Maine FLSA Exempt / Nonexempt Compliance Form

Description

How to fill out FLSA Exempt / Nonexempt Compliance Form?

If you desire to be thorough, obtain, or create official document formats, use US Legal Forms, the largest selection of legal forms, which are accessible online.

Utilize the site's straightforward and convenient search feature to find the documents you require.

Numerous templates for professional and personal purposes are categorized by type and state, or keywords.

Step 4. Once you have located the required form, select the Buy now option. Choose the pricing plan you prefer and provide your information to register for an account.

Step 5. Process the transaction. You may use your credit card or PayPal account to finalize the purchase.

- Use US Legal Forms to acquire the Maine FLSA Exempt / Nonexempt Compliance Form in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and select the Download option to obtain the Maine FLSA Exempt / Nonexempt Compliance Form.

- You can also retrieve forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have chosen the form for your correct city/state.

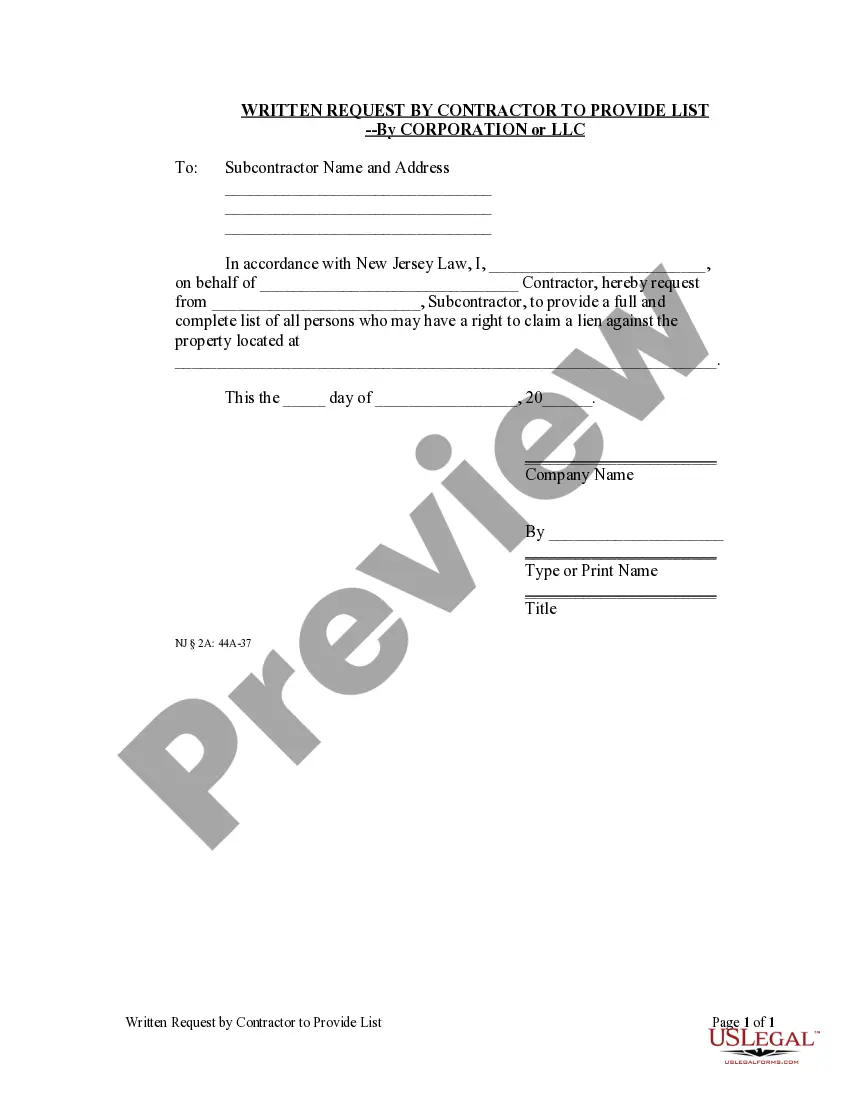

- Step 2. Use the Preview option to review the form's details. Don't forget to go through the summary.

- Step 3. If you are not satisfied with the template, use the Search field at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

The determination of whether it is better to be exempt or nonexempt often depends on personal circumstances and work-life balance. Exempt employees typically enjoy a higher salary but lack overtime compensation, while nonexempt employees earn overtime for extra hours worked. Understanding these differences through the Maine FLSA Exempt / Nonexempt Compliance Form can help you make an informed choice.

A: Unless specifically exempted, employees covered by Maine's overtime statute must receive pay for hours worked in excess of 40 in a work week at a rate not less than one and one-half their regular rates of pay. This is referred to as "overtime" pay.

Exempt: Employees primarily performing work that is not subject to overtime provisions of the Fair Labor Standards Act. Overtime pay is not required by FLSA for exempt employees; however, the University chooses to pay overtime to exempt Non-V Class employees.

Maine exempts a collection of occupations from overtime entirely, including taxi drivers, certain salespeople, all farm workers, under-18 camp counselors, automobile mechanics, salespeople, and some drivers, members of the employer's immediate family, and employees involved in the perishable, agricultural, or meat/fish

Standards Act (FLSA) However, Section 13(a)(1) of the FLSA provides an exemption from both minimum wage and overtime pay for employees employed as bona fide executive, administrative, professional and outside sales employees.

Nonexempt: An individual who is not exempt from the overtime provisions of the FLSA and is therefore entitled to overtime pay for all hours worked beyond 40 in a workweek (as well as any state overtime provisions). Nonexempt employees may be paid on a salary, hourly or other basis.

The second type is for employees (commonly referred to as exempt) whose primary job duties meet the Executive, Administrative or Professional exemptions established in 26 MRS §663 (K). These employees are paid a predetermined fixed amount regardless of the hours worked.

With few exceptions, to be exempt an employee must (a) be paid at least $23,600 per year ($455 per week), and (b) be paid on a salary basis, and also (c) perform exempt job duties. These requirements are outlined in the FLSA Regulations (promulgated by the U.S. Department of Labor).

Overtime can be voluntary (it may be offered or requested by an employer during very busy periods) or compulsory (it can be guaranteed or non-guaranteed). It will depend on the terms and conditions of the contract whether overtime is: voluntary.

Generally, right to overtime pay cannot be waived.