Guam Jury Instruction - 10.10.4 Business Loss vs. Hobby Loss

Description

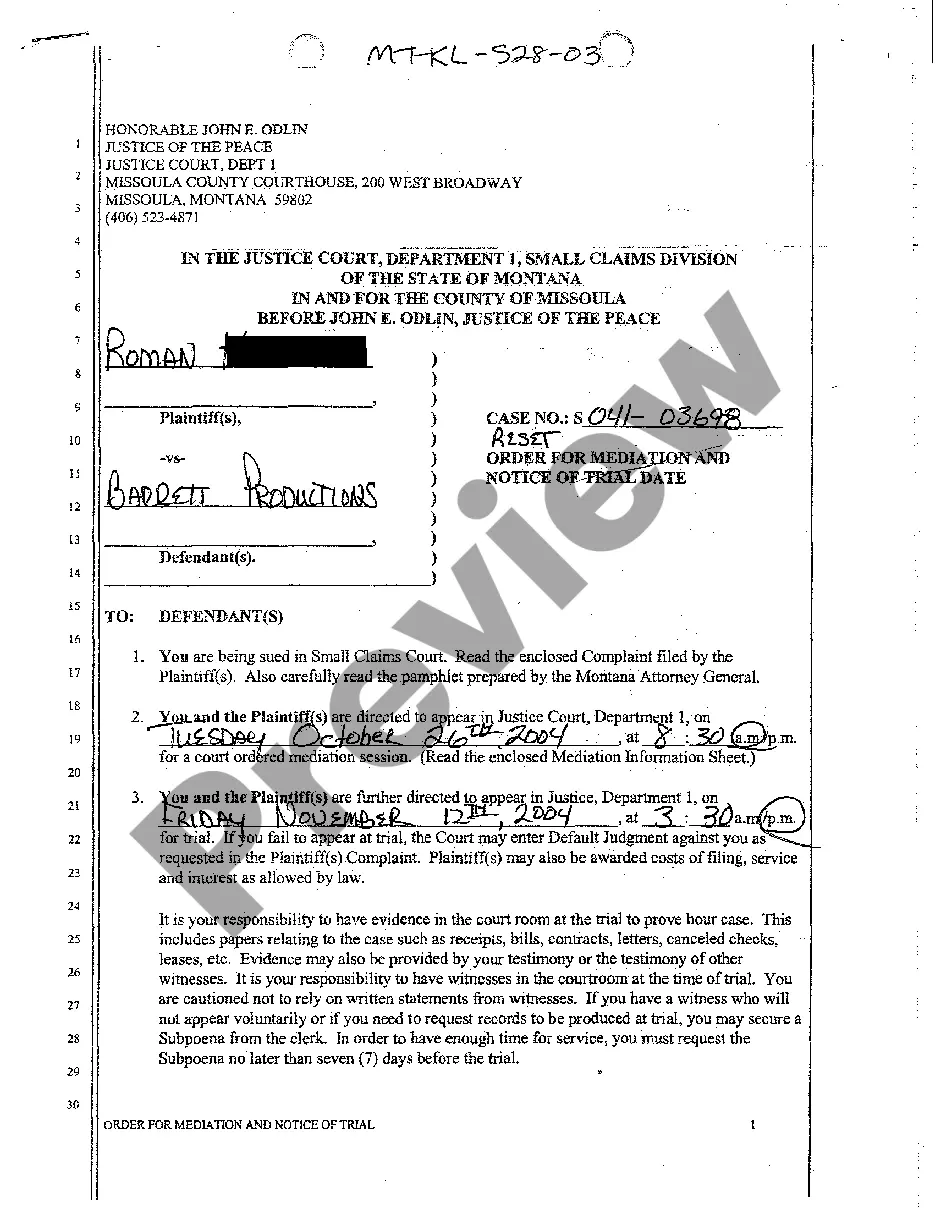

How to fill out Jury Instruction - 10.10.4 Business Loss Vs. Hobby Loss?

US Legal Forms - among the greatest libraries of legitimate kinds in the USA - delivers a wide array of legitimate papers templates you may down load or produce. Utilizing the site, you can get a huge number of kinds for business and individual reasons, categorized by classes, states, or key phrases.You will discover the most recent variations of kinds like the Guam Jury Instruction - 10.10.4 Business Loss vs. Hobby Loss within minutes.

If you have a subscription, log in and down load Guam Jury Instruction - 10.10.4 Business Loss vs. Hobby Loss through the US Legal Forms catalogue. The Download button will appear on every single type you see. You gain access to all previously delivered electronically kinds from the My Forms tab of your respective accounts.

If you would like use US Legal Forms the first time, listed here are simple recommendations to help you started off:

- Be sure you have selected the proper type for the metropolis/state. Select the Review button to review the form`s information. Read the type explanation to actually have selected the right type.

- In case the type does not suit your needs, utilize the Research field at the top of the monitor to obtain the one who does.

- When you are satisfied with the shape, verify your selection by clicking the Acquire now button. Then, select the pricing program you favor and give your references to sign up for the accounts.

- Process the financial transaction. Utilize your charge card or PayPal accounts to complete the financial transaction.

- Select the file format and down load the shape in your device.

- Make adjustments. Fill up, edit and produce and indicator the delivered electronically Guam Jury Instruction - 10.10.4 Business Loss vs. Hobby Loss.

Every single web template you included in your bank account lacks an expiration time and it is your own property forever. So, if you want to down load or produce yet another version, just proceed to the My Forms section and click on in the type you want.

Gain access to the Guam Jury Instruction - 10.10.4 Business Loss vs. Hobby Loss with US Legal Forms, the most substantial catalogue of legitimate papers templates. Use a huge number of specialist and condition-distinct templates that meet up with your organization or individual requires and needs.