Maine Personal Shopper Services Contract - Self-Employed Independent Contractor

Description

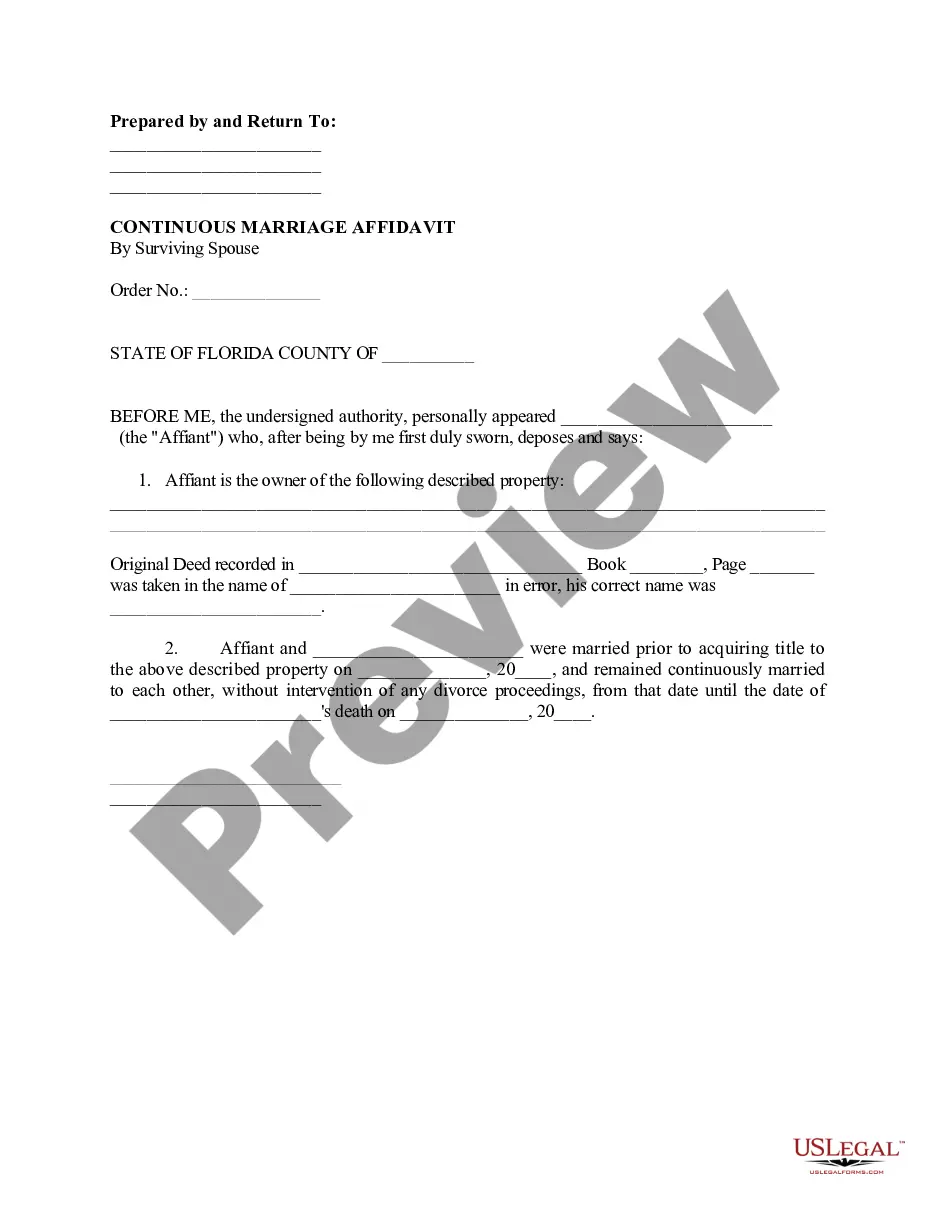

How to fill out Personal Shopper Services Contract - Self-Employed Independent Contractor?

If you need to total, obtain, or print authorized document templates, utilize US Legal Forms, the largest collection of legal forms available online. Take advantage of the site's straightforward and user-friendly search to find the documents you need. Numerous templates for business and personal purposes are organized by categories and states, or keywords. Use US Legal Forms to locate the Maine Personal Shopper Services Contract - Self-Employed Independent Contractor in just a few clicks.

If you are currently a US Legal Forms user, Log In to your account and click the Download button to obtain the Maine Personal Shopper Services Contract - Self-Employed Independent Contractor. You can also access forms you previously downloaded in the My documents section of your account.

If you are using US Legal Forms for the first time, follow the steps below: Step 1. Ensure you have chosen the form for the appropriate area/state. Step 2. Use the Preview option to review the form’s content. Be sure to read the details. Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template. Step 4. Once you have found the form you need, click the Purchase now button. Select the pricing plan you prefer and enter your credentials to register for an account. Step 5. Process the transaction. You can use your Visa or MasterCard or PayPal account to complete the transaction. Step 6. Choose the format of the legal form and download it onto your device. Step 7. Complete, edit, and print or sign the Maine Personal Shopper Services Contract - Self-Employed Independent Contractor.

- Every legal document template you acquire is yours permanently.

- You have access to every form you downloaded in your account.

- Click the My documents section and select a form to print or download again.

- Complete and acquire, and print the Maine Personal Shopper Services Contract - Self-Employed Independent Contractor with US Legal Forms.

- There are numerous professional and state-specific forms you can use for your business or personal needs.

Form popularity

FAQ

The legal requirements for being self-employed include registering your business, obtaining necessary licenses, and keeping proper financial records. Specific to personal shoppers, a Maine Personal Shopper Services Contract - Self-Employed Independent Contractor can protect you legally while providing clear terms for your services. It's also essential to understand tax obligations to ensure compliance.

To become a subcontractor in Maine, start by identifying the services you can offer and networking with primary contractors. Developing a solid Maine Personal Shopper Services Contract - Self-Employed Independent Contractor will be key to formalizing your agreements. Additionally, ensure you comply with state regulations and establish your brand to attract clients.

Yes, as an independent contractor, you are considered self-employed. This designation means you manage your own business and control your work processes, including how you operate under a Maine Personal Shopper Services Contract - Self-Employed Independent Contractor. Being self-employed also impacts how you file taxes and manage your financial responsibilities.

Freelancing without a contract is possible, but not advisable. A Maine Personal Shopper Services Contract - Self-Employed Independent Contractor creates a formal agreement that outlines the project scope, payment terms, and deadlines. This clarity can safeguard you against potential misunderstandings and disputes that may arise during the project.

Yes, having a contract is important even if you are self-employed. A Maine Personal Shopper Services Contract - Self-Employed Independent Contractor ensures that both you and your clients understand the terms of the service arrangement. It protects your interests and can enhance your professionalism, which is critical in building long-term client relationships.

The new federal rule on independent contractors focuses on the criteria used to classify workers. It impacts who qualifies as an independent contractor rather than an employee, which is crucial for those engaging in services like personal shopping. Understanding these regulations can help you effectively utilize a Maine Personal Shopper Services Contract - Self-Employed Independent Contractor to align your work with the law.

If you are employed without a contract, you may face challenges in clarifying job expectations, payment terms, and responsibilities. Without a Maine Personal Shopper Services Contract - Self-Employed Independent Contractor, enforcing your rights becomes difficult. This situation can lead to misunderstandings or conflicts, which could have been easily avoided with a clear agreement.

Working without a signed contract can create uncertainty for both parties. While some arrangements can be valid verbally, having a Maine Personal Shopper Services Contract - Self-Employed Independent Contractor provides clarity on expectations and responsibilities. It protects your interests and ensures both parties are on the same page, reducing potential disputes.

Both terms are widely understood, but they carry slightly different connotations. 'Self-employed' is broader and includes anyone running their own business, while 'independent contractor' refers to those providing specific services under a contractual agreement. For personal shoppers in Maine, using a Maine Personal Shopper Services Contract - Self-Employed Independent Contractor can help communicate your role effectively and enhance your professional image.

An independent contractor is someone who provides services to clients without forming an employee-employer relationship. They maintain autonomy over their work processes and schedules. In the context of personal shopping, utilizing a Maine Personal Shopper Services Contract - Self-Employed Independent Contractor helps clarify this role and establish professional boundaries.