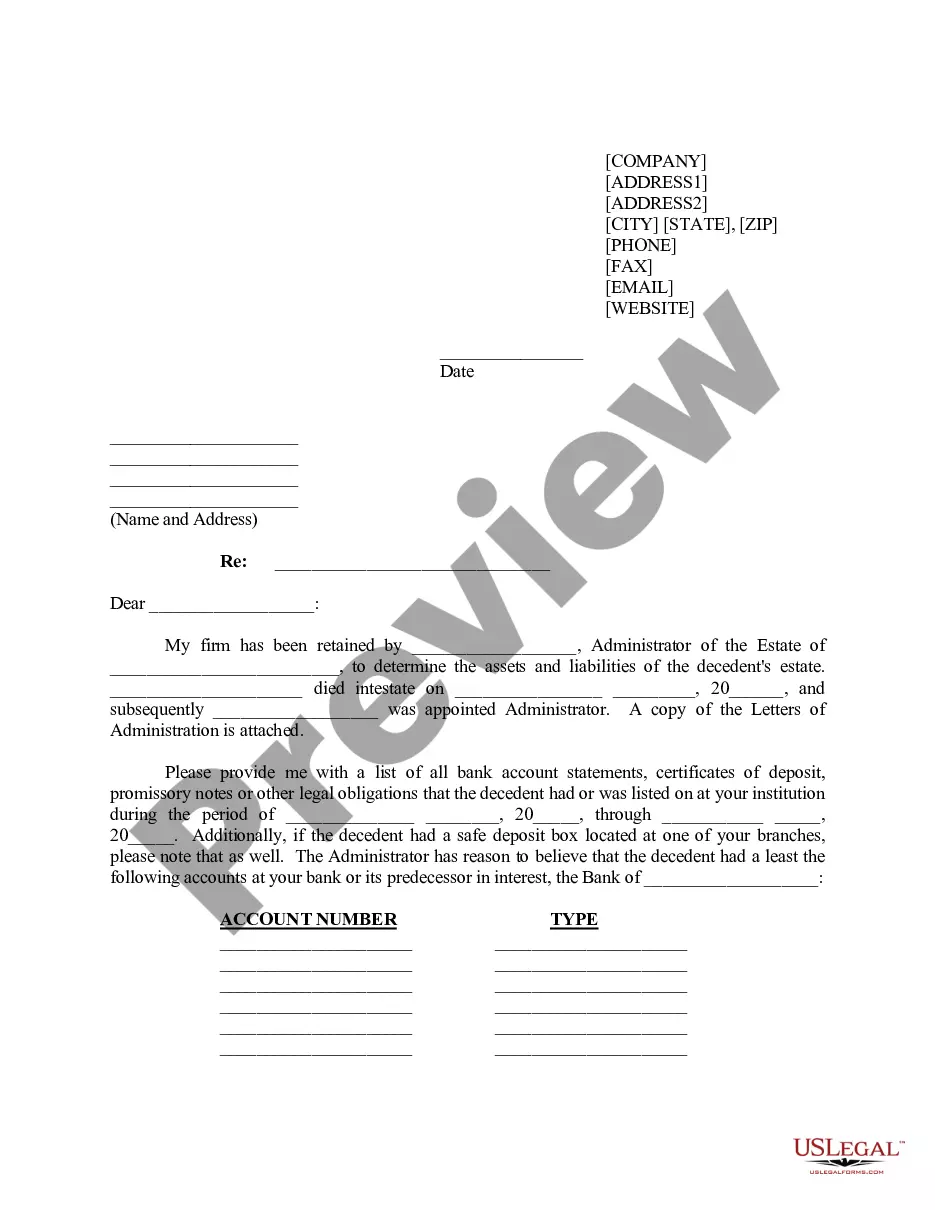

This form anticipates that a decedent left a will directing that all assets in a certain investment account be transferred to a trust. This form is a sample request to the investment firm from the trustee/executor for the assets.

Maine Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent

Description

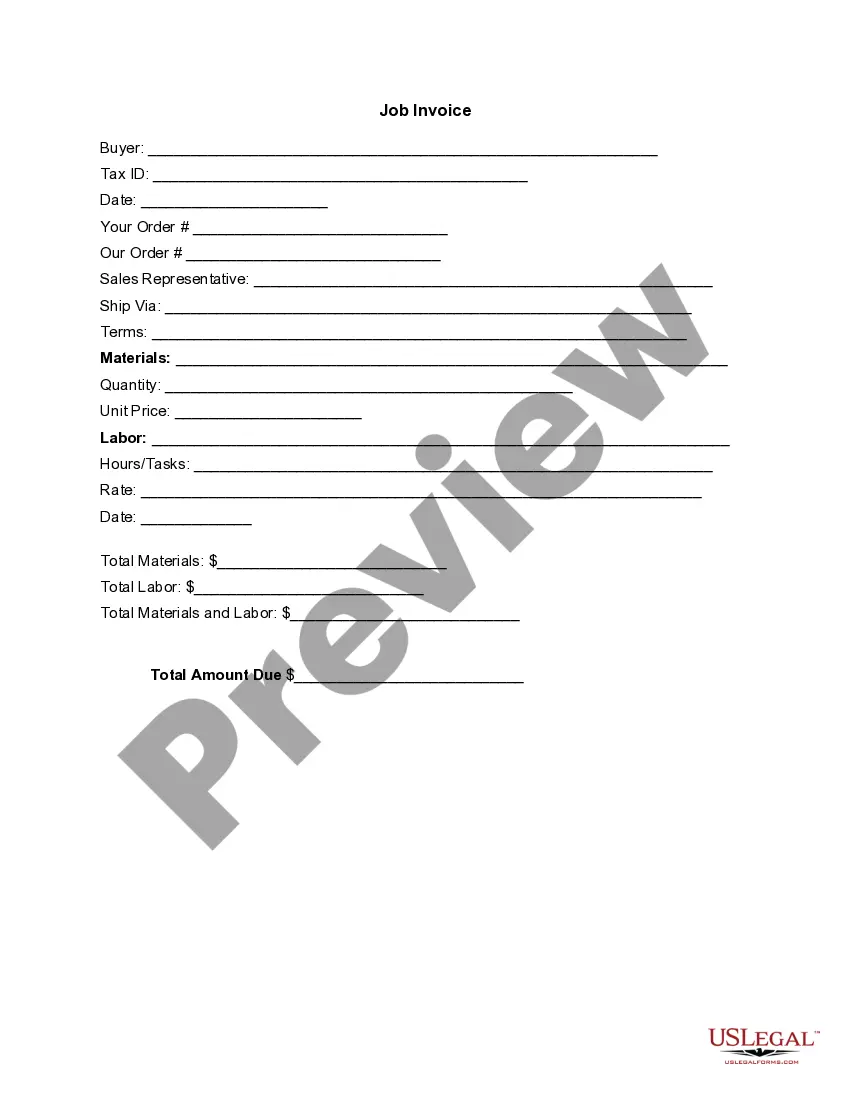

How to fill out Letter Of Instruction To Investment Firm Regarding Account Of Decedent From Executor / Trustee For Transfer Of Assets In Account To Trustee Of Trust For The Benefit Of Decedent?

If you require to finish, acquire, or print legal document templates, utilize US Legal Forms, the most extensive collection of legal forms available on the web.

Take advantage of the website's straightforward and easy search to locate the documents you need.

Various templates for commercial and personal purposes are categorized by types and requests, or keywords.

Step 4. After locating the form you need, click the Get now button. Choose your preferred payment method and enter your details to register for an account.

Step 5. Process the payment. You can use your credit card or PayPal account to finalize the transaction.

- Utilize US Legal Forms to find the Maine Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to find the Maine Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent.

- You can also access forms you previously saved from the My documents tab in your account.

- If you are using US Legal Forms for the first time, check the guidelines under.

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Make use of the Review feature to examine the form's content. Don't forget to read the summary.

- Step 3. If you are unsatisfied with the form, use the Search area located at the top of the screen to find alternative versions in the legal form format.

Form popularity

FAQ

Yes, you can write your own will in Maine, provided it meets specific legal requirements. It is advisable to ensure that the will clearly states your wishes and follows state guidelines. Additionally, you might consider including a Maine Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent, as this could guide your executor in making asset transfers as per your intentions.

The IL 1041 form, used for filing an income tax return for an estate, should be filed with the Illinois Department of Revenue. If you're also handling the asset transfer of a decedent's estate, consider using the Maine Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent. This can assist with the coordination of asset transfers, ensuring that all tax obligations are managed effectively.

While it is possible to file for probate in Maine without a lawyer, having legal assistance can greatly simplify the process. An attorney can help you understand the requirements and craft the Maine Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent if necessary. Their expertise ensures compliance with Maine laws and can expedite the process.

To file for probate in Maine, you must submit appropriate forms to the probate court, including the death certificate and a petition for probate. If you are acting as an executor, you will also need to prepare the Maine Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent. The court will then schedule a hearing and verify the will, if one exists.

To avoid probate in Maine without a will, consider creating a Maine Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent. This document can help streamline the transfer of assets directly to beneficiaries, bypassing probate. Additionally, setting up joint accounts and trusts can further help in preventing probate, ensuring that your wishes are honored efficiently.

An executor should typically wait at least six months after the probate process begins before distributing assets. This timeframe allows for the settlement of debts, taxes, and potential claims against the estate. However, the specific timing can vary based on the estate's circumstances. Implementing a Maine Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent can provide clarity in handling asset distribution.

Not all estates are required to go through probate in Maine. Small estates, generally valued under a certain threshold, can often be settled without formal probate procedures. For larger estates, a Maine Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent can streamline the process and ensure compliance with state laws.

To avoid probate in Maine, consider establishing a living trust or designating beneficiaries on accounts and insurance policies. These strategies enable your assets to transfer directly to beneficiaries, bypassing the probate process. It's wise to consult a legal expert regarding the Maine Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent for personalized guidance.

In Maine, the maximum time for probate can vary depending on the complexity of the estate and any potential disputes. Generally, the probate process can take anywhere from a few months to over a year. It is essential for executors to manage the process efficiently. Utilizing a Maine Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent can help ensure timely asset transfer.

The letter of instruction from the executor of the estate contains directives on how to manage the estate's assets according to the deceased's wishes. This document often outlines the executor's responsibilities, including asset distribution and financial management. Utilizing the Maine Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent is essential to ensure that the executor can fulfill their duties and transfer assets efficiently.