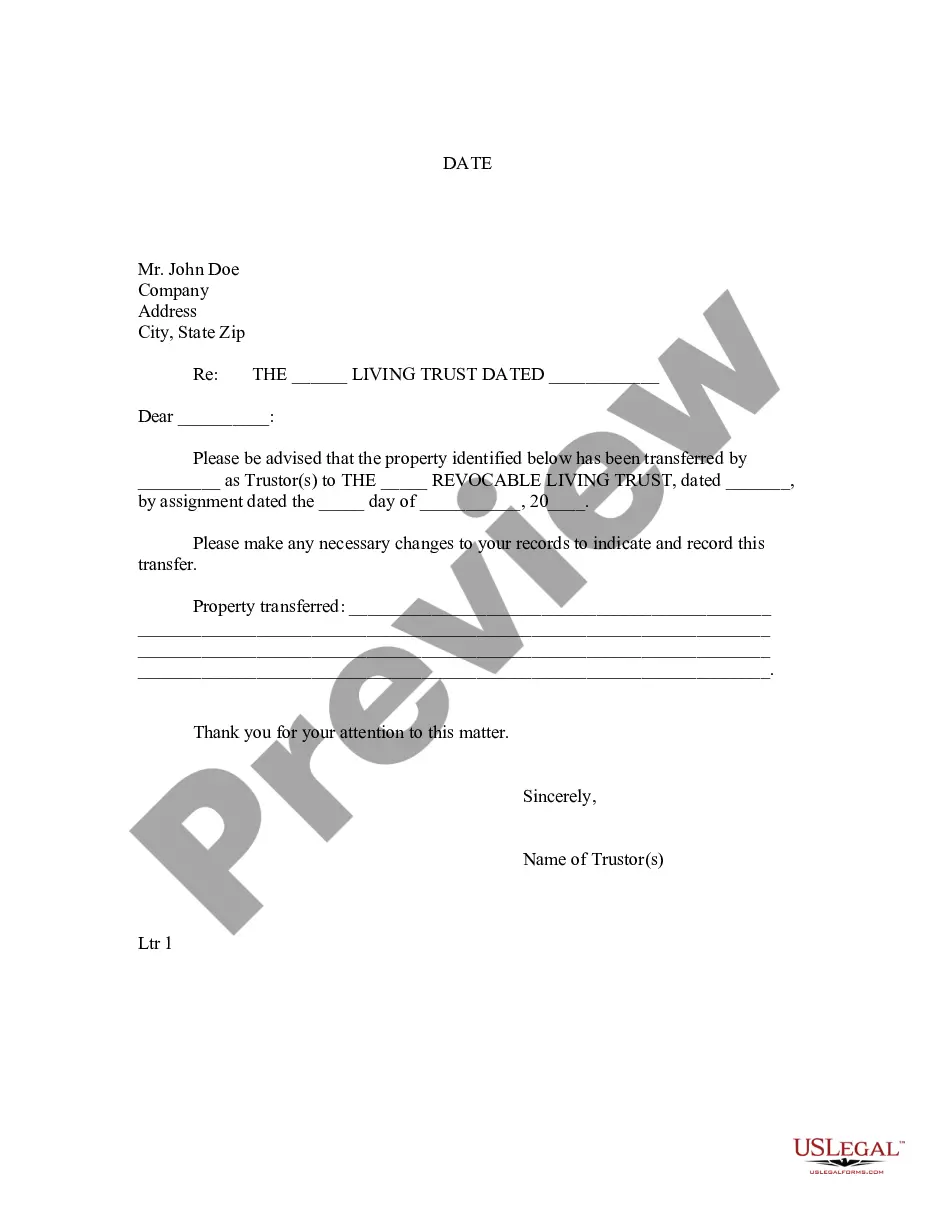

Michigan Letter to Lienholder to Notify of Trust

Description

How to fill out Michigan Letter To Lienholder To Notify Of Trust?

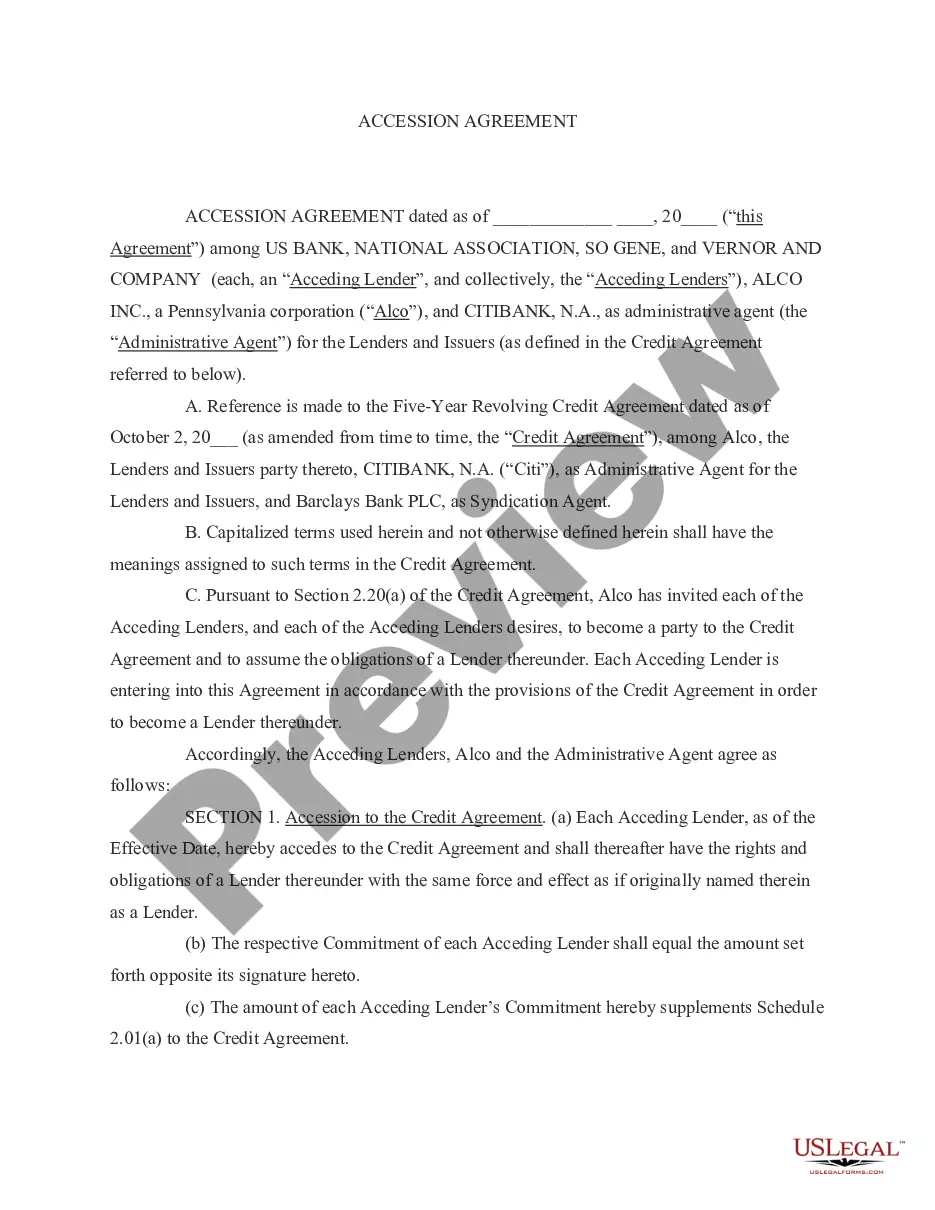

Obtain any template from 85,000 legal documents such as Michigan Letter to Lienholder to Notify of Trust online with US Legal Forms. Each template is created and refreshed by state-certified attorneys.

If you already possess a subscription, Log In. After reaching the form’s page, click the Download button and navigate to My documents to retrieve it.

If you have not subscribed yet, follow the guidelines provided below.

With US Legal Forms, you will always have immediate access to the appropriate downloadable template. The platform provides you with access to documents and organizes them into categories to enhance your search. Use US Legal Forms to acquire your Michigan Letter to Lienholder to Notify of Trust swiftly and effortlessly.

- Review the state-specific criteria for the Michigan Letter to Lienholder to Notify of Trust you wish to utilize.

- Browse the description and preview the template.

- When you are certain that the sample meets your needs, click Buy Now.

- Select a subscription plan that suits your financial situation.

- Establish a personal account.

- Complete the payment via one of two available methods: by credit card or through PayPal.

- Select a format to download the document in; two formats are available (PDF or Word).

- Save the document to the My documents section.

- Once your reusable template is set, print it out or save it to your device.

Form popularity

FAQ

Writing a trust distribution letter requires clarity and precision. Start by outlining the trust's details, including the Michigan Letter to Lienholder to Notify of Trust, and specify how assets will be distributed. Be sure to include recipient information and a clear breakdown of the distribution. Utilizing platforms like US Legal Forms can streamline this process, providing templates that ensure your letter meets all necessary legal standards.

A trust notification is a formal communication that informs relevant parties about the existence of a trust. When you send a Michigan Letter to Lienholder to Notify of Trust, it helps prevent any misunderstandings regarding property or financial transactions. This notification ensures that the lienholder is aware of the trust's terms and the trustee's authority. By doing so, you protect the interests of both the trust and its beneficiaries.

To publish a notice to creditors in Michigan, you must place the notice in a local newspaper that circulates in the area where the trust was established. This publication alerts potential creditors of the trust's existence and their opportunity to claim debts. For a concise process, consider using a Michigan Letter to Lienholder to Notify of Trust as a template to inform creditors proactively.

A certificate of trust in Michigan typically must include essential information such as the trust's name, date, and the names of the trustees. Moreover, it should outline the powers of the trustees and any limitations. When interacting with lienholders, a Michigan Letter to Lienholder to Notify of Trust can effectively convey this information.

A notice of intent to lien in Michigan is a formal declaration by a creditor indicating their intention to place a lien on a property. This notice provides specific details about the debt owed and serves as a precursor to taking legal action. If you are managing a trust, you might consider using a Michigan Letter to Lienholder to Notify of Trust to address any liens affecting the trust's assets.

No, a trust does not have to be recorded in Michigan. The trust operates privately unless you decide to record certain documents, like a deed. However, to properly notify lienholders, using a Michigan Letter to Lienholder to Notify of Trust can help clarify the trust's provisions to interested parties.

In Michigan, a certificate of trust typically does not need to be recorded unless you are transferring real estate or other specific assets. Instead, this document serves as proof of the trust's existence and details its terms when necessary. When dealing with lienholders through a Michigan Letter to Lienholder to Notify of Trust, including your certificate may facilitate clearer communication.

In Michigan, a trust does not generally need to be filed with the court. This means you can create and manage your trust without court involvement. However, depending on your unique circumstances, such as disputes or specific asset management, legal advice can be beneficial. For those leveraging a Michigan Letter to Lienholder to Notify of Trust, understanding this process is crucial.