Arkansas Sale or Return

Description

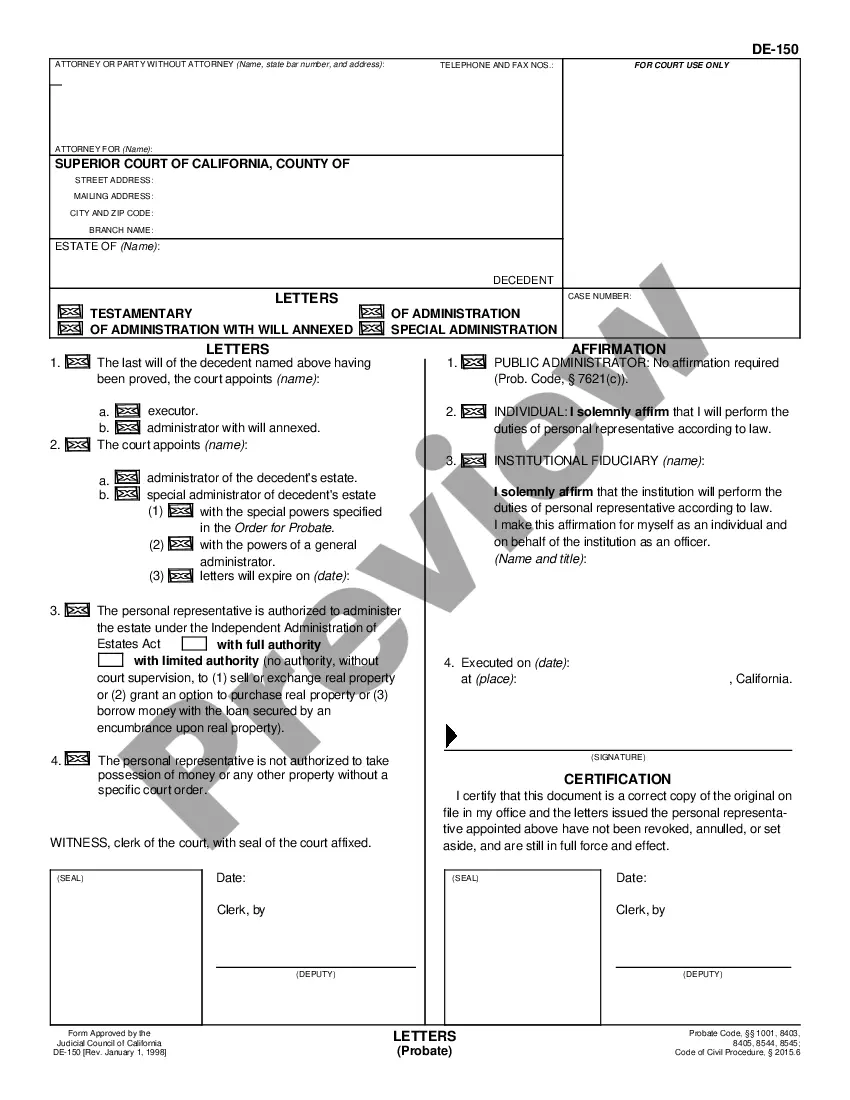

How to fill out Sale Or Return?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a range of legal form templates that you can download or print.

By utilizing the website, you can find thousands of forms for both business and personal purposes, organized by categories, states, or keywords. You can access the latest versions of forms such as the Arkansas Sale or Return in just a few moments.

If you already possess a subscription, Log In and download the Arkansas Sale or Return from the US Legal Forms library. The Download button will appear on every form you view. You have access to all previously downloaded forms in the My documents tab of your account.

Complete the transaction. Use a credit card or PayPal account to finalize the payment.

Select the format and download the form to your device. Make modifications. Fill out, modify, and print and sign the downloaded Arkansas Sale or Return. Each template you add to your account has no expiration date and is yours forever. So, if you wish to download or print another copy, simply go to the My documents section and click on the form you desire.

- If you are looking to use US Legal Forms for the first time, here are basic steps to get you started.

- Ensure you’ve selected the correct form for your city/county. Click the Preview button to review the form's content.

- Check the form description to confirm you’ve chosen the correct document.

- If the form doesn’t meet your needs, utilize the Search field at the top of the screen to find one that does.

- Once you are pleased with the form, confirm your selection by clicking the Buy now button.

- Then, choose your preferred pricing plan and provide your information to register for an account.

Form popularity

FAQ

If you suspect someone is not paying sales tax, you can report this issue to the Arkansas Department of Finance and Administration. They have a process in place for investigating such claims. Understanding the Arkansas Sale or Return obligations can help you identify non-compliance. If you are uncertain about the reporting process, USLegalForms can guide you through the necessary steps.

Reporting sales tax in Arkansas involves submitting your sales tax return, which includes the total sales and the tax amount collected, through the state's online filing system. The Arkansas Sale or Return process mandates timely submissions to avoid penalties. Keeping consistent records will make this process easier. If needed, USLegalForms offers valuable resources to help you stay compliant.

To report sales tax collected, you must include it in your sales tax return when filing with the state of Arkansas. Ensure you track all collected sales tax throughout the reporting period to maintain accuracy. Utilizing the Arkansas Sale or Return guidelines will help you remain compliant. For further assistance in organizing this information, explore the tools available on USLegalForms.

When selling a home, you report the sale information on IRS Form 8949 and Schedule D of your tax return. This documentation helps establish any capital gains or losses associated with the sale. Knowing how to navigate the Arkansas Sale or Return process can simplify your reporting. If you have questions, consulting USLegalForms provides resources that help homeowners manage their tax obligations.

To file sales tax in Arkansas, you must complete the appropriate sales tax return and submit it to the Arkansas Department of Finance and Administration. You can file online through their portal, making it easier to handle your Arkansas Sale or Return responsibilities. Always make sure to keep accurate records of your sales to ensure compliance. If you need assistance, consider utilizing services from USLegalForms to streamline the process.

In Arkansas, you typically do not report sales tax on your taxes, as sales tax is collected by the seller at the point of sale. However, if you're a business, you need to ensure that you accurately report and remit the sales tax collected from customers. This process is part of fulfilling your obligation under the Arkansas Sale or Return guidelines. Businesses can use platforms like USLegalForms to manage their sales tax reporting effectively.

No, a vendor's license and a seller's permit are not the same. A vendor's license generally allows you to conduct business in a specific area, while a seller's permit is specifically for collecting sales tax on taxable transactions. It's crucial for your business to have both if you wish to operate legally in Arkansas.

If you are a resident or earn income in Arkansas, you must file a state tax return. This requirement depends on your income level and source, so it's wise to understand your specific obligations. Using platforms like USLegalForms can provide you with the necessary forms to file correctly and stay compliant with Arkansas tax regulations.

Yes, a seller's permit is crucial if your business sells taxable items in Arkansas. Without this permit, you cannot legally collect sales tax from customers. It's important to understand the requirements and secure your seller's permit to maintain compliance with state laws.

To close your Arkansas sales tax account, you must submit a request to the Arkansas Department of Finance and Administration. Make sure to file any outstanding sales tax returns before you make this request. Once your account is closed, you will no longer be responsible for collecting or remitting Arkansas sales tax associated with your business.