Although no definite rule exists for determining whether one is an independent contractor or an employee, certain indicia of the status of an independent contractor are recognized, and the insertion of provisions embodying these indicia in the contract will help to insure that the relationship reflects the intention of the parties. These indicia generally relate to the basic issue of control. The general test of what constitutes an independent contractor relationship involves which party has the right to direct what is to be done, and how and when. Another important test involves the method of payment of the contractor.

Michigan Agreement by Accounting Firm to Employ Auditor as Self-Employed Independent Contractor

Description

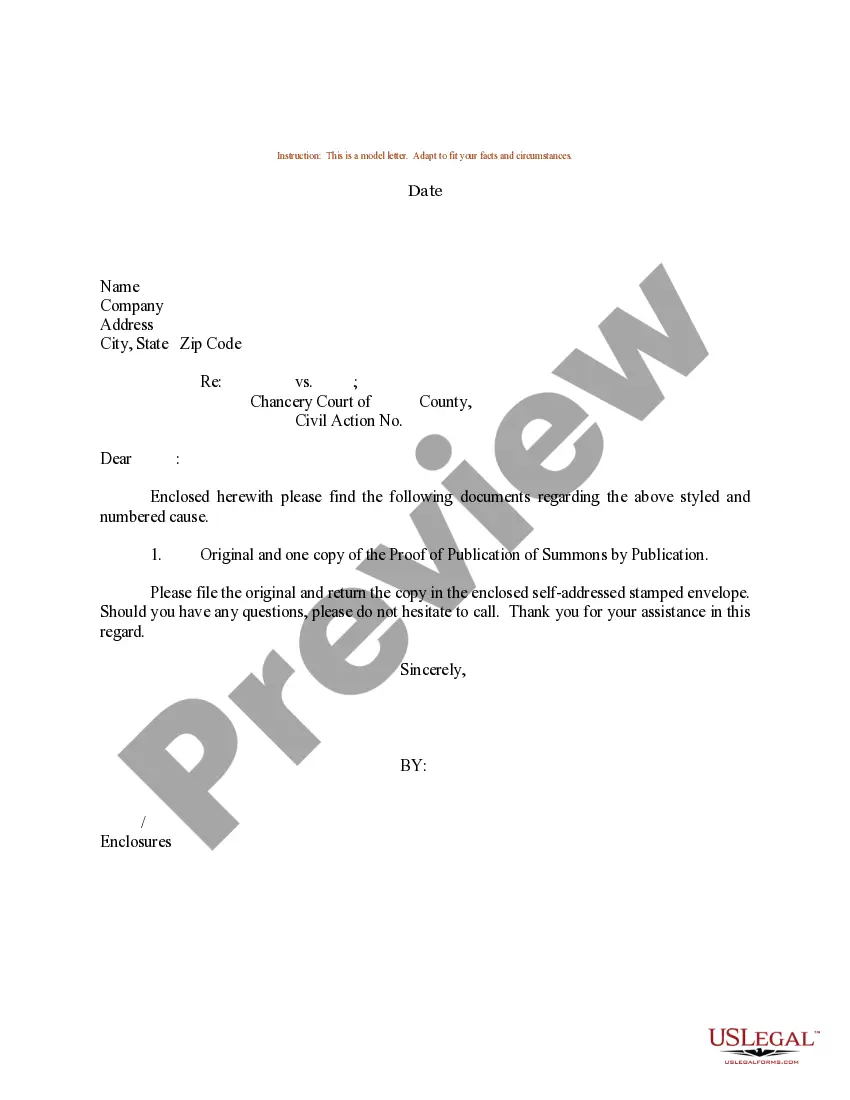

How to fill out Agreement By Accounting Firm To Employ Auditor As Self-Employed Independent Contractor?

If you intend to finish, obtain, or generate authentic document templates, turn to US Legal Forms, the largest assortment of legal forms available online.

Utilize the site’s straightforward and user-friendly search feature to locate the documents you need.

A wide selection of templates for business and personal purposes are organized by categories and jurisdictions, or keywords.

Step 4. Once you have found the required form, select the Purchase now button. Choose the payment plan you prefer and enter your details to register for an account.

Step 5. Proceed with the transaction. You can use your credit card or PayPal account to finalize the purchase. Step 6. Select the format of the legal form and download it onto your device.

- Use US Legal Forms to locate the Michigan Agreement by Accounting Firm to Hire Auditor as Self-Employed Independent Contractor with just a few clicks.

- If you are already a user of US Legal Forms, Log In to your account and then click the Download button to obtain the Michigan Agreement by Accounting Firm to Hire Auditor as Self-Employed Independent Contractor.

- You can also access forms you have previously obtained in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for your specific city/state.

- Step 2. Utilize the Review option to evaluate the form’s content. Be sure to read the description.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

The economic reality test in Michigan evaluates the relationship between a worker and an employer to determine employment status. It looks at whether the worker is economically dependent on the employer or operates independently. This distinction is vital for those working under a Michigan Agreement by Accounting Firm to Employ Auditor as Self-Employed Independent Contractor, as it impacts legal rights and responsibilities.

The independent contractor test in Michigan determines whether a worker is classified correctly as an independent contractor or an employee. This assessment considers various factors, including the degree of control over work and the nature of the relationship. For individuals entering a Michigan Agreement by Accounting Firm to Employ Auditor as Self-Employed Independent Contractor, understanding this classification is crucial for compliance and tax obligations.

The Michigan general contractor test evaluates the knowledge and proficiency of individuals seeking to obtain a general contractor license. This examination assesses topics such as project management, building codes, and safety regulations. Understanding the criteria can help those who enter agreements, like the Michigan Agreement by Accounting Firm to Employ Auditor as Self-Employed Independent Contractor, ensure compliance and enhance their operational capacity.

In Michigan, independent contractors are responsible for paying self-employment tax on their earnings. This includes Social Security and Medicare taxes, which independent contractors must report on their tax returns. When working under a Michigan Agreement by Accounting Firm to Employ Auditor as Self-Employed Independent Contractor, ensure you account for these taxes in your financial planning.

In Michigan, the amount of work you can perform without a contractor license is limited. Generally, minor repairs and projects may not require a license; however, larger contracts or those involving significant work, like under a Michigan Agreement by Accounting Firm to Employ Auditor as Self-Employed Independent Contractor, will typically necessitate licensing. It is best to consult local regulations to understand these limits clearly.

Yes, Michigan requires 1099 filings for independent contractors. If you enter into a Michigan Agreement by Accounting Firm to Employ Auditor as Self-Employed Independent Contractor, and you earn over a specific threshold, the payer is responsible for issuing a 1099 form. This filing helps ensure proper reporting of income to the IRS, making it a critical step for compliance.

Operating as an unlicensed contractor in Michigan can lead to significant penalties. You may face fines or other legal repercussions, especially if you enter into contracts, such as a Michigan Agreement by Accounting Firm to Employ Auditor as Self-Employed Independent Contractor, without proper licensing. To avoid these consequences, ensure you obtain the correct licenses before starting any work.

In Michigan, anyone operating a business, including self-employed individuals under agreements like the Michigan Agreement by Accounting Firm to Employ Auditor as Self-Employed Independent Contractor, typically requires a business license. The specific requirements can vary based on the type of business and location, so it’s advisable to check with local authorities to ensure you meet all necessary legal requirements.

Yes, Michigan imposes a self-employment tax. This tax applies to individuals who earn income as self-employed independent contractors, which may include agreements such as the Michigan Agreement by Accounting Firm to Employ Auditor as Self-Employed Independent Contractor. It's crucial to consider this tax when calculating your overall obligations to ensure compliance and avoid penalties.

To become an independent contractor in Michigan, start by establishing your business, ensuring you have the proper tools and resources. You should also communicate clearly with your clients about your services and expectations. When finalizing your arrangement, consider using a Michigan Agreement by Accounting Firm to Employ Auditor as Self-Employed Independent Contractor to formalize your relationship and prevent misunderstandings.