Maine Liquidation of Partnership with Sale and Proportional Distribution of Assets

Description

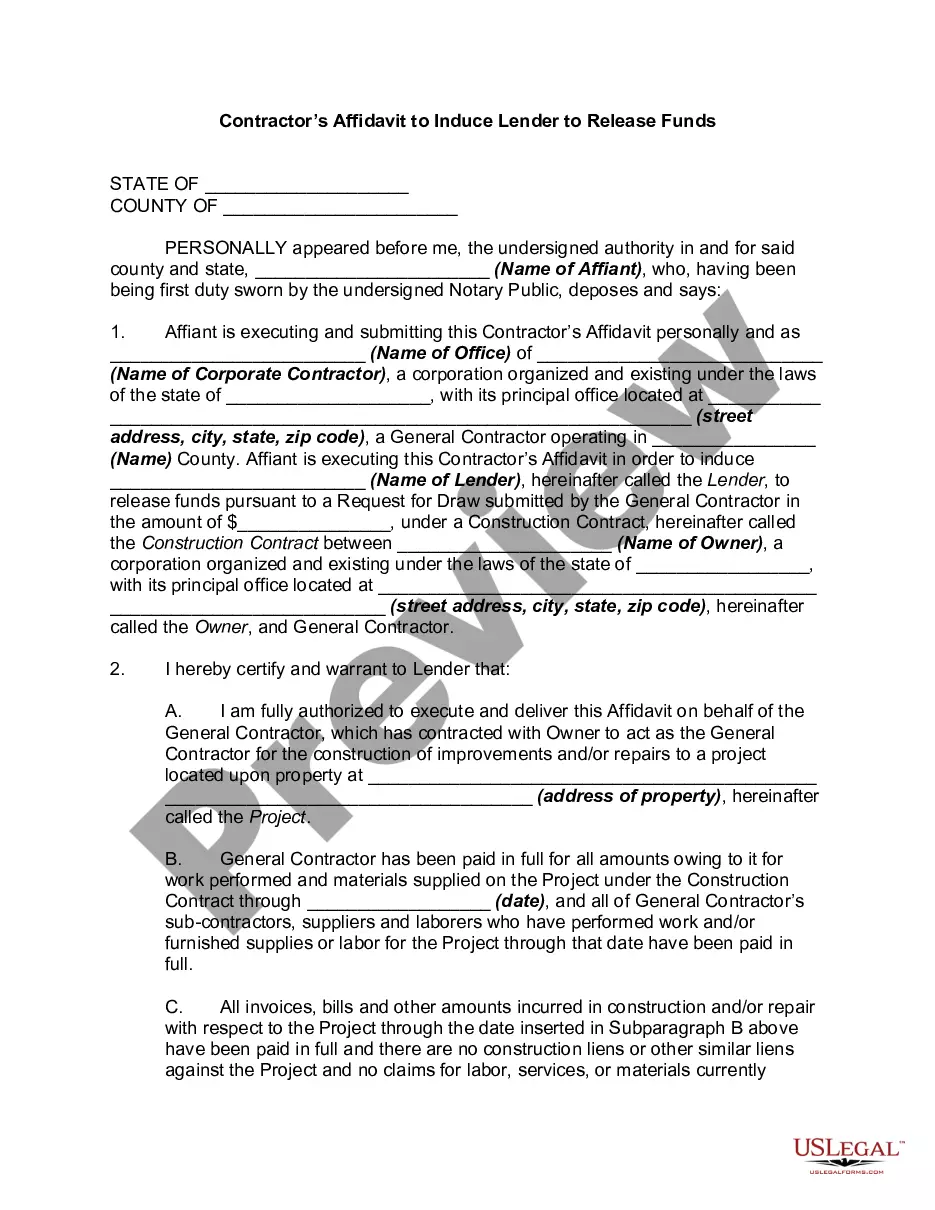

How to fill out Liquidation Of Partnership With Sale And Proportional Distribution Of Assets?

You are capable of spending numerous hours online looking for the sanctioned document template that meets the state and federal requirements you need.

US Legal Forms offers a vast array of legal templates which can be examined by experts.

You can download or print the Maine Liquidation of Partnership with Sale and Proportional Distribution of Assets from the service.

If available, utilize the Review option to preview the document template as well.

- If you already have an account with US Legal Forms, you can Log In and select the Obtain option.

- After that, you can complete, modify, print, or sign the Maine Liquidation of Partnership with Sale and Proportional Distribution of Assets.

- Each legal document template you acquire is yours indefinitely.

- To obtain another copy of any purchased form, navigate to the My documents tab and select the appropriate option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document template for the region/city of your preference.

- Review the form details to confirm you have selected the right template.

Form popularity

FAQ

Upon dissolution, assets should generally be distributed in the following order: first, settle outstanding debts, then distribute any remaining assets to partners based on their respective ownership percentages. During the Maine Liquidation of Partnership with Sale and Proportional Distribution of Assets, following this sequence ensures fairness and compliance with legal requirements.

The Voluntary Strike off and Dissolution of an LLP If the LLP is struck off with outstanding debts then creditors and other parties can apply for the business to be restored to the register so they can take action to recover the money they are owed.

Once the debts owed to all creditors are satisfied, the partnership property will be distributed to each partner according to their ownership interest in the partnership. If there was a partnership agreement, then that document controls the distribution.

Liquidating distributions (cash or noncash) are a form of a return of capital. Any liquidating distribution you receive is not taxable to you until you recover the basis of your stock. After the basis of your stock is reduced to zero, you must report the liquidating distribution as a capital gain.

If a company goes into liquidation, all of its assets are distributed to its creditors. Secured creditors are first in line. Next are unsecured creditors, including employees who are owed money. Stockholders are paid last.

What is the partner's basis in property received in liquidation of his interest? When a partnership distributes property in a liquidating distribution, the recipient partner's outside basis reduced by any amount of cash included in the distribution is allocated to the distributed property.

Property Distributions. When property is distributed to a partner, then the partnership must treat it as a sale at fair market value ( FMV ). The partner's capital account is decreased by the FMV of the property distributed. The book gain or loss on the constructive sale is apportioned to each of the partners' accounts

Upon the winding up of a limited partnership, the assets shall be distributed as follows: (1) To creditors, including partners who are creditors, to the extent permitted by law, in satisfaction of liabilities of the limited partnership other than liabilities for distributions to partners under section 34-20d or 34-27d;

Only partners who receive a liquidating distribution of cash may have an immediate taxable gain or loss to report. The value of marketable securities, such as stock investments that are traded on a public stock exchange, and decreases to your share of the partnership's debt are both treated as cash distributions.

When a partnership dissolves, the individuals involved are no longer partners in a legal sense, but the partnership continues until the business's debts are settled, the legal existence of the business is terminated and the remaining assets of the company have been distributed.