Maine Line of Credit Promissory Note

Description

How to fill out Line Of Credit Promissory Note?

It is possible to spend several hours on the web attempting to find the legitimate papers design which fits the federal and state requirements you require. US Legal Forms offers a huge number of legitimate types which can be examined by pros. It is possible to acquire or print out the Maine Line of Credit Promissory Note from the service.

If you have a US Legal Forms account, you are able to log in and click the Download option. Next, you are able to complete, modify, print out, or indication the Maine Line of Credit Promissory Note. Every single legitimate papers design you purchase is yours eternally. To acquire another copy for any bought develop, visit the My Forms tab and click the related option.

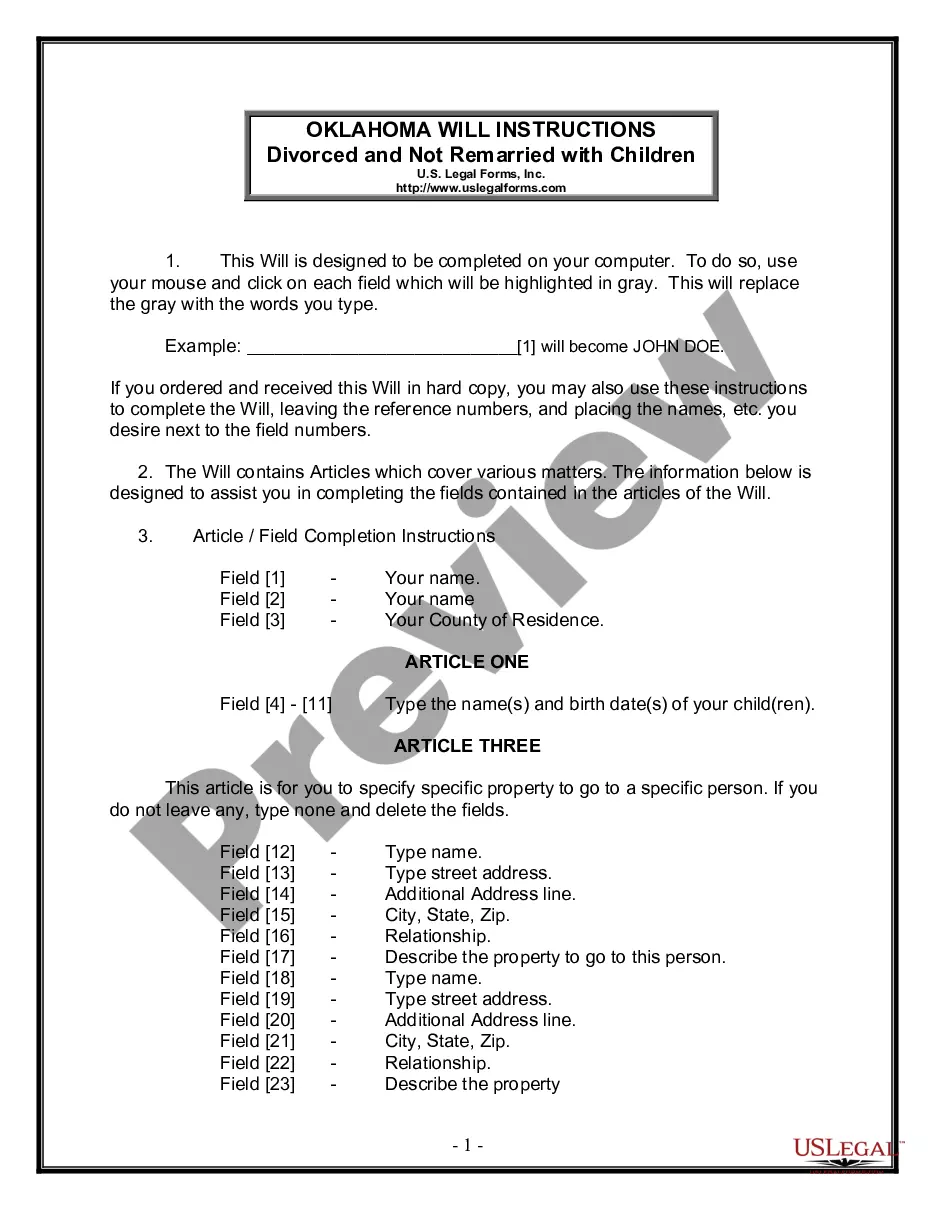

If you are using the US Legal Forms site initially, keep to the basic directions beneath:

- Initially, make certain you have chosen the correct papers design for that state/city of your choice. See the develop explanation to ensure you have chosen the proper develop. If readily available, make use of the Preview option to look with the papers design as well.

- If you wish to locate another model from the develop, make use of the Lookup discipline to find the design that meets your requirements and requirements.

- Upon having located the design you would like, simply click Acquire now to move forward.

- Select the prices plan you would like, key in your qualifications, and register for a merchant account on US Legal Forms.

- Total the financial transaction. You should use your charge card or PayPal account to cover the legitimate develop.

- Select the file format from the papers and acquire it to your device.

- Make modifications to your papers if necessary. It is possible to complete, modify and indication and print out Maine Line of Credit Promissory Note.

Download and print out a huge number of papers themes utilizing the US Legal Forms web site, that provides the most important collection of legitimate types. Use expert and state-specific themes to handle your small business or specific demands.

Form popularity

FAQ

What is a HELOC note? It's a promissory note, which creates a legal agreement obligating a borrower to repay a debt to a lender. Signing off on a HELOC promissory note conveys responsibilities to you as the borrower and extends rights to the lender. Both are important if you're considering a home equity line of credit.

A promissory note is a key piece of a home loan application and mortgage agreement. It ensures that a borrower agrees to be indebted to a lender for loan repayment. Ultimately, it serves as a necessary piece of the legal puzzle that helps guarantee that sums are repaid in full and in a timely fashion.

Although it's a legal document, writing a promissory note doesn't have to be difficult. There are even websites online that offer fill-in-the-blank templates, like eForms or .

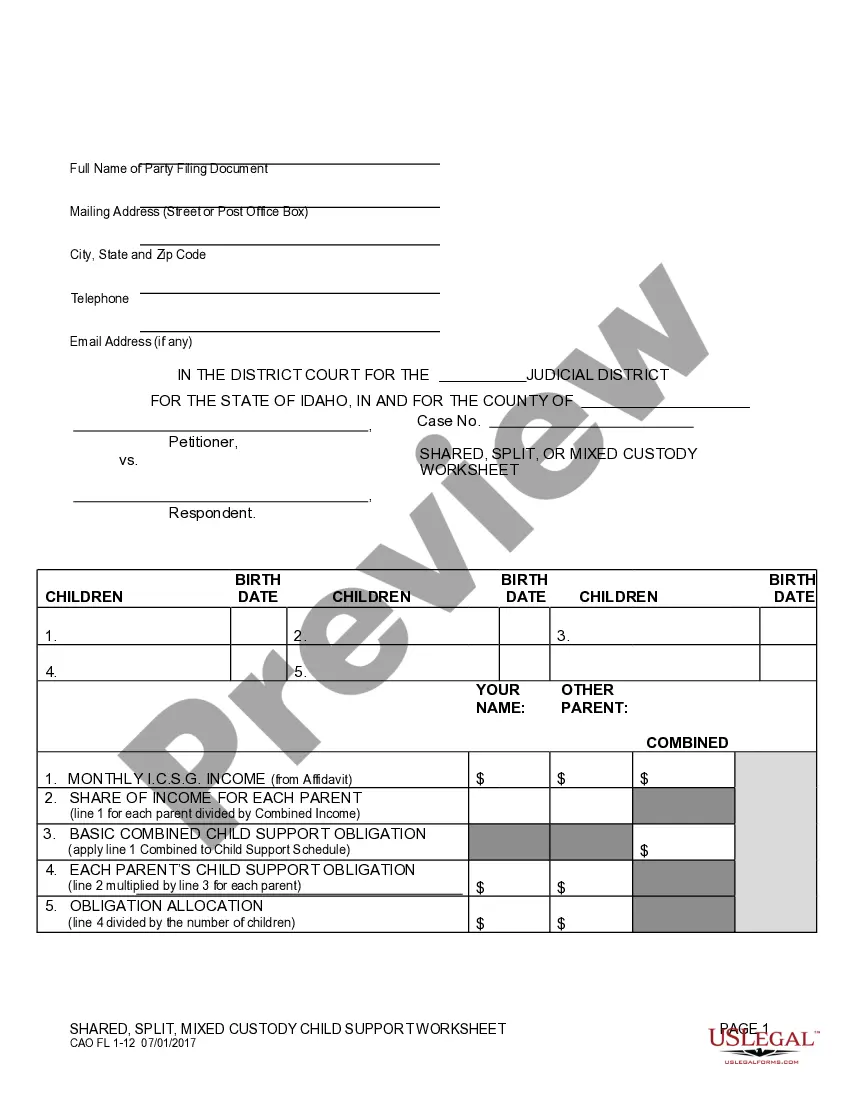

(sc.Default) A form of promissory note to be used to evidence advances under an uncommitted line of credit when the lender uses a line of credit ...

Rule #5 - In order to pay off the debt, or what is called "discharging the debt"; all one has to do is write/ (or create) your own certified promissory note (a negotiable instrument under Uniform Commercial Code (UCC) Section 3- 104 paragraph (e)), with your signature on the promissory note in the amount of the ...

Promissory notes may also be referred to as an IOU, a loan agreement, or just a note. It's a legal lending document that says the borrower promises to repay to the lender a certain amount of money in a certain time frame. This kind of document is legally enforceable and creates a legal obligation to repay the loan.

A form of promissory note to be used to evidence advances under an uncommitted line of credit when the lender uses a line of credit confirmation letter instead of a separate line of credit agreement and the parties are not contemplating a negotiable instrument.

A promissory note is a written and signed promise to repay a sum of money in exchange for a loan or other financing. A promissory note typically contains all the terms involved, such as the principal debt amount, interest rate, maturity date, payment schedule, the date and place of issuance, and the issuer's signature.