California Sale or Return

Description

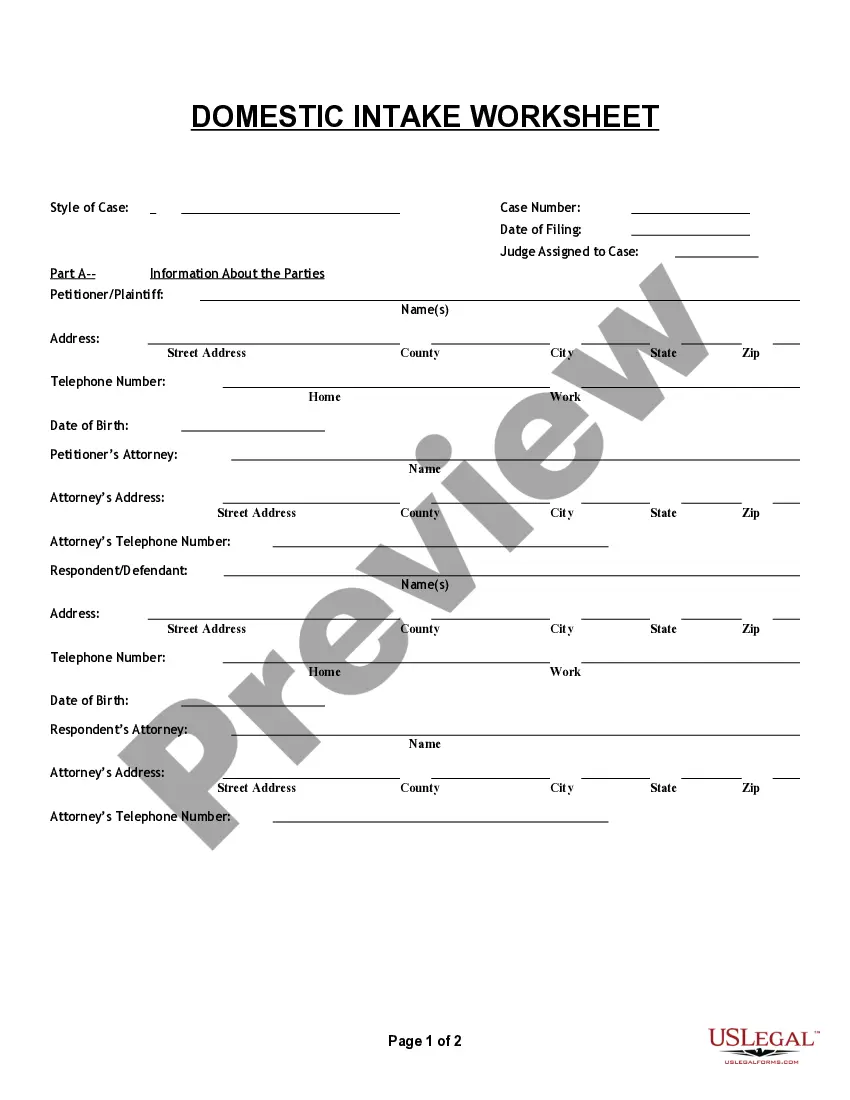

How to fill out Sale Or Return?

Have you ever encountered a scenario where you need documents for potential business or particular tasks almost daily.

There are numerous legal document templates available online, but finding reliable versions is challenging.

US Legal Forms offers a vast array of templates, including the California Sale or Return, that are designed to comply with federal and state regulations.

Once you find the correct form, click Get now.

Choose the pricing plan you desire, complete the required information to create your account, and finalize the purchase using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the California Sale or Return template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it is for the correct city/region.

- Use the Review button to verify the form.

- Read the description to confirm you've selected the right document.

- If the form is not what you are looking for, utilize the Search section to find the form that meets your needs and requirements.

Form popularity

FAQ

The frequency of filing sales tax returns in California generally depends on your business's sales tax liability. Many businesses file quarterly, while some smaller businesses may only need to file annually. Staying informed on the California Sale or Return timelines ensures you meet your obligations and avoid penalties. Using user-friendly resources, such as those available at uslegalforms, can streamline your preparation and filing.

Whether you need to file a California return depends on several factors, including your income level, residency, and specific financial situations. If your income meets the minimum threshold or you have other tax obligations, filing is usually necessary. Understanding the details of California Sale or Return requirements will help you identify your responsibilities easily. For assistance, platforms like uslegalforms offer resources that can aid in making the filing process clear.

Avoiding capital gains tax when selling a house in California can be achieved through various strategies, including the primary residence exclusion up to $250,000 for individuals. This useful approach allows you to minimize your tax burden effectively. Keeping abreast of California Sale or Return details will empower you throughout this process. Consulting tax advisors can also provide tailored guidance for your specific situation.

In California, property tax payments typically continue regardless of age. However, seniors have the option to participate in property tax assistance programs that may provide relief. This assistance is essential for understanding your benefits and ensuring you get the most from any California Sale or Return options available. You should consider consulting a professional to explore the various aids designed specifically for older homeowners.

California does not have a straightforward tax refund process for tourists like some other states, but refunds can be available under specific conditions. Tourists may qualify for refunds on sales taxes through the California Sale or Return policy for certain purchases. To pursue this option, tourists should keep receipts and follow the state's guidelines for refunds. You can learn more about the process through the uslegalforms platform, which provides resources to help tourists manage their tax claims.

In California, anyone who makes taxable sales or takes part in business activities must file a sales tax return. This includes businesses that engage in the sale of tangible personal property, subject to the California Sale or Return policy. It is crucial to file these returns timely to avoid penalties. If you seek clarity on your obligations, the uslegalforms platform can help demystify the filing requirements.

Yes, tourists can potentially receive sales tax back in California, depending on the circumstances of their purchases. Under the California Sale or Return policy, certain conditions may allow for refunds. Tourists should ensure they keep all receipts and understand the filing process for refunds. For clarity, explore resources on the uslegalforms platform that outline how tourists can navigate this process.

Eligibility for a tax refund in California typically includes those who have overpaid sales tax or made exempt purchases under the California Sale or Return law. Individuals and businesses that meet these criteria can apply for refunds. It's crucial to maintain thorough records of your transactions to support your claims. If you need assistance, consider using the uslegalforms platform to guide you through the refund application process.

In general, tourists can claim sales tax back in certain states, but policies vary. California does have specific guidelines related to the California Sale or Return option, where eligible purchases can qualify for a refund. Tourists should retain their receipts and familiarize themselves with the state's procedures. You can explore the uslegalforms platform for more detailed information and resources on claiming tax refunds.

Yes, you can get reimbursed for sales tax in certain situations. If you have a valid claim under the California Sale or Return policy, you may qualify for a sales tax refund. It’s important to keep your receipts and documentation to support your request. Additionally, you can consult the uslegalforms platform for guidance on how to navigate the reimbursement process.