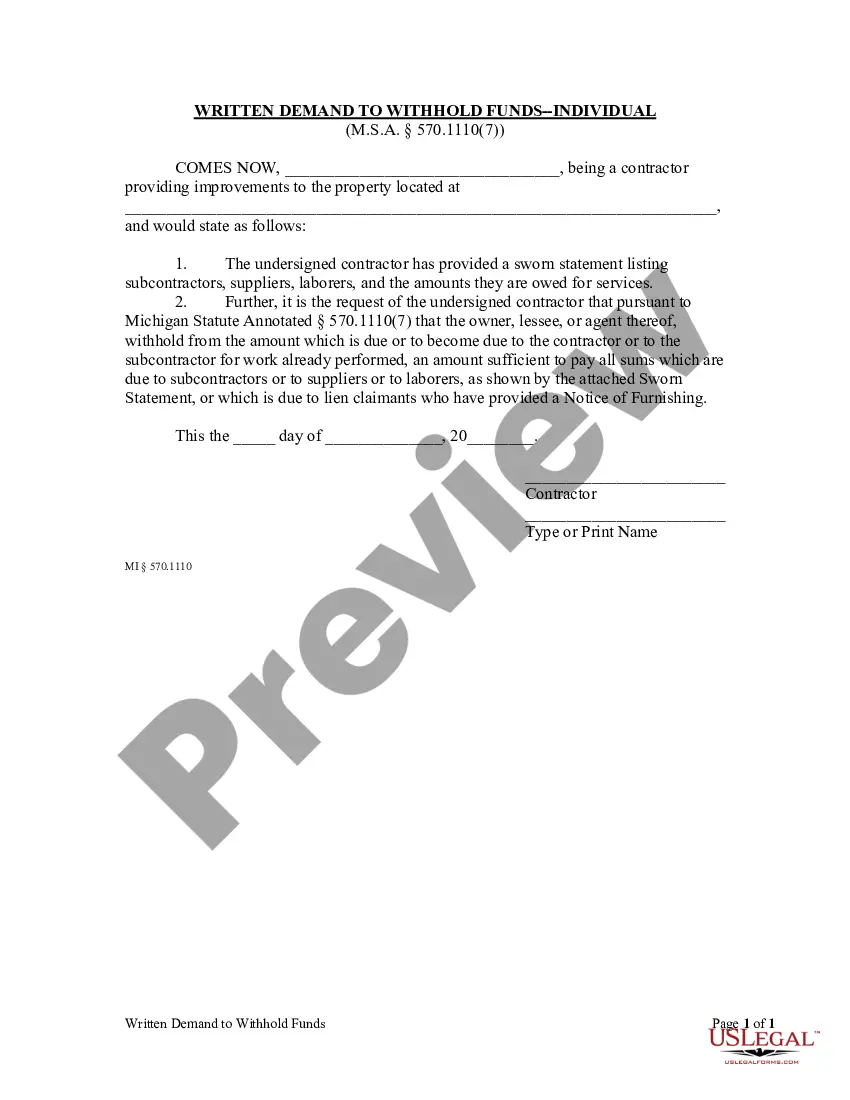

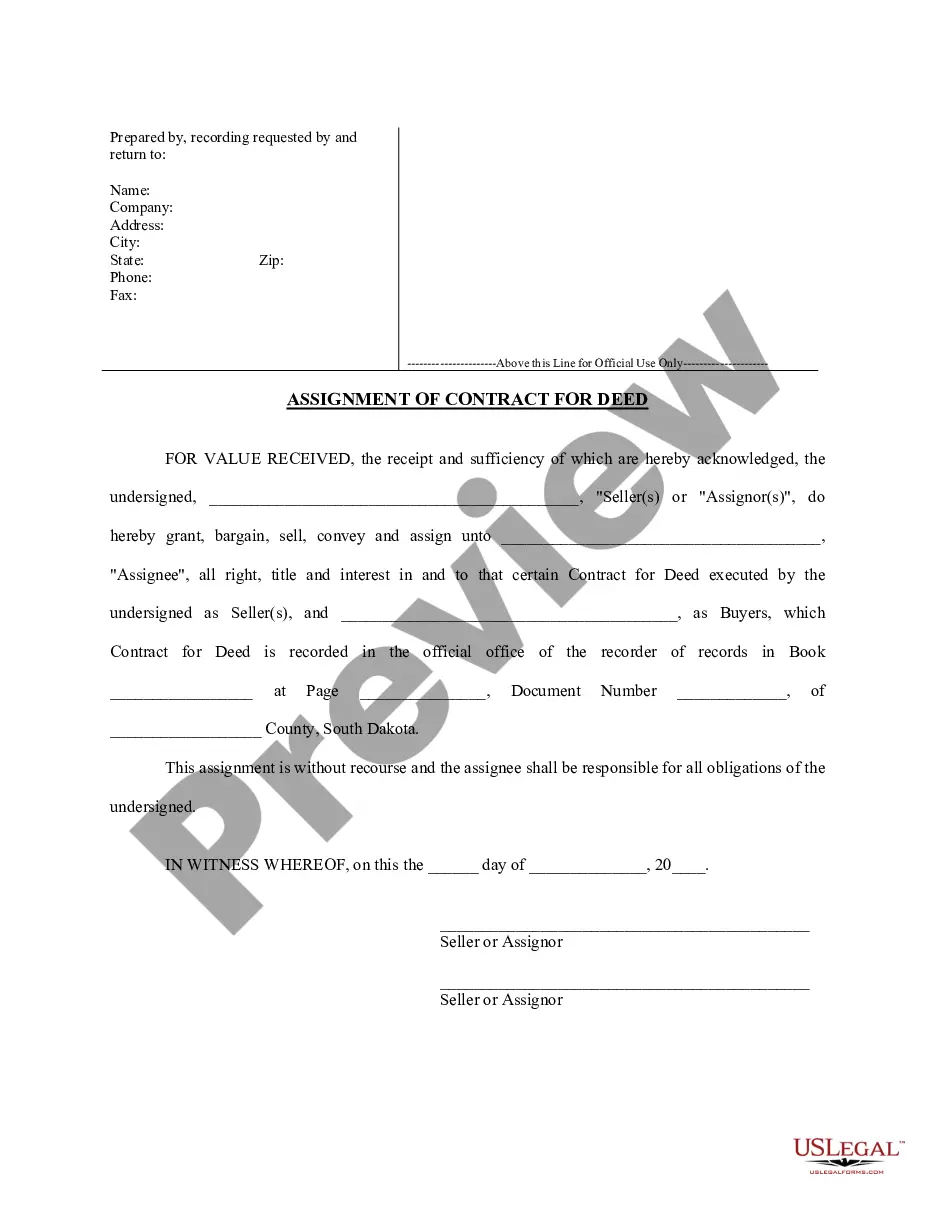

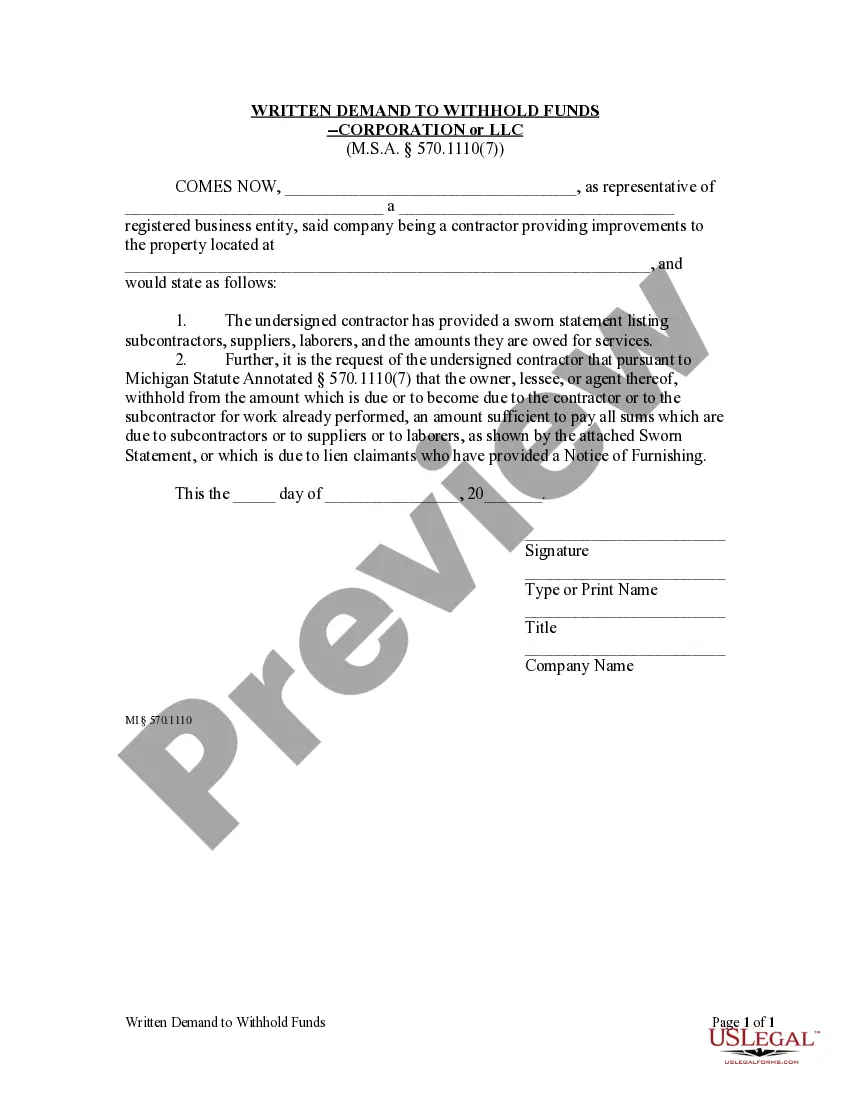

After the corporate or LLC contractor or subcontractor has provided a sworn statement, the owner or lessee, upon written demand from the contractor, shall withhold from the contractor or the subcontractor an amount sufficient to pay all sums which are due to subcontractors or to suppliers or to laborers, as shown by the sworn statement, or which is due to lien claimants who have provided a Notice of Furnishing.

Michigan Request to Withhold Funds - Corporation or LLC

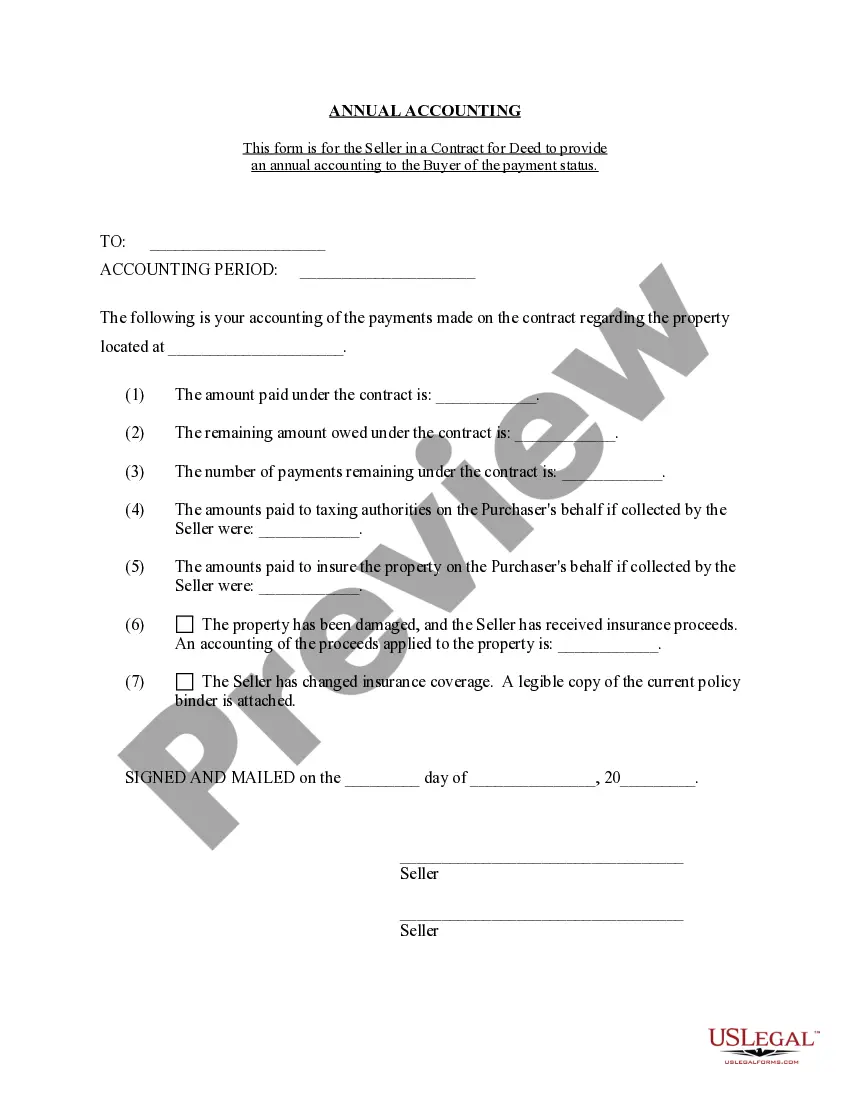

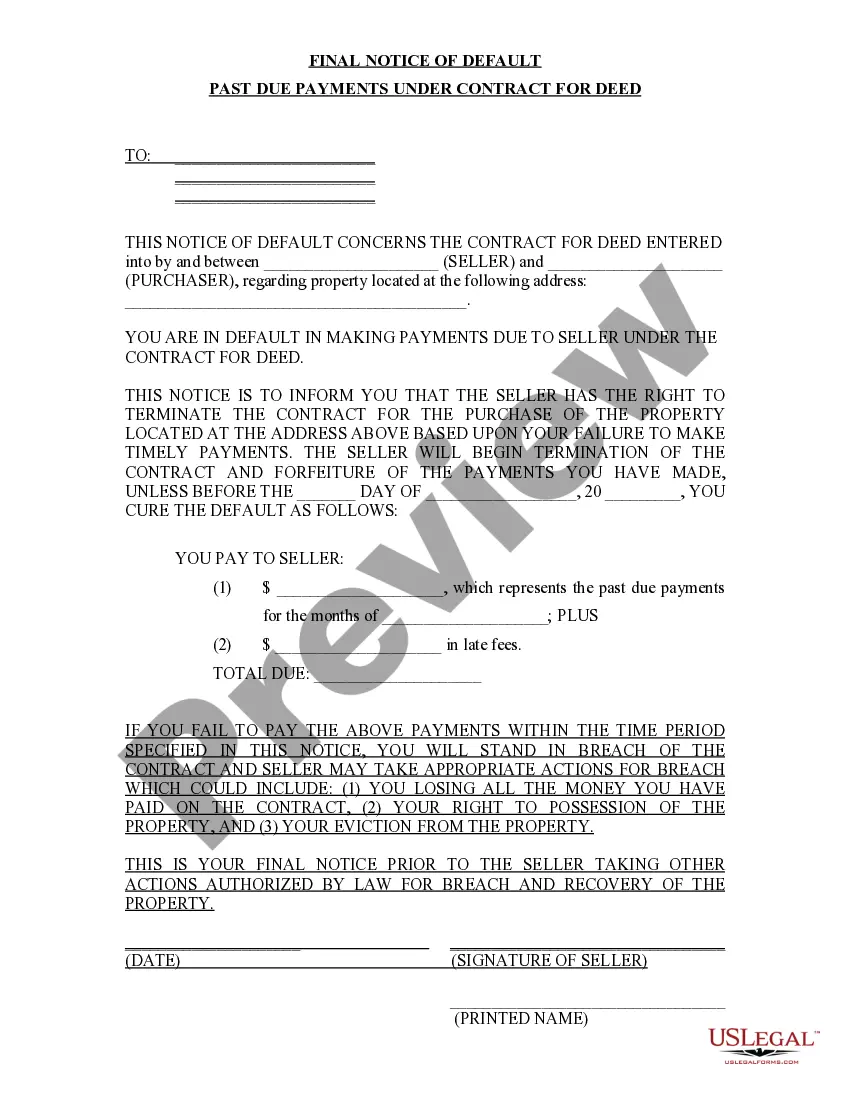

Description

How to fill out Michigan Request To Withhold Funds - Corporation Or LLC?

Access any template from 85,000 legal documents like Michigan Request to Withhold Funds - Corporation or LLC available online through US Legal Forms. Each template is prepared and updated by state-accredited legal experts.

If you are already subscribed, Log In. Once on the form's page, click the Download button and navigate to My documents to find it.

If you haven't subscribed yet, follow the steps outlined below.

With US Legal Forms, you will consistently have immediate access to the correct downloadable template. The service provides documents and organizes them into categories for easy navigation. Use US Legal Forms to quickly and effortlessly acquire your Michigan Request to Withhold Funds - Corporation or LLC.

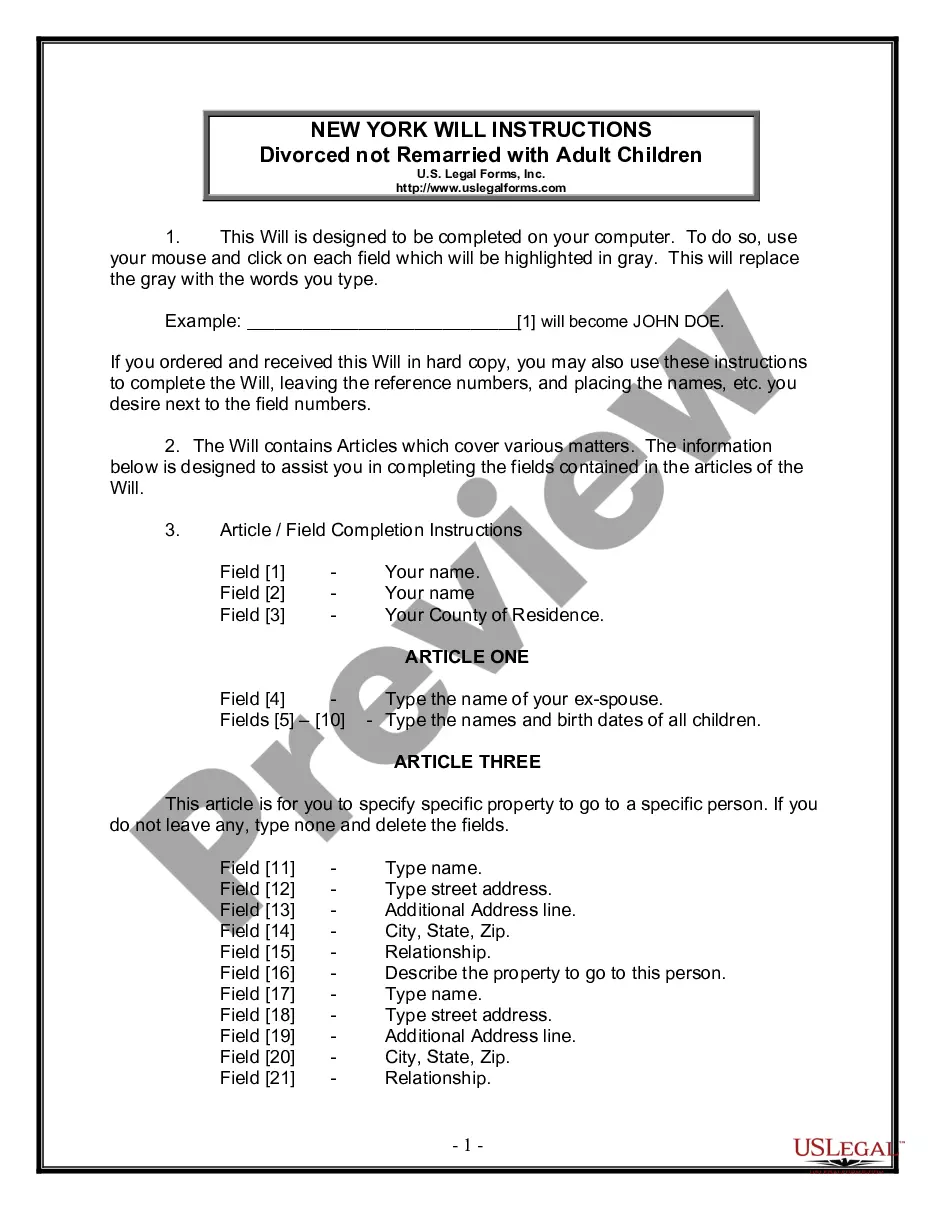

- Verify the state-specific prerequisites for the Michigan Request to Withhold Funds - Corporation or LLC you need.

- Review the description and preview the example.

- Once you are confident that the template meets your needs, select Buy Now.

- Select a subscription plan that aligns with your budget.

- Establish a personal account.

- Make a payment using one of the two available methods: by credit card or through PayPal.

- Choose a format to download the document in; options include (PDF or Word).

- Save the file in the My documents tab.

- After your reusable template is downloaded, either print it or store it on your device.

Form popularity

FAQ

Several states do not impose state income tax at all, meaning they do not require tax withholding on wages. States like Florida, Texas, and Washington are notable examples. If you're operating an out-of-state LLC or corporation, understanding the implications of Michigan Request to Withhold Funds - Corporation or LLC is important for maintaining compliance across borders.

Every Michigan employer who is required to withhold federal income tax under the Internal Revenue Code must be registered for and withhold Michigan income tax. What is Michigan's 2020 payroll withholding tax rate? The tax rate for 2020 is 4.25%.

Alabama. Arizona. Arkansas. California. Connecticut. District of Columbia. Georgia. Hawaii.

An employee may claim exemption from Michigan income tax withholding only if they do not anticipate a Michigan income tax liability for 2017 because employment is less than full time AND exemption allowances are greater than annual compensation.

This means an employer must withhold taxes on employee earnings after the employee has worked more than 60 days in that state. Some states use an income-level threshold where income earned (wages paid) at or above a certain dollar amount for work performed in that state is subject to state withholding.

Also remember withholding is not required for the nine states that do not have a state income tax: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming.

To Register for Withholding Tax E-Register via Michigan Treasury Online! For more information visit the MTO Help Center. E-Registration applications are processed within 5-10 minutes of submission. Please allow six weeks for processing of a paper registration application.

Foreign persons include nonresident aliens, foreign corporations, and foreign partnerships. Payments subject to withholding include compensation for services, interest, dividends, rents, royalties, annuities, and certain other payments. Tax is withheld at 30% of the gross amount of the payment.

In general, an employer is always subject to the laws of any state in which it has an employee performing services, whether or not the employer has a facility in the state. The employee's state of residence also may need to be considered even if the employee doesn't work there.

If you are already registered with the Michigan Department of Treasury, you can find your Michigan Withholding Account Number and Filing Frequency online or by contacting the Michigan Department of Treasury at 517-636-6925.