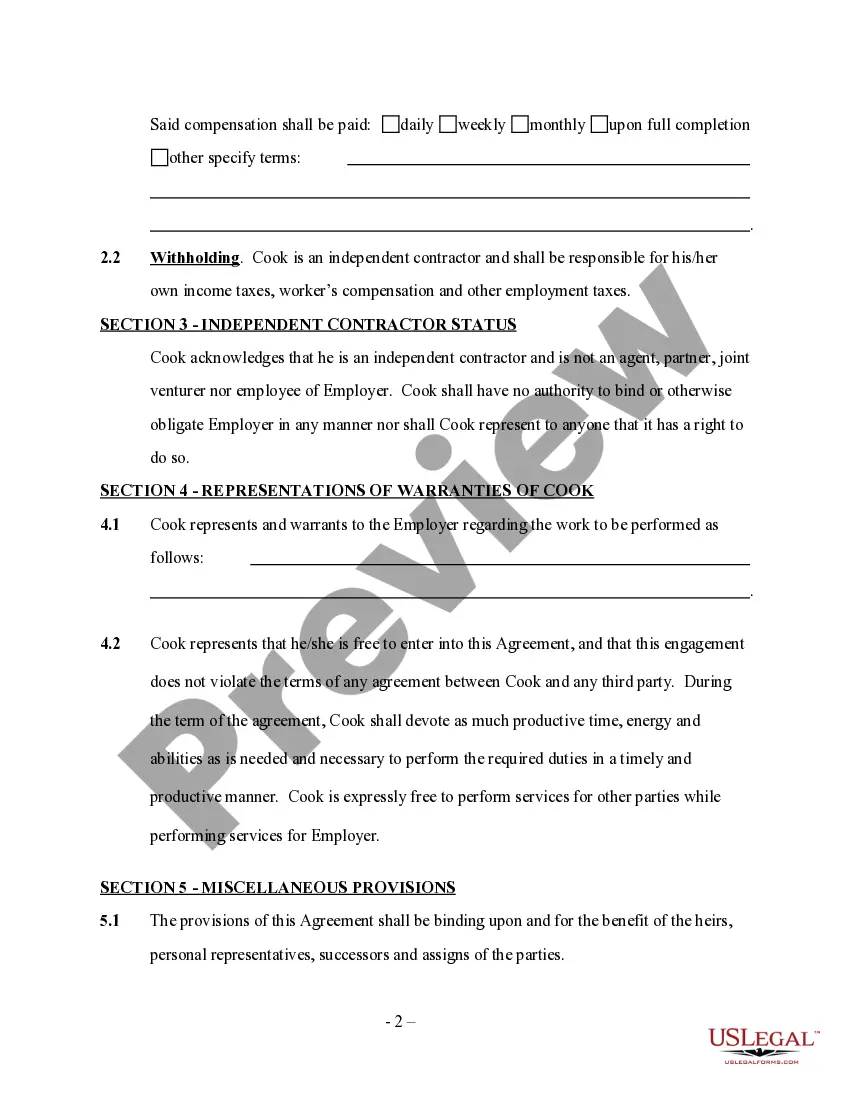

Maine Cook Services Contract - Self-Employed

Description

How to fill out Cook Services Contract - Self-Employed?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a vast selection of legal form templates that you can download or print. By utilizing the website, you can find thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can access the most recent versions of forms like the Maine Cook Services Contract - Self-Employed within minutes.

If you already have a subscription, Log In and download the Maine Cook Services Contract - Self-Employed from the US Legal Forms library. The Download button will appear on each form you view. You can access all previously downloaded forms in the My documents section of your account.

To use US Legal Forms for the first time, here are simple steps to get started: Ensure you have selected the correct form for your city/county. Click the Review button to examine the form's content. Read the form description to confirm that you have chosen the correct form. If the form does not meet your requirements, utilize the Search box at the top of the screen to find one that does. If you are satisfied with the form, confirm your selection by clicking the Buy now button. Then, choose your preferred pricing plan and provide your information to register for an account. Process the transaction. Use a credit card or PayPal account to complete the transaction. Select the format and download the form to your device. Make changes. Fill out, modify, print, and sign the downloaded Maine Cook Services Contract - Self-Employed. Every template you added to your account has no expiration date and is yours forever. Therefore, if you wish to download or print another copy, just go to the My documents section and click on the form you need.

- Access the Maine Cook Services Contract - Self-Employed with US Legal Forms, one of the most extensive collections of legal document templates.

- Utilize numerous professional and state-specific templates that fulfill your business or personal needs and requirements.

Form popularity

FAQ

Setting up as a self-employed contractor requires you to choose a business structure, register your business, and understand tax requirements. A detailed Maine Cook Services Contract - Self-Employed can significantly aid in formalizing your services and ensuring client clarity. It's highly recommended to seek out legal resources that help in shaping these documents, such as the offerings available at US Legal Forms.

Becoming a subcontractor in Maine involves first understanding the primary contract terms and the scope of work expected. You will also need a solid Maine Cook Services Contract - Self-Employed to clarify your responsibilities and payment structure. Connecting with general contractors and networking in your field can open new opportunities. Consider using US Legal Forms to draft necessary contracts as you start.

To establish yourself as an independent contractor, you should register your business, obtain any necessary licenses, and set up a tax structure. Additionally, create a Maine Cook Services Contract - Self-Employed that outlines your services and payment details. This contract solidifies your role and helps in approaching potential clients. Platforms like US Legal Forms provide resources to assist you through this process.

Creating a private contract with yourself can be beneficial in setting clear professional guidelines. While it might sound unusual, a Maine Cook Services Contract - Self-Employed serves as a formal commitment to your work standards. This practice establishes discipline in managing your self-employed activities. Suggestively, tools from US Legal can help format an agreement for personal reference.

Indeed, you can be self-employed and maintain multiple contracts. Each Maine Cook Services Contract - Self-Employed should detail the scope of work, payment terms, and other critical factors. This clarity helps in managing client relationships and fulfilling obligations. Utilizing services like US Legal Forms can ease the contract drafting process.

Yes, having a contract is not only possible but advisable for self-employed individuals. A well-drafted Maine Cook Services Contract - Self-Employed can protect your rights and clarify expectations between you and your clients. This document serves as a reference point in case of disputes. Using platforms like US Legal Forms simplifies the creation of such contracts.

The rules for self-employed individuals have evolved, particularly in areas like tax obligations and financial reporting. It's essential to stay informed about changes that affect your status and rights. Engaging with resources like the US Legal platform can help you understand the specifics. Always ensure your Maine Cook Services Contract - Self-Employed aligns with these updates.

While both terms are often interchangeable, there are subtle differences. 'Self-employed' refers broadly to individuals running their own businesses, while 'independent contractor' emphasizes a contractual relationship for specific projects. Depending on your services, using a Maine Cook Services Contract - Self-Employed can enhance clarity in your professional identity.

Yes, contract workers are generally considered self-employed, as they provide services independently of an employer. They typically enter into agreements like a Maine Cook Services Contract - Self-Employed to clarify their working conditions. This classification allows them to manage their own business and financial decisions.

Operating without a contract can lead to misunderstandings and disputes with clients. You may find it difficult to enforce payment terms or clarify your responsibilities. To avoid these complications, using a Maine Cook Services Contract - Self-Employed helps to protect your interests and provide a clear framework for your work.