Maine Unsatisfied Problems Identified in Seller's Files

Description

How to fill out Unsatisfied Problems Identified In Seller's Files?

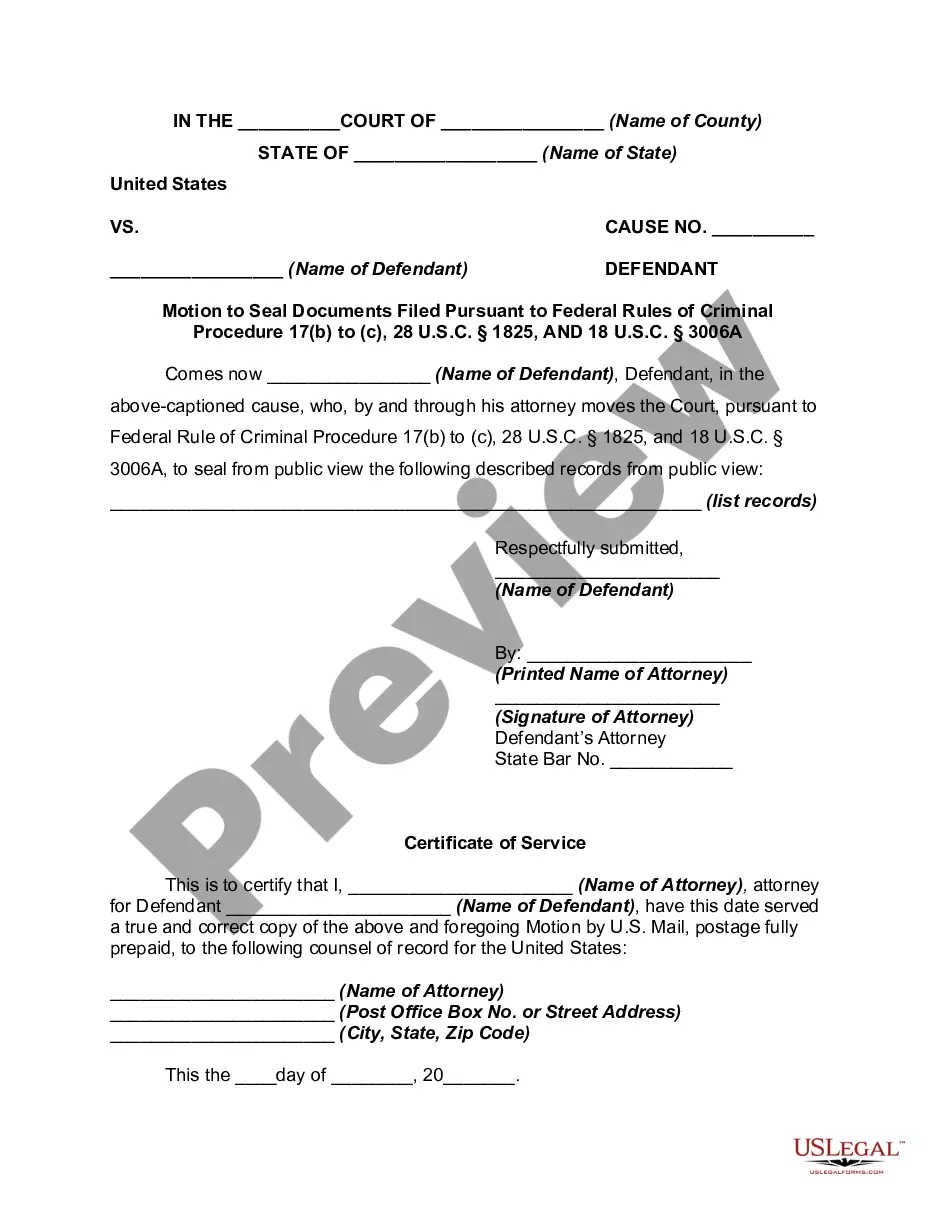

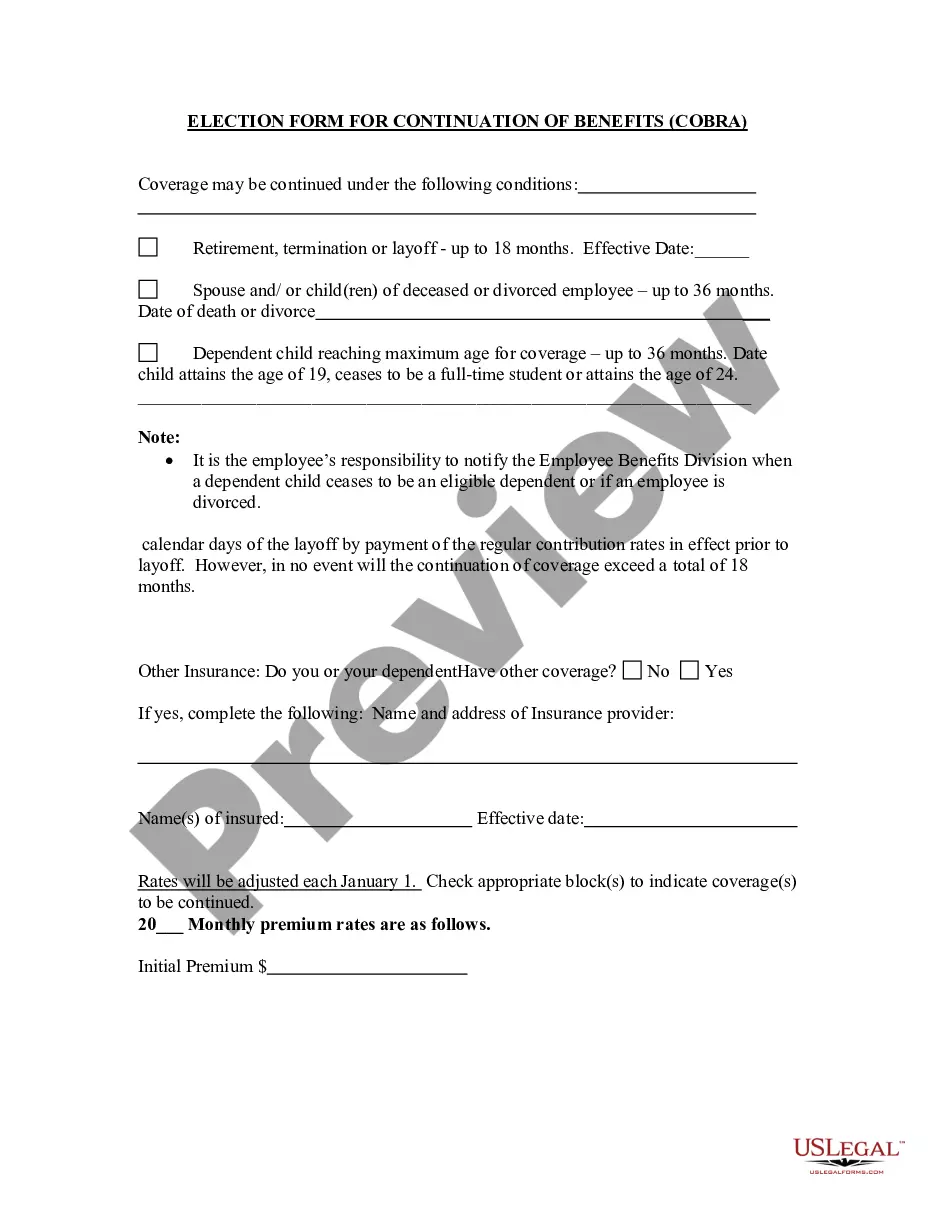

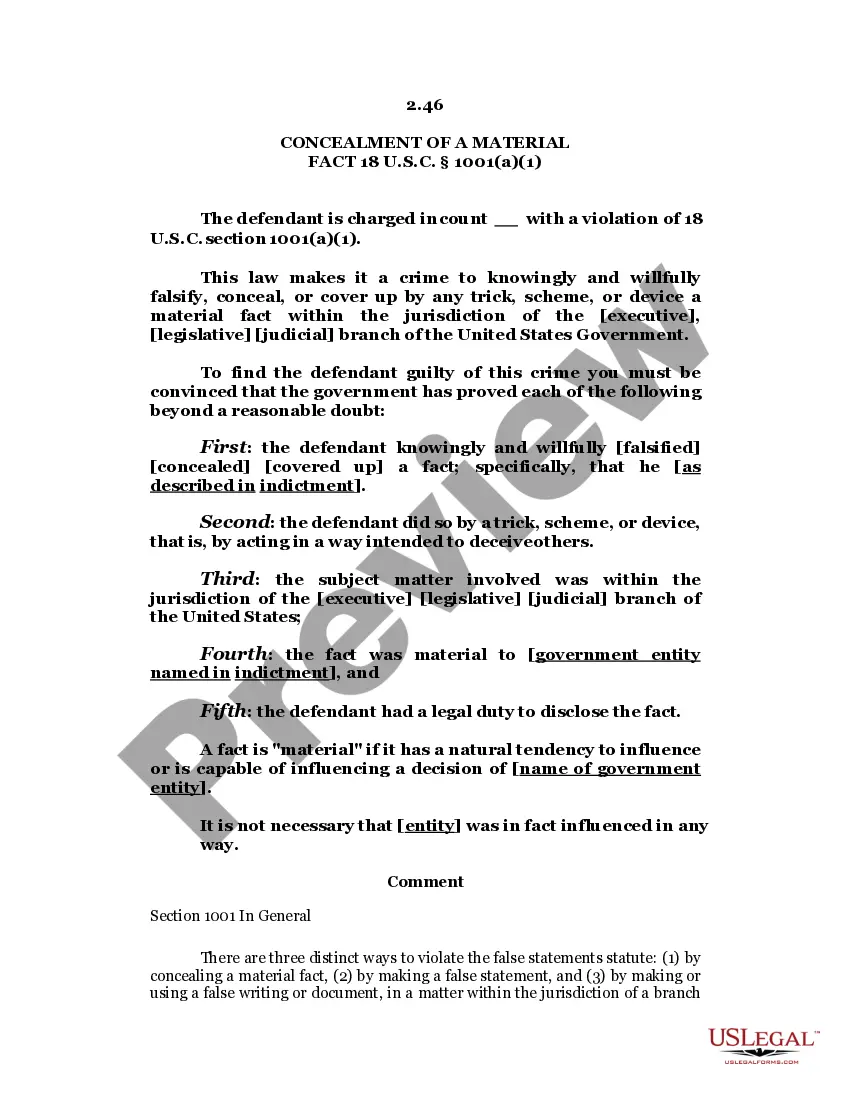

You may invest hours online trying to find the lawful document format that suits the state and federal specifications you need. US Legal Forms gives 1000s of lawful varieties that happen to be examined by experts. It is simple to down load or print the Maine Unsatisfied Problems Identified in Seller's Files from our assistance.

If you already have a US Legal Forms bank account, you can log in and then click the Down load switch. Afterward, you can total, modify, print, or indication the Maine Unsatisfied Problems Identified in Seller's Files. Every single lawful document format you buy is the one you have permanently. To get an additional version associated with a obtained form, go to the My Forms tab and then click the corresponding switch.

If you work with the US Legal Forms website initially, stick to the simple instructions beneath:

- First, be sure that you have chosen the right document format for your region/city of your choice. Read the form information to ensure you have selected the appropriate form. If available, make use of the Review switch to appear with the document format also.

- If you would like get an additional version from the form, make use of the Search field to get the format that suits you and specifications.

- Once you have found the format you desire, click on Purchase now to proceed.

- Find the prices prepare you desire, key in your credentials, and register for a merchant account on US Legal Forms.

- Complete the financial transaction. You can use your bank card or PayPal bank account to cover the lawful form.

- Find the file format from the document and down load it to the gadget.

- Make adjustments to the document if necessary. You may total, modify and indication and print Maine Unsatisfied Problems Identified in Seller's Files.

Down load and print 1000s of document themes using the US Legal Forms site, which provides the greatest variety of lawful varieties. Use professional and express-certain themes to handle your organization or individual demands.

Form popularity

FAQ

Non-Maine residents who sell real estate located in Maine are subject to a withholding amount equal to 2.5% of the sale price. This withholding is used as an estimated tax payment towards any Maine tax liability on the gain realized from the state.

Tax Exempt Items Food for human consumption. Manufacturing machinery. Raw materials for manufacturing. Utilities and fuel used in manufacturing. Medical devices and services.

A sales tax is imposed at the rate of 5.5% of the sale price on retail sales of tangible personal property; products transferred electronically; prepaid calling arrangements (not to be confused with prepaid wireless, which is addressed under ?Service Provider Tax? in this document); transmission and distribution of ...

Tax-exempt customers Some customers are exempt from paying sales tax under Maine law. Examples include government agencies, some nonprofit organizations, and merchants purchasing goods for resale. Sellers are required to collect a valid exemption or resale certificate from buyers to validate each exempt transaction.

In some limited circumstances, a consumer may not have to pay retail sales tax in Maine. For instance, there isn't a tax on groceries and prescription drugs.

1. What is Maine real estate withholding? Maine law requires, at the time of closing on total considerations of $100,000 or more, that every buyer of real property must withhold 2.5% of the consideration from any nonresident individual, estate, or business seller.

Maine taxes both long- and short-term capital gains at the full income tax rates described in the income tax section above. This means that income from capital gains can face a state rate of up to 7.15% in Maine.

The Sales and Use Tax Law provides specific exemptions for a number of different kinds of organizations and institutions, such as hospitals, schools, churches and libraries, etc.