Guam Document Organizer and Retention

Description

How to fill out Document Organizer And Retention?

Are you presently in a situation where you need documents for both business or personal purposes almost every day.

There are numerous legal document templates available online, but finding reliable ones is challenging.

US Legal Forms offers thousands of templates, such as the Guam Document Organizer and Retention, designed to comply with state and federal requirements.

Choose a preferred file format and download your copy.

Access all the document templates you have purchased in the My documents menu. You can obtain an additional copy of the Guam Document Organizer and Retention whenever necessary. Just click on the selected form to download or print the document template.

Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes. This service provides professionally crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Guam Document Organizer and Retention template.

- If you don't have an account and wish to start using US Legal Forms, follow these instructions.

- Identify the form you need and ensure it is for the correct city/county.

- Use the Preview button to review the form.

- Check the description to confirm you have selected the correct form.

- If the form isn't what you are looking for, use the Search field to find the form that meets your needs.

- Once you find the right form, click Purchase now.

- Select the payment plan you prefer, fill in the required details to create your account, and pay for your order using PayPal or Visa or Mastercard.

Form popularity

FAQ

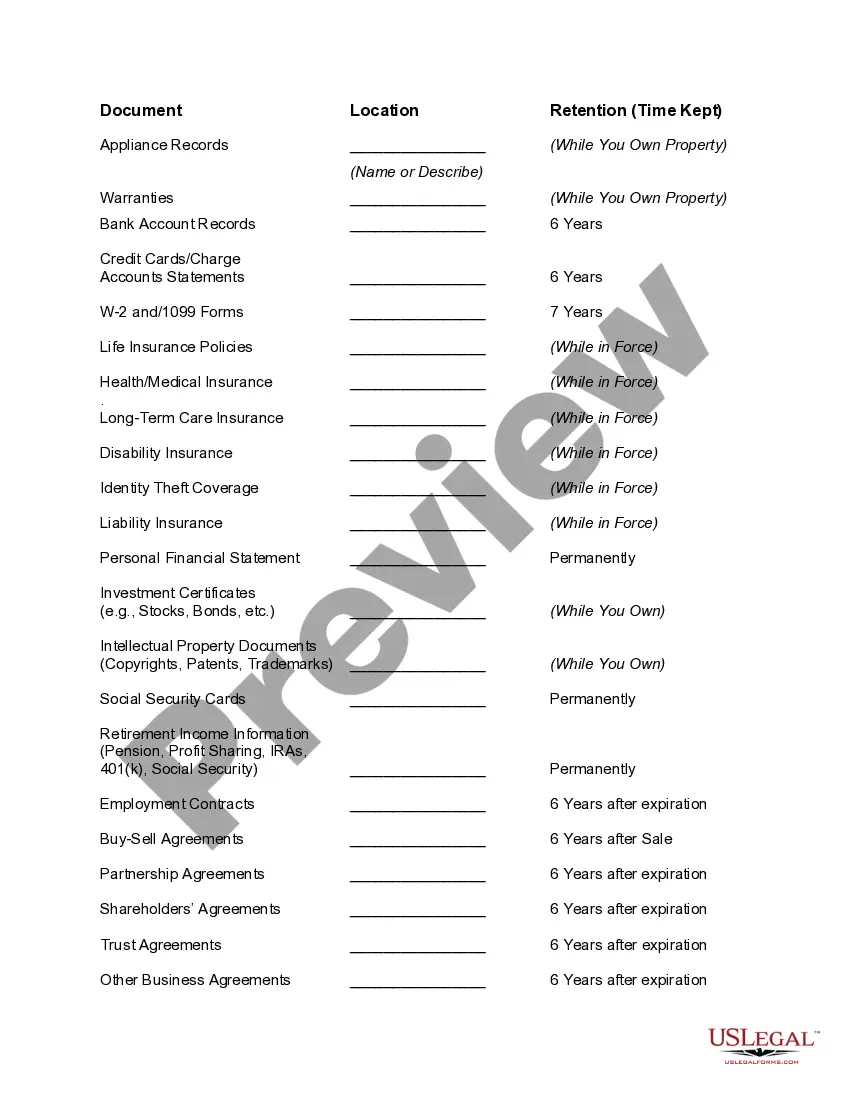

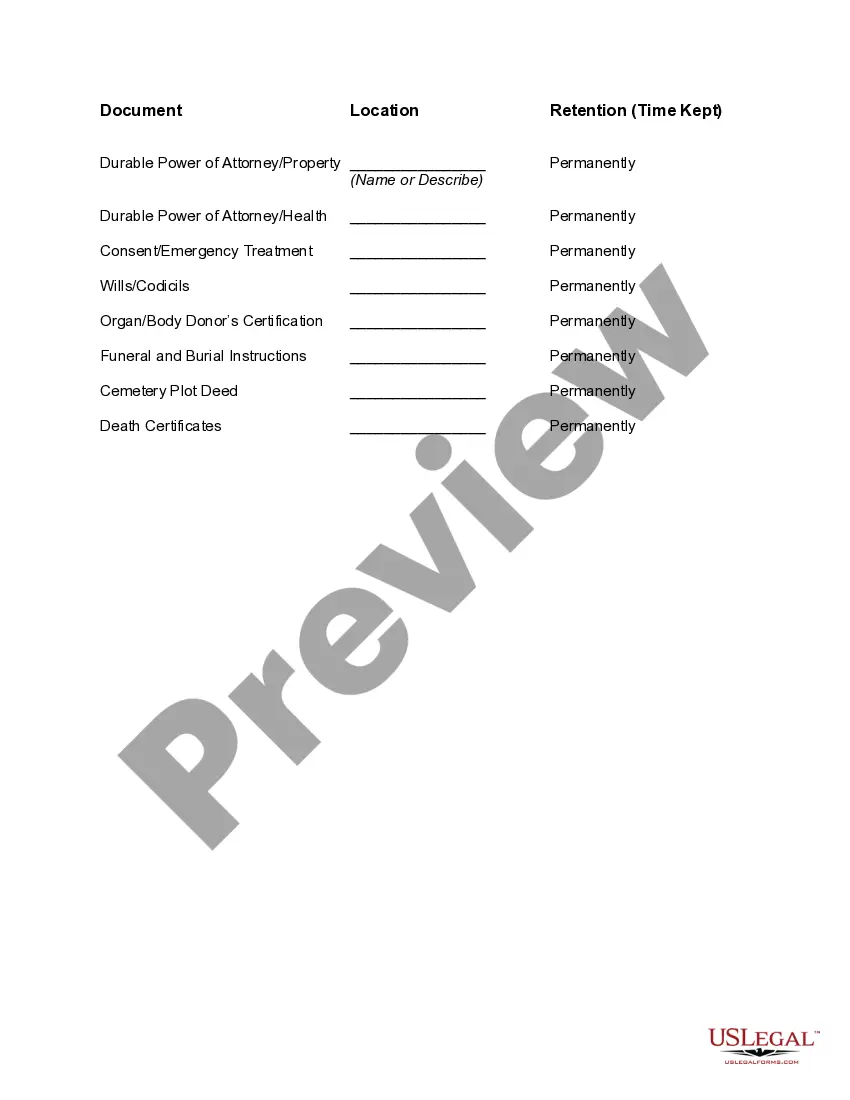

A retention period (associated with a retention schedule or retention program) is an aspect of records and information management (RIM) and the records life cycle that identifies the duration of time for which the information should be maintained or "retained," irrespective of format (paper, electronic, or other).

A DRP will identify documents that need to be maintained, contain guidelines for how long certain documents should be kept, and save your company valuable computer and physical storage space.

A document retention schedule is a policy that clearly defines what documents need to be maintained and for how long. A retention policy will include all types of documents and records that are created on behalf of the company as part of its business.

A document retention policy identifies confidential information and categorizes it by how and where documents are stored (electronically or in paper) and the required retention period based on federal, state, and other regulatory requirements.

A document retention policy establishes and describes how a company expects its employees to manage company information (whether in electronic files, emails, hard copies, or other formats) from creation through destruction, according to applicable laws and the company's particular legal and business needs.

According to the U.S. Department of Labor, the Fair Labor Standards Act (FLSA) requires employers to maintain records for a period of at least three years. Records to compute pay, which include time cards, work and time schedules and records of additions to or reductions from wages, must be kept for two years.

(also disposition standard), n. The length of time records should be kept in a certain location or form for administrative, legal, fiscal, historical, or other purposes.

Document retention guidelines typically require businesses to store records for one, three or seven years. In some cases, you will need to keep the records forever. If you're unsure what to keep and what to shred, your accountant, lawyer and state record-keeping agency may provide guidance.

Document retention is a system that allows you and your employees to automatically create policies and determine what should be done with particular documents or records at a certain point of time.

6.2 Retention times for specific records are defined in Table 1, unless otherwise specified quality records shall be retained for 10 years. In no case shall the retention time be less than seven years after final payment on the associated contract.