Maine Charitable Remainder Inter Vivos Unitrust Agreement

Description

How to fill out Charitable Remainder Inter Vivos Unitrust Agreement?

It is feasible to dedicate time online looking for the valid document template that aligns with the federal and state criteria you require.

US Legal Forms offers thousands of valid forms that can be reviewed by professionals.

You can acquire or create the Maine Charitable Remainder Inter Vivos Unitrust Agreement from their services.

- If you already possess a US Legal Forms account, you can Log In and select the Download option.

- Afterward, you can complete, modify, print, or sign the Maine Charitable Remainder Inter Vivos Unitrust Agreement.

- Every valid document template you purchase is your own for an extended period.

- To obtain another copy of any purchased form, navigate to the My documents tab and click on the corresponding option.

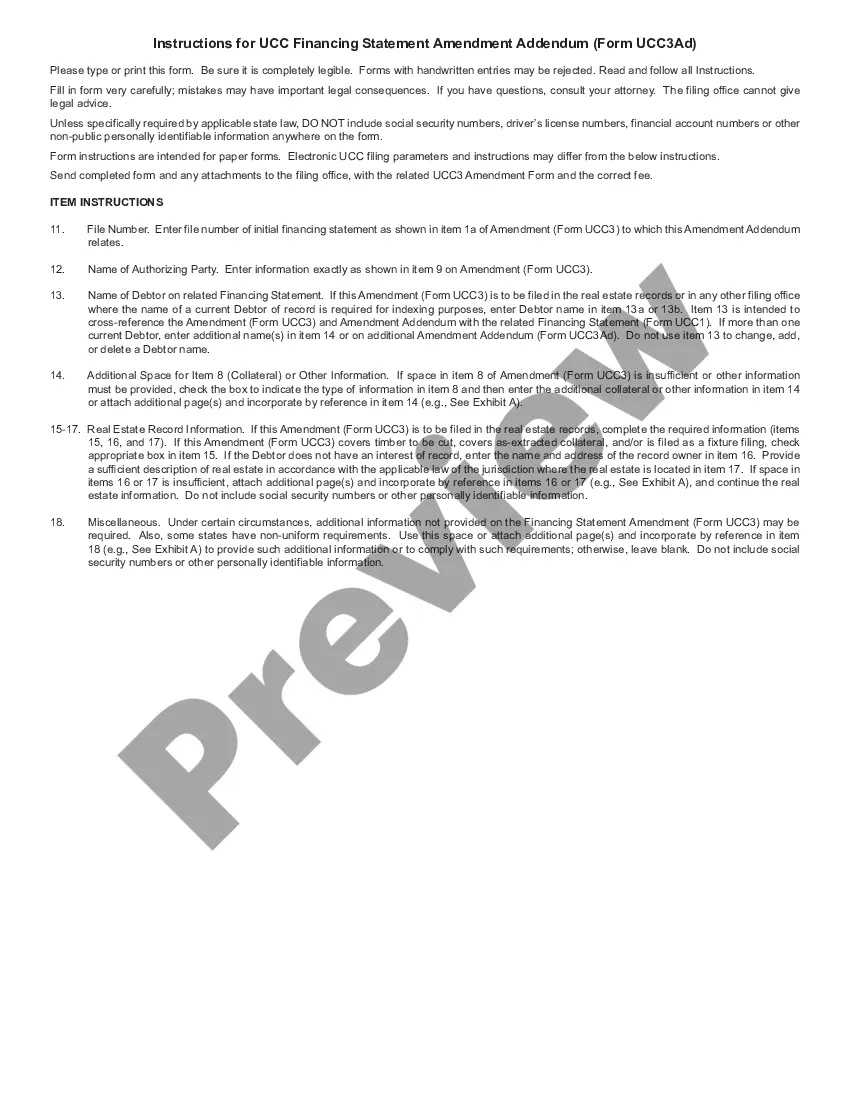

- If this is your first time using the US Legal Forms website, adhere to the simple guidelines below.

- First, ensure that you have selected the correct document template for the county/area of your choice.

- Examine the form description to confirm you have selected the appropriate form. If available, use the Preview option to browse the document template as well.

- If you wish to find another version of the form, utilize the Search area to locate the template that meets your needs and specifications.

- Once you have identified the template you desire, click on Purchase now to proceed.

- Choose the pricing plan you wish, enter your credentials, and sign up for your account on US Legal Forms.

- Complete the purchase. You can use your credit card or PayPal account to pay for the valid form.

- Select the format of the document and download it to your device.

- Make adjustments to your document if necessary. You can complete, modify, and sign and print the Maine Charitable Remainder Inter Vivos Unitrust Agreement.

- Download and print thousands of document templates using the US Legal Forms website, which provides the largest selection of valid forms.

- Utilize professional and state-specific templates to address your business or personal needs.

Form popularity

FAQ

The maximum term for income payments from a charitable remainder unitrust is typically limited to 20 years or the life of the beneficiaries, whichever is shorter. However, with a Maine Charitable Remainder Inter Vivos Unitrust Agreement, you can customize the agreement to fit your needs. Overall, this structure allows you to provide support over a significant period while contributing to worthy causes.

A Charitable Remainder Trust (CRT) provides income to beneficiaries for a specified period, with the remainder going to charity. Conversely, a Charitable Lead Trust (CLT) distributes income to a charity for a set time before transferring the remaining assets to family or heirs. The Maine Charitable Remainder Inter Vivos Unitrust Agreement focuses on income generation for the donor while supporting a charitable mission, contrasting with the CLT's priority on immediate philanthropic support.

Advised Fund (DAF) is a charitable giving vehicle that allows you to make contributions, receive immediate tax advantages, and recommend grants over time. In contrast, a Charitable Remainder Trust (CRT), like a Maine Charitable Remainder Inter Vivos Unitrust Agreement, provides income to beneficiaries during their lifetime, with the remaining assets going to charity thereafter. While both support philanthropic efforts, they serve different purposes in income planning and tax strategy.

The distinction lies in their payment methodologies. A charitable remainder unitrust, like the Maine Charitable Remainder Inter Vivos Unitrust Agreement, pays a percentage of the trust's value to the income beneficiaries, which can change as the trust grows, offering potential for increased income. Alternatively, a charitable remainder trust typically pays a fixed dollar amount, which remains stable, providing predictability but lacking growth potential.

While both a unitrust and a charitable remainder trust serve similar purposes in charitable giving, they differ mainly in their payment structures. A Maine Charitable Remainder Inter Vivos Unitrust Agreement pays beneficiaries a fixed percentage of the trust’s value annually, which can increase with the trust's growth. On the other hand, a charitable remainder trust can provide fixed dollar amounts that do not fluctuate, offering less potential for income growth over time.

The charitable remainder unitrust deduction refers to a tax benefit you receive when you establish a unitrust. By implementing a Maine Charitable Remainder Inter Vivos Unitrust Agreement, you can deduct a portion of your charitable contribution from your income taxes, which can result in significant savings. This deduction is calculated based on the present value of the remainder interest that will go to charity after the income payments have ended.

A unitrust allows you to make a charitable contribution while benefiting from a stream of income. With a Maine Charitable Remainder Inter Vivos Unitrust Agreement, you can receive payments based on a percentage of the trust's value, growing over time. This structure not only provides financial benefits but also helps fulfill philanthropic goals, ensuring your legacy continues.

While a charitable remainder trust offers several benefits, there are potential downsides to consider. For instance, once you fund the trust, you relinquish control over the assets, which may limit your financial flexibility. Furthermore, the complexity of establishing a trust, including ongoing administrative costs, may require professional guidance to navigate effectively, especially in the context of a Maine Charitable Remainder Inter Vivos Unitrust Agreement.

To establish a Charitable Remainder Unitrust, you usually need to draft a trust document that meets IRS requirements. It's advisable to work with a legal professional who understands the specifics of the Maine Charitable Remainder Inter Vivos Unitrust Agreement, as they can ensure the trust aligns with your financial goals and charitable intentions. After drafting, you will fund the trust with assets that can generate income over time.

A Charitable Remainder Unitrust (CRUT) and a Charitable Remainder Trust (CRT) serve similar purposes in estate planning, but they differ primarily in how payments are structured. A CRUT pays a fixed percentage of its value to the income beneficiaries, which means the payout can fluctuate based on the trust's assets. In contrast, a CRT pays a fixed dollar amount each year. Understanding these differences is crucial when setting up a Maine Charitable Remainder Inter Vivos Unitrust Agreement.