Maine Agreement to Dissolve and Wind up Partnership with Sale to Partner and Disproportionate Distribution of Assets

Description

How to fill out Agreement To Dissolve And Wind Up Partnership With Sale To Partner And Disproportionate Distribution Of Assets?

Selecting the appropriate authorized document template can be a challenge.

Of course, there are numerous templates accessible online, but how can you find the legal form you require.

Utilize the US Legal Forms website. The platform offers thousands of templates, including the Maine Agreement to Dissolve and Wind Up Partnership with Sale to Partner and Disproportionate Distribution of Assets, which you can use for both business and personal needs.

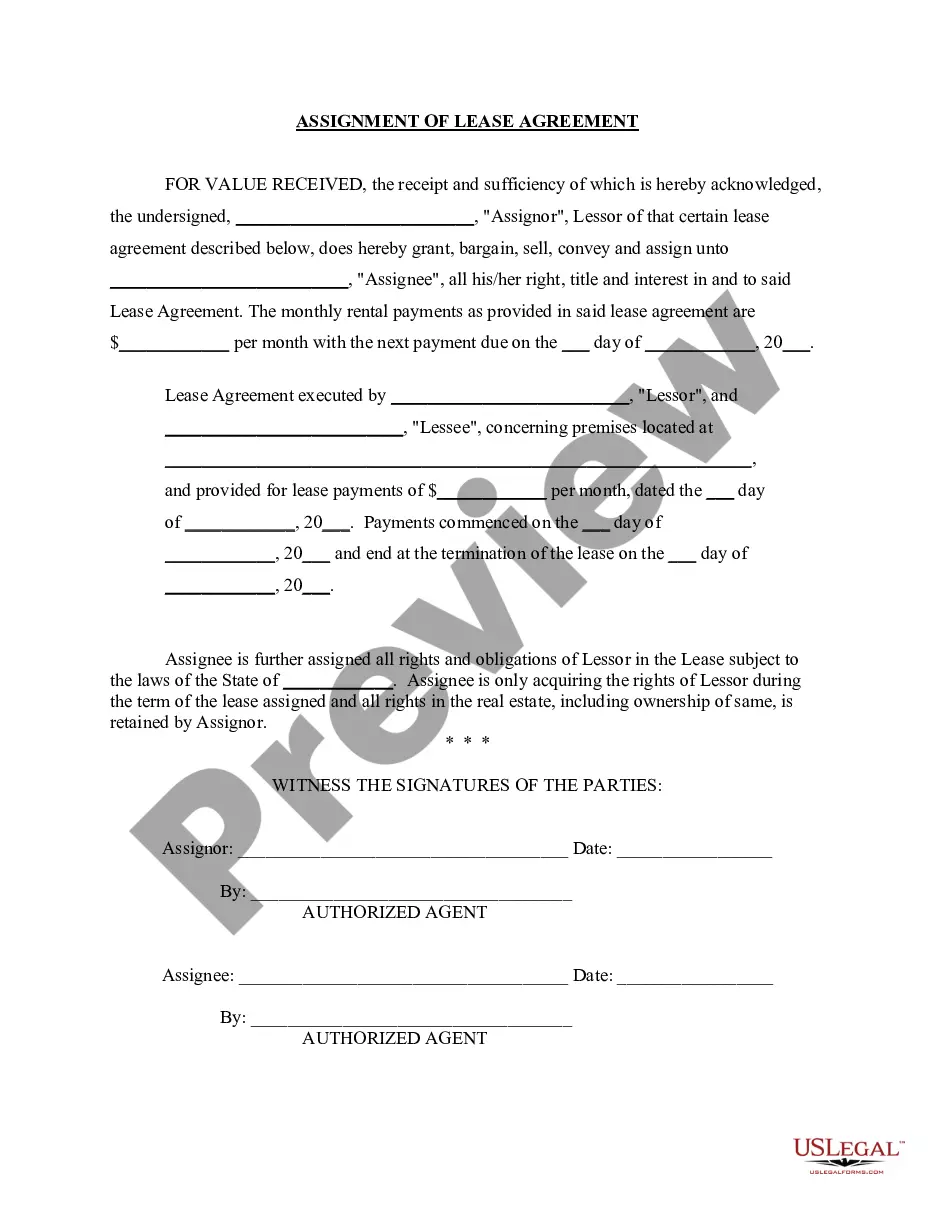

You can review the form using the Preview button and read the form description to confirm it is suitable for you.

- All forms are reviewed by professionals and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Download button to get the Maine Agreement to Dissolve and Wind Up Partnership with Sale to Partner and Disproportionate Distribution of Assets.

- Use your account to browse the legal forms you have previously purchased.

- Visit the My documents tab in your account and obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple guidelines for you to follow.

- First, ensure you have selected the correct form for your city/state.

Form popularity

FAQ

Dissolution can occur due to several conditions, including reaching the end date specified in the partnership agreement, a partner's withdrawal, or a mutual decision by the partners. Additionally, the Maine Agreement to Dissolve and Wind up Partnership with Sale to Partner and Disproportionate Distribution of Assets outlines various conditions for dissolution. It's essential to review your agreement and state laws to fully understand your options.

If dissolution is not covered in the partnership agreement, the partners can later create a separate dissolution agreement for that purpose. However, the default rule is that any remaining money or property will be distributed to each partner according to their ownership interest in the partnership.

To dissolve an LLC in Maine, simply follow these three steps: Follow the Operating Agreement. Close Your Business Tax Accounts....Step 1: Follow Your Maine LLC Operating Agreement.Step 2: Close Your Business Tax Accounts.Step 3: File Articles of Dissolution.08-Dec-2021

Section 39 of the Indian Partnership Act 1932 states that the dissolution of partnership firm among all the partners of the partnership firm is the Dissolution of the Partnership Firm. The dissolution of partnership firm ceases the existence of the organization.

The liquidation or dissolution process for partnerships is similar to the liquidation process for corporations. Over a period of time, the partnership's non-cash assets are converted to cash, creditors are paid to the extent possible, and remaining funds, if any, are distributed to the partners.

Typically, state law provides that the partnership must first pay partners according to their share of capital contributions (the investments in the partnership), and then distribute any remaining assets equally.

Section 37 of the UPA provides that unless otherwise agreed, the partners who have not wrongfully dissolved the partnership or the legal representative of the last surviving solvent partner have the right to wind up the partnership affairs, provided, however, that any partner, his legal representative, or his assignee

These, according to , are the five steps to take when dissolving your partnership:Review Your Partnership Agreement.Discuss the Decision to Dissolve With Your Partner(s).File a Dissolution Form.Notify Others.Settle and close out all accounts.

How to Dissolve a PartnershipReview and Follow Your Partnership Agreement.Vote on Dissolution and Document Your Decision.Send Notifications and Cancel Business Registrations.Pay Outstanding Debts, Liquidate, and Distribute Assets.File Final Tax Return and Cancel Tax Accounts.Limiting Your Future Liability.

Any remaining assets are then divided among the remaining partners in accordance with their respective share of partnership profits. Under the RUPA, creditors are paid first, including any partners who are also creditors.