Maine Letter of Transmittal

Description

How to fill out Letter Of Transmittal?

Choosing the best authorized record template might be a battle. Needless to say, there are tons of templates available on the Internet, but how will you get the authorized form you want? Use the US Legal Forms internet site. The service gives thousands of templates, like the Maine Letter of Transmittal, that can be used for enterprise and private requires. All the types are examined by pros and fulfill federal and state needs.

If you are presently registered, log in in your accounts and click on the Obtain key to obtain the Maine Letter of Transmittal. Make use of your accounts to check from the authorized types you may have purchased in the past. Go to the My Forms tab of the accounts and acquire yet another duplicate in the record you want.

If you are a new consumer of US Legal Forms, here are easy directions that you can adhere to:

- First, ensure you have selected the proper form for your city/state. You may look through the form utilizing the Preview key and look at the form information to ensure this is basically the right one for you.

- If the form will not fulfill your preferences, use the Seach field to get the correct form.

- When you are positive that the form is suitable, click on the Get now key to obtain the form.

- Select the rates strategy you desire and type in the required information. Make your accounts and purchase the transaction with your PayPal accounts or credit card.

- Select the data file formatting and download the authorized record template in your system.

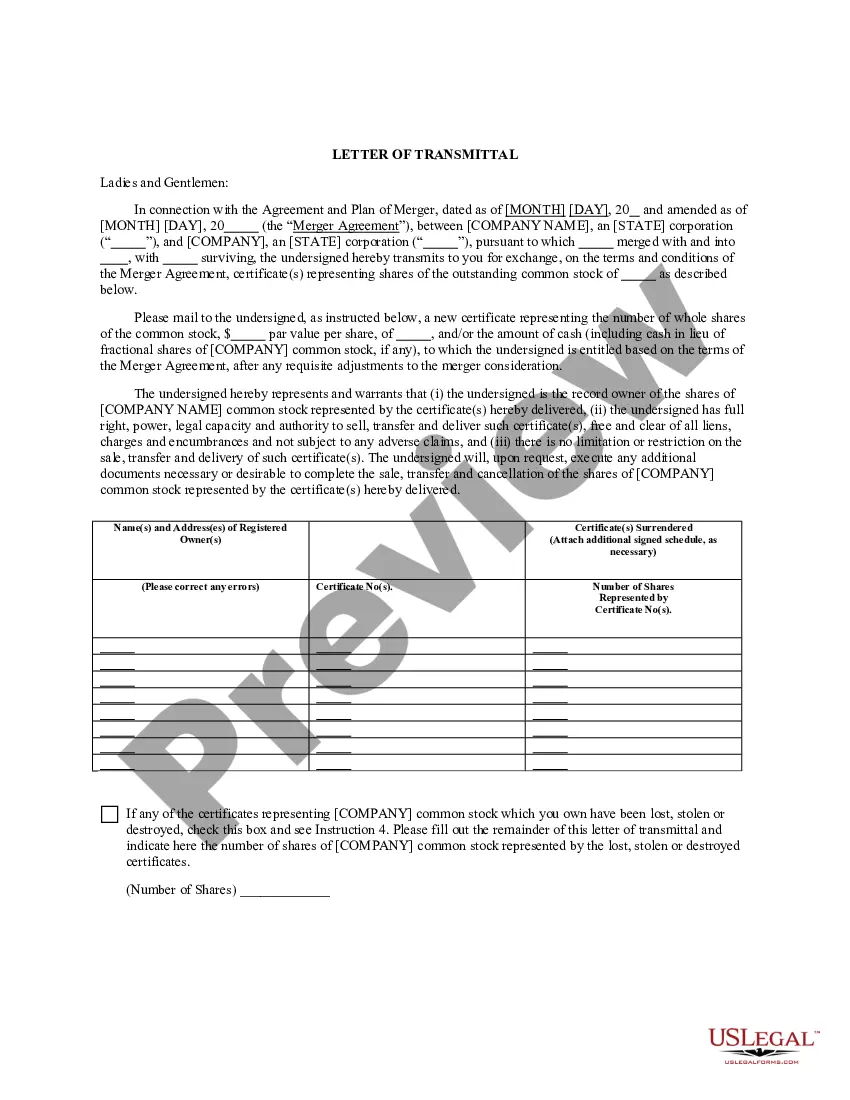

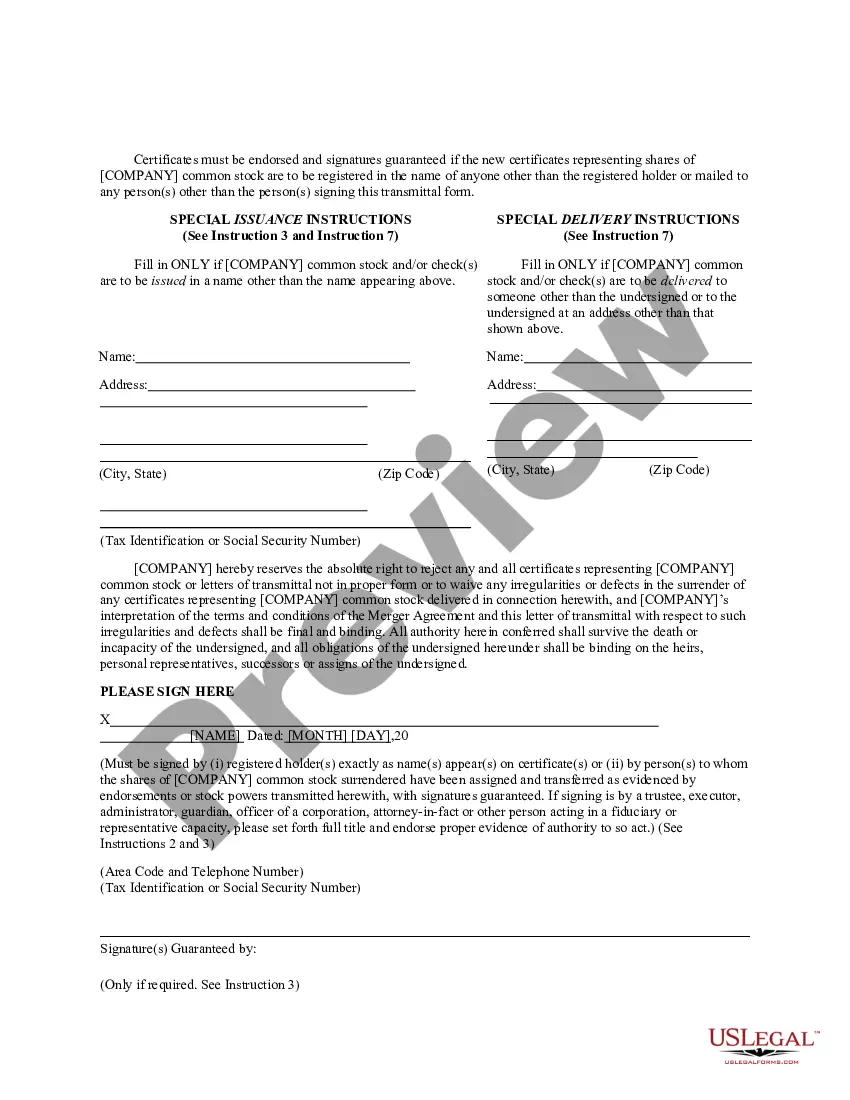

- Full, modify and print and indicator the attained Maine Letter of Transmittal.

US Legal Forms is the most significant library of authorized types where you can see a variety of record templates. Use the service to download professionally-manufactured paperwork that adhere to express needs.

Form popularity

FAQ

2022 1040ES-ME Pay your estimated tax electronically using Maine EZ Pay at .maine.gov/revenue and eliminate the need to file Form 1040ES-ME or detach and mail this voucher with check or money order payable to Treasurer, State of Maine, to: Maine Revenue Services, P.O. Box 9101, Augusta, ME 04332-9101.

Paying State Income Tax in Maine Go to: . Hover over "Electronic Services" and navigate to "EZ Pay". You will be redirected to a secure payment portal. Log in or register, then click "Make a Payment" at the bottom of the screen.

Income/Estate Tax Division What is being mailed:Mailing Address:Individual Income Tax (Form 1040ME) Mail to this address if you are expecting a refundP.O. Box 1066, Augusta, ME 04332-1066Individual Income Tax Estimate Payments (Form 1040ES-ME)P.O. Box 9101, Augusta, ME 04332-910111 more rows

Call the forms line at 207-624-7894 (leave your name and mailing address) or write to: Maine Revenue Services, PO Box 9107, Augusta, ME 04332-9107.

You can still update your address with Maine Revenue Services. Here's what you need to do. Submit in writing the date of request, as well as your name (printed), Social Security number, signature, and proof of the new address (such as an updated photo ID, a utility bill, lease, etc.).

Alaska, Arizona, California, Colorado, Hawaii, Idaho, New Mexico, Nevada, Oregon, Utah, Washington, Wyoming: Internal Revenue Service, P.O. Box 7704, San Francisco, CA 94120-7704.

Where is my refund? Check our 1040 Refund Status web page at .maine.gov/revenue (click on 'Where is my Refund? ') for the status of your refund.