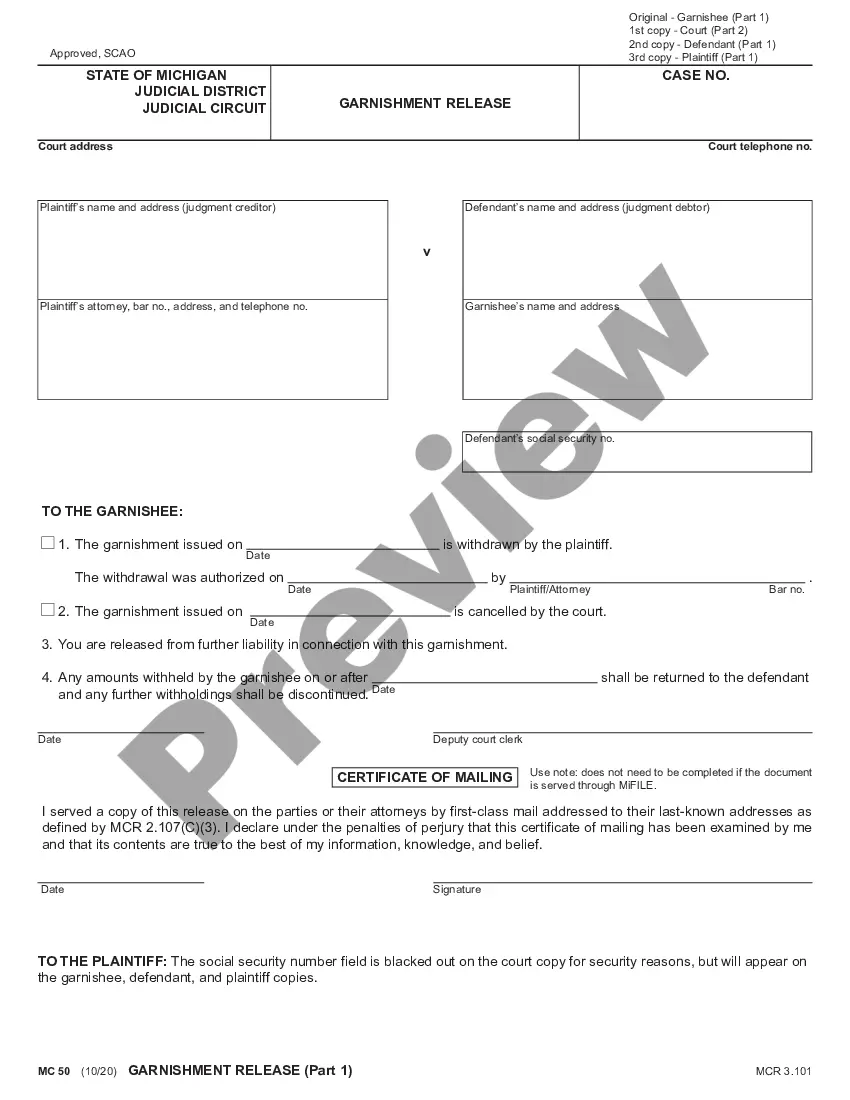

This Final Statement on Garnishment of Periodic Payments is an official document from the Michigan State Court Administration Office, and it complies with all applicable state and Federal codes and statutes. USLF updates all state and Federal forms as is required by state and Federal statutes and law.

Michigan Final Statement On Garnishment of Periodic Payments

Description

How to fill out Michigan Final Statement On Garnishment Of Periodic Payments?

Have any template from 85,000 legal documents such as Michigan Final Statement on Garnishment of Periodic Payments on-line with US Legal Forms. Every template is prepared and updated by state-certified attorneys.

If you already have a subscription, log in. When you are on the form’s page, click on the Download button and go to My Forms to get access to it.

In case you haven’t subscribed yet, follow the tips below:

- Check the state-specific requirements for the Michigan Final Statement on Garnishment of Periodic Payments you want to use.

- Read through description and preview the sample.

- Once you’re sure the template is what you need, click on Buy Now.

- Choose a subscription plan that works well for your budget.

- Create a personal account.

- Pay in a single of two appropriate ways: by credit card or via PayPal.

- Choose a format to download the document in; two ways are available (PDF or Word).

- Download the file to the My Forms tab.

- After your reusable form is ready, print it out or save it to your device.

With US Legal Forms, you will always have immediate access to the right downloadable template. The service provides you with access to forms and divides them into groups to simplify your search. Use US Legal Forms to get your Michigan Final Statement on Garnishment of Periodic Payments fast and easy.

Form popularity

FAQ

Yes, you can make payment arrangements after garnishment. Understanding the Michigan Final Statement On Garnishment of Periodic Payments is crucial in this process. Once garnishment is in place, you may negotiate with your creditor to establish a different payment plan. This can help you regain control over your financial situation and avoid further complications.

The new Michigan garnishment law changes the way creditors can garnish wages and bank accounts. It provides additional protections for debtors, ensuring they can retain a portion of their earnings. Additionally, this law emphasizes the importance of the Michigan Final Statement On Garnishment of Periodic Payments, which outlines what debtors must know about their rights. Utilizing platforms like uslegalforms can help you navigate these new changes effectively.

In Michigan, garnishment begins when a creditor obtains a court order. This order allows them to seize a portion of your income or bank account to settle a debt. The process typically starts with a notice to the debtor, informing them of the garnishment. Understanding the Michigan Final Statement On Garnishment of Periodic Payments is crucial for anyone facing this situation.

In Michigan, a garnishment typically lasts until the debt is fully repaid or the court issues an order to terminate it. The duration may vary based on the creditor's claims and any relevant court orders. Depending on the circumstances, a garnishment could last several months to a few years. To better understand the specific timelines associated with the Michigan Final Statement On Garnishment of Periodic Payments, utilizing resources from USLegalForms can be very helpful.

The key difference between periodic and non-periodic garnishment lies in the payment frequency. Periodic garnishment involves regular, ongoing payments, such as wages, while non-periodic garnishment may target a one-time payment, like a tax refund. Understanding this distinction is crucial for both creditors and debtors. For further clarification on these types and details about the Michigan Final Statement On Garnishment of Periodic Payments, refer to USLegalForms.

Yes, you can look up garnishments in Michigan through public records. This information may include details about active writs of garnishment and the associated cases. Courts provide access to this data, allowing individuals to verify if there are any existing garnishments against them or others. To streamline your research on the Michigan Final Statement On Garnishment of Periodic Payments, using USLegalForms can offer valuable insights.

Garnishment rules in Michigan outline how and when creditors can collect debts through periodic payments. Creditors must follow legal procedures, including providing notification to the debtor and payer. Additionally, certain limits apply to the amounts that can be garnished from wages or benefits, ensuring some protection for the debtor. For detailed guidance, consider exploring USLegalForms regarding the Michigan Final Statement On Garnishment of Periodic Payments.

After a writ of garnishment is filed in Michigan, the court notifies the debtor and the payer, such as an employer. The payer is then legally required to withhold a portion of the debtor’s payments, sending these amounts to the creditor. The debtor may have the option to contest the garnishment, but they must act quickly to protect their rights. Utilizing resources like USLegalForms can simplify understanding the Michigan Final Statement On Garnishment of Periodic Payments.

A writ of periodic garnishment in Michigan is a court order that enables creditors to collect regular payments from a debtor's income. This writ ensures that specific amounts are deducted from wages or other benefits automatically and sent to the creditor until the debt is satisfied. It serves as a streamlined approach for creditors to recover funds owed over time. For more insights, USLegalForms can help clarify how the Michigan Final Statement On Garnishment of Periodic Payments works.