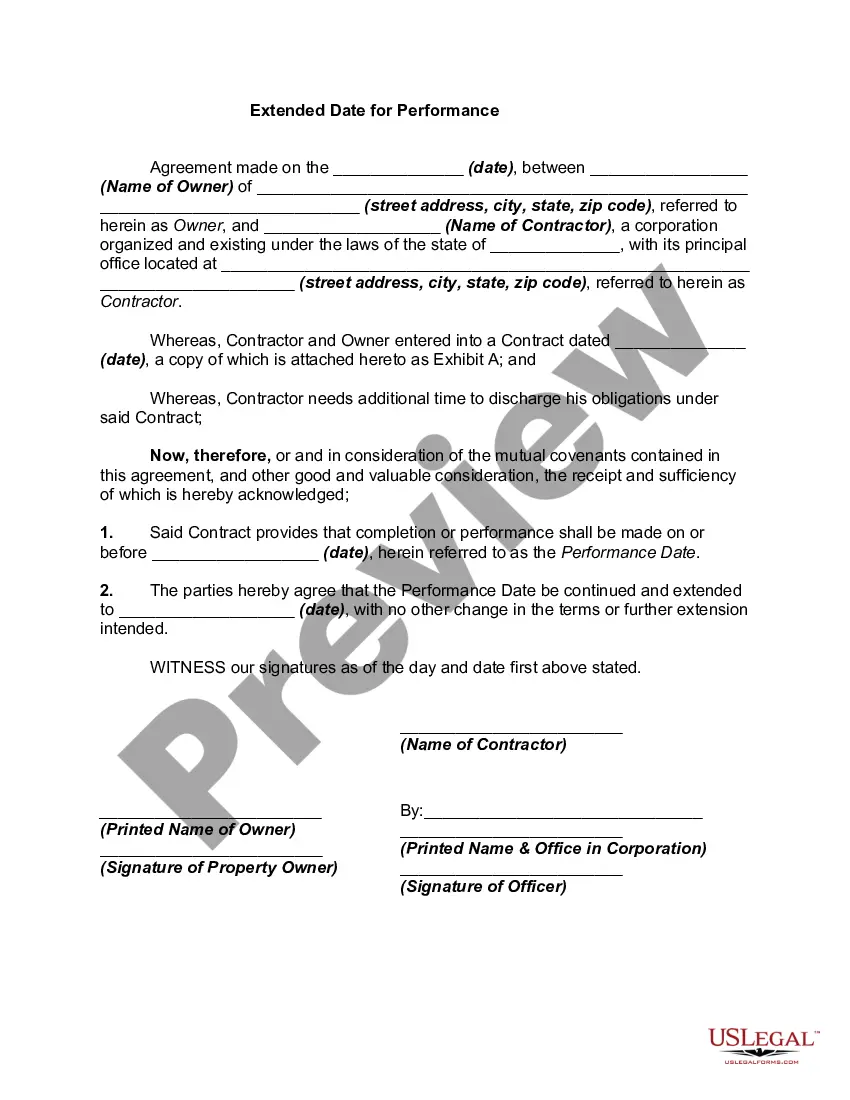

Maine Extended Date for Performance

Description

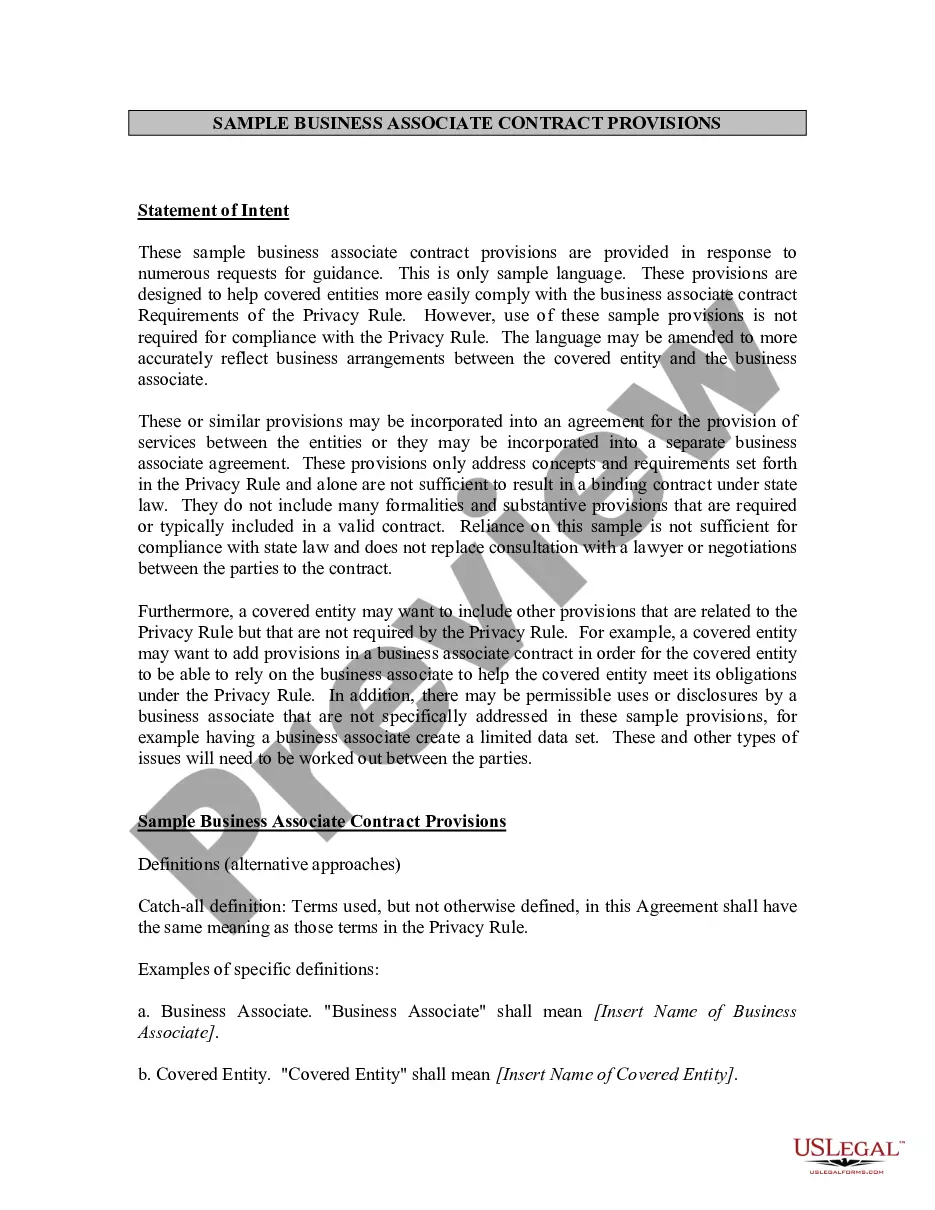

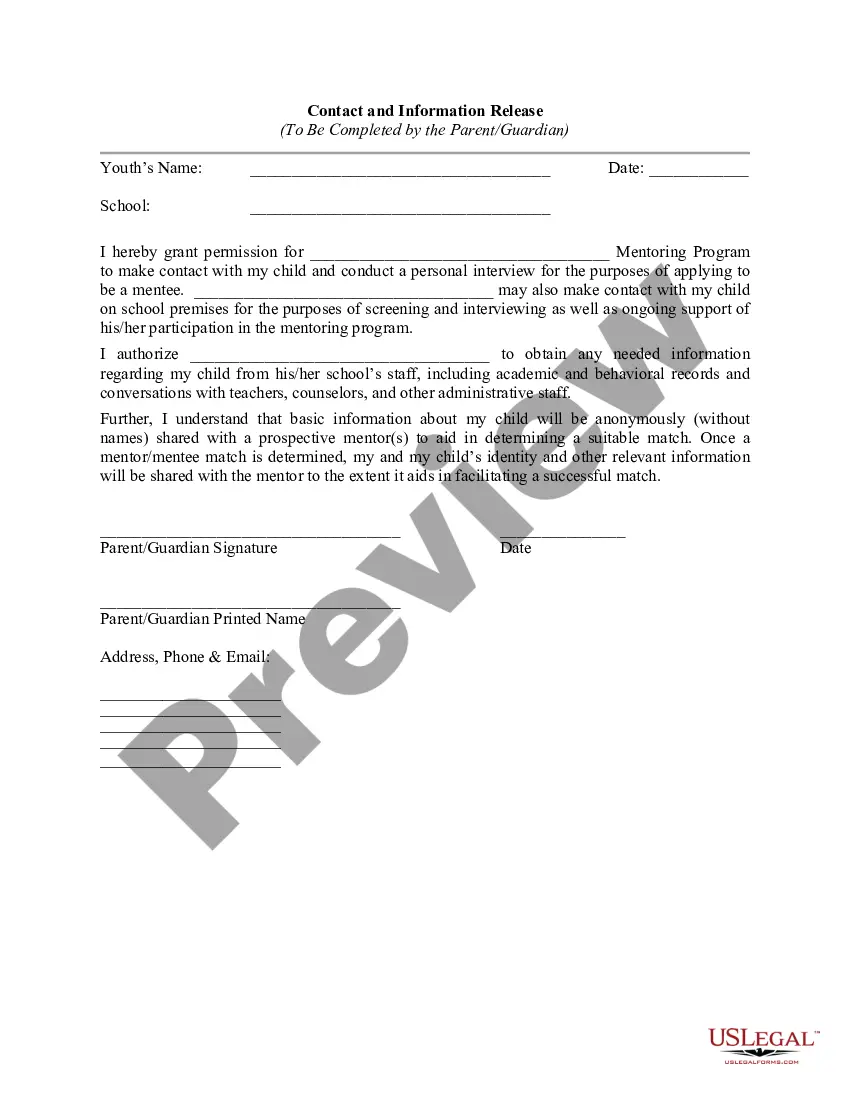

How to fill out Extended Date For Performance?

If you wish to acquire, retrieve, or produce authentic document templates, utilize US Legal Forms, the largest selection of legal forms accessible online.

Employ the website's straightforward and convenient search feature to find the documents you require.

A variety of templates for business and personal purposes are organized by categories and states, or keywords.

Each legal document template you download is yours permanently. You have access to every form you saved within your account. Visit the My documents section and select a form to print or download again.

Be proactive and retrieve, then print the Maine Extended Date for Performance with US Legal Forms. There are thousands of professional and state-specific forms you can use for your business or personal needs.

- Use US Legal Forms to obtain the Maine Extended Date for Performance with just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click the Download button to retrieve the Maine Extended Date for Performance.

- You can also access forms you previously saved from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Make sure you have selected the form for your specific city/state.

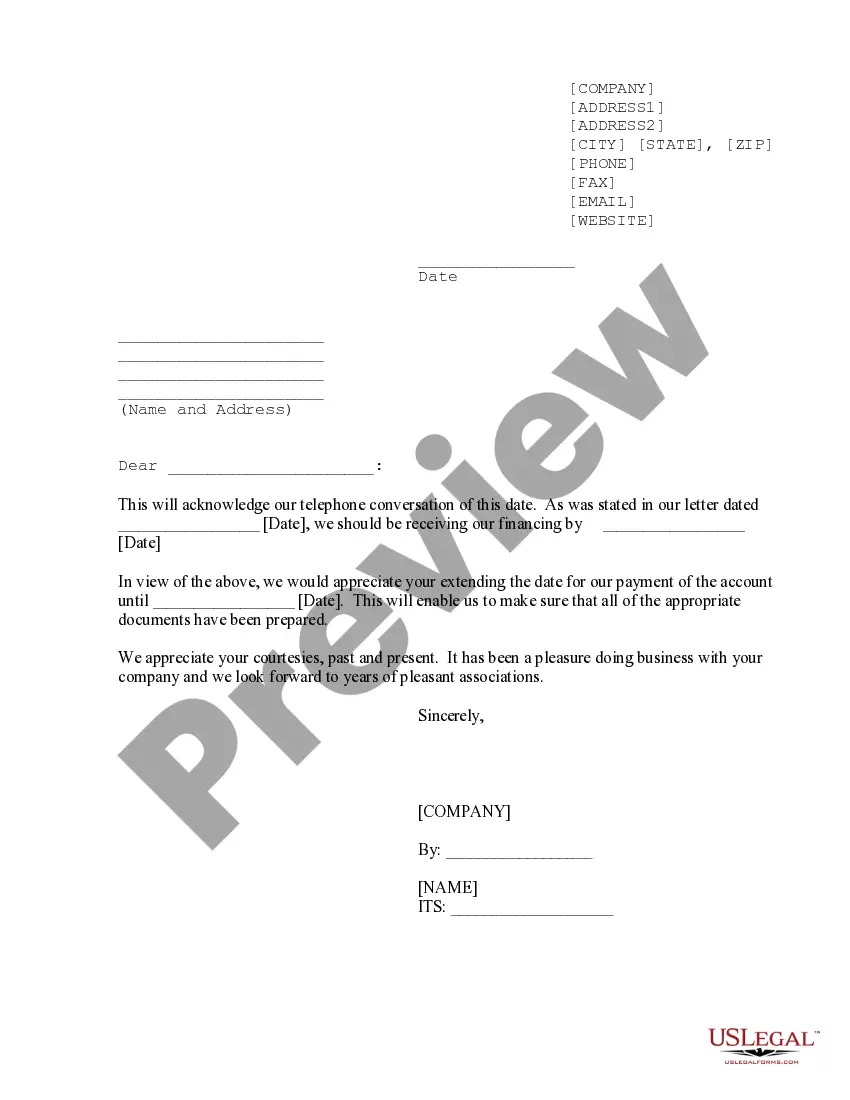

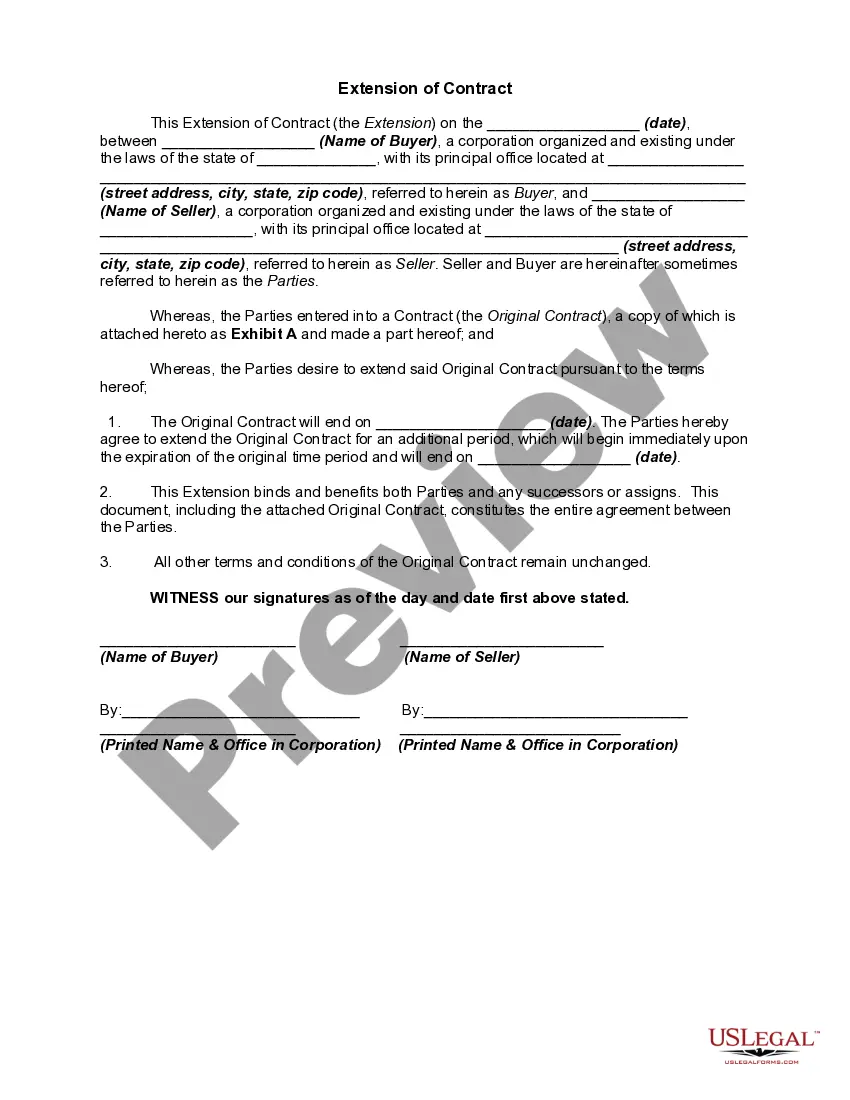

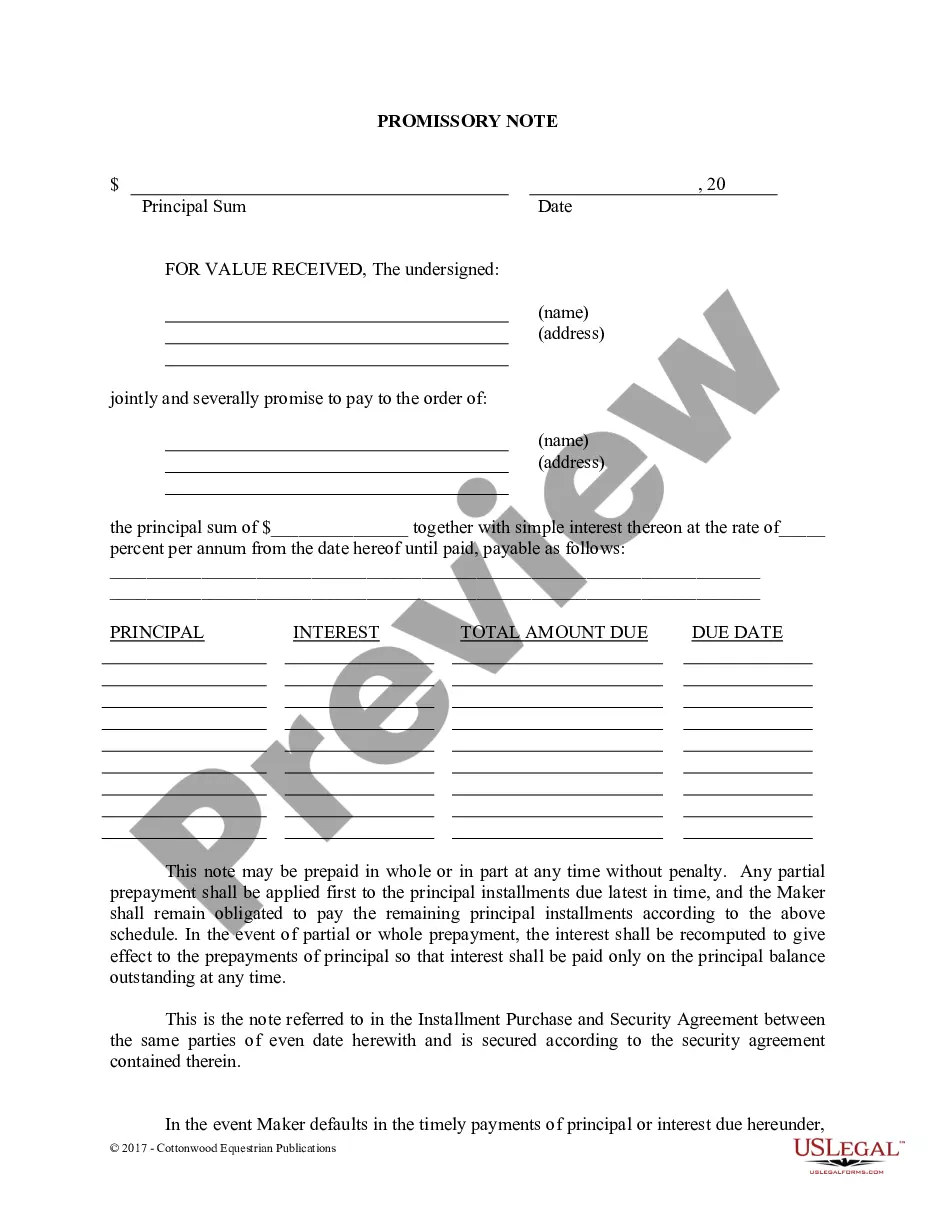

- Step 2. Use the Preview option to review the form's content. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have located the necessary form, click on the Get now button. Select the pricing plan you prefer and provide your details to create an account.

- Step 5. Complete the transaction. You can use your Visa or MasterCard or PayPal account to finalize the purchase.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Maine Extended Date for Performance.

Form popularity

FAQ

Asking for an extension after the deadline typically requires you to file your tax return late along with an explanation for the delay. While the Maine Extended Date for Performance may offer options, addressing your situation quickly is key to minimizing penalties. Platforms like US Legal Forms are helpful for understanding your rights and responsibilities in these cases.

To file an extension in Maine, you must submit a specific form with the necessary information, including your estimated tax liability. The Maine Extended Date for Performance provides a simple way to extend your filing period. Utilizing resources like US Legal Forms makes it easier to find the correct forms and instructions for a seamless extension.

Filing an extension after the deadline can be challenging, but you can still submit your return as soon as possible. Ensure you understand the potential penalties associated with a late extension request. For a smoother experience, US Legal Forms offers templates and information to help you properly navigate this process.

Filing taxes late without an extension can lead to penalties and interest on any taxes due. The Maine Extended Date for Performance does not apply in such instances, which may complicate your tax situation. To navigate these challenges, consider consulting platforms like US Legal Forms that provide valuable resources for managing late tax filings.

If you miss the deadline to file an extension, you may still be able to submit your tax return, but expect penalties. The state of Maine has specific guidelines related to late filings, which are important to understand. Utilizing services like US Legal Forms can help clarify your options and ensure compliance with state tax laws.

Yes, you can still request an extension on your taxes even after the filing deadline, but it may come with penalties and interest. The Maine Extended Date for Performance allows you to enjoy additional time for filing, but you should act promptly to minimize costs. Consider using resources like US Legal Forms for guidance on managing your tax paperwork effectively.

If you forgot to file your state taxes, don’t panic. You should file your tax return as soon as you remember, as this demonstrates your intention to comply with tax laws. Check if you qualify for the Maine Extended Date for Performance, which might ease some penalties. Additionally, using uslegalforms can provide you with the necessary forms and guidance, making the process smoother and more manageable.

If you miss the tax deadline in Maine, you may face penalties, but you still can take steps to rectify the situation. The Maine Extended Date for Performance might give you some leeway, allowing you to file without facing additional penalties in certain circumstances. You must act quickly, as tax authorities often expect you to submit your tax return and payment promptly. Utilizing resources like uslegalforms can help you navigate this issue effectively.

Maine Schedule NRH, or Non-Resident Homestead, is a form that non-residents use to claim a credit for property taxes. This schedule helps eligible taxpayers benefit from available tax privileges, even if they live outside of Maine. If you need assistance with this process, consider using the services provided by uslegalforms. They can guide you through filing accurately while adhering to the Maine Extended Date for Performance.

If you file your state taxes late in Maine, you may face penalties and interest on the unpaid balance. The Maine Extended Date for Performance can sometimes provide additional time, but it is crucial to understand the deadlines. Keep in mind that filing late may affect your eligibility for refunds or credits. It’s always recommended to file as soon as possible to minimize any potential consequences.