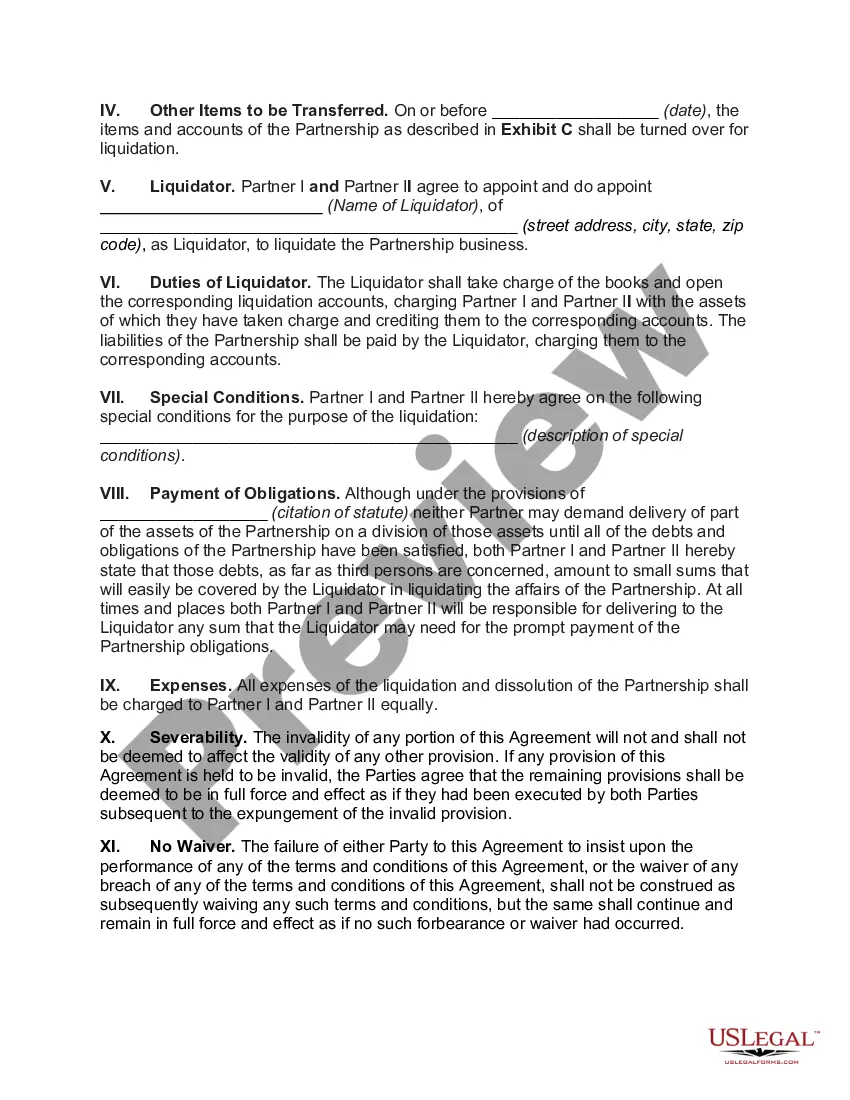

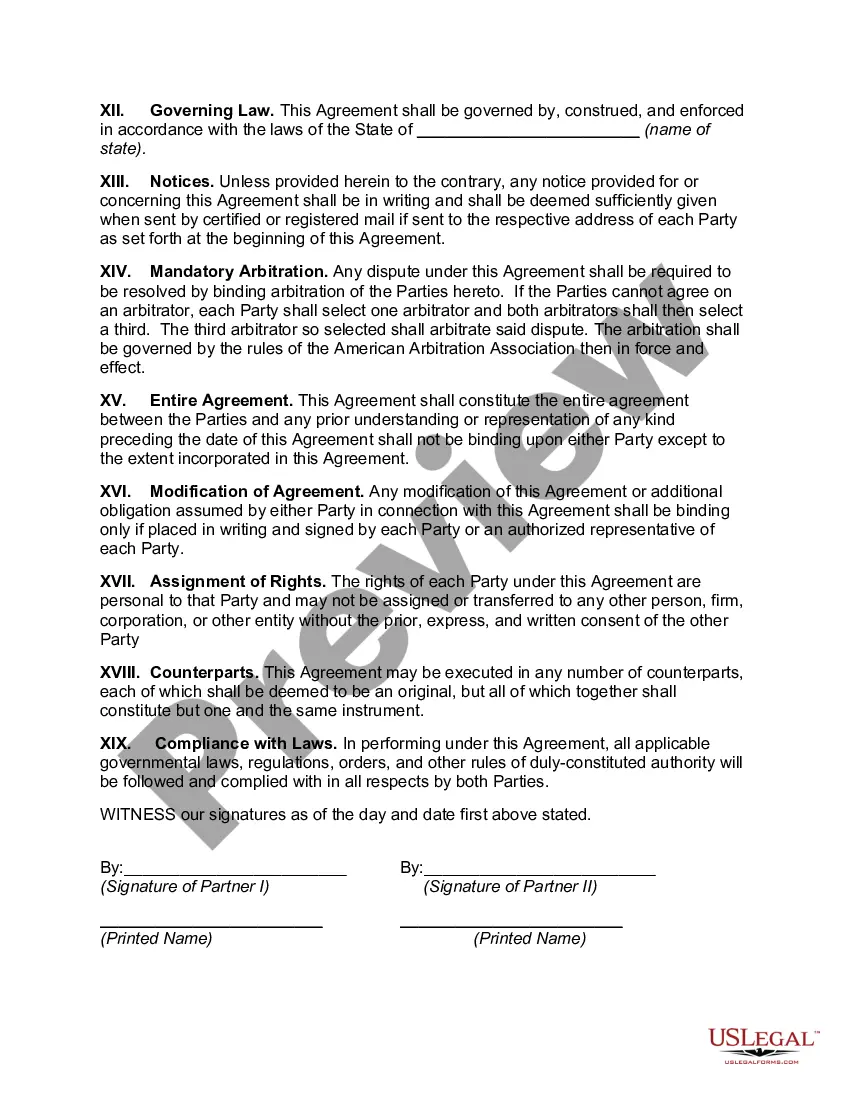

Maine Agreement to Dissolve and Wind up Partnership with Division of Assets between Partners

Description

How to fill out Agreement To Dissolve And Wind Up Partnership With Division Of Assets Between Partners?

You can devote effort on the internet attempting to locate the authentic document template that satisfies the state and federal requirements you need.

US Legal Forms provides thousands of authentic forms that have been evaluated by experts. You can easily acquire or print the Maine Agreement to Dissolve and Wind up Partnership with Division of Assets between Partners from the service.

If you already possess a US Legal Forms account, you may Log In and select the Download option. Subsequently, you may complete, modify, print, or sign the Maine Agreement to Dissolve and Wind up Partnership with Division of Assets between Partners.

Once you have found the template you desire, click on Get now to continue. Choose the payment plan you prefer, enter your details, and register for an account on US Legal Forms. Complete the purchase. You may use your Visa, Mastercard, or PayPal account to pay for the authentic form. Select the file format of the document and download it to your system. Make modifications to your document as necessary. You can complete, edit, sign, and print the Maine Agreement to Dissolve and Wind up Partnership with Division of Assets between Partners. Download and print countless document templates using the US Legal Forms website, which offers the largest variety of authentic forms. Utilize professional and state-specific templates to meet your business or personal requirements.

- Each authentic document template you obtain is yours permanently.

- To obtain another copy of the purchased form, navigate to the My documents tab and select the appropriate option.

- If you are using the US Legal Forms website for the first time, adhere to the straightforward instructions provided below.

- First, confirm that you have selected the correct document template for the state/city of your preference.

- Review the form summary to ensure you have chosen the accurate form.

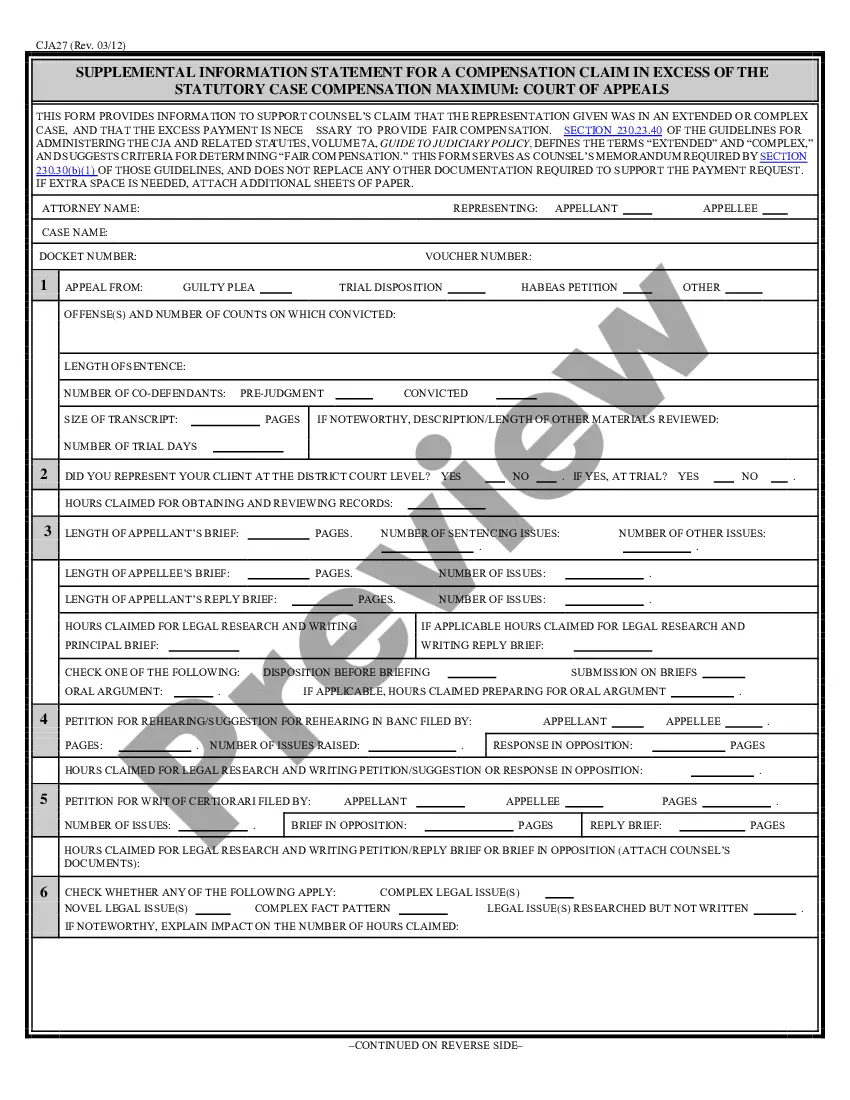

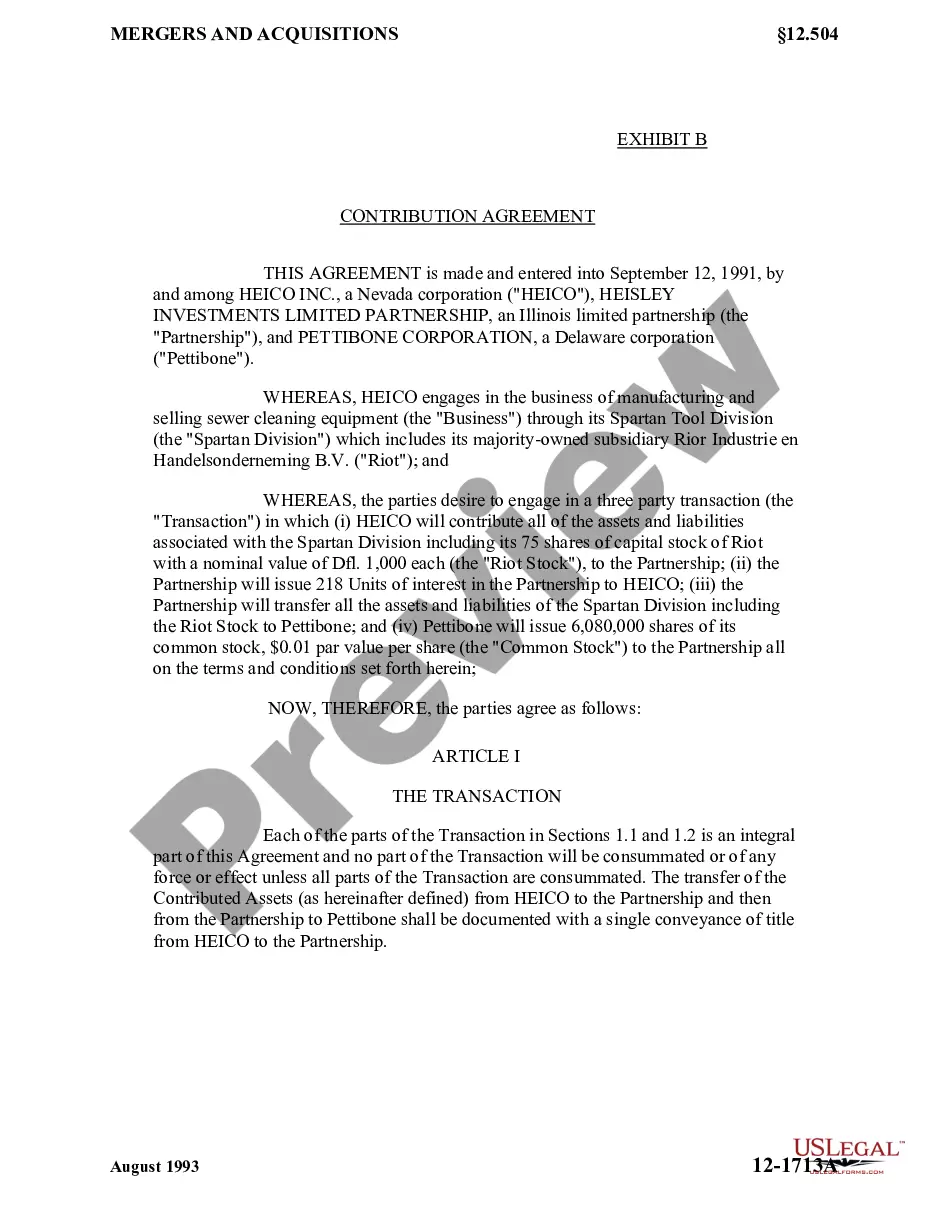

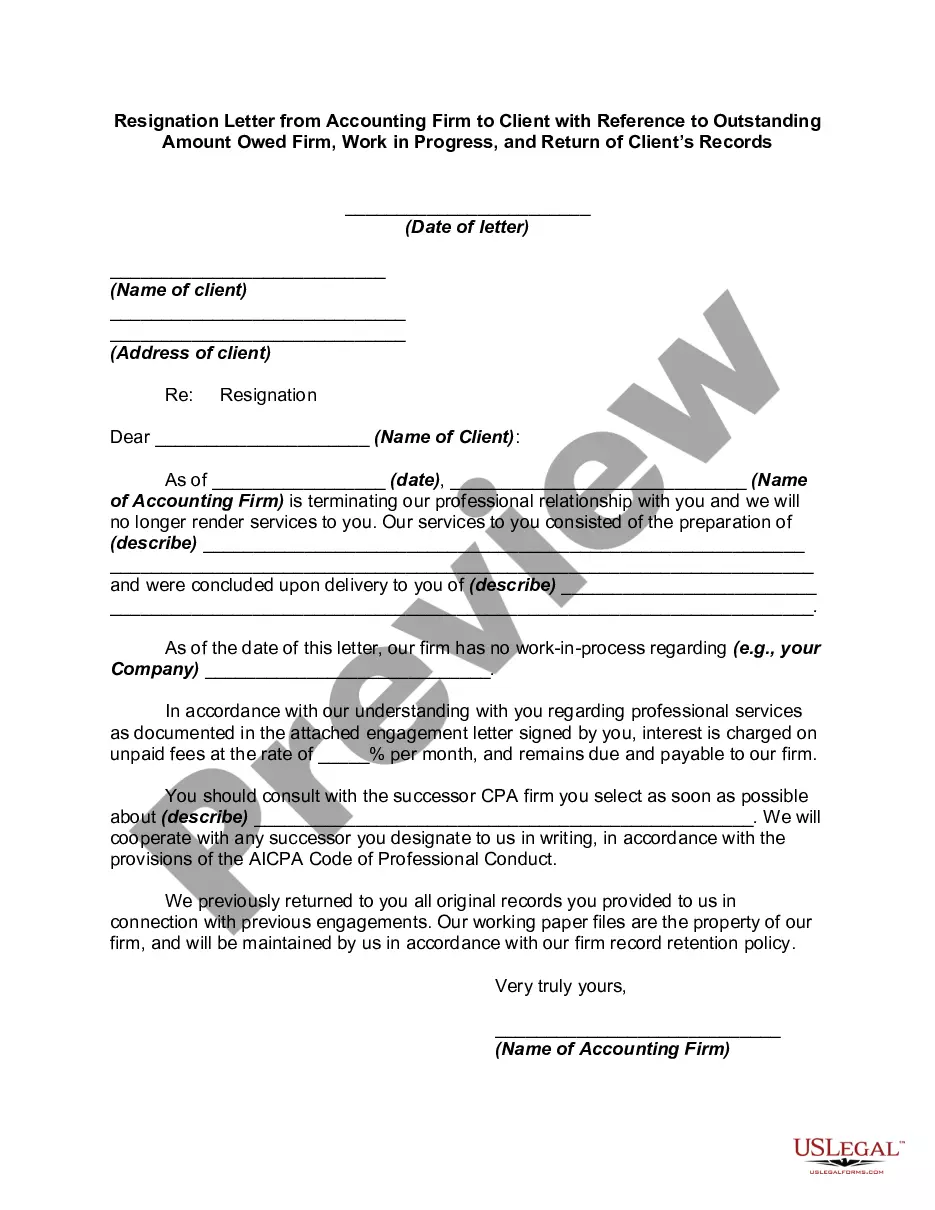

- If available, utilize the Preview option to examine the document template as well.

- To find another version of the form, utilize the Search field to obtain the template that suits your needs.

Form popularity

FAQ

A partnership may be dissolved under several circumstances, such as mutual agreement among partners, the expiration of the partnership term, or significant changes in partnership conditions. Additionally, the death or bankruptcy of a partner can trigger dissolution. It’s crucial to follow the procedures outlined in your Maine Agreement to Dissolve and Wind up Partnership with Division of Assets between Partners to ensure a smooth transition.

If dissolution is not covered in the partnership agreement, the partners can later create a separate dissolution agreement for that purpose. However, the default rule is that any remaining money or property will be distributed to each partner according to their ownership interest in the partnership.

Typically, state law provides that the partnership must first pay partners according to their share of capital contributions (the investments in the partnership), and then distribute any remaining assets equally.

Any remaining assets are then divided among the remaining partners in accordance with their respective share of partnership profits. Under the RUPA, creditors are paid first, including any partners who are also creditors.

If dissolution is not covered in the partnership agreement, the partners can later create a separate dissolution agreement for that purpose. However, the default rule is that any remaining money or property will be distributed to each partner according to their ownership interest in the partnership.

Once the debts owed to all creditors are satisfied, the partnership property will be distributed to each partner according to their ownership interest in the partnership. If there was a partnership agreement, then that document controls the distribution.

Removing a partner from a general partnership is the act of removing someone from your business that operates as a partnership. It can happen in several different ways, but the most common option is through a clause in the partnership agreement itself.

The liquidation or dissolution process for partnerships is similar to the liquidation process for corporations. Over a period of time, the partnership's non-cash assets are converted to cash, creditors are paid to the extent possible, and remaining funds, if any, are distributed to the partners.