Maine Personal Representative's Deed of Distribution

The Personal Representative's Deed of Distribution is a legal form used to transfer property from the estate of a deceased person who died intestate (without a will). This deed is executed by the personal representative appointed by the court, who conveys the property to beneficiaries under intestate law or to a buyer. Unlike other property transfer deeds, this document specifically relates to property distribution under a court-authorized intestate estate process.

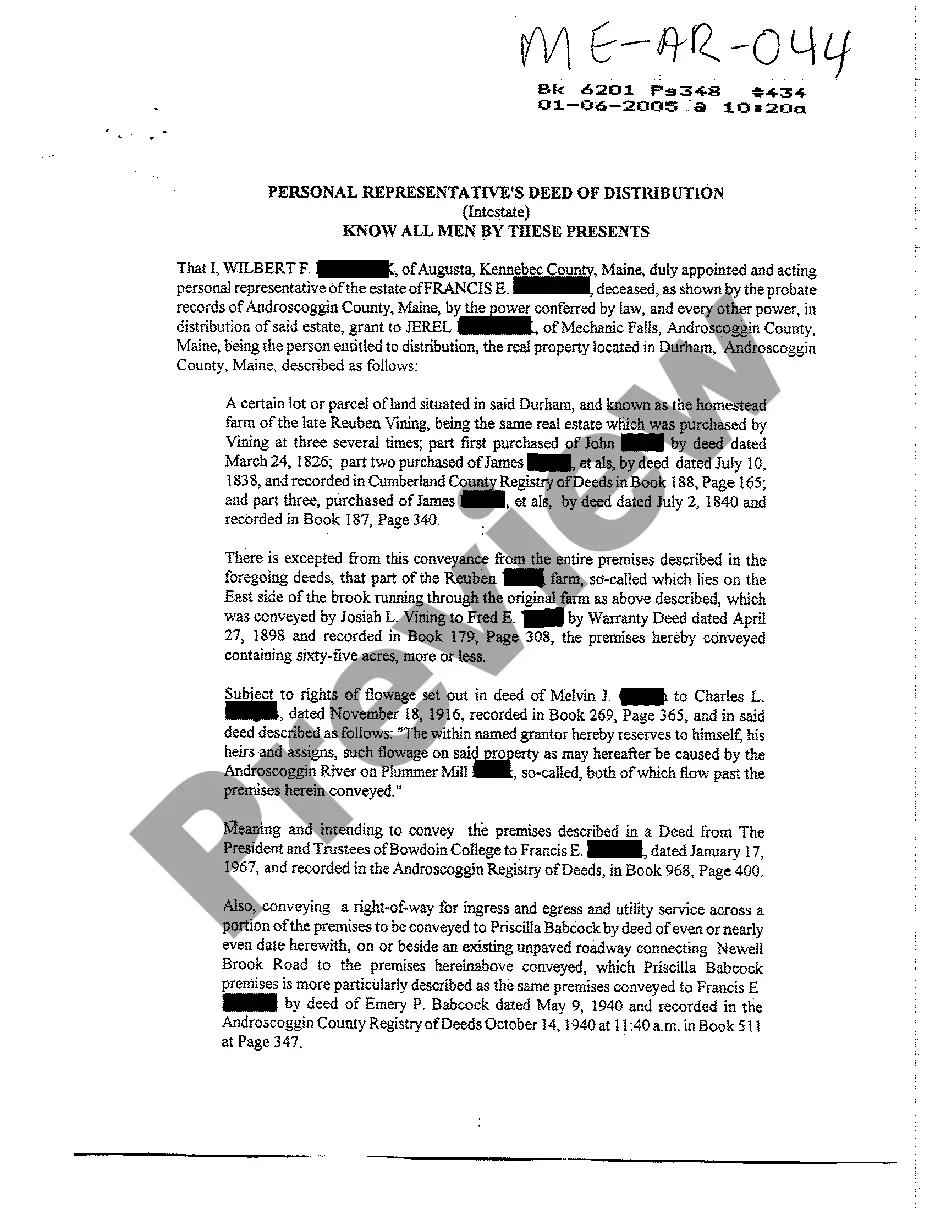

- The grantor is the personal representative of the estate.

- The grantee is either a beneficiary or a purchaser of the property.

- The deed confirms that the property transfer is authorized by the court.

- The description of the property being transferred must be included.

You should use the Personal Representative's Deed of Distribution when you are the court-appointed personal representative of an intestate estate and need to distribute property to rightful beneficiaries or convey it to a buyer. This form is essential when formalizing the transfer of real estate that belonged to someone who did not leave a will.

This form is appropriate for:

- Personal representatives of intestate estates.

- Beneficiaries receiving property from an intestate estate.

- Individuals or entities purchasing property from an estate.

To complete the Personal Representative's Deed of Distribution, follow these steps:

- Identify the parties involved: the personal representative (grantor) and the beneficiary or buyer (grantee).

- Clearly specify the property being transferred, including its address and legal description.

- Fill in the court authorization details required for the property transfer.

- Ensure that the document is signed in front of a notary public.

- File or present the deed as required by local laws to complete the transfer.

Yes, this form must be notarized to be legally valid. US Legal Forms makes the notarization process simple by offering integrated online notarization, allowing you to get the form notarized securely via a video call at any time, without the need to travel.

- Failing to include a complete legal description of the property.

- Not obtaining proper court authorization before executing the deed.

- Incorrectly identifying the parties involved in the transaction.

- Neglecting to have the deed notarized when necessary.

- Convenience of filling out the form online from any location.

- Editability allows for easy corrections and adjustments without starting over.

- Reliability, with forms drafted by licensed attorneys ensuring legal compliance.

What to keep in mind

- This deed is essential for transferring property from an intestate estate to beneficiaries or buyers.

- Proper completion, including notarization, is necessary for legal recognition.

- Maine residents must adhere to specific state guidelines when using this form.

Form popularity

FAQ

No. The person must be appointed by the probate court as the personal representative and letters issued for the appointment as personal representative to be effective. California Probate Code §8400(a).To learn about the duties of a personal representative in California probate, click here.

In Colorado, the person approved or appointed by the probate court to administer a decedent's estate is called a personal representative. The personal representative has a fiduciary duty to settle the decedent's estate.Use the personal representative's deed of sale to convey real property to a purchaser.

As the Personal Representative, you are responsible for doing the following: 2022 Collecting and inventorying the assets of the estate; 2022 Managing the assets of the estate during the probate process; 2022 Paying the bills of the estate. Making distribution to the heirs or beneficiaries of the estate.

A personal representative deed and warranty deed are the same only in that they both convey ownership of land. The types of title assurance that the different deeds provide to the new owner are very different.

Used to transfer property rights from a deceased person's estate. Involves Probate Court. Like a Quit Claim deed, there are no warranties. Generally, the Personal Representative is unwilling to warrant or promise anything relating to property that he/she has never personally owned.

In order to provide finality to the termination of a trust or the closing of an estate, the form of deed given by a personal representative or a trustee simply calls for the seller to convey as opposed to convey and warrant the property.Again, all the buyer gets is whatever the trust or estate owned.

A personal representative is appointed by a judge to oversee the administration of a probate estate.When a personal representative is nominated to the position in a will, he's commonly called the executor of the estate.