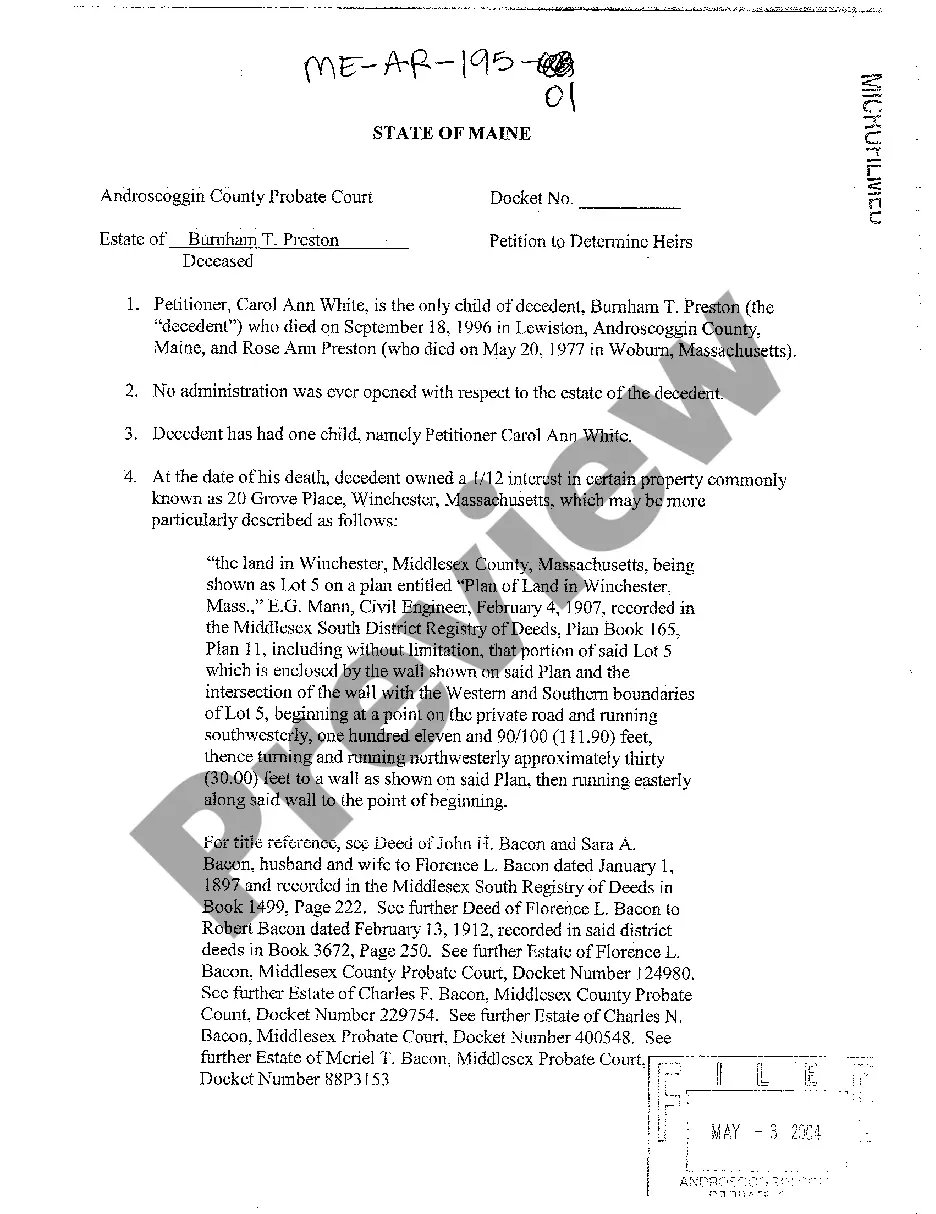

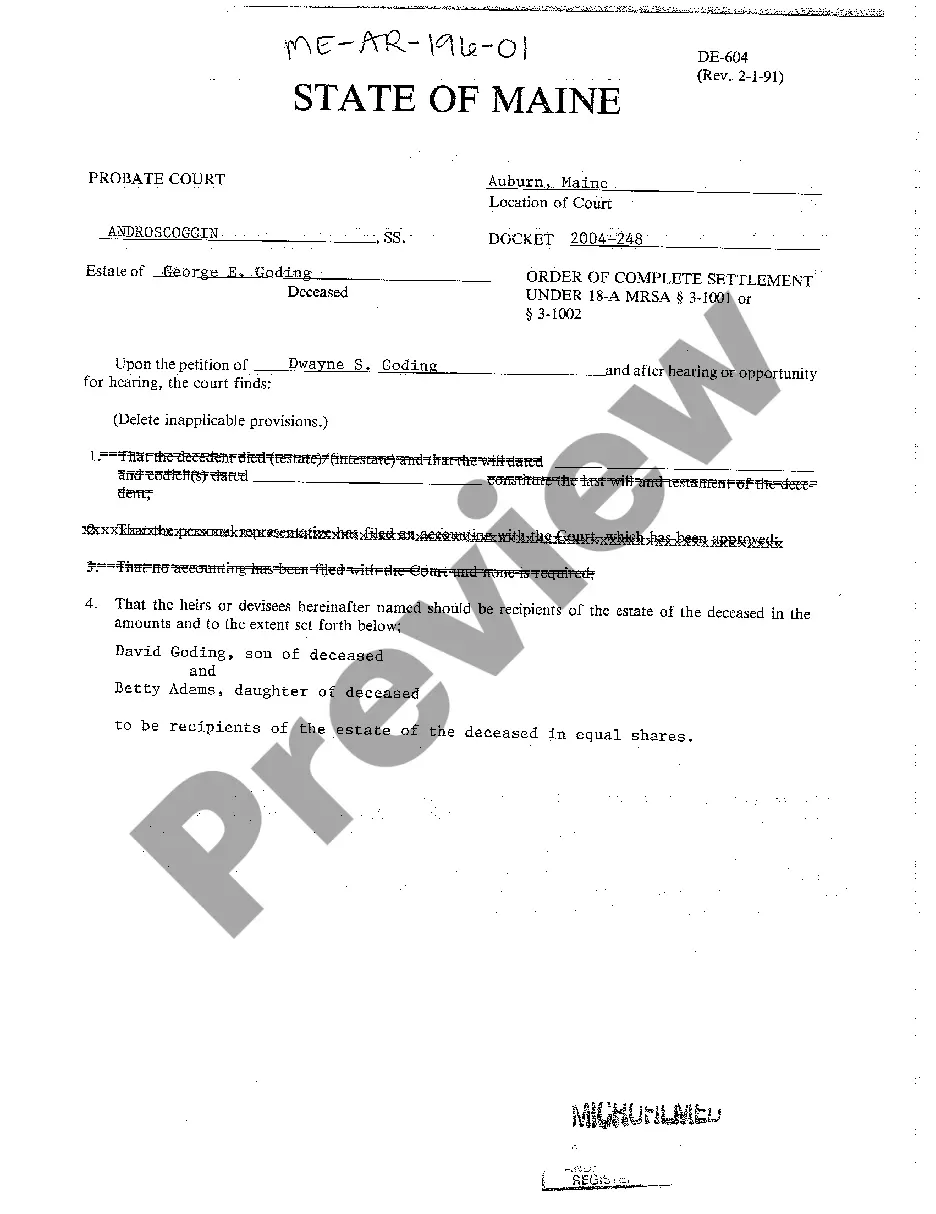

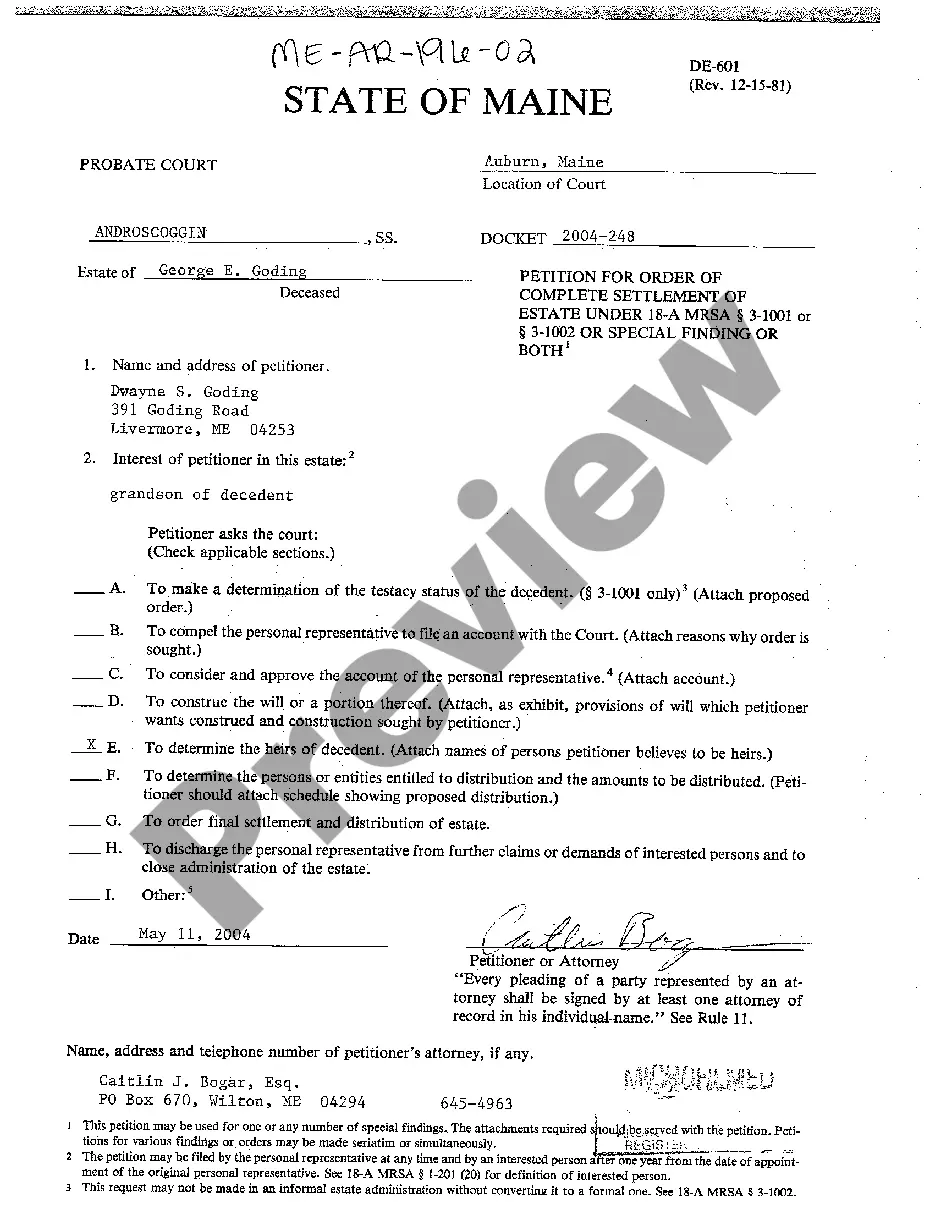

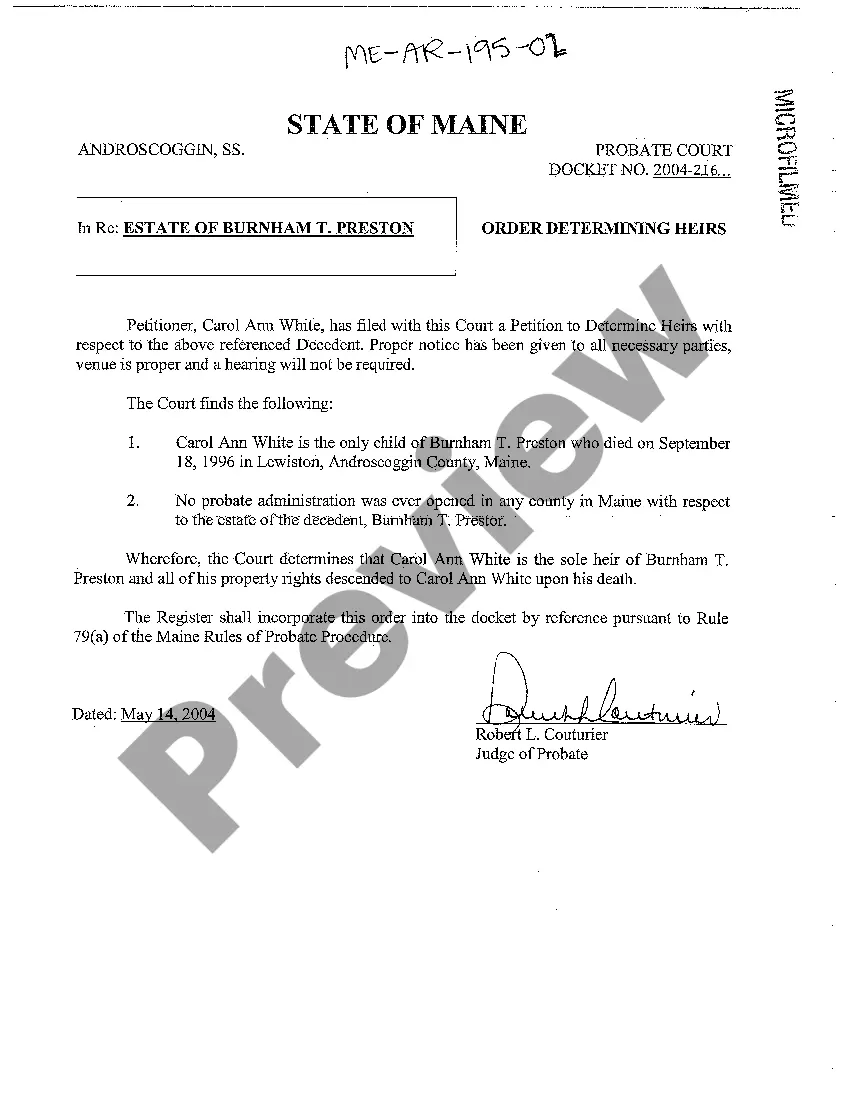

Maine Order to Determine Heirs

Description

How to fill out Maine Order To Determine Heirs?

Amid numerous paid and complimentary instances that you can find online, you cannot guarantee their dependability.

For instance, who created them or whether they possess the expertise to meet your requirements.

Stay composed and utilize US Legal Forms!

Once you’ve registered and purchased your subscription, you can employ your Maine Order to Determine Heirs repeatedly or for as long as it remains valid in your location. Modify it in your preferred offline or online editor, complete it, sign it, and print it. Achieve more for less with US Legal Forms!

- Find Maine Order to Determine Heirs templates crafted by experienced lawyers and sidestep the costly and time-consuming task of searching for an attorney and subsequently paying them to draft documents for you that are readily available.

- If you hold a subscription, Log In to your account to locate the Download button adjacent to the document you seek.

- You will also have access to all of your previously obtained templates in the My documents section.

- If you are visiting our site for the first time, follow the steps outlined below to acquire your Maine Order to Determine Heirs swiftly.

- Ensure that the document you find is applicable in your jurisdiction.

- Review the template by consulting the details through the Preview feature.

Form popularity

FAQ

If you are named as an heir, you may have to prove to the estate trustee that you are the person named. This can be done by showing the estate trustee identification or providing an affidavit.

In many states, the required period is 120 hours, or five days. In some states, however, an heir need only outlive the deceased person by any period of time -- theoretically, one second would do.

Ask friends and family of the deceased. Advertise in a local newspaper for several consecutive weeks. Write to last known addresses. Search online. Search real and personal property index in the assessor's office in the counties where the heir resided.

This law states that no matter what your will says, your spouse has a right to inherit one-third or one-half (depending on the state and sometimes depending on the length of the marriage) of your total estate. To exercise this right, your spouse has to petition the probate court to enforce the law.

All taxes and liabilities paid from the estate, including medical expenses, attorney fees, burial or cremation expenses, estate sale costs, appraisal expenses, and more. The executor should keep all receipts for any services or transactions needed to liquidate the assets of the deceased.

Heirs-at-law An heir-at-law is the deceased's next of kin, and they are required to be notified whether there is a will or not even if they're specifically not named in an existing will.

In most cases, a deceased person's heirs-at-law are determined by the intestacy laws of the state in which she lived at the time of her death. But the intestacy laws of another state might apply if she owned real estate or tangible personal property there.

An heir is a person who is legally entitled to collect an inheritance, when a deceased person did not formalize a last will and testament. Generally speaking, heirs who inherit the property are children, descendants or other close relatives of the decedent.