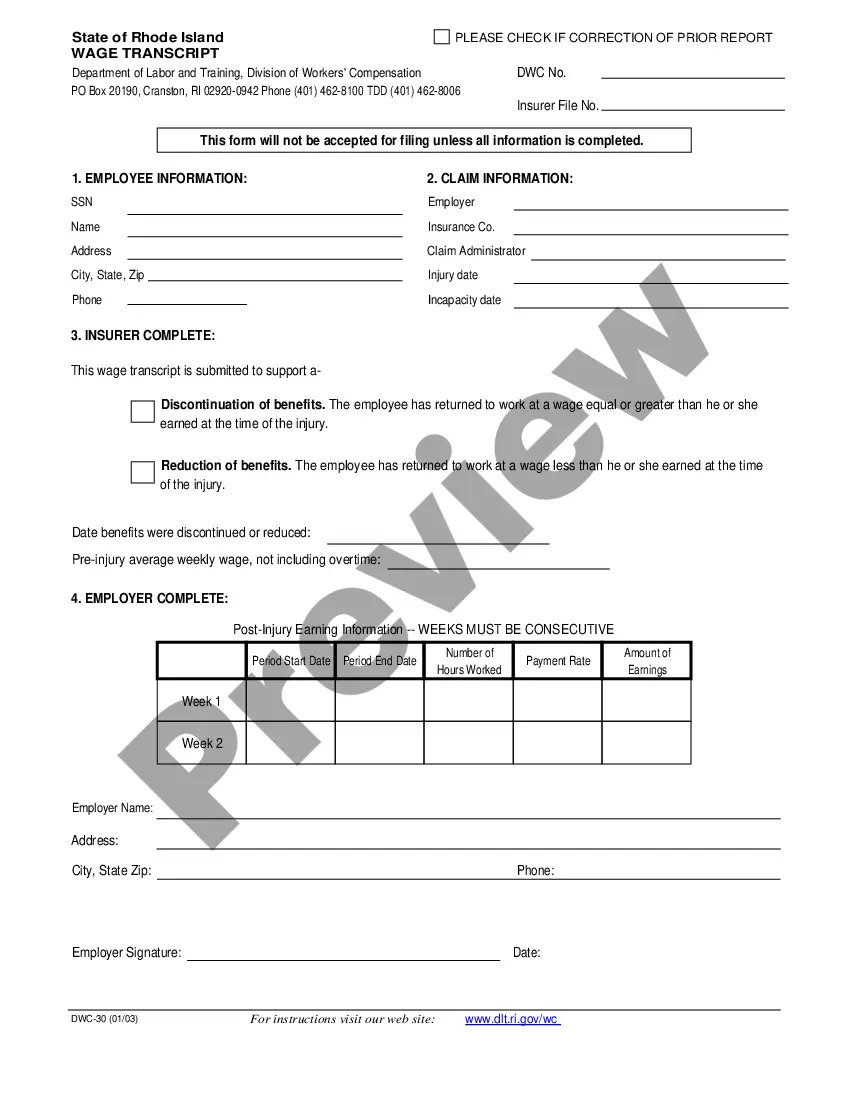

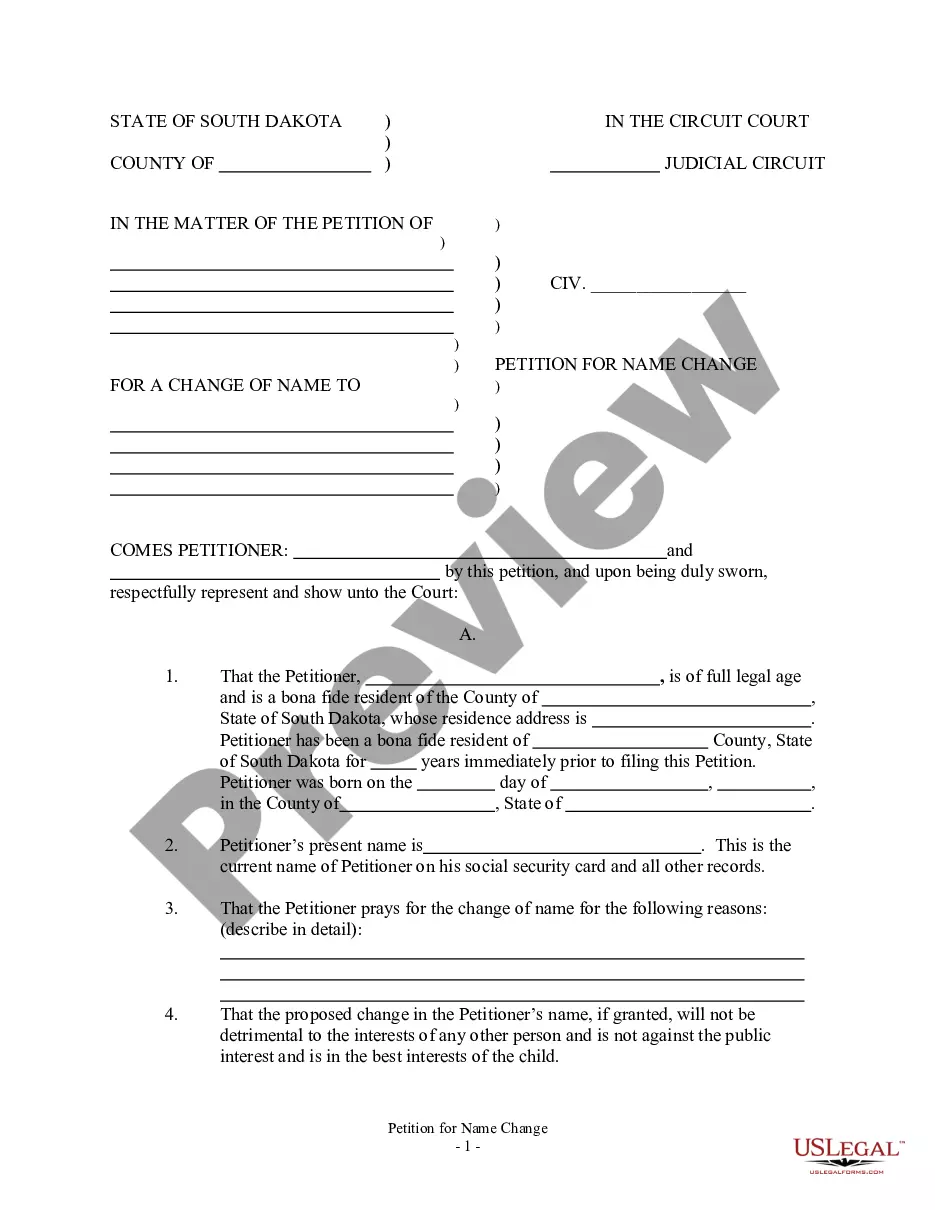

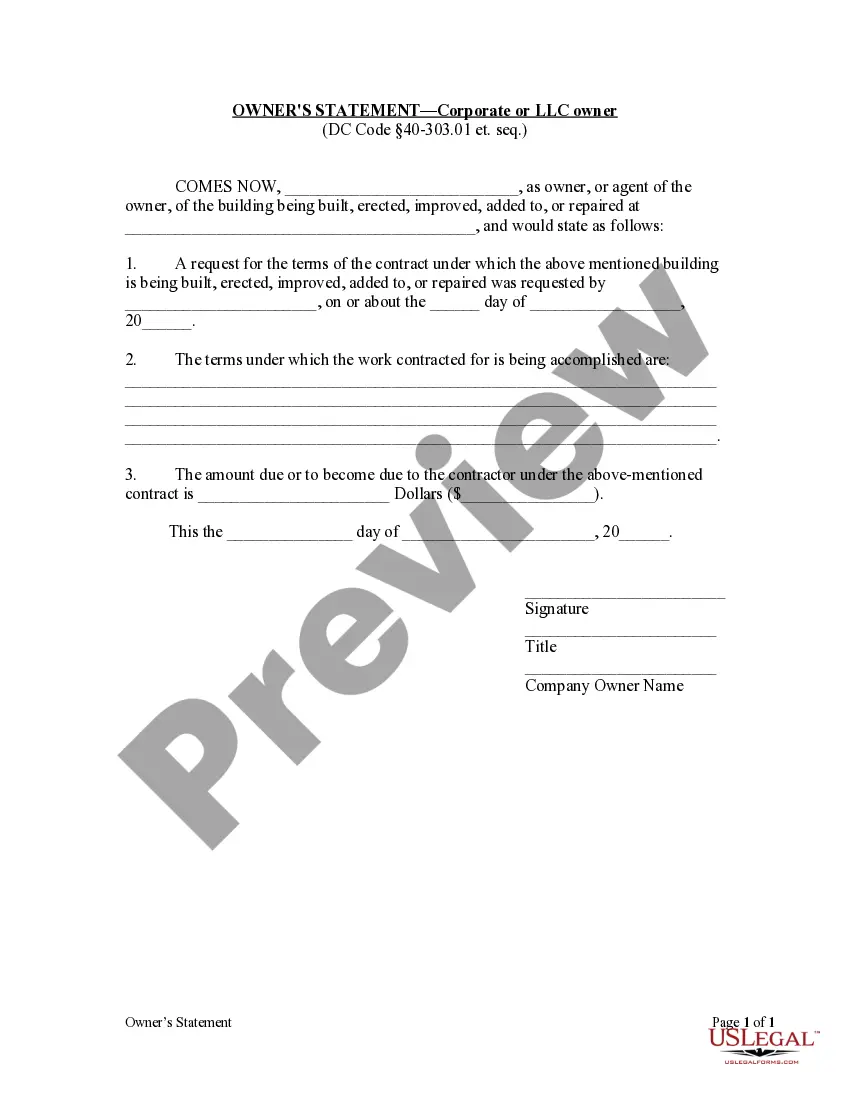

- Step 1. Ensure you have selected the form for your correct region/state.

- Step 2. Use the Review option to examine the form’s details. Don’t forget to check the description.

- Step 3. If you are not content with the form, use the Search field at the top of the screen to find other variations of the legal form format.

- Step 4. Once you have found the form you need, click the Get now button. Choose your preferred payment plan and provide your credentials to register for an account.

- Step 5. Complete the transaction. You may pay using your credit card or PayPal account to finalize the purchase.

- Step 6. Choose the format of the legal document and download it to your device.

- Step 7. Complete, edit, and print or sign the Michigan Nonqualified Defined Benefit Deferred Compensation Agreement.

Form popularity

FAQ

Participating in a nonqualified deferred compensation plan can be advantageous, especially for high-income earners looking to enhance their retirement savings. Depending on your financial situation, the Michigan Nonqualified Defined Benefit Deferred Compensation Agreement may provide tax benefits and a way to save beyond standard retirement plan limits. It's essential to assess your financial goals and consult with a financial advisor to make an informed decision on participation.

The primary difference between a 401(k) plan and a deferred compensation plan lies in their structure and tax treatment. A 401(k) is a qualified plan, meaning it has settings around contributions, limits, and taxes. In contrast, the Michigan Nonqualified Defined Benefit Deferred Compensation Agreement does not have these strict limits, allowing higher earners to save more for retirement without the same restrictions.

qualified deferred compensation arrangement, such as the Michigan Nonqualified Defined Benefit Deferred Compensation Agreement, offers employees the ability to save a portion of their salary for future use. This arrangement is not subject to federal income tax until the funds are withdrawn, making it a useful tool for retirement planning. It provides flexible options compared to qualified plans, accommodating higher income individuals.

A nonqualified deferred compensation arrangement is a financial agreement between an employer and an employee. This type of plan allows employees to defer a portion of their income to a future date, often when they retire or leave the company. The Michigan Nonqualified Defined Benefit Deferred Compensation Agreement is designed to provide employees with additional retirement savings, separate from traditional retirement plans like 401(k)s.

Form 4884 is a key document used in Michigan to report information related to deferred compensation agreements. This form assists in maintaining compliance with state regulations governing the Michigan Nonqualified Defined Benefit Deferred Compensation Agreement. It ensures that both employers and employees meet their reporting obligations, helping to facilitate smooth management of deferred compensation plans. Using tools from uslegalforms can simplify the preparation and submission of Form 4884.

The state of Michigan offers a deferred compensation plan designed for state employees. This plan allows participants to set aside a portion of their income for retirement, providing tax advantages. By contributing to the Michigan Nonqualified Defined Benefit Deferred Compensation Agreement, employees can enhance their retirement savings and secure a stable financial future. This plan helps bridge the gap between retirement income and living expenses.

An example of a nonqualified deferred compensation plan is a supplemental executive retirement plan (SERP), which provides additional retirement benefits to select employees beyond standard pension plans. In a Michigan Nonqualified Defined Benefit Deferred Compensation Agreement, this SERP might promise a defined benefit at retirement based on salary and years of service, thus enhancing the employee's overall retirement package. Such plans are specifically designed to attract and retain top talent within your organization.

Nonqualified deferred compensation plans can be advantageous for high-income earners looking to save more for retirement beyond what qualified plans allow. They provide flexibility in terms of contribution amounts and payment timing, which can be beneficial for tax planning. Many find that a Michigan Nonqualified Defined Benefit Deferred Compensation Agreement meets their retirement needs effectively. However, it's essential to understand the risks involved, including the potential for losing benefits if the company faces financial difficulties.

A nonqualified deferred compensation plan is an agreement that allows an employee to defer a portion of their income until a later date, usually retirement. Unlike qualified plans, these are not subject to the same contribution limits and regulatory requirements. In the case of a Michigan Nonqualified Defined Benefit Deferred Compensation Agreement, the focus is on providing a pension-like benefit that offers greater flexibility for both the employer and employee. This arrangement can help employees prepare for financial stability in retirement.

To set up a Michigan Nonqualified Defined Benefit Deferred Compensation Agreement, begin by engaging with a financial advisor who specializes in retirement plans. They will guide you through the necessary legal requirements, plan structure, and funding options. It's important to ensure the plan aligns with your specific financial goals and complies with regulations. Additionally, consider using U.S. Legal Forms to access documents that can streamline the setup process.