Maine Agreement to Dissolve and Wind Up Partnership with Sale to Partner Assets of a Building and Construction Business

Description

How to fill out Agreement To Dissolve And Wind Up Partnership With Sale To Partner Assets Of A Building And Construction Business?

If you need to finalize, obtain, or print legal document templates, utilize US Legal Forms, the premier collection of legal documents, that are accessible online.

Employ the site’s user-friendly and efficient search to locate the documents you need.

Various templates for business and personal purposes are categorized by type and state, or keywords.

Step 4. Once you have found the form you need, click the Get now button. Choose the pricing plan you prefer and enter your details to register for an account.

Step 5. Complete the transaction. You can use your Visa or Mastercard or PayPal account to make the payment. Step 6. Choose the format of your legal document and download it to your device. Step 7. Fill out, edit, and print or sign the Maine Agreement to Dissolve and Wind Up Partnership with Sale to Partner Assets of a Building and Construction Business.

- Utilize US Legal Forms to find the Maine Agreement to Dissolve and Wind Up Partnership with Sale to Partner Assets of a Building and Construction Business in just a few clicks.

- If you are already a customer of US Legal Forms, Log In to your account and click the Download button to obtain the Maine Agreement to Dissolve and Wind Up Partnership with Sale to Partner Assets of a Building and Construction Business.

- You can also access forms you previously obtained in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions listed below.

- Step 1. Ensure you have selected the form for the correct area/state.

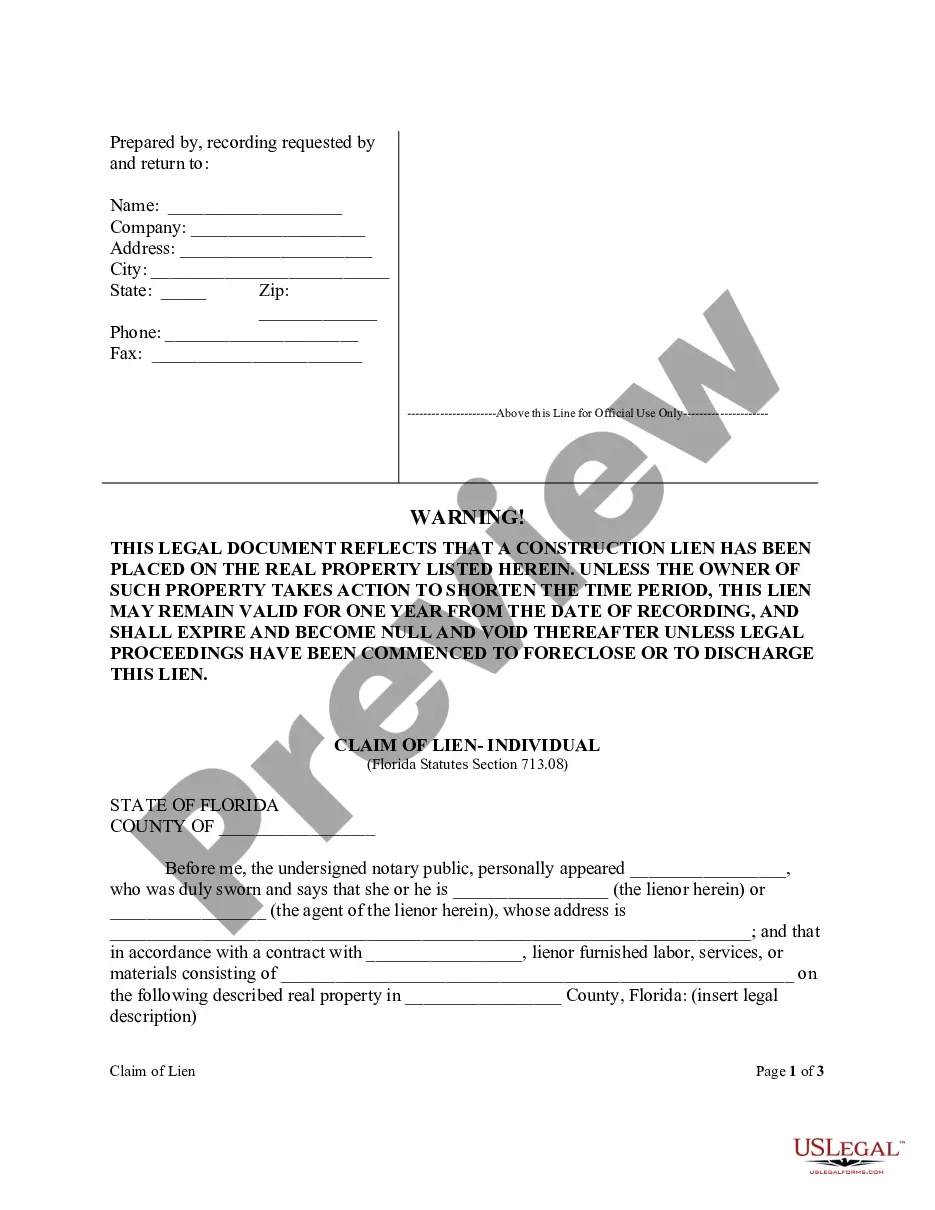

- Step 2. Use the Review feature to preview the form’s content. Don’t forget to read the summary.

- Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find other versions of the legal document template.

Form popularity

FAQ

To wind up a partnership firm, you must first settle the debts and liabilities incurred by the business. After addressing these obligations, partners should distribute any remaining assets according to the partnership agreement or state law. This process might involve drafting a Maine Agreement to Dissolve and Wind Up Partnership with Sale to Partner Assets of a Building and Construction Business to formalize transactions and ensure clarity. Using a professional platform like uslegalforms can simplify this process, providing templates and guidance suited for your specific needs.

The procedure for dissolving a partnership generally starts with reviewing the partnership agreement for specific dissolution terms. Following that, partners should reach a consensus on the decision to dissolve, which is significantly outlined in the Maine Agreement to Dissolve and Wind Up Partnership with Sale to Partner Assets of a Building and Construction Business. Next, liquidating assets, settling debts, and distributing remaining assets should occur in a structured manner. Consulting with a legal expert will help ensure all steps are followed correctly.

Ending a partnership gracefully requires open communication and mutual consent between partners. It’s important to refer to your Maine Agreement to Dissolve and Wind Up Partnership with Sale to Partner Assets of a Building and Construction Business to ensure that you follow the outlined steps. Taking a respectful approach, addressing all outstanding matters, and expressing gratitude can help maintain a positive relationship post-dissolution. Proper documentation and legal support can streamline this entire process.

Upon partnership dissolution, assets are typically distributed according to the terms in the partnership agreement. In your Maine Agreement to Dissolve and Wind Up Partnership with Sale to Partner Assets of a Building and Construction Business, you will find guidance on how assets will be divided among partners based on their contributions. Debts and obligations of the partnership should be settled first, before distributing remaining assets. Engaging a legal professional can help clarify this process.

To remove yourself from a partnership, you can initiate a formal discussion with your partners about your desire to exit. It’s crucial to review the terms outlined in your Maine Agreement to Dissolve and Wind Up Partnership with Sale to Partner Assets of a Building and Construction Business, as it typically includes provisions for withdrawing a partner. After reaching an agreement, you may need to file additional documentation to finalize the process. Consider consulting a legal expert for guidance.

A partnership may be dissolved under various circumstances, including mutual agreement, the withdrawal of a partner, or legal disputes. Other factors, like reaching the partnership's intended purpose, can also trigger dissolution. It’s advisable to refer to the Maine Agreement to Dissolve and Wind Up Partnership with Sale to Partner Assets of a Building and Construction Business for comprehensive guidelines tailored to your situation.

When a partner dissolves a partnership, several outcomes may unfold. The business must settle financial obligations, liquidate assets, and possibly distribute remaining profits among the partners. By using the Maine Agreement to Dissolve and Wind Up Partnership with Sale to Partner Assets of a Building and Construction Business, you can navigate this process efficiently and minimize conflicts.

To dissolve a partnership agreement, you should follow the steps defined in your partnership contract. Typically, this includes notifying all partners, settling any debts, and distributing the partnership's remaining assets. Using a Maine Agreement to Dissolve and Wind Up Partnership with Sale to Partner Assets of a Building and Construction Business simplifies the legal aspects and ensures compliance with state laws.

Yes, a partner has the legal right to dissolve a partnership, depending on the terms set forth in the partnership agreement. Utilizing the Maine Agreement to Dissolve and Wind Up Partnership with Sale to Partner Assets of a Building and Construction Business can provide clarity on this process. It’s essential for partners to communicate openly and seek a resolution that protects everyone's interests.

When one partner wishes to leave the partnership, it can initiate a series of legal and financial adjustments. According to the Maine Agreement to Dissolve and Wind Up Partnership with Sale to Partner Assets of a Building and Construction Business, the remaining partners may need to buy out the leaving partner’s interest. This ensures fair compensation while maintaining business continuity.