Maine Modeling Services Contract - Self-Employed

Description

How to fill out Modeling Services Contract - Self-Employed?

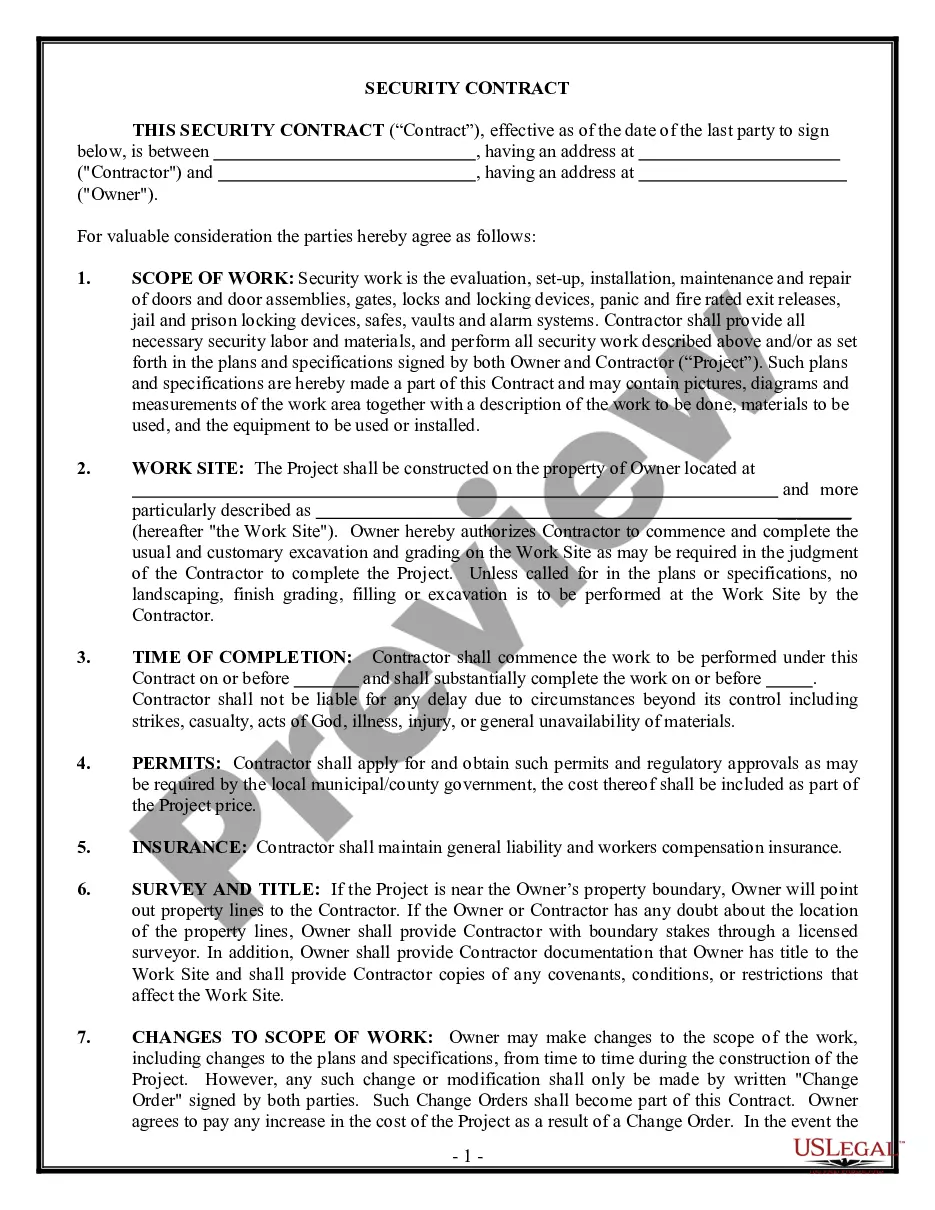

You can dedicate numerous hours online trying to discover the valid document template that meets the state and federal prerequisites you will require.

US Legal Forms provides thousands of valid templates that are reviewed by experts.

You can download or print the Maine Modeling Services Contract - Self-Employed from our services.

If available, use the Preview button to view the document template as well. If you wish to obtain another variation of the form, utilize the Search field to find the template that fits your needs and specifications. Once you have located the template you require, click Buy now to continue. Choose the pricing plan you need, enter your details, and register for an account on US Legal Forms. Complete the transaction. You can use your Visa or Mastercard or PayPal account to pay for the valid form. Access the format in the document and download it to your device. Make adjustments to the document if necessary. You can complete, modify, sign, and print the Maine Modeling Services Contract - Self-Employed. Download and print thousands of document templates using the US Legal Forms site, which offers the largest collection of valid templates. Utilize professional and state-specific templates to manage your business or personal needs.

- If you already have a US Legal Forms account, you can Log In and then click the Download button.

- After that, you can complete, modify, print, or sign the Maine Modeling Services Contract - Self-Employed.

- Every valid document template you acquire is yours permanently.

- To obtain another copy of any purchased form, navigate to the My documents section and click the corresponding button.

- If you are visiting the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the area/city that you choose.

- Review the form description to confirm you have selected the appropriate form.

Form popularity

FAQ

Yes, to operate as a contractor in Maine, you generally need to obtain a business license and specific permits related to your services. Depending on your field, there may be additional licensing requirements. Utilizing tools like the Maine Modeling Services Contract - Self-Employed can help you navigate these licensing needs effectively.

An independent contractor in Maine is a self-employed individual who provides services under a contract. They operate their own business and are responsible for their taxes, unlike employees who have taxes withheld. The Maine Modeling Services Contract - Self-Employed outlines these essential aspects and helps define the working relationship.

To become a subcontractor in Maine, start by researching the specific requirements and regulations. You should register your business, obtain any necessary permits, and network with other contractors. Utilizing resources like USLegalForms can provide templates, such as the Maine Modeling Services Contract - Self-Employed, to streamline your application process.

Proving independent contractor status requires documentation that shows the nature of your work relationship. You need to maintain records such as contracts, invoices, and correspondence, which outline the terms of your services. By using a Maine Modeling Services Contract - Self-Employed, you can clearly define your role and responsibilities.

Becoming a 1099 subcontractor involves establishing your business as self-employed. Start by registering your business and obtaining any necessary licenses. Once you secure a contract, ensure you understand how to manage taxes as a 1099 worker, reflecting your income under the Maine Modeling Services Contract - Self-Employed.

To become a subcontractor, you need to understand the requirements of the Maine Modeling Services Contract - Self-Employed. Generally, you must have a business structure in place, obtain necessary permits, and have liability insurance. Additionally, you should familiarize yourself with tax obligations and ensure you meet the standards set by the contracting party.

Yes, you can write your own legally binding contract as long as it meets certain legal requirements, such as mutual consent and clear terms. However, if you're unsure, using a template can provide guidance. The Maine Modeling Services Contract - Self-Employed is designed to help you create a legally sound document while keeping the process straightforward.

When drafting a contract agreement for services, start with the basics: specify who is providing the service, what the service entails, and the payment schedule. It is important to also outline any conditions for termination. The Maine Modeling Services Contract - Self-Employed can help ensure you capture all necessary elements while maintaining clarity.

employment contract should cover key areas like services rendered, payment amounts, and deadlines. Make sure to specify what constitutes completed work and any liability clauses. The Maine Modeling Services Contract SelfEmployed is a great tool to guide you in crafting a professional and legally sound agreement.

To write a contract for a 1099 employee, detail the specific job duties, payment rates, and terms of employment in the document. Additionally, clarify the independent nature of the relationship to comply with IRS requirements. Utilizing a Maine Modeling Services Contract - Self-Employed can provide a framework for ensuring adherence to legal guidelines.