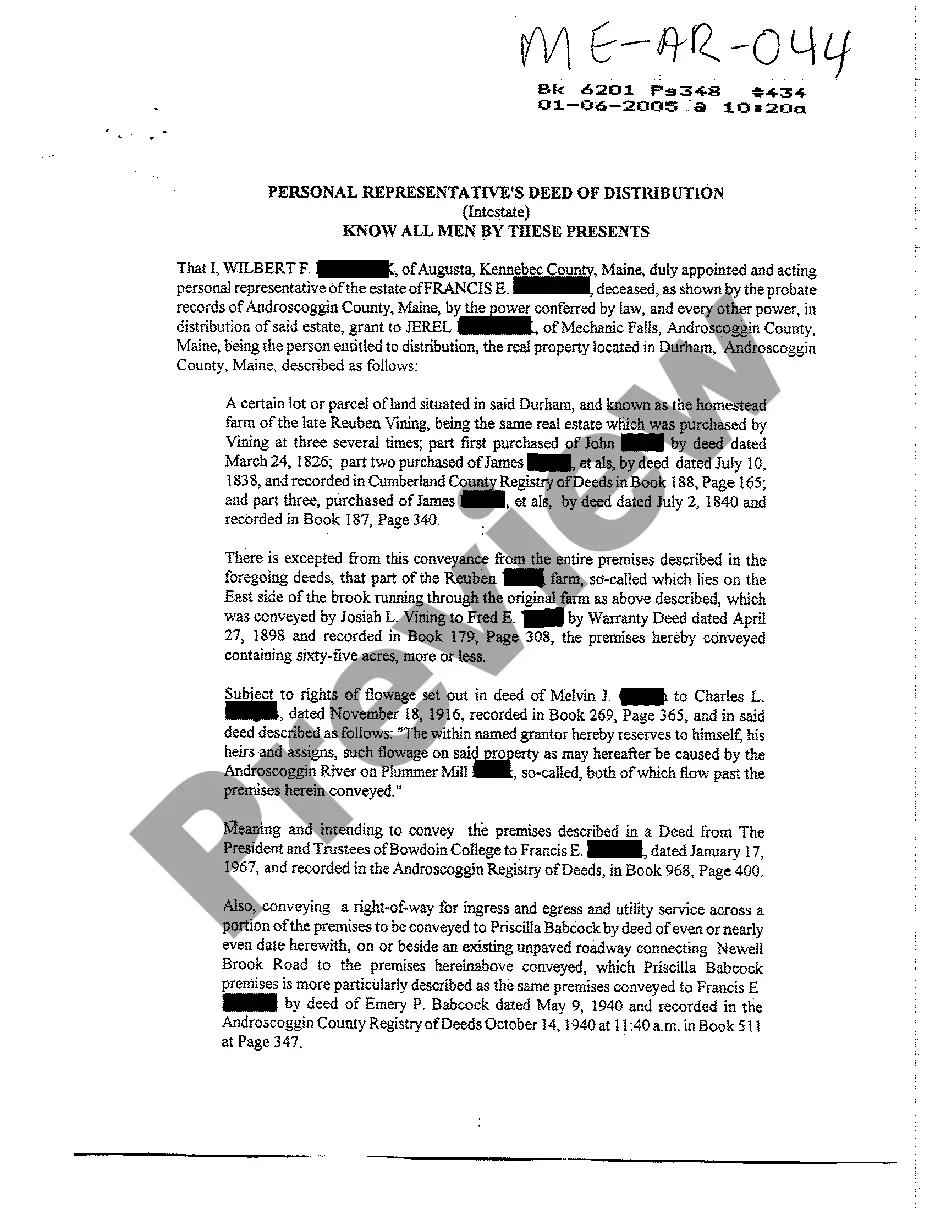

Maine Personal Representative's Deed of Distribution

Description

How to fill out Maine Personal Representative's Deed Of Distribution?

You are invited to the finest legal document repository, US Legal Forms.

Here you can locate any template such as Maine Personal Representative's Deed of Distribution forms and acquire them (as many as you need or desire).

Create official documents in a few hours rather than days or even weeks, without breaking the bank with a lawyer.

If the template meets all of your criteria, click Buy Now. To set up your account, select a pricing plan. Use a credit card or PayPal account to register. Download the document in your preferred format (Word or PDF). Print the document and complete it with your or your business's information. After you’ve finalized the Maine Personal Representative's Deed of Distribution, present it to your attorney for confirmation. It’s an additional step but a crucial one for ensuring you’re fully protected. Sign up for US Legal Forms today and access a multitude of reusable templates.

- Obtain your state-specific template in just a few clicks and feel assured knowing it was created by our experienced legal experts.

- If you are already a registered user, simply Log In to your account and click Download beside the Maine Personal Representative's Deed of Distribution you require.

- As US Legal Forms is an online platform, you’ll have permanent access to your saved templates, no matter which device you are using.

- Check them in the My documents section.

- If you do not have an account yet, what are you waiting for.

- Follow our guidelines below to get started.

- If this is a state-specific template, verify its validity in your state.

- Review the description (if available) to ascertain if it’s the correct example.

Form popularity

FAQ

Generally speaking, a Personal Representative is responsible for opening the estate, collecting the assets of the estate, protecting the estate property, preparing an inventory of the property, paying various estate expenses, valid claims (including debts and taxes) against the estate, representing the estate in claims

This will most likely be your spouse or a close relative, but not necessarily the person in your life who is best suited to the task. When handling finances and personal affairs, you would like your personal representative to be someone close to you and honest, whom you can trust.

4% of the first $100,000. 3% of the next $100,000. 2% of the next $800,000. 1% of the next $9,000,000. 0.5% of the next $15,000,000. and reasonable compensation as determined by the California Probate Court for any amount above $25,000,000.

That person (it could be one or more individuals, a bank or trust company, or both) who acts for, or stands in the shoes of, the deceased is generally called the personal representative. If the decedent dies testate that is, with a Will an Executor is appointed as the personal representative.

A personal representative is appointed by a judge to oversee the administration of a probate estate.When a personal representative is nominated to the position in a will, he's commonly called the executor of the estate.

A personal representative is appointed by a judge to oversee the administration of a probate estate.When a personal representative is nominated to the position in a will, he's commonly called the executor of the estate.

A personal representative is the person, or it may be more than one person, who is legally entitled to administer the estate of the person who has died (referred to as 'the deceased'). The term 'personal representatives', sometimes abbreviated to PR, is used because it includes both executors and administrators.

A beneficiary, or heir, is someone to which the deceased person has left assets, and a personal representative, sometimes called an executor or administrator, is the person in charge of handling the distribution of assets.

A beneficiary, or heir, is someone to which the deceased person has left assets, and a personal representative, sometimes called an executor or administrator, is the person in charge of handling the distribution of assets.