Minnesota Renunciation and Disclaimer of Right to Inheritance or to Inherit Property from Deceased - Specific Property

Description

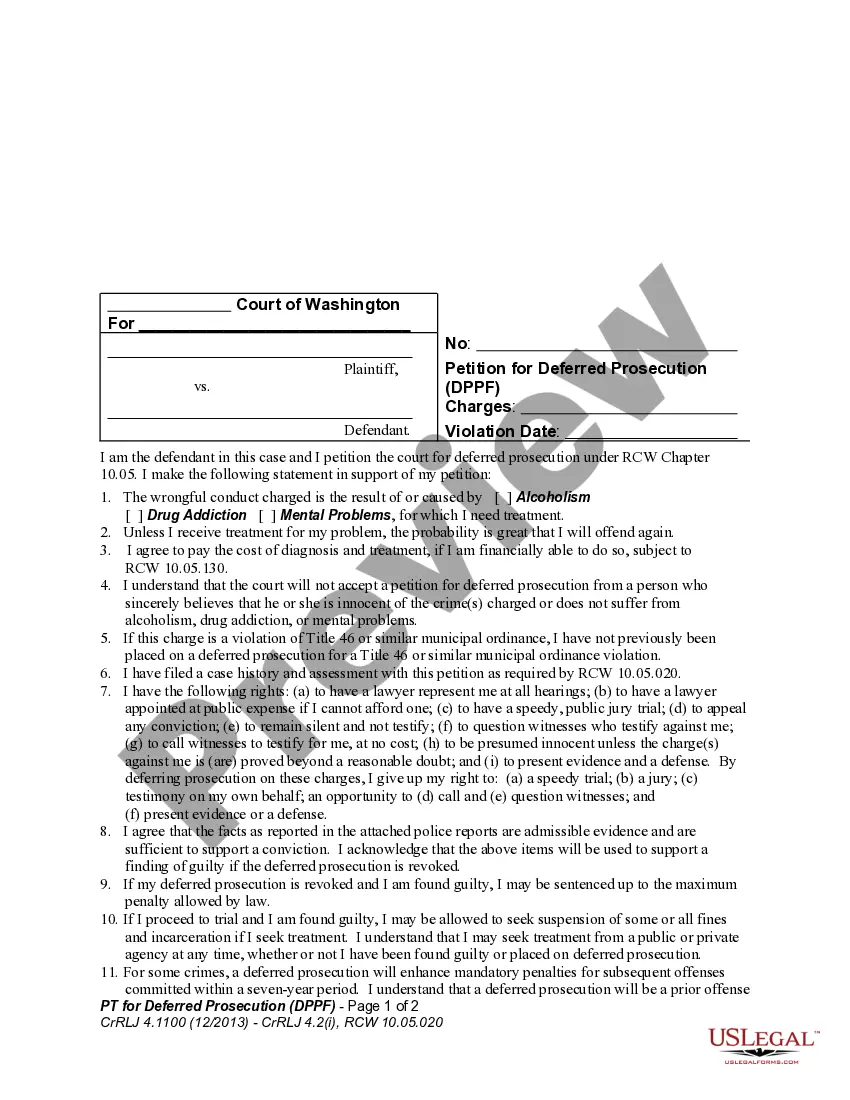

How to fill out Renunciation And Disclaimer Of Right To Inheritance Or To Inherit Property From Deceased - Specific Property?

Are you currently in the situation where you require papers for both company or specific purposes almost every working day? There are tons of lawful file themes accessible on the Internet, but locating ones you can rely on isn`t straightforward. US Legal Forms delivers thousands of form themes, just like the Minnesota Renunciation and Disclaimer of Right to Inheritance or to Inherit Property from Deceased - Specific Property, that happen to be created in order to meet state and federal requirements.

Should you be presently acquainted with US Legal Forms internet site and possess your account, merely log in. Afterward, you are able to download the Minnesota Renunciation and Disclaimer of Right to Inheritance or to Inherit Property from Deceased - Specific Property web template.

Unless you offer an profile and need to begin using US Legal Forms, abide by these steps:

- Discover the form you want and ensure it is for your right town/state.

- Use the Preview switch to analyze the form.

- Read the explanation to ensure that you have chosen the correct form.

- If the form isn`t what you are seeking, make use of the Lookup discipline to discover the form that fits your needs and requirements.

- If you obtain the right form, simply click Buy now.

- Select the rates prepare you desire, complete the necessary details to produce your account, and purchase the transaction making use of your PayPal or credit card.

- Pick a hassle-free document formatting and download your duplicate.

Find every one of the file themes you have purchased in the My Forms food list. You may get a further duplicate of Minnesota Renunciation and Disclaimer of Right to Inheritance or to Inherit Property from Deceased - Specific Property at any time, if needed. Just click on the essential form to download or print the file web template.

Use US Legal Forms, one of the most considerable selection of lawful forms, in order to save some time and steer clear of mistakes. The service delivers professionally made lawful file themes that you can use for a selection of purposes. Create your account on US Legal Forms and commence generating your daily life easier.

Form popularity

FAQ

Hear this out loud PauseThis disclaimer should be signed, notarized, and filed with the probate court and/or the executor of the last will and testament in a timely manner. The IRS time frame is within nine months of the death of the decedent?or if the disclaiming beneficiary is a minor, after they reach age 21. How to refuse an inheritance | .com ? articles ? how-to-refuse-an... .com ? articles ? how-to-refuse-an...

Hear this out loud PauseYou make your disclaimer in writing. Your inheritance disclaimer specifically says that you refuse to accept the assets in question and that this refusal is irrevocable, meaning it can't be changed. You disclaim the assets within nine months of the death of the person you inherited them from. How to Disclaim an Inheritance (And Why You Would) | SmartAsset smartasset.com ? financial-advisor ? disclaim-inhe... smartasset.com ? financial-advisor ? disclaim-inhe...

Hear this out loud PauseIn order to disclaim an inheritance, you will need to write a Disclaimer, which states that you are disclaiming your inheritance in writing. Within your Disclaimer, you will need to explain what is being disclaimed, whether it is only part of your inheritance or all of it, as well as sign the document to make it legal. Reasons to Disclaim an Inheritance - Trust & Will trustandwill.com ? learn ? reasons-to-disclaim-an-i... trustandwill.com ? learn ? reasons-to-disclaim-an-i...

In order to disclaim an inheritance, you will need to write a Disclaimer, which states that you are disclaiming your inheritance in writing. Within your Disclaimer, you will need to explain what is being disclaimed, whether it is only part of your inheritance or all of it, as well as sign the document to make it legal.

If all inheritors do not agree then the property cannot be sold. Chill! If majority of the inheritors are willing to sell the property they need to go through a probate court. The inheritors can file a 'partition action' lawsuit in the probate court.

Minnesota law does not set a specific timeline for settling an estate, but it generally should be done as "expeditiously and efficiently as is compatible with the best interests of the estate." Delays can result in additional expenses and even legal repercussions for the executor.

You must send notice to the personal representative of the estate if you decline the interest from the will. If you are disclaiming real property, you need to submit an additional notice to the county recorder where the real property resides. In Minnesota, you have up to nine months to disclaim your inheritance.

Hear this out loud PauseIf a beneficiary properly disclaims inherited retirement assets, their status as the beneficiary is fully annulled. Disclaiming inherited assets is often done to avoid taxes but also so that other individuals can receive the assets. Disclaiming Inherited Plan Assets - Investopedia investopedia.com ? articles ? retirement investopedia.com ? articles ? retirement