Maine Public Relations Agreement - Self-Employed Independent Contractor

Description

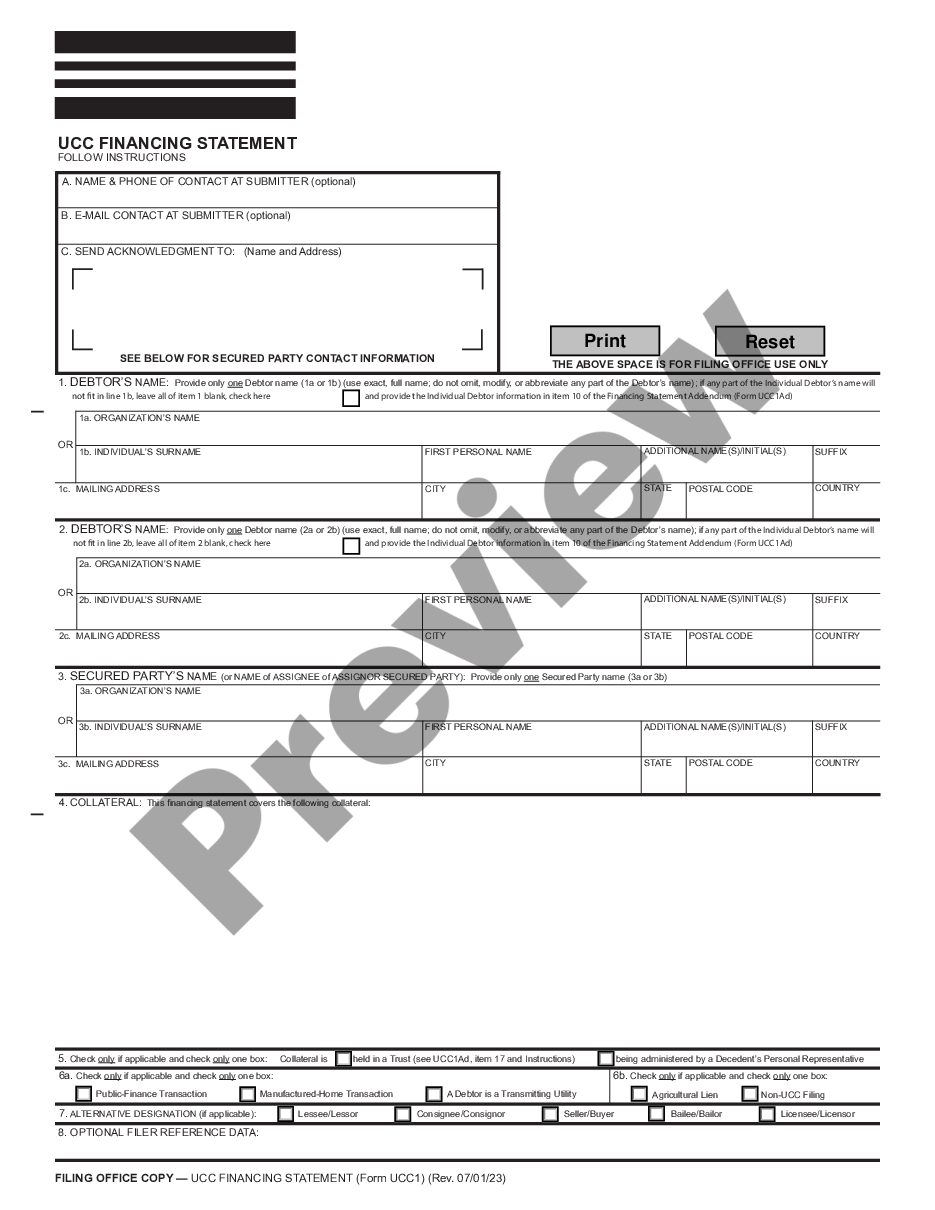

How to fill out Public Relations Agreement - Self-Employed Independent Contractor?

If you require to summarize, retrieve, or create sanctioned document templates, utilize US Legal Forms, the largest collection of legal forms, which is accessible online.

Make use of the site's simple and convenient search function to find the documents you require.

A variety of templates for business and personal purposes are organized by categories and states, or keywords.

Step 3. If you are not satisfied with the form, use the Search section at the top of the page to discover alternative versions of the legal form template.

Step 4. Once you have located the form you need, click the Purchase now button. Choose the payment plan you prefer and provide your details to register for an account.

- Utilize US Legal Forms to obtain the Maine Public Relations Agreement - Self-Employed Independent Contractor with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Obtain button to access the Maine Public Relations Agreement - Self-Employed Independent Contractor.

- You can also locate forms you previously acquired in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form for your relevant area/state.

- Step 2. Take advantage of the Preview option to review the form's content. Remember to read through the description.

Form popularity

FAQ

Yes, if you work as an independent contractor, you are typically considered self-employed. This classification means you manage your own taxes, set your own hours, and work for multiple clients. A Maine Public Relations Agreement - Self-Employed Independent Contractor can help clarify your relationship with your clients and outline the terms of your work. Utilizing such a contract can provide important protections and define roles, ensuring a smooth working relationship.

To create an independent contractor agreement, start by clearly defining the roles and responsibilities of both parties. Include essential details such as payment terms, the scope of work, and deadlines. Utilizing a professionally crafted Maine Public Relations Agreement - Self-Employed Independent Contractor template can simplify this process, ensuring all key elements are covered. Platforms like USLegalForms provide ready-made templates that help you create a tailored agreement, giving you peace of mind while ensuring compliance with state laws.

Non-disclosure agreements do indeed apply to independent contractors, especially in industries where confidentiality is key. Incorporating an NDA into your Maine Public Relations Agreement - Self-Employed Independent Contractor can safeguard your client's proprietary information. Always ensure you understand the scope of the NDA before signing, as it binds you to confidentiality and limits your ability to disclose specific details after the project ends.

Yes, non-disclosure agreements (NDAs) can apply to independent contractors. If your work involves sensitive information or trade secrets, including an NDA in your Maine Public Relations Agreement - Self-Employed Independent Contractor can help protect that information. It is advisable to review any NDA terms carefully to understand your responsibilities regarding confidentiality.

If you break an independent contractor agreement, you may face legal consequences, including potential lawsuits for breach of contract. The specific penalties will depend on the terms outlined in your Maine Public Relations Agreement - Self-Employed Independent Contractor. It is crucial to understand your obligations and work towards finding a resolution with your client whenever possible to avoid legal disputes.

Typically, the independent contractor agreement can be written by either party, but it is often beneficial for the contractor to draft the initial proposal. This allows you to clearly define your services, payment terms, and any other conditions in a Maine Public Relations Agreement - Self-Employed Independent Contractor. Consider using a template from uslegalforms to ensure that you include all necessary clauses and protect your interests.

To protect yourself as a self-employed independent contractor, consider drafting a Maine Public Relations Agreement - Self-Employed Independent Contractor. This document can clarify your responsibilities and rights while setting terms for payment and deliverables. Additionally, make sure to maintain proper records of your work, seek appropriate insurance, and regularly communicate with your clients to avoid misunderstandings.

If you get hurt as a self-employed independent contractor, your options for compensation may be limited compared to traditional employees. Generally, independent contractors do not receive workers' compensation benefits. However, having a Maine Public Relations Agreement - Self-Employed Independent Contractor can help outline your personal liability and any insurance requirements that can provide you with some protection.

Writing a Maine Public Relations Agreement - Self-Employed Independent Contractor involves outlining the responsibilities and expectations of both parties. Begin with a clear title and date, then list each party's details. Describe the services to be offered, payment terms, and any confidentiality agreements. Utilizing resources like US Legal Forms can help simplify this process with professional templates.

To fill out a Maine Public Relations Agreement - Self-Employed Independent Contractor, start by entering your personal details and the contractor's information. Next, specify the services to be provided and the payment terms. Be sure to include the duration of the agreement and any additional clauses necessary for your situation. For a streamlined process, consider using the templates available on US Legal Forms.