This Guide to Garnishment of Periodic Payments is an official document from the Michigan State Court Administration Office, and it complies with all applicable state and Federal codes and statutes. USLF updates all state and Federal forms as is required by state and Federal statutes and law.

Michigan Guide to Garnishment of Periodic Payments

Description

How to fill out Michigan Guide To Garnishment Of Periodic Payments?

Obtain any version from 85,000 legal papers including Michigan Guide to Garnishment of Periodic Payments online with US Legal Forms. Each template is composed and refreshed by state-certified legal experts.

If you already possess a subscription, Log In. Once you are on the document’s page, click on the Download button and navigate to My documents to retrieve it.

If you haven’t subscribed yet, follow the steps outlined below.

With US Legal Forms, you will always have instant access to the relevant downloadable template. The service provides access to documents and organizes them into categories to ease your search. Utilize US Legal Forms to obtain your Michigan Guide to Garnishment of Periodic Payments quickly and effortlessly.

- Verify the state-specific prerequisites for the Michigan Guide to Garnishment of Periodic Payments you wish to utilize.

- Examine the description and preview the template.

- When you’re sure the template meets your needs, simply click Buy Now.

- Select a subscription plan that fits your budget.

- Establish a personal account.

- Make a payment using one of two suitable methods: by credit card or through PayPal.

- Choose a format to download the file in; two formats are available (PDF or Word).

- Download the document to the My documents section.

- Once your reusable template is downloaded, print it or save it to your device.

Form popularity

FAQ

Periodic garnishment involves the regular deduction of a set amount from your paycheck or benefits, ensuring consistent payments to your creditors. In contrast, non-periodic garnishment typically occurs as a one-time deduction or for a specific event. Understanding the distinction is crucial when navigating the Michigan Guide to Garnishment of Periodic Payments. Utilizing resources like US Legal Forms can help you manage these processes effectively, ensuring you stay informed and compliant.

In Michigan, garnishment rules provide specific guidelines on how creditors can collect debts through garnishments. Generally, the law allows creditors to garnish wages, bank accounts, and periodic payments such as pensions and retirement benefits. It is essential to refer to the Michigan Guide to Garnishment of Periodic Payments to understand the limits and procedures involved. By using this guide, you can navigate the garnishment process effectively and protect your earnings.

The case number and case caption (ex: XYZ Bank vs. John Doe) the date of your objection. your name and current contact information. the reasons (or grounds) for your objection, and. your signature.

If it's already started, you can try to challenge the judgment or negotiate with the creditor. But, they're in the driver's seat, and if they don't allow you to stop a garnishment by agreeing to make voluntary payments, you can't really force them to. You can, however, stop the garnishment by filing a bankruptcy case.

A non-periodic writ of garnishment, referred to in the Michigan court system as MC 13, is used to collect money held by a debtor in a bank account. Additionally, a non-periodic writ of garnishment can be used to collect or levy other property to satisfy outstanding debt.

What Can You Do When Your Account is Garnished? To lift the garnishment, you can try to contact the collection agency to negotiate alternative payment options. You may be able to lower interest payments, reduce the amount you owe, or make partial payments for a certain amount of time.

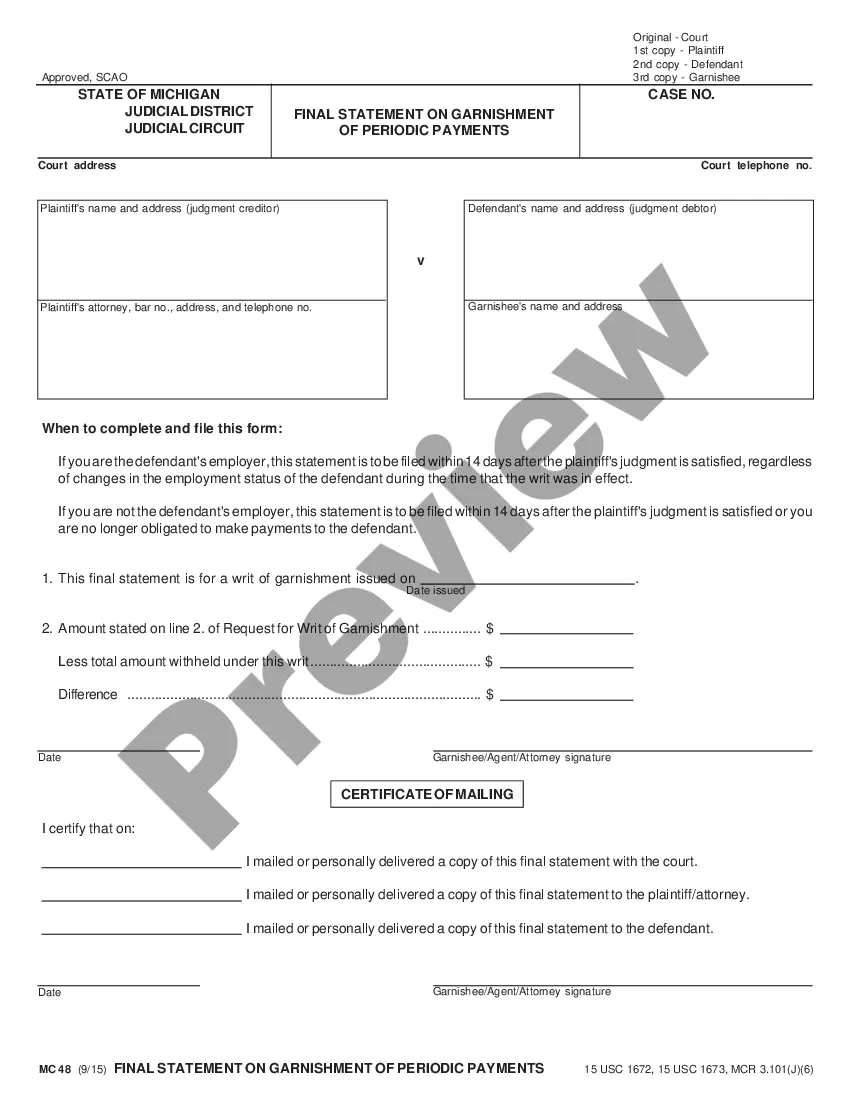

A periodic garnishment means that the plaintiff has the right to take part or all of a defendant's payments to pay for a judgment. You have been identified as a "garnishee," a person who has control over some or all of the money that is paid to the defendant.

The Final Statement on Garnishment is a form that your employer completed upon making a final payment on your garnishment. So, yes, your employer should not continue withholding money from your check for this garnishment.

A.) The amount by which disposable earnings exceed 30 times the federal minimum hourly wage (currently $7.25 an hour), or. b.) 25 percent of disposable earnings (after federal, state, and local taxes and retirement contributions).