Maine Bill of Transfer to a Trust

Description

How to fill out Bill Of Transfer To A Trust?

Have you ever found yourself in a scenario where you require documents for potential business or personal purposes almost daily.

There are numerous authentic document templates accessible online, but locating versions you can rely on is challenging.

US Legal Forms offers a vast selection of form templates, such as the Maine Bill of Transfer to a Trust, which are crafted to meet state and federal regulations.

Once you find the correct template, click Purchase now.

Choose the pricing plan you prefer, enter the necessary information to process your payment, and complete the transaction using your PayPal or credit card. Select a convenient file format and download your copy.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Maine Bill of Transfer to a Trust template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is appropriate for the specific state/region.

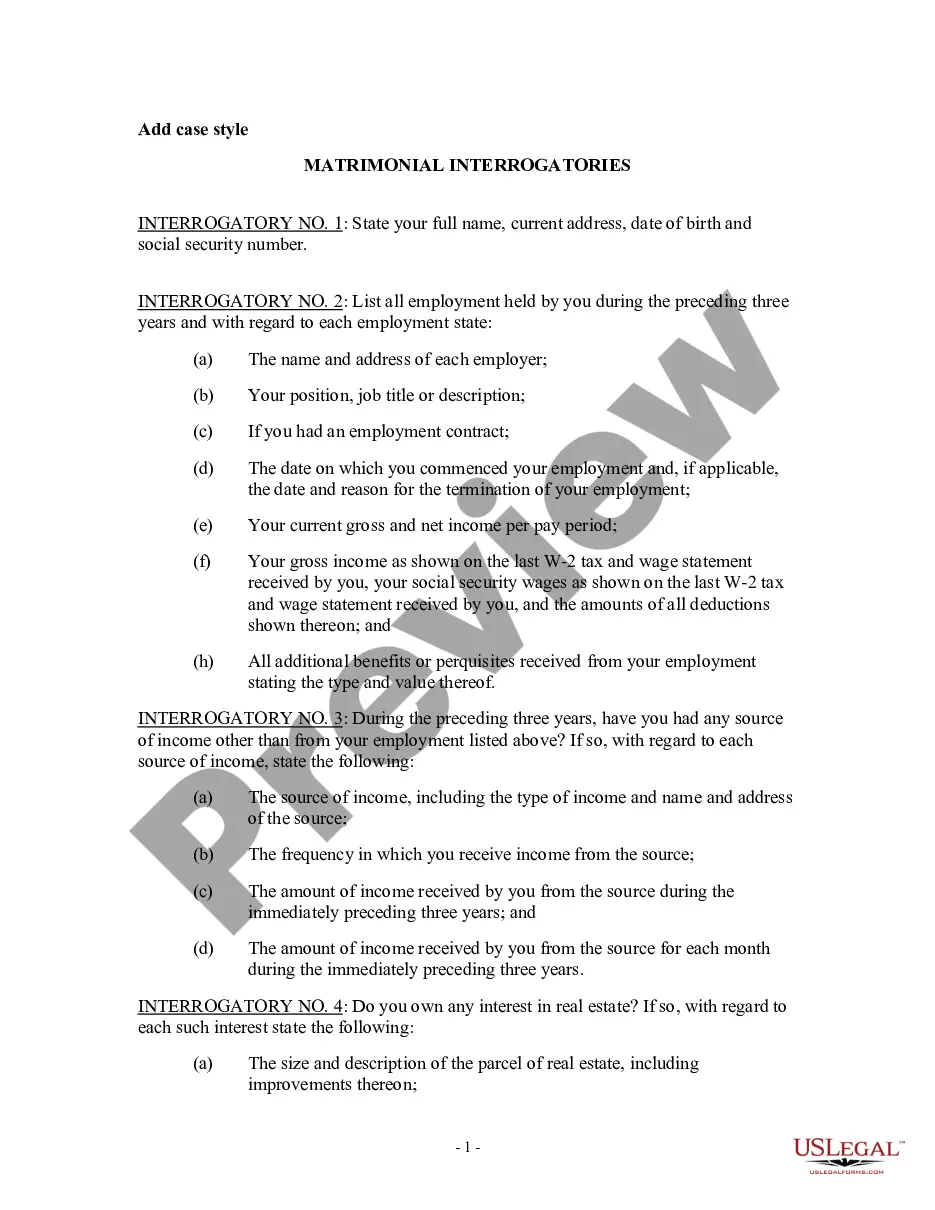

- Utilize the Preview option to review the document.

- Check the description to confirm you have selected the correct form.

- If the form does not meet your needs, use the Search field to find a template that suits your requirements.

Form popularity

FAQ

Generally, transferring assets to a trust is not a taxable event. However, tax implications can arise based on the asset type and how the trust is structured. The Maine Bill of Transfer to a Trust should guide you in understanding these tax considerations. It is advisable to consult a tax professional to navigate potential tax liabilities associated with trust transfers.

Certain assets may not be ideal for inclusion in a trust, such as retirement accounts that typically have designated beneficiaries. Additionally, properties with significant debt or assets that require active management might complicate matters. Understanding the provisions of the Maine Bill of Transfer to a Trust can help clarify what should be included. Always consider consulting a professional for tailored advice.

One significant mistake parents often make is not properly funding the trust. Simply establishing the trust without transferring appropriate assets can render it ineffective. It's essential to understand that using the Maine Bill of Transfer to a Trust is just part of the process; continuous management and funding are crucial. Engaging with a legal expert can help ensure that your trust functions as intended.

Choosing between a transfer on death (TOD) and a trust depends on your individual needs. A TOD allows for a straightforward transfer of assets, bypassing probate, while a trust provides ongoing management and protection of assets. The Maine Bill of Transfer to a Trust offers long-term benefits like creditor protection and privacy. Therefore, evaluate your situation carefully to make the best choice.

Transferring assets to a trust after death usually involves the probate process. The assets should first be identified and documented, then transferred according to the terms of the existing trust. If no trust exists, the Maine Bill of Transfer to a Trust might need to be established posthumously, guided by relevant laws. Consulting with a legal professional can provide clarity during this process.

Any individual who holds assets can transfer those assets into a trust. This process is often initiated by the property owner, who may be an individual or a couple. A legal document, such as the Maine Bill of Transfer to a Trust, facilitates this transfer. It's important to understand the implications and benefits of this action.

Setting up a trust in Maine involves drafting a trust document that outlines how the assets will be managed and distributed. You will need to specify your assets and choose a trusted individual as the trustee. Utilizing the Maine Bill of Transfer to a Trust simplifies this process, and platforms like USLegalForms can provide the necessary resources and templates to get started efficiently.

Moving assets into a trust can provide several benefits, including protection from probate and potential tax advantages. However, deciding to transfer assets needs careful consideration of your unique circumstances. The Maine Bill of Transfer to a Trust offers a structured approach to asset management that can fit your needs, so it is wise to consult a legal expert.

Certain transactions in Maine may be exempt from transaction tax, including those related to the transfer of property to a trust under specific circumstances. For example, transfers involving primary residences or certain family transactions may qualify. Knowing these exemptions can be beneficial when considering the Maine Bill of Transfer to a Trust for your estate planning.

Gifts to a trust can be taxable, depending on the amount and the type of trust. Generally, contributions under a certain dollar amount may not incur tax, but it’s crucial to evaluate the specifics of the gift and the trust structure. The Maine Bill of Transfer to a Trust can help streamline this process and clarify potential tax implications for you.