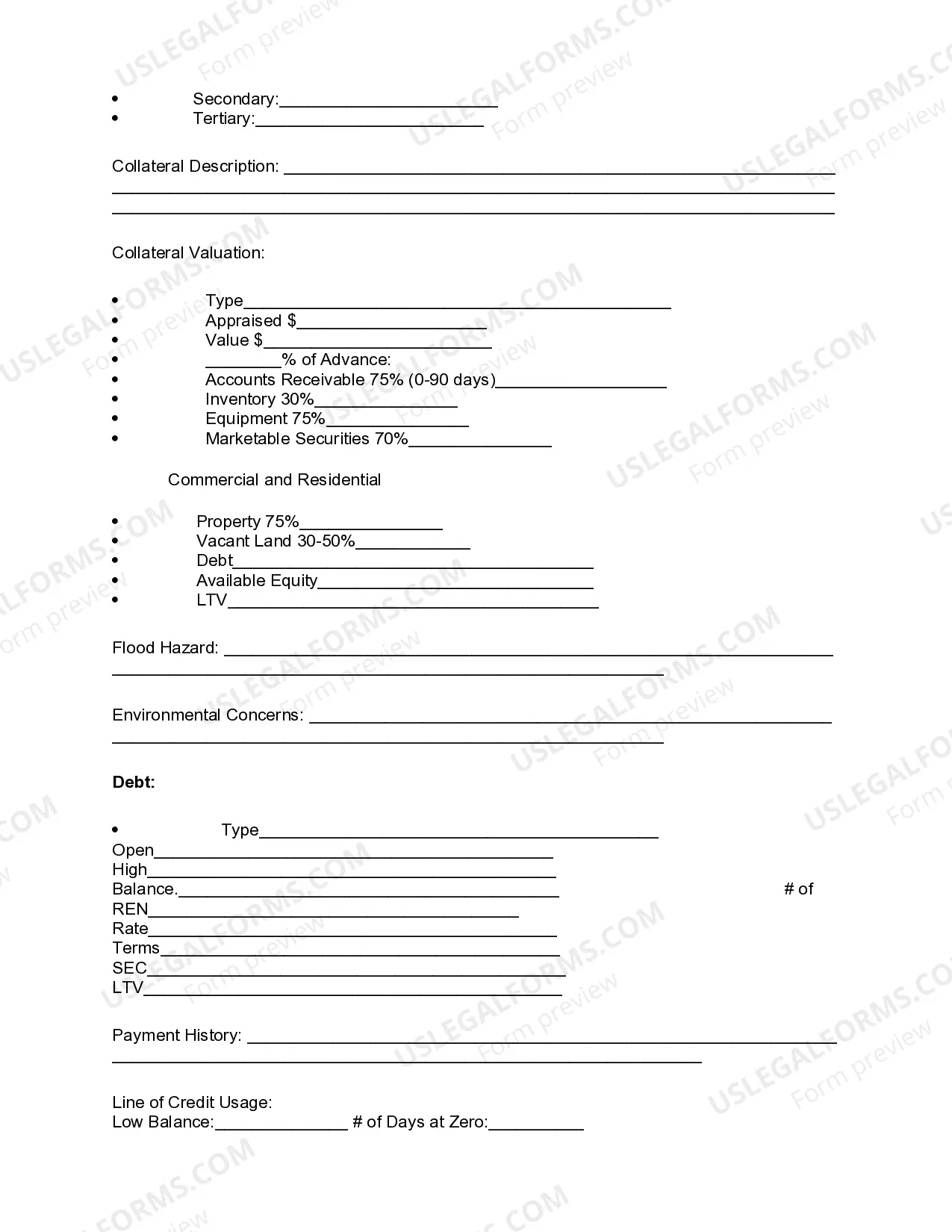

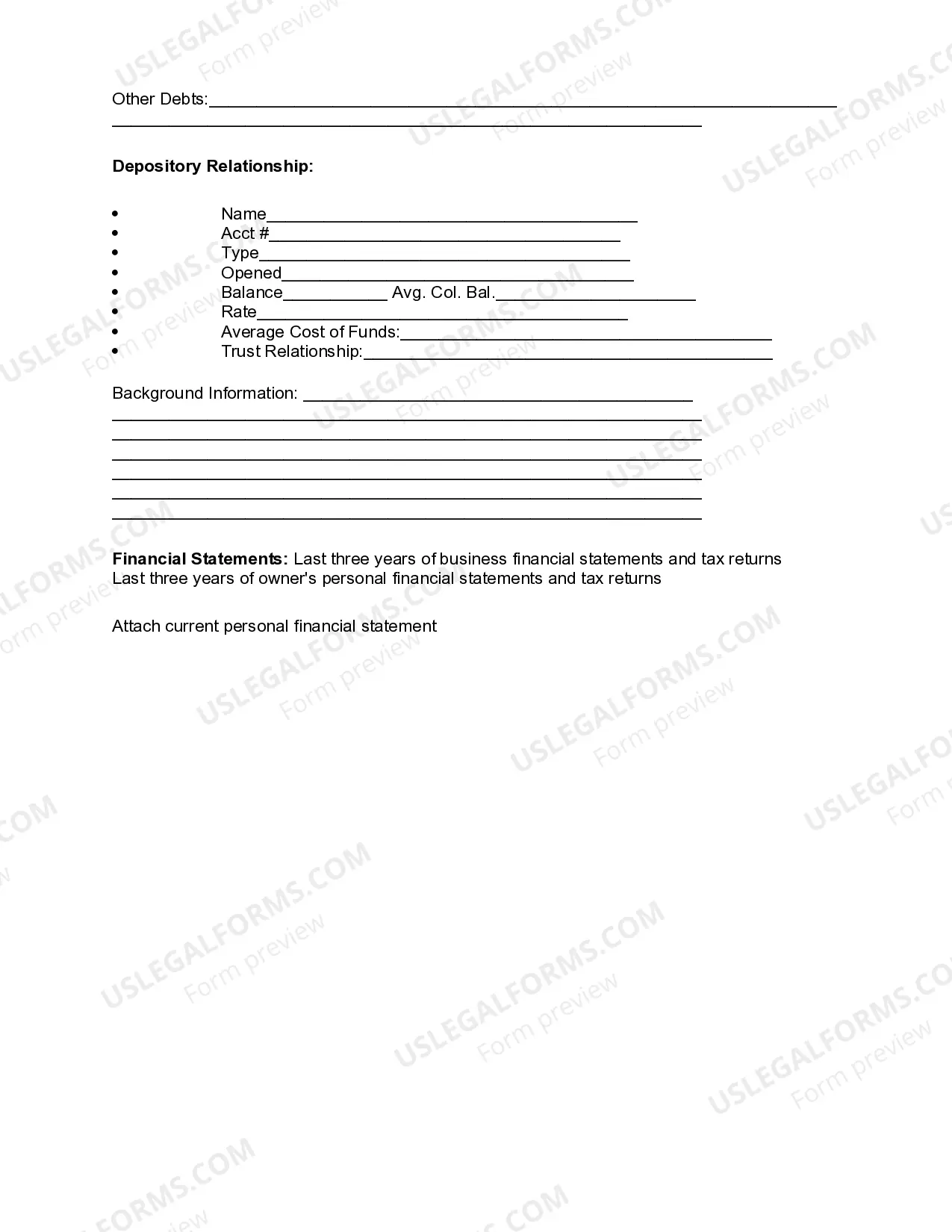

Michigan Review of Loan Application

Description

How to fill out Review Of Loan Application?

Finding the right lawful record design might be a have difficulties. Obviously, there are a lot of templates accessible on the Internet, but how can you obtain the lawful type you want? Use the US Legal Forms internet site. The services gives 1000s of templates, including the Michigan Review of Loan Application, which you can use for enterprise and private demands. All the types are examined by pros and meet state and federal needs.

In case you are currently listed, log in to your bank account and then click the Obtain key to obtain the Michigan Review of Loan Application. Make use of your bank account to appear from the lawful types you may have ordered previously. Go to the My Forms tab of your own bank account and have one more version from the record you want.

In case you are a brand new end user of US Legal Forms, here are straightforward guidelines that you can stick to:

- Very first, make sure you have selected the right type to your town/area. You are able to examine the shape using the Review key and study the shape outline to ensure this is basically the right one for you.

- If the type is not going to meet your preferences, take advantage of the Seach field to find the correct type.

- When you are sure that the shape is acceptable, click the Get now key to obtain the type.

- Select the pricing strategy you need and type in the needed details. Make your bank account and pay for the order using your PayPal bank account or credit card.

- Choose the data file formatting and down load the lawful record design to your system.

- Complete, change and printing and indicator the received Michigan Review of Loan Application.

US Legal Forms is the greatest local library of lawful types that you can see various record templates. Use the company to down load appropriately-produced paperwork that stick to status needs.

Form popularity

FAQ

A credit review?also known as account monitoring or account review inquiry?is a periodic assessment of an individual's or business's credit profile. Creditors?such as banks, financial services institutions, credit bureaus, settlement companies, and credit counselors?may conduct credit reviews.

Getting approved for a personal loan generally takes anywhere from one day to one week. As we mentioned above, how long it takes for a personal loan to go through depends on several factors, like your credit score. However, one of the primary factors that will affect your approval time is where you get your loan from.

Typically, a loan review is conducted on commercial loan files, either internally by bank or credit union staff, or by hired third-party auditors. These investigators check for completeness of loan documentation and/or evaluate loan performance.

Loan review refers to examining outstanding loans to make sure borrowers adhere to their credit agreements and the bank follows its loan policies. While banks today use various loan review procedures, a few general principles are followed by nearly all banks.

Your income and employment history are good indicators of your ability to repay outstanding debt. Income amount, stability, and type of income may all be considered. The ratio of your current and any new debt as compared to your before-tax income, known as debt-to-income ratio (DTI), may be evaluated.

Loan application volume (how many mortgages a lender is processing at once) The complexity of your loan profile (for example, someone with issues in their credit history might take longer to approve than someone with an ultra-clean credit report)

A loan review provides an assessment of the overall quality of a loan portfolio. Specifically, a loan review: ? Assesses individual loans, including repayment risks.

The loan has been assigned to an underwriter to review and approve the loan. It is a normal process don't be alarmed by the wording. Once the loan is approved, the underwriter will request any additional documents needed for what is called the clear to close.