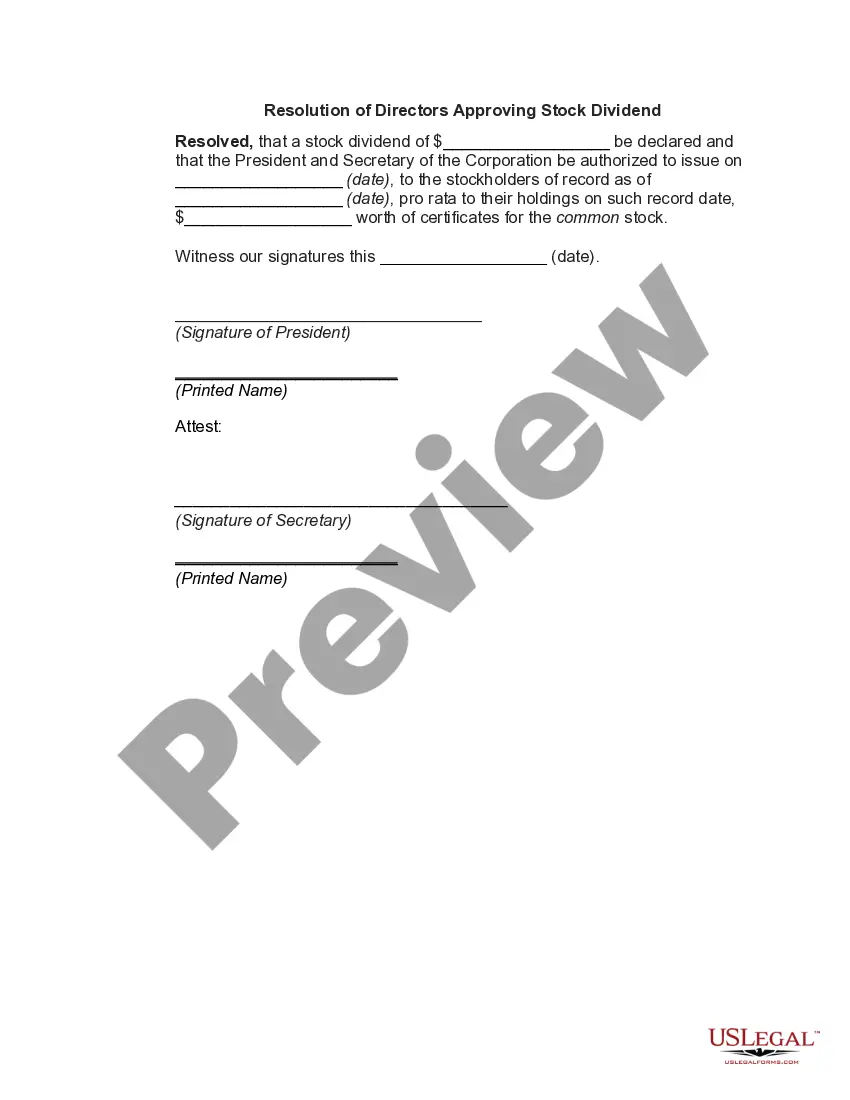

Michigan Stock Dividend - Resolution Form - Corporate Resolutions

Description

How to fill out Stock Dividend - Resolution Form - Corporate Resolutions?

Selecting the optimal legal document template can be challenging.

Of course, there are numerous templates accessible online, but how do you find the legal format you need.

Utilize the US Legal Forms website. The platform provides thousands of templates, including the Michigan Stock Dividend - Resolution Form - Corporate Resolutions, suitable for business and personal purposes.

You can view the form using the Review option and read the form description to ensure it is the right one for you.

- All forms are reviewed by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and click on the Download button to retrieve the Michigan Stock Dividend - Resolution Form - Corporate Resolutions.

- Use your account to browse through the legal forms you have previously purchased.

- Visit the My documents section of your account to obtain another copy of the form you require.

- If you are a new user of US Legal Forms, here are some simple instructions for you to follow.

- First, make sure you have selected the correct form for your city/county.

Form popularity

FAQ

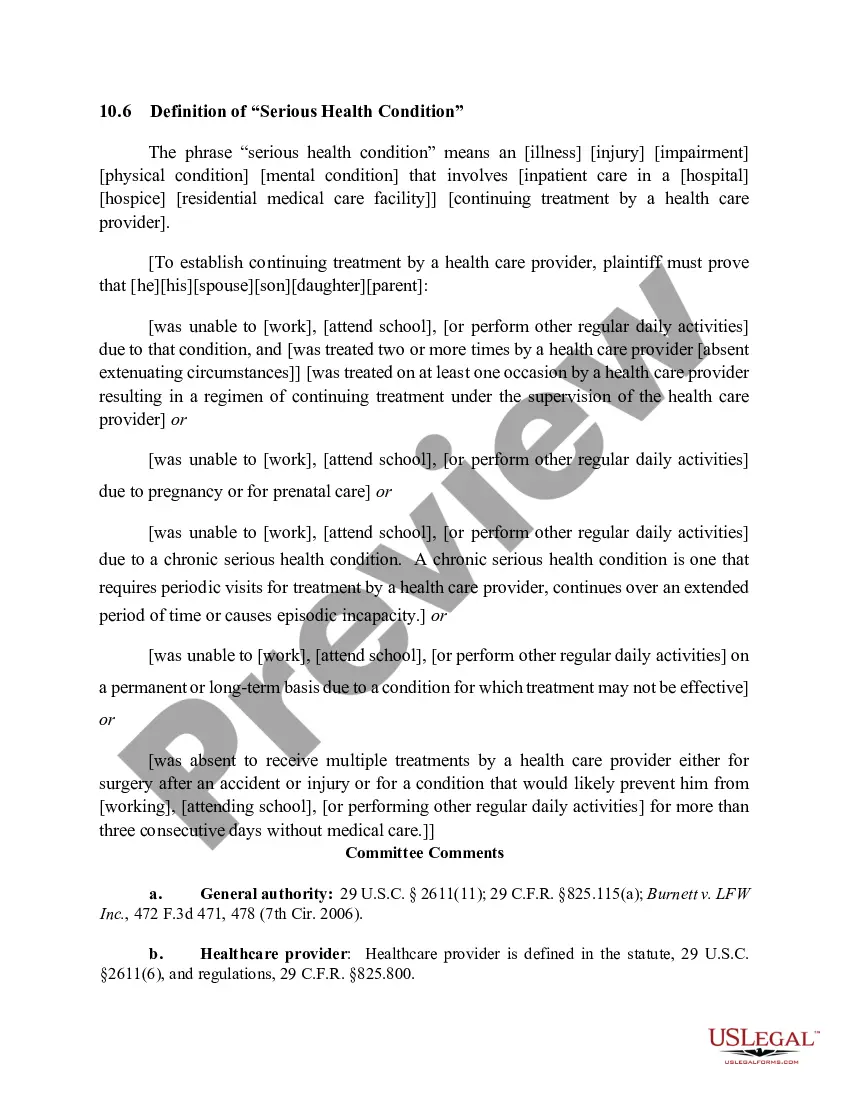

A shareholder resolution is necessary to formalize decisions made by shareholders regarding corporate governance or significant business issues. It provides a clear record of shareholder intent and can influence corporate policy. By using the Michigan Stock Dividend - Resolution Form - Corporate Resolutions, you can easily document these resolutions and facilitate better communication within your corporation.

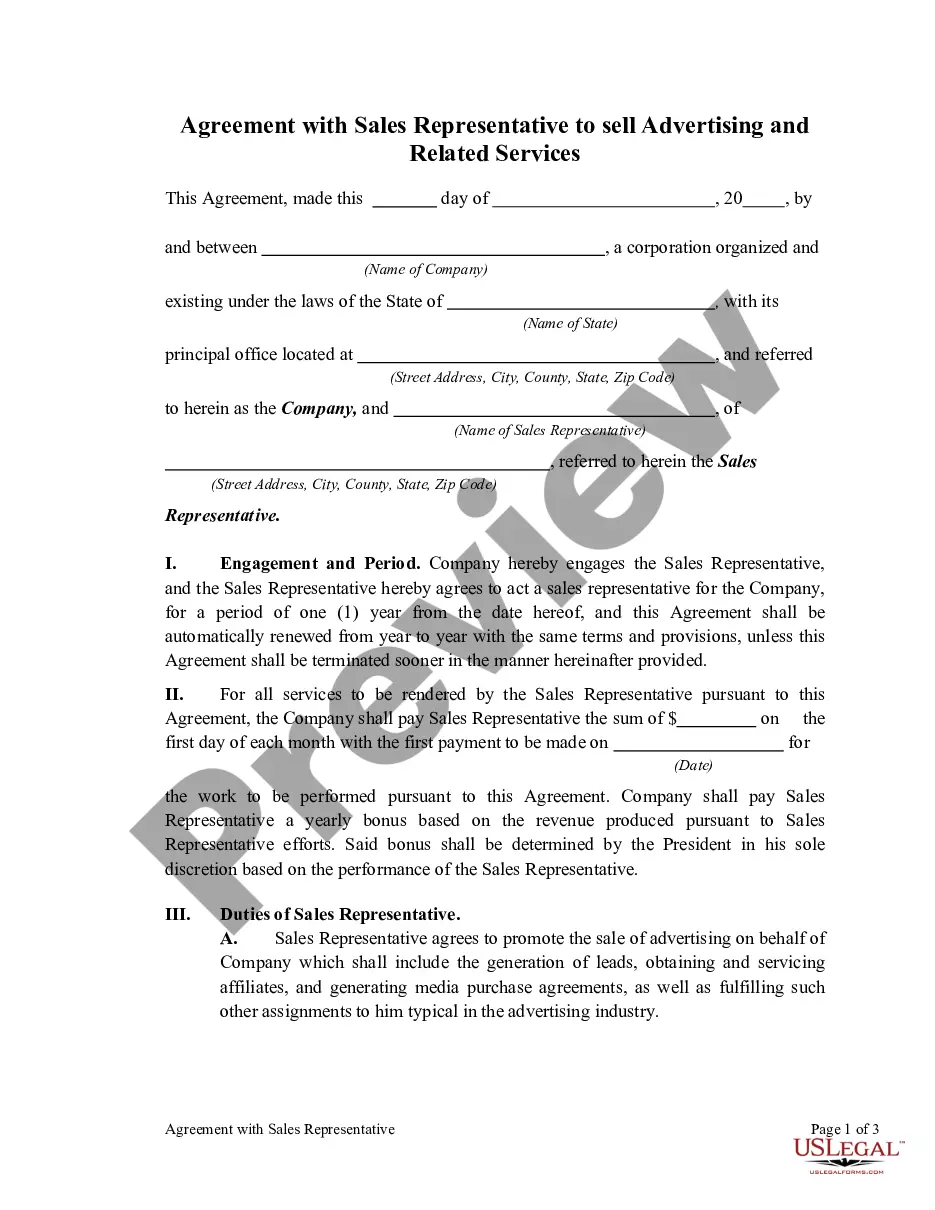

A corporate resolution for share transfer is a document outlining the transfer of shares from one party to another within a corporation. This resolution details the number of shares being transferred and the parties involved, ensuring clarity and legality in the transaction. Using the Michigan Stock Dividend - Resolution Form - Corporate Resolutions helps ensure that these transfers are documented and executed properly.

A corporate resolution is an official record of a decision or action taken by a corporation's board of directors or shareholders. This document is crucial for demonstrating compliance with legal standards and ensuring transparency in corporate governance. By utilizing the Michigan Stock Dividend - Resolution Form - Corporate Resolutions, you can effectively create resolutions that accurately reflect your corporation's decisions.

A corporate resolution form is a document used to record decisions made by a corporation's board of directors or shareholders. This form ensures that all significant decisions are documented and can be referenced in the future. The Michigan Stock Dividend - Resolution Form - Corporate Resolutions provides an efficient way to create these important forms and maintain organized records.

A corporate resolution to sell stock is a formal decision made by a corporation's board of directors allowing the sale of stock to specified individuals or entities. This resolution must be documented to ensure proper governance and record-keeping. You can utilize the Michigan Stock Dividend - Resolution Form - Corporate Resolutions to effectively create and manage these essential documents.

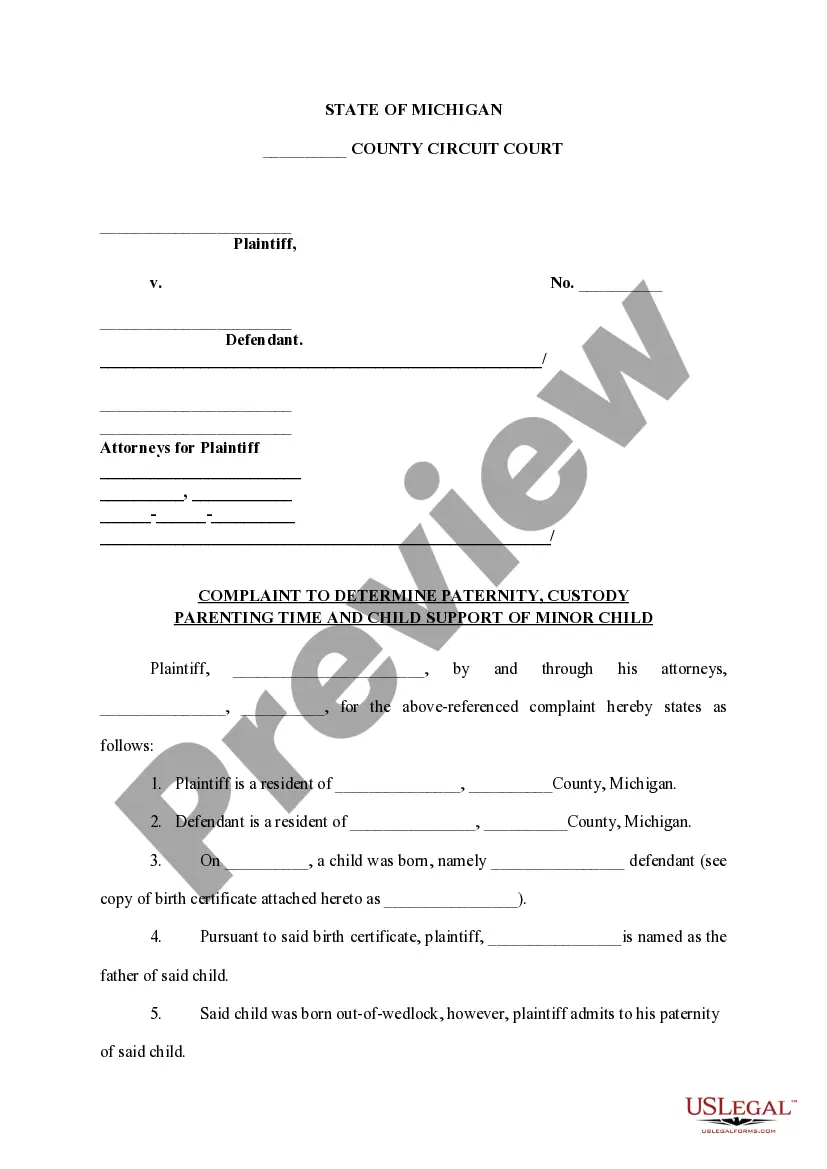

Michigan articles of incorporation are legal documents filed with the state to establish a corporation's existence. They contain essential information such as the corporation's name, purpose, duration, and registered office address. Using a Michigan Stock Dividend - Resolution Form - Corporate Resolutions can assist new businesses in navigating their corporate structure and compliance issues.

A shareholder resolution for the sale of shares is a document that authorizes the sale of a specified number of shares owned by shareholders in a corporation. This resolution outlines the terms under which the sale will happen and helps establish the process for executing the transaction. Leveraging the Michigan Stock Dividend - Resolution Form - Corporate Resolutions can streamline this process and help ensure clarity.

A shareholder resolution document is a formal request made by shareholders to address specific issues or decisions within a corporation. This document ensures that the views of shareholders are formally recognized and can lead to changes in corporate policy or governance. Utilizing the Michigan Stock Dividend - Resolution Form - Corporate Resolutions can simplify creating these documents and ensure compliance.

The taking clause in the Michigan Constitution protects property rights by preventing the government from taking private property without just compensation. This ensures fairness in government actions related to property use and development. Understanding the implications of this clause is essential for property owners and business operators alike. For businesses, using the Michigan Stock Dividend - Resolution Form - Corporate Resolutions can serve as a part of maintaining compliance and good governance.

The primary benefit of forming an LLC in Michigan is personal liability protection. This means your personal assets are shielded from business debts and legal actions. Furthermore, LLCs offer flexibility in management and taxation, making them an attractive option for many entrepreneurs. Lastly, utilizing the Michigan Stock Dividend - Resolution Form - Corporate Resolutions can enhance your company's governance as it grows.