Maine Account Executive Agreement - Self-Employed Independent Contractor

Description

How to fill out Account Executive Agreement - Self-Employed Independent Contractor?

Selecting the optimal legal document format can be challenging. Naturally, there are numerous templates available online, but how can you obtain the legal form you require? Utilize the US Legal Forms website. This service offers thousands of templates, such as the Maine Account Executive Agreement - Self-Employed Independent Contractor, which can be utilized for business and personal purposes. All documents are reviewed by experts and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Acquire button to obtain the Maine Account Executive Agreement - Self-Employed Independent Contractor. Use your account to view the legal documents you have purchased previously. Navigate to the My documents tab of your account to obtain another copy of the document you need.

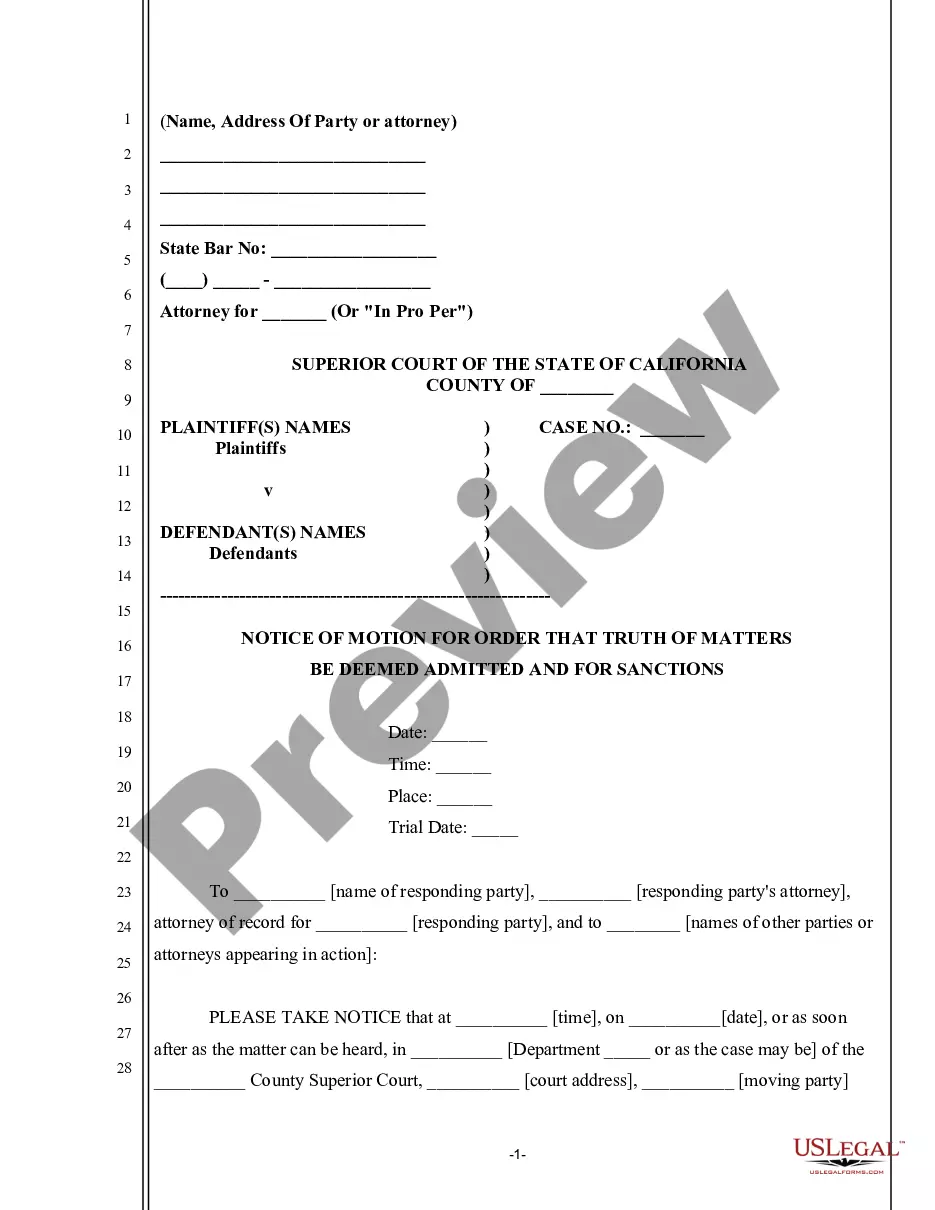

If you are a new user of US Legal Forms, here are simple steps for you to follow: First, ensure you have selected the correct form for your city/state. You can review the document using the Preview button and examine the document outline to confirm it is suitable for you. If the form does not meet your expectations, utilize the Search field to find the appropriate document. Once you are confident that the form is satisfactory, click the Purchase now button to obtain the document. Choose the pricing plan you prefer and enter the required information. Create your account and pay for your order using your PayPal account or credit card. Select the file format and download the legal document format to your device. Complete, edit, and print and sign the acquired Maine Account Executive Agreement - Self-Employed Independent Contractor.

With US Legal Forms, you can confidently secure the legal documentation you need for both personal and professional use.

- US Legal Forms is the largest database of legal documents available with various document templates.

- Utilize the service to obtain properly crafted documents that comply with state requirements.

- The platform provides a user-friendly interface for navigating through legal forms.

- It ensures that all templates are up-to-date and relevant to current laws.

- You can manage your account easily to keep track of your purchased documents.

- The legal forms are designed to save time and ensure compliance with legal standards.

Form popularity

FAQ

Yes, independent contractors file as self-employed. When you engage in work as a self-employed independent contractor under a Maine Account Executive Agreement, you are responsible for reporting your income and paying self-employment taxes. This means you will need to keep track of all income earned and expenses incurred to ensure proper filing. Utilizing platforms like US Legal Forms can help you understand the requirements and generate the necessary documents to simplify your tax preparation process.

Filling out an independent contractor form involves providing your personal information, the nature of the work, and compensation details. Carefully read through the entire form to ensure all sections are complete and accurate. An organized Maine Account Executive Agreement - Self-Employed Independent Contractor will minimize future disputes. You can access user-friendly forms through uslegalforms to assist you in this process.

The terms self-employed and independent contractor can often be used interchangeably, but there are nuanced differences. Self-employed individuals may have more control over their businesses, while independent contractors typically work on specific projects for clients. For legal documents like the Maine Account Executive Agreement - Self-Employed Independent Contractor, using the term that best reflects your relationship with the client is crucial.

When filling out an independent contractor agreement, ensure that you include all pertinent details such as the names of the parties, project description, and compensation terms. Clearly outline expectations and responsibilities to avoid misunderstandings later. A comprehensive Maine Account Executive Agreement - Self-Employed Independent Contractor greatly enhances clarity. For ease, you might explore templates available on uslegalforms.

An independent contractor typically needs to complete a W-9 form, which provides their taxpayer identification number. Additionally, if applicable, they may need state-specific forms, especially when submitting a Maine Account Executive Agreement - Self-Employed Independent Contractor. It’s important to check local regulations and consider consulting uslegalforms for guidance on required documentation.

To write an independent contractor agreement, start by clearly defining the scope of work and the relationship between the parties involved. Include essential details like payment terms, timelines, and obligations. A well-structured Maine Account Executive Agreement - Self-Employed Independent Contractor should also address confidentiality and dispute resolution. Utilizing tools from uslegalforms can simplify this process.

To create an independent contractor agreement, start by outlining the work scope, deliverables, and payment details under the Maine Account Executive Agreement - Self-Employed Independent Contractor. Make sure to include roles, timelines, and confidentiality clauses if needed. You can simplify this process by utilizing template services like US Legal Forms, which offer customizable options and legal compliance guidance.

Yes, having a contract is essential for self-employed individuals, including those using the Maine Account Executive Agreement - Self-Employed Independent Contractor. A solid contract clarifies expectations, responsibilities, and payment terms, reducing the chances of misunderstandings. It also provides legal protection in case of disputes, thus promoting a smoother working relationship.

Typically, an independent contractor or a business representative drafts the Maine Account Executive Agreement - Self-Employed Independent Contractor. It’s crucial to ensure the agreement contains all necessary terms that benefit both parties. You can also consult legal experts or use comprehensive templates from platforms like US Legal Forms to streamline the process and enhance clarity.

The new federal rule on independent contractors aims to clarify the criteria for determining employee status. This rule impacts how many workers qualify as independent contractors under the law. For those entering agreements, such as the Maine Account Executive Agreement - Self-Employed Independent Contractor, awareness of these changes is vital. It is always recommended to consult a legal expert to navigate these regulations effectively.