Michigan General Partnership for Business

Description

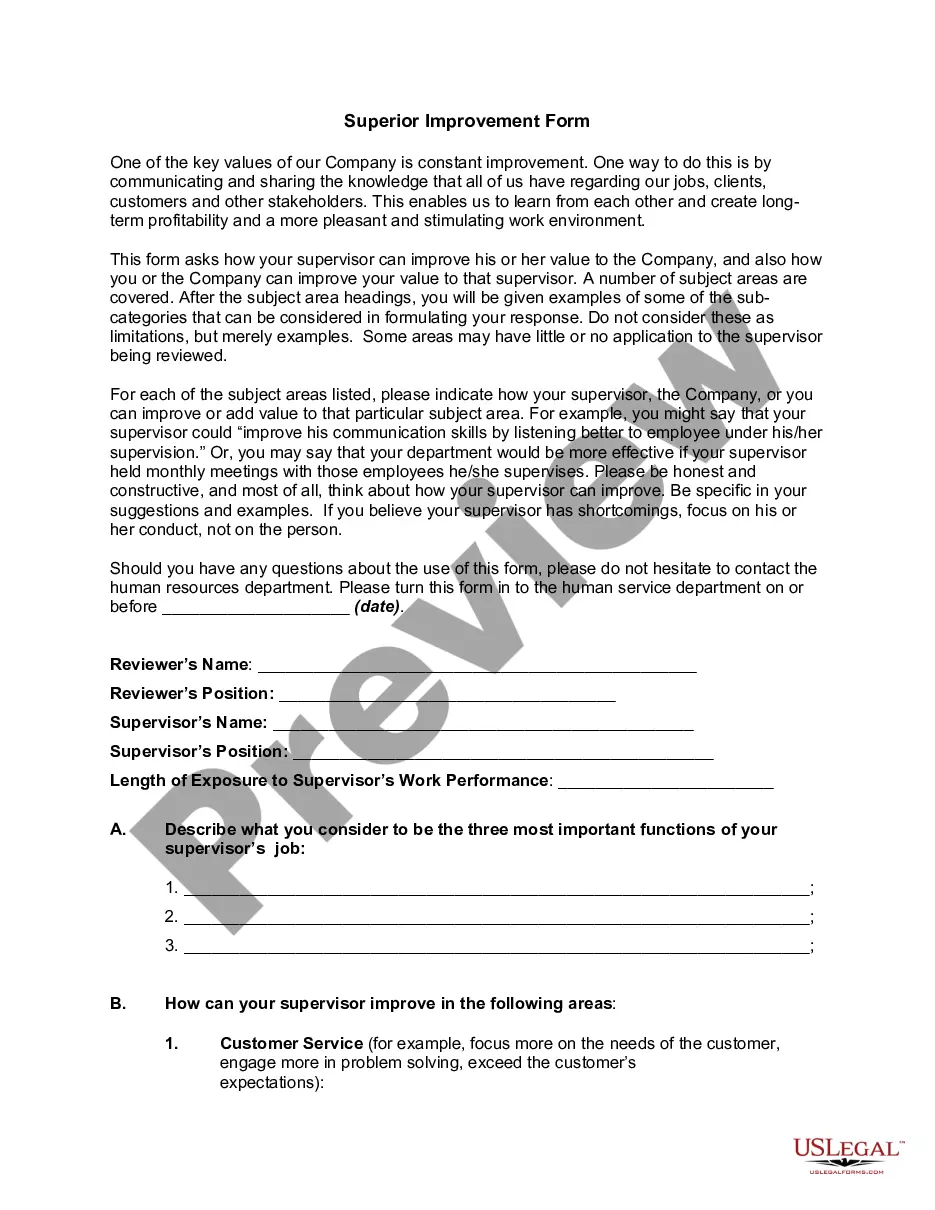

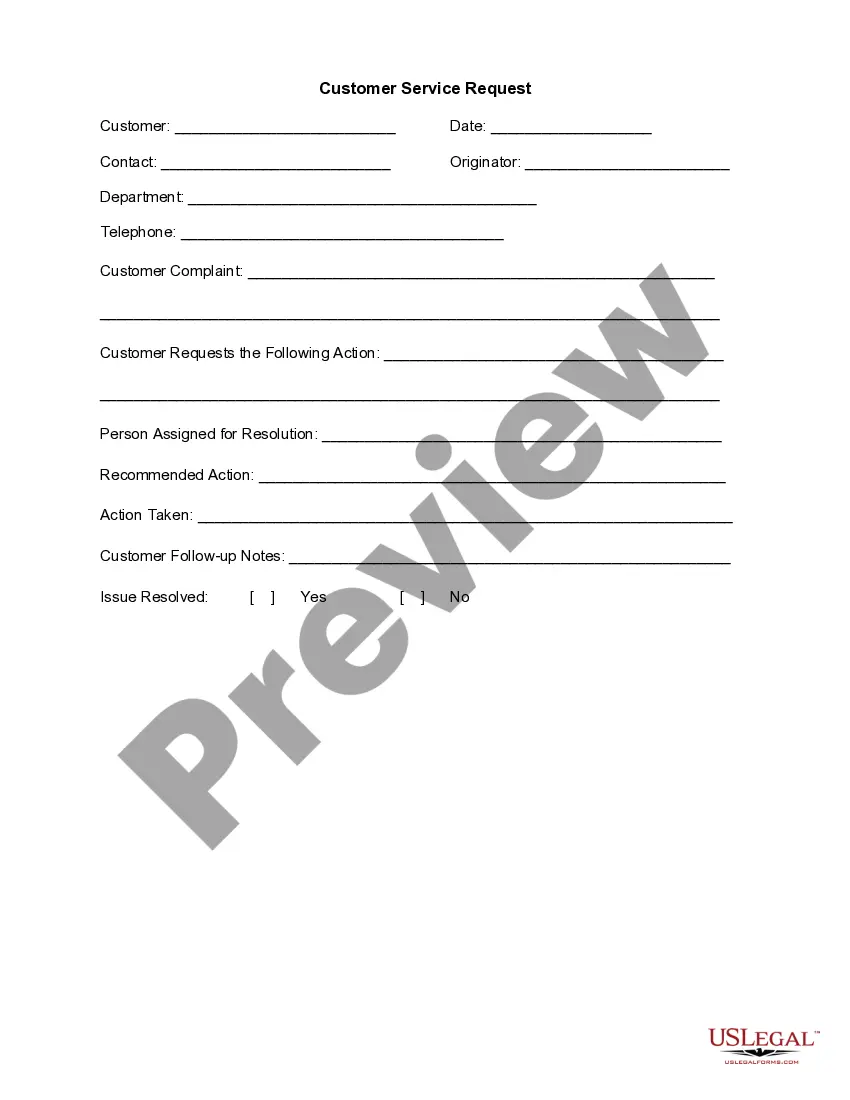

How to fill out General Partnership For Business?

You can dedicate hours online searching for the legal document format that meets the state and federal requirements you need.

US Legal Forms offers a vast array of legal forms that are reviewed by professionals.

You can quickly obtain or print the Michigan General Partnership for Business from my service.

Check the form description to make sure you have selected the right form. If available, use the Review button to look through the document format as well.

- If you already have a US Legal Forms account, you can Log In and click the Download button.

- Then, you can complete, edit, print, or sign the Michigan General Partnership for Business.

- Every legal document format you acquire is yours permanently.

- To obtain another copy of the downloaded form, go to the My documents tab and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document format for the state/city of your choice.

Form popularity

FAQ

An LLC is not a partnership, though many LLC owners casually refer to their co-owners as business partners." All LLC ownersknown formally as members"are protected from personal liability for business debts.

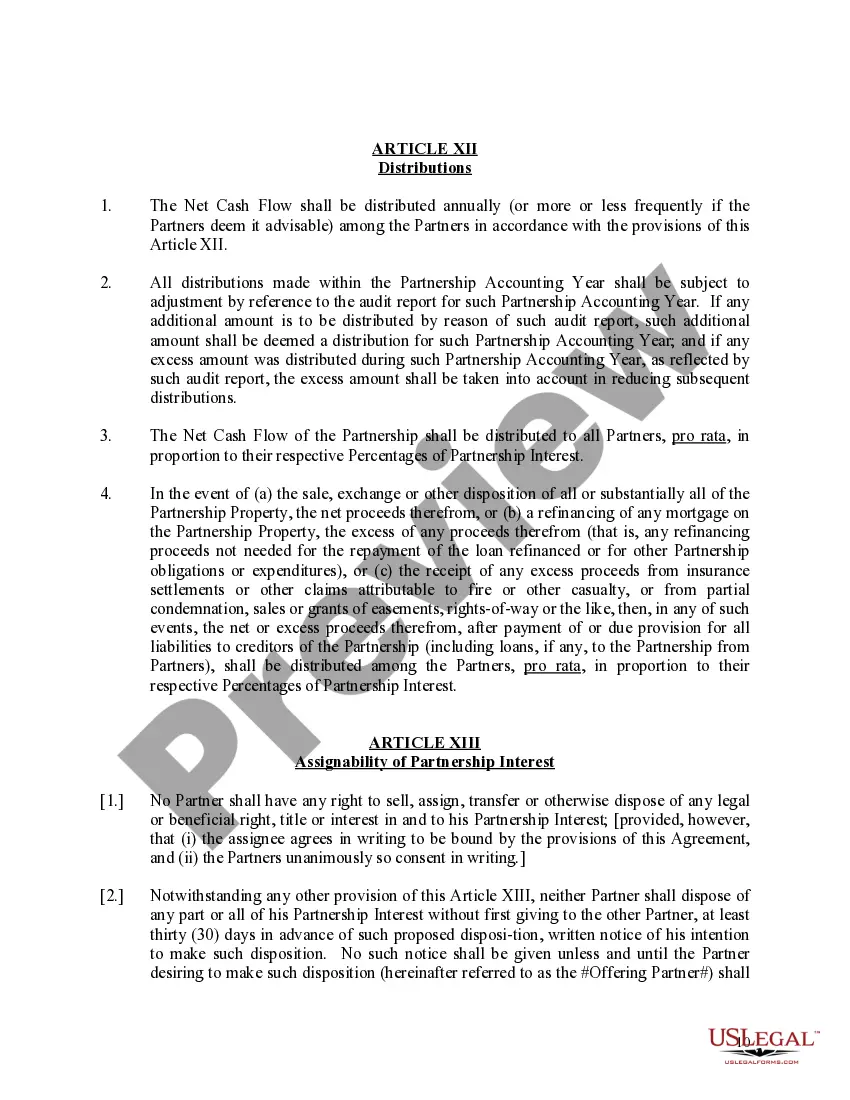

A general partnership is a business arrangement by which two or more individuals agree to share in all assets, profits, and financial and legal liabilities of a jointly-owned business.

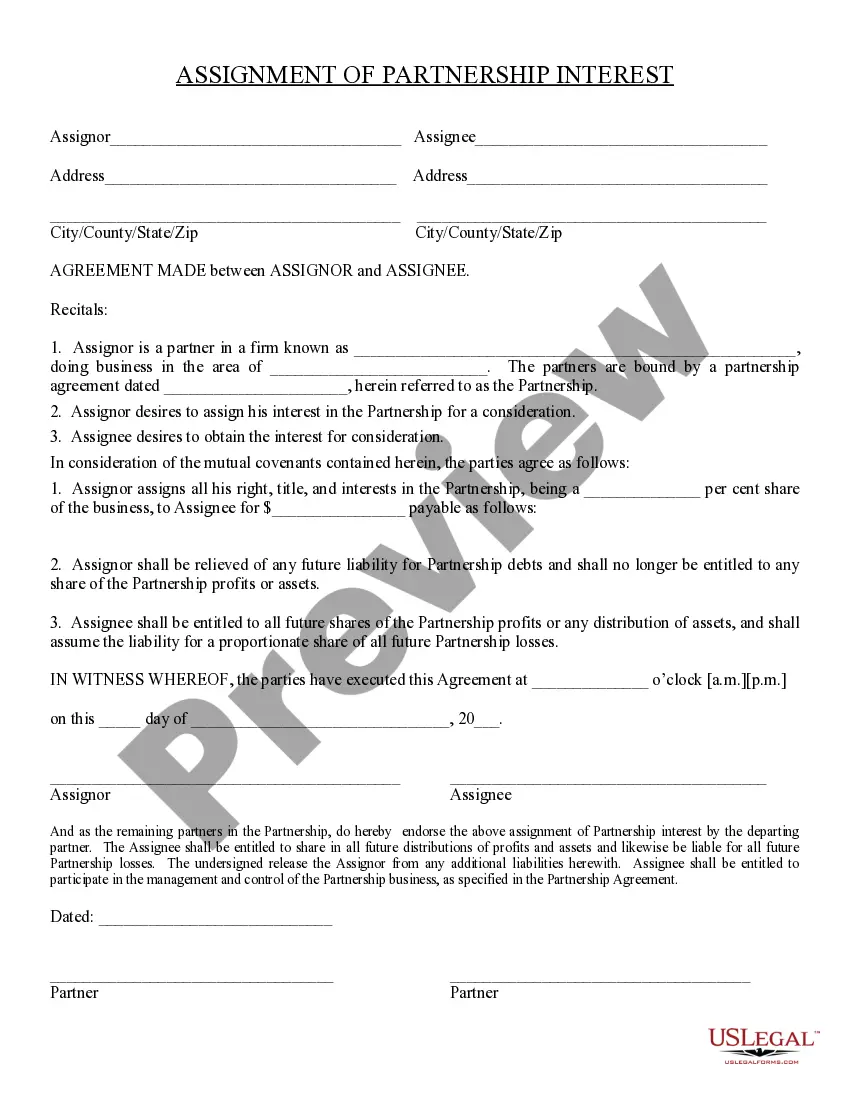

Forming a Partnership in MichiganChoose a business name for your partnership and check for availability.Register the business name with local, state, and/or federal authorities.Draft and sign a partnership agreement.Obtain any required local licenses.More items...

Example of a General Partnership For example, let's say that Fred and Melissa decide to open a baking store. The store is named F&M Bakery. By opening a store together, Fred and Melissa are both general partners in the business, F&M Bakery.

General partnership disadvantages include:General Partners are Responsible for Other Partners' Actions. In a general partnership, each partner is liable for what the other does.You'll Have to Split the Profits.Disagreements Could Arise.Your Personal Assets are Vulnerable.

Simplified taxes: The biggest advantage of a general partnership is the tax benefit. Businesses structured as partnerships do not pay income tax. Instead, all profits and losses are passed through to the individual partners.

A domestic LLC with at least two members is classified as a partnership for federal income tax purposes unless it files Form 8832 and elects to be treated as a corporation.

Once you've decide to go ahead and form a partnership, there are a few steps that must be followed.Step 1: Select a business name.Step 2: File trademark on business name (optional)Step 3: Complete required paperwork.Step 4: Determine if you need an EIN, additional licenses or tax IDs.More items...?

In general, an LLC offers better liability protection and more tax flexibility than a partnership. But the type of business you're in, the management structure, and your state's laws may tip the scales toward partnership.

A general partnership is a business entity made of two or more partners who agree to establish and run a business.