Michigan Job Expense Record

Description

How to fill out Job Expense Record?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a diverse selection of legal form templates that you can download or print.

By using the website, you can access thousands of forms for business and personal use, organized by categories, states, or keywords. You can retrieve the latest forms like the Michigan Job Expense Record in just a few seconds.

If you already have a monthly subscription, Log In to obtain the Michigan Job Expense Record from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously saved forms in the My documents tab of your account.

Process the transaction. Use a credit card or PayPal account to complete the purchase.

Select the format and download the form to your device. Edit. Fill out, modify, print, and sign the saved Michigan Job Expense Record.

Every template you add to your account does not have an expiration date and is yours indefinitely. Therefore, to download or print another copy, simply visit the My documents section and click on the form you need.

Gain access to the Michigan Job Expense Record with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that cater to your business or personal needs and requirements.

- Make sure you have selected the appropriate form for your city/state.

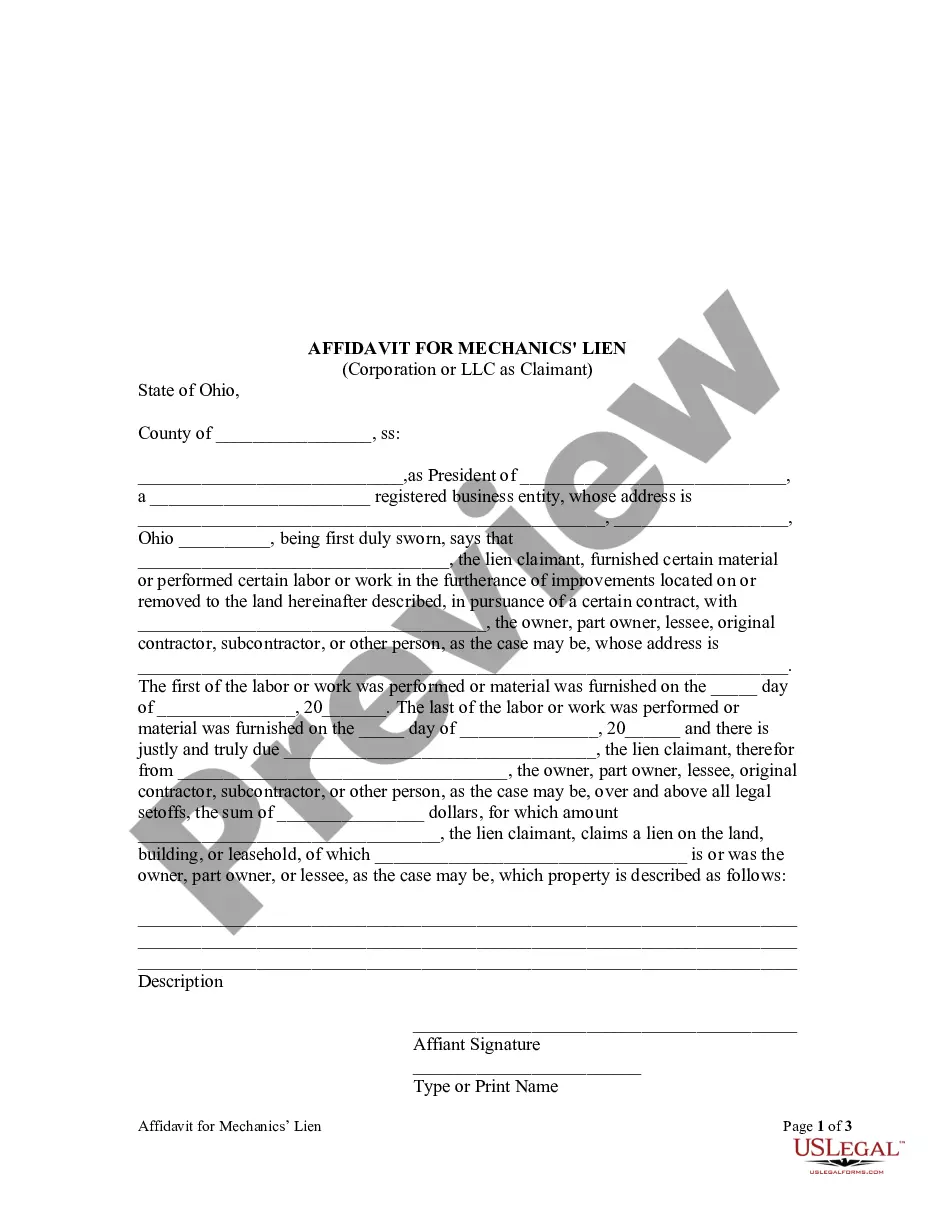

- Click the Preview button to inspect the form's content.

- Review the form description to ensure you have selected the correct one.

- If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Purchase now button.

- Then, choose your payment plan and provide your information to register for an account.

Form popularity

FAQ

Yes, you need to include W-2 forms with your Michigan tax return if you are filing as an employee. This documentation is essential for accurately reporting your income and calculating your tax obligations. It’s also beneficial to have a thorough Michigan Job Expense Record, which can make the overall filing process smoother and help identify any deductions.

To submit a W-2 to the state of Michigan, employers must complete the W-2 form and send copies to the employee and the state. This process typically involves filing both electronically and by mail if necessary. It's also essential to keep a detailed Michigan Job Expense Record to account for any deductions related to employee wages when calculating your payroll taxes.

MILogin is the new single sign on application you will use to access your MiWAM (Michigan Web Account Manager) account. MiWAM is where you can view your unemployment claim, certify for benefits, submit job search contacts, etc.

Acceptable documentation to prove your employment includes, but is not limited to:Tax returns.Pay check stubs.Earning and leave statements showing the employer's name and address.W-2 forms.State or Federal employer identification numbers.Letters offering employment.Business receipts.

How long will the verification take after I submit my documents? Experienced ID verification staff will review the documents in the order that they are received. This process may take 3 to 4 weeks to complete. Photo IDs must be in color.

There are two ways to file a new claim or re-open an existing claim:FASTEST AND PREFERRED METHOD: Online - Visit and sign into MILogin to access or create an account on the Michigan Web Account Manager (MiWAM).Telephone - Call 1-866-500-0017.

Submit Proof of Employment The request will include additional information, the deadline date for submission, and examples of acceptable proof. Acceptable proof included, but is not limited to tax returns, paycheck stubs, earnings statements, W-2 forms, business licenses or business receipts.

Claimants now required to requalify for PUA previously selected one or more of the following four non-qualifying reasons for PUA: Your work hours have been reduced as a direct result of COVID-19. You are seeking part-time employment and affected by COVID-19.

Allowable work search activities may include submitting applications, contacting employers, checking resources at employment offices, checking job listings at Michigan Works, attending job fairs or employment workshops.

If you have become unemployed or your hours of work have been reduced, you may file a claim for unemployment benefits. You may file your claim by telephone toll-free at 1-866-500-0017 (TTY customers use 1-866-366-0004), or file online at under the heading.