Michigan Living Trust Property Record

Overview of this form

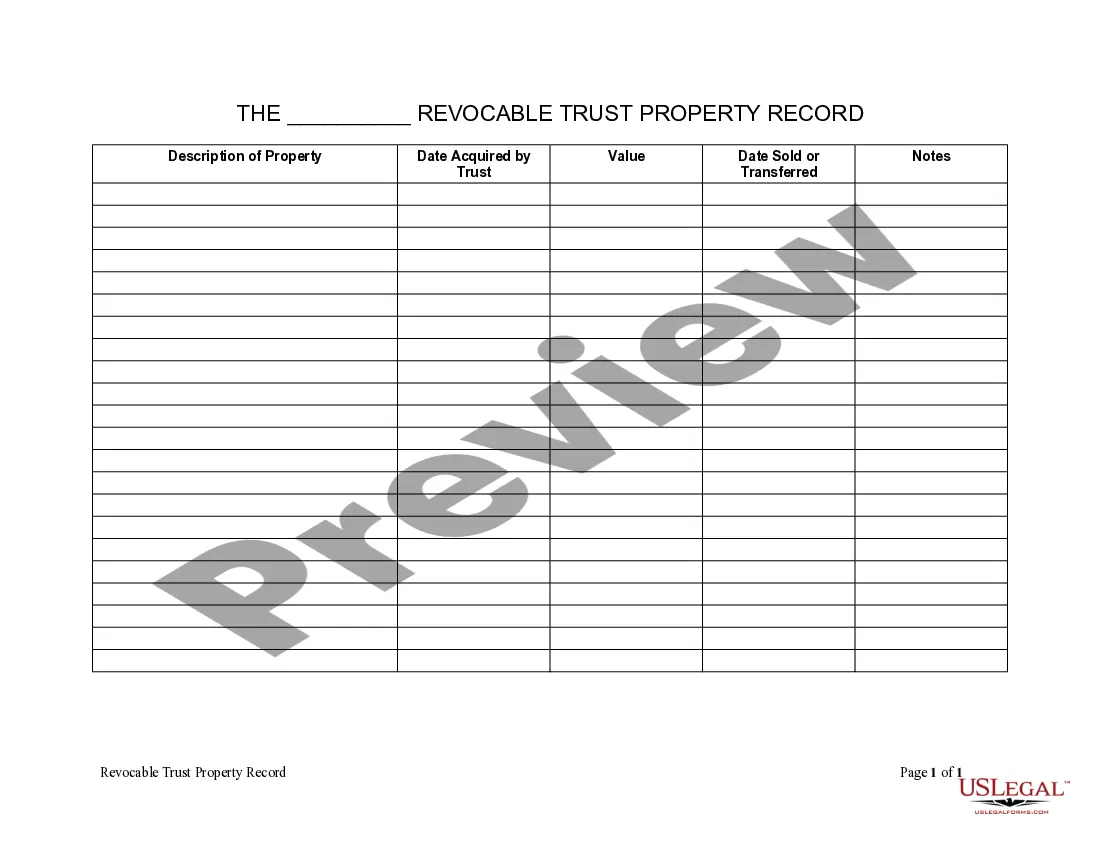

The Living Trust Property Record is a specialized form used to inventory assets placed in a living trust during a person's lifetime. This form allows the Trustee to maintain a detailed account of all property within the trust, including real, personal, and intellectual property. By documenting essential information, such as property descriptions, acquisition dates, values, and transfer dates, the living trust property record ensures clarity and organization for effective estate planning.

Main sections of this form

- Description of Property: Clearly outline each item or asset included in the trust.

- Date Acquired by Trust: Record the date each property was transferred into the trust.

- Value: Provide an estimated or appraised value for each asset listed.

- Date Sold or Transferred: Note any dates when property may have been sold or transferred from the trust.

- Signature of Trustee: The Trustee must sign to affirm the accuracy of the information provided.

Common use cases

This form is essential when establishing or updating a living trust to keep an accurate inventory of all assets held within. It is particularly beneficial during the initial creation of a living trust, after adding new assets, or when an asset is sold or transferred. By maintaining an organized record, it aids in ensuring a smooth administration of the trust upon the Trustee's next steps or a beneficiary's eventual inheritance process.

Who should use this form

- Individuals setting up a living trust for estate planning purposes.

- Trustees responsible for the management of a living trust.

- Beneficiaries needing to understand the assets held in a living trust.

- Estate planning attorneys requiring a reliable inventory record template.

Steps to complete this form

- Identify the property: Start by listing each asset included in the trust.

- Record acquisition information: Enter the date each asset was transferred to the trust.

- Estimate the value: Provide an estimated or appraised value for all listed assets.

- Document transfers: If any assets were sold or transferred, include the corresponding dates.

- Sign and date: The Trustee must sign to certify the information represents an accurate record.

Notarization guidance

Notarization is generally not required for this form. However, certain states or situations might demand it. You can complete notarization online through US Legal Forms, powered by Notarize, using a verified video call available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to update the form when new assets are added or existing assets are sold.

- Not including important details such as the value of the property.

- Inaccurately reporting dates of acquisition or transfer.

- Omitting the Trustee's signature, which may lead to disputes.

Why use this form online

- Convenience: Easily download and fill out the form at your own pace.

- Editability: Update the form as needed without hassle.

- Reliability: Access templates drafted by licensed attorneys to ensure legal compliance.

Looking for another form?

Form popularity

FAQ

While trusts offer many benefits, there are some disadvantages, like the potential loss of certain tax benefits and costs associated with establishing and maintaining the trust. Additionally, transferring your house may require additional paperwork and legal guidance as reflected in the Michigan Living Trust Property Record. Consider these factors carefully and consult with a legal professional before making your decision.

To title assets in a living trust, you must change the title of the assets from your name to the name of the trust. This may involve preparing new deeds or titles for real estate or personal property. By ensuring that all titles are accurately updated in the Michigan Living Trust Property Record, you secure your assets and streamline their management.

Listing property in a trust involves identifying the assets you want to include and preparing relevant documentation. Your property should be titled in the name of the trust to ensure it is officially recognized in the Michigan Living Trust Property Record. Working with a legal expert can streamline this process and provide peace of mind.

To place your property in a trust in Michigan, you will need to prepare a trust agreement and execute a deed transferring the title of the property to the trust. Once completed, make sure to update the Michigan Living Trust Property Record for accuracy. This straightforward process helps you manage your assets effectively.

In Michigan, you do not have to file a trust with the court to create a valid living trust. Instead, the trust's documents should be kept in a safe place. To ensure everything is in order, consulting an expert can help clarify the implications for your Michigan Living Trust Property Record.

Accessing your Michigan Living Trust Property Record is straightforward. You can visit your local county clerk’s office where the trust is registered, as they maintain official records. Additionally, many counties offer online databases for you to search trust records conveniently. Consider using US Legal Forms for assistance in navigating the process and ensuring you have the correct documents.

In Michigan, trusts are generally not considered public records, which offers privacy for the grantor and beneficiaries. However, details may become public if the trust is involved in probate proceedings. Establishing a well-documented Michigan Living Trust Property Record allows you to keep your personal affairs private while ensuring that your wishes are honored.

Filing a trust in Michigan generally means preparing the trust document and ensuring it complies with state laws. While there is no formal filing process with the state, keeping personal copies and sharing them with beneficiaries is essential. For an easy and accurate way to create your trust and maintain your Michigan Living Trust Property Record, explore US Legal Forms.

Filing a living trust in Michigan involves creating the trust document and then funding the trust by transferring assets into it. You do not need to file the trust with the court; however, it is wise to keep a copy in a secure location. For more guidance on this process, consider using US Legal Forms to help you establish a thorough Michigan Living Trust Property Record.

To ensure a trust is valid in Michigan, it must be in writing and signed by the grantor. Additionally, the grantor must intend to create a trust and there must be a clear beneficiary named. Proper documentation, including the creation of a Michigan Living Trust Property Record, is essential to establishing a valid trust and safeguarding your assets.